Crypto Seizure Value Calculator

Seizure Strategy Comparison

Based on the 2025 Global Asset Forfeiture trends, determine whether immediate liquidation or strategic retention of seized crypto creates greater value.

In 2025 the U.S. moved over 207,000BTC into a new Strategic Bitcoin Reserve - a single seizure worth roughly crypto seizure $17billion. That move turned a courtroom‑driven liquidation into a national‑level strategic asset, and it signals a broader shift: governments are now treating digital tokens as ordinary property they can keep, not just dump. Below we unpack how that policy ripple spreads across continents, what each major jurisdiction actually does with seized crypto, and which trends are shaping the next wave of enforcement.

What Asset Forfeiture Means in the Digital Age

Asset forfeiture is the legal process by which authorities seize property linked to criminal activity. Traditionally this covered cash, cars, or real‑estate; today it also embraces cryptocurrencies, NFTs, and DeFi tokens. Courts increasingly recognize digital tokens as "property" under existing statutes, meaning the same forfeiture rules that apply to a stolen laptop now apply to a stolen Bitcoin wallet.

Cryptocurrency Seizures: From Liquidation to Retention

Cryptocurrency seizures refer specifically to the confiscation of crypto assets by law‑enforcement or regulatory bodies. While early cases typically forced an immediate sale to convert crypto into fiat, 2025 introduced a new playbook: retain the assets, let them appreciate, and use the gains for victim restitution or future enforcement budgets.

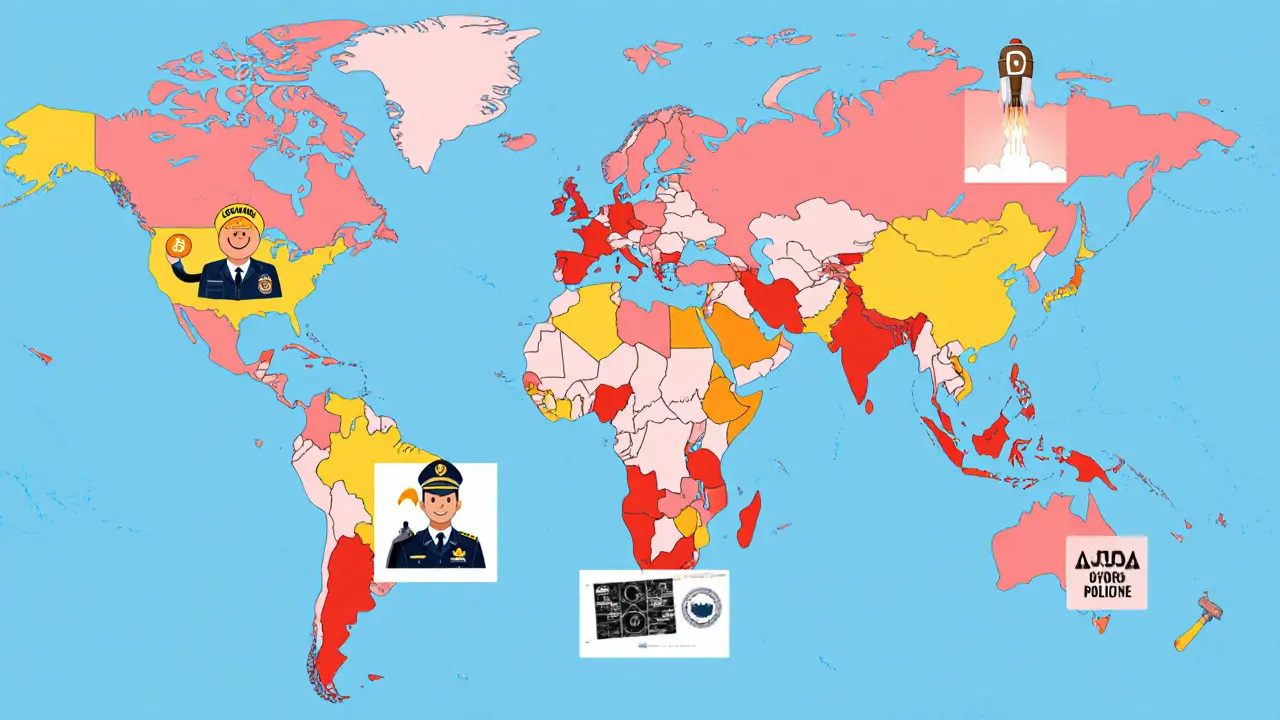

How Countries Classify and Manage Seized Crypto

Below is a snapshot of the legal stance and enforcement practice in a sample of 12 jurisdictions. The table uses microdata so search engines can read the data directly.

