GalaxyOne Yield Calculator

Calculate your potential earnings with GalaxyOne's cash deposit yields. The standard account offers up to 4% APY while accredited investors qualify for up to 8% APY.

Enter your investment details to see potential earnings.

Important Notes: GalaxyOne's high-yield offering (8% APY) is only available to accredited investors. The SEC is currently investigating this product, which could change or be discontinued at any time. These yields are not guaranteed and may change with 30 days' notice.

There’s no such thing as "Coin Galaxy"-at least not as a real crypto exchange. If you’ve been searching for it, you’re probably mixing up two separate things: GalaxyOne, a legitimate U.S.-based investment platform, and Galaxy Coin (GALAXY/GLXC), a random BEP20 token with zero connection to the company. This confusion is common, and it’s costing people time, trust, and sometimes money. Let’s clear it up once and for all.

What GalaxyOne Actually Is

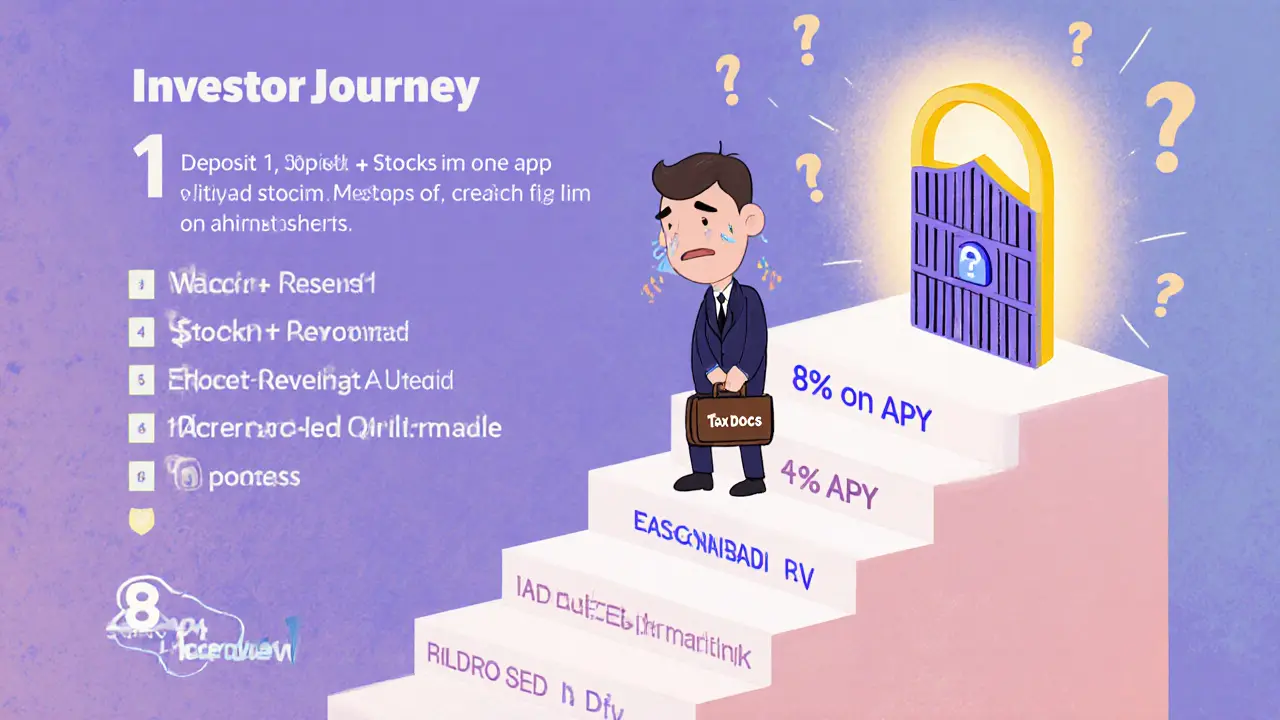

GalaxyOne isn’t just another crypto app. It’s a full investment platform built by Galaxy Digital, the same firm founded by Mike Novogratz that handles billions in digital assets for institutions. Launched in September 2024, GalaxyOne lets you trade U.S. stocks, ETFs, and crypto-all in one place. That’s rare. Most brokers like Fidelity or Charles Schwab only offer crypto through trusts or ETFs. Most crypto exchanges like Coinbase don’t let you buy Apple or Tesla shares at all.GalaxyOne changes that. You can see your Bitcoin and your SPY ETF side by side. You can move money between them without switching apps or logging into three different accounts. It’s designed for people who want to manage their entire portfolio in one dashboard-not just crypto fanatics, but investors who believe digital assets belong alongside traditional ones.