| Country | Legal status of crypto | Seizure authority | Post‑seizure handling |

|---|---|---|---|

| United States | Legal, regulated as property | Federal agencies (DOJ, OFAC, CFTC) | Retained in Strategic Bitcoin Reserve; sold selectively for restitution |

| Germany | Legal, subject to BaFin licensing | Federal Criminal Police Office (BKA) | Often liquidated to cover penalties; some holdings moved to state‑run digital asset funds |

| Russia | Restricted, heavy licensing | FSB and Ministry of Internal Affairs | Usually liquidated; recent pilot to keep BTC for state treasury |

| Spain | Legal, regulated by CNMV | Guardia Civil & National Police | Seized assets auctioned; proceeds fund victim restitution |

| Canada | Legal, regulated by FINTRAC | RCMP & Canada Revenue Agency | Mostly liquidated; emerging discussion on retention |

| Japan | Legal, overseen by FSA | National Police Agency | Liquidated; proceeds used for victim compensation |

| South Korea | Legal, regulated by FSC | Financial Intelligence Unit | Typically auctioned; small portion earmarked for future enforcement budgets |

| UAE | Legal in free zones, otherwise restricted | Dubai Police Cyber Unit | Auctioned; revenues funnel into anti‑money‑laundering programs |

| Namibia | Restricted - exchanges banned | Bank of Namibia & Police | Confiscated crypto destroyed or seized by state |

| Mauritius | Legal, classified as regulated digital assets | Financial Services Commission | Often retained in a sovereign digital‑asset fund |

| South Africa | No formal legal status (treated as intangible asset) | South African Revenue Service & SAPS | Liquidated unless linked to ongoing investigations |

| Angola | Legal, but officials advise caution | National Police & Central Bank | Seized assets usually auctioned |

Key Enforcement Trends in 2025

Three patterns dominate the global landscape:

- Retention over liquidation: The U.S. Strategic Bitcoin Reserve sets a precedent. Germany and Mauritius are testing small‑scale sovereign funds, while Russia glimpses a pilot to hold BTC in its treasury.

- Cross‑border cooperation: Spain’s Guardia Civil operation, backed by U.S. agencies, recovered over 5,000BTC tied to a ransomware gang. Such joint raids are becoming the norm, especially in the EU‑US nexus.

- Expansion of asset types: Courts now accept NFTs and DeFi tokens as forfeitable property. The first U.S. case involving a stolen NFT collection was settled in March 2025, with the assets placed in a government‑run custodial wallet.

Statistical Snapshot: Who Loses What?

Crime data from the first half of 2025 paints a stark picture. Over $2.17billion was stolen from crypto services worldwide, outpacing the entire 2024 total. Victim counts and value‑per‑victim vary by region:

- Highest victim counts: United States, Germany, Russia, Canada, Japan, Indonesia, South Korea.

- Highest value per victim: UAE, Chile, India, Lithuania, Iran, Israel, Norway.

- Regional theft leadership: North America dominates Bitcoin and altcoin theft; Europe leads in Ethereum and stablecoin theft; APAC follows closely in BTC and ETH.

These numbers influence where enforcement agencies allocate resources. For example, the U.S. Cyber and Emerging Technologies Unit has doubled its budget to chase cross‑border ransomware gangs targeting high‑value Bitcoin wallets.

Policy Implications: Market Stability vs. Victim Restitution

Keeping seized crypto off the market prevents price crashes that could hurt innocent investors. At the same time, governments can earn returns by holding assets that appreciate. The U.S. estimates a $3billion net gain from the Strategic Bitcoin Reserve by 2030, which will fund victim restitution programs and future enforcement actions.

Critics argue that governments should sell quickly to compensate victims. Proponents counter that delayed liquidation can generate far more funds for victims in the long run. Transparency measures-public dashboards of seized assets, periodic audits, and victim‑impact reports-are emerging as safeguards against abuse.

How The Legal Landscape Differs by Region

Legal status isn’t binary. Consider these three contrasting approaches:

- Full legality: Mauritius treats crypto as regulated digital assets, allowing exchanges under a licensing regime while also building a sovereign digital‑asset fund.

- Partial restriction: The United Arab Emirates permits crypto in free‑zone jurisdictions but imposes strict AML/KYC requirements elsewhere.

- Explicit ban: Namibia’s 2017 position paper bars exchanges and prohibits crypto as payment, leading to swift destruction of any confiscated tokens.

Understanding these nuances is crucial for compliance teams and for investigators tracing cross‑border money flows.

Practical Checklist for Professionals

If you work in compliance, law enforcement, or a crypto‑related business, keep this cheat‑sheet handy:

- Identify the jurisdiction’s classification of crypto (legal, restricted, banned).

- Know the designated seizure authority (e.g., DOJ, BKA, Guardia Civil).

- Determine post‑seizure protocol: retention, auction, or destruction.

- Implement chain‑of‑custody tools: multi‑sig wallets, cold‑storage logs, and immutable audit trails.

- Prepare victim restitution plans early; many agencies now require a restitution roadmap before approving a seizure.

- Monitor emerging policy changes - the U.S. may expand the Strategic Bitcoin Reserve to include altcoins by 2026.

Looking Ahead: What 2026 Might Bring

Analysts predict three big shifts:

- Broader asset categories: Expect NFTs, tokenized real‑estate, and even metaverse parcels to be routinely seized.

- International treaty on digital asset forfeiture: The UN is drafting a framework to harmonize cross‑border seizures and prevent asset‑flipping.

- AI‑driven detection: Law‑enforcement units are trialling machine‑learning models that flag suspicious wallet activity in real time, reducing response lag.

Staying ahead means building flexible compliance programs that can adapt to new asset types and jurisdictional rules.

Frequently Asked Questions

Can a government keep seized Bitcoin forever?

Yes, if the law treats the crypto as property and there’s no statutory requirement to liquidate. The U.S. Strategic Bitcoin Reserve plans to hold its holdings for at least a decade, using any appreciation for public purposes.

What happens to seized NFTs?

Courts now view NFTs as intangible property. After seizure, they’re often placed in a government‑controlled custodial wallet and later auctioned, with proceeds earmarked for victim restitution.

Does seizure automatically mean the owner loses the asset?

Not always. Some jurisdictions allow owners to challenge the forfeiture in court. If the case is dismissed, the asset is returned or the seizure is lifted.

How do cross‑border seizures work?

Agencies exchange legal requests, share blockchain analytics, and often conduct simultaneous raids. Mutual Legal Assistance Treaties (MLATs) and newer digital‑asset agreements streamline the process.

Is there a risk of market manipulation when governments sell seized crypto?

Yes. Sudden large sales can depress prices. That’s why many governments now prefer retention or staggered auctions to mitigate market impact.

Pierce O'Donnell

August 25, 2025 AT 17:57Looks like everyone’s getting hyped about “strategic reserves,” but confiscating private wealth still feels like a power grab.

Vinoth Raja

September 1, 2025 AT 16:37The recent establishment of a sovereign Bitcoin vault epitomizes the convergence of macro‑regulatory frameworks and cryptographic asset tokenomics.

By reclassifying decentralized ledger units as statutory property, jurisdictions are operationalizing a de‑jure asset classification schema that leverages the intrinsic immutability of hash‑rooted ledgers.

This paradigm shift catalyzes a reallocation of exogenous risk vectors from traditional fiat exposure toward a quasi‑state‑backed digital store of value.

From a compliance perspective, the introduction of custodial cold‑storage protocols under governmental aegis necessitates rigorous multi‑sig threshold governance models.

Such models must interface with existing Anti‑Money Laundering (AML) transaction monitoring engines, thereby enriching the data provenance streams fed into blockchain analytics pipelines.

Moreover, the strategic retention policy aligns with a hedging strategy against market depth shocks that could be triggered by bulk liquidation events.

Empirical volatility metrics suggest that a staggered release schedule would dampen price impact coefficients in the short‑term price formation function.

The cross‑border enforcement mechanisms outlined in recent mutual legal assistance treaties further augment the jurisdictional interoperability of seizure orders.

In practice, this translates to a seamless transnational subpoena of wallet identifiers, underpinned by cryptographic proof‑of‑possession attestations.

Legal scholars are now debating whether the sovereign authority to hold digital assets constitutes a non‑exhaustive usufruct right or an absolute fee simple interest.

The latter interpretation could potentially engender a precedent for state‑level portfolio diversification, extending beyond Bitcoin to include high‑yield DeFi tokens.

Nevertheless, the policy elasticity remains contingent upon the evolving regulatory taxonomy surrounding digital assets, which continues to oscillate between classification as securities, commodities, or mere intangible property.

Stakeholders must therefore calibrate their risk‑adjusted return models to accommodate regulatory latency and enforcement lag.

From an operational risk standpoint, the custodial key management infrastructure must adhere to NIST SP 800‑57 standards to mitigate insider threat vectors.

In sum, the strategic reserve initiative not only reshapes the fiscal architecture of asset forfeiture but also heralds a new epoch of state‑level participation in decentralized finance ecosystems.

Kaitlyn Zimmerman

September 8, 2025 AT 15:17Just a heads up that many countries still require a court order before they can actually move the coins over to a state wallet it’s not an automatic hand‑off and you’ll often see a chain‑of‑custody log that tracks every transfer you should ask for that if you’re dealing with a cross‑border case it can save a lot of headaches later on

DeAnna Brown

September 15, 2025 AT 13:57Oh man, this whole “strategic Bitcoin reserve” thing is straight out of a Hollywood blockbuster! The US finally decided to treat crypto like gold, and you can feel the patriotic buzz every time they mention “national security”. I mean, who wouldn’t be proud seeing our agencies flexing their digital muscles on the world stage? It’s high time we stop treating Bitcoin like some fringe hobby and start respecting it as the powerhouse it’s become. Go team America!

Chris Morano

September 22, 2025 AT 12:37Totally get the concern about power dynamics, but it’s also worth noting that the proceeds are earmarked for victim restitution which could actually help a lot of people hurt by these scams.

Ikenna Okonkwo

September 29, 2025 AT 11:17While the strategic reserve showcases a proactive stance, policymakers must weigh the opportunity cost of locking up assets that could otherwise be liquidated to fund immediate relief efforts; a hybrid approach might serve both long‑term gains and short‑term justice.

Bobby Lind

October 6, 2025 AT 09:57Wow!!! This is such a game‑changer for crypto enforcement!!! The idea of governments actually holding onto Bitcoin is mind‑blowing and could really stabilize markets!!!

Jessica Cadis

October 13, 2025 AT 08:37The technical details you laid out are spot on; integrating multi‑sig governance with existing AML frameworks will be crucial for transparency.

Katharine Sipio

October 20, 2025 AT 07:17It is essential for jurisdictions to adopt clear guidelines on the post‑seizure handling of digital assets to ensure both legal compliance and public trust.

Matthew Theuma

October 27, 2025 AT 04:57Looks like the govts are finally getting their heads in the game 😅 but they gotta make sure the keys stay safe, otherwise we’re just trading one risk for another.

Jason Zila

November 3, 2025 AT 03:37The retention model could boost future restitution funds.

Cecilia Cecilia

November 10, 2025 AT 02:17Agreed the national narrative is strong yet the legal nuances must not be overlooked.

Schuyler Whetstone

November 17, 2025 AT 00:57Another government overreach, stealing private wealth under the guise of “victim restitution” while they sit on a pile of digital gold and call it justice. It’s just a fancy way to say they’re expanding their power grab into the crypto world.

David Moss

November 23, 2025 AT 23:37What they don’t tell you is that this “Strategic Bitcoin Reserve” is part of a larger plan to control the global monetary system and push a digital fiat agenda that’s been brewing for years behind closed doors.

Shikhar Shukla

November 30, 2025 AT 22:17The discourse surrounding sovereign crypto holdings must be grounded in rigorous statutory analysis rather than populist rhetoric, lest we compromise the rule of law.

Deepak Kumar

December 7, 2025 AT 20:57Exactly! By blending retention with targeted liquidation, agencies can fund ongoing investigations while still preserving asset value for future needs.

Carolyn Pritchett

December 14, 2025 AT 19:37Honestly, the whole “strategic reserve” hype is just a circus act to distract from the fact that most of these seizures are poorly managed and end up as paper losses.

lida norman

December 21, 2025 AT 18:17It’s heartbreaking seeing people lose everything, but if we can turn those seized coins into help for victims, maybe there’s a silver lining 😊