How It Works

Getting started is straightforward if you’re in the U.S. You need a Social Security number or ITIN, and you must be a resident. The onboarding takes about 27 minutes on average, and 92% of people finish it on their first try. You link your bank account via Plaid, and then you’re ready to go.Minimum deposit? Just $1 for a standard brokerage account. For the higher-yield option, you need $100 and must qualify as an accredited investor-meaning you’ve earned over $200,000 annually for the last two years, or have a net worth over $1 million (not counting your home). If you qualify, you can earn up to 8% APY on cash balances. Everyone else gets up to 4% APY. That’s higher than most big banks, but keep in mind: these yields aren’t guaranteed forever. Galaxy can change them with 30 days’ notice.

For crypto trading, you get 15 coins: Bitcoin, Ethereum, Solana, Cardano, Polygon, and a few others. Not as many as Coinbase’s 240+, but enough for most people. Fees are 0.15% to 0.25% per trade-maker-taker model. No commissions on stocks or ETFs. Your crypto is stored in cold wallets, and 98% of assets are kept offline. The platform uses AES-256 encryption, same as banks.

How It Compares to Other Platforms

| Feature | GalaxyOne | Coinbase | SoFi | Fidelity |

|---|---|---|---|---|

| Stocks & ETFs | Yes | No | Yes | Yes |

| Direct Crypto Trading | Yes (15 coins) | Yes (240+ coins) | No | Only via Grayscale trusts |

| Cash APY | Up to 4% (8% for accredited) | 5% on USDC | 4.6% | 4.41% |

| Available Outside U.S. | No | Yes (45 countries) | No | No |

| IRA Support | No | Yes | Yes | Yes |

| Mobile App Rating | 4.6/5 (iOS) | 4.4/5 | 4.5/5 | 4.3/5 |

GalaxyOne wins if you want simplicity and integration. It loses if you’re into altcoins, live outside the U.S., or need a crypto IRA. For someone who owns Tesla stock and wants to buy Solana without jumping between platforms? Perfect fit.

Security and Compliance

Galaxy Digital is a publicly traded company on the NYSE (BRPH). GalaxyOne operates under Galaxy Digital Broker Dealer Inc., which is registered with the SEC and FINRA. That’s not just marketing fluff-it means they’re audited, monitored, and subject to federal rules. They hold state money transmitter licenses in 48 states. Their custody system is built on the same infrastructure they use for institutional clients managing billions.But here’s the catch: the SEC is watching. In April 2025, they issued a Wells Notice to Galaxy Digital, signaling potential legal action over the 8% yield product. Regulators argue that offering high returns on crypto deposits without proper registration could violate securities laws. Commissioner Hester Peirce has publicly warned that these kinds of yields “threaten investor protection.”

That doesn’t mean GalaxyOne is a scam. It means the business model is under pressure. If the SEC forces them to drop the high-yield option, the platform loses a major selling point. For now, it’s still available-but don’t count on it lasting beyond 2026.

What Users Say

On Trustpilot, GalaxyOne has a 4.1/5 rating from over 1,200 reviews. Reddit’s r/GalaxyOne community has 18,400 members, with most posts praising the unified interface. One user wrote: “Finally seeing my BTC and SPY positions side-by-side without switching apps.” That’s the whole point.But complaints are real. Customer service waits average 58 hours. Android users report slow ACH verification-some waiting three days. Syncing issues between the app and web platform are the top technical problem, making up 23% of support tickets. And if you’re self-employed, getting verified can be a nightmare. Galaxy added alternative income docs in version 2.1.3, but it’s still messy.

One user, “BitBull2024,” documented a 27% portfolio growth over six months by splitting funds between Solana staking (6.2% APY) and dividend stocks. That’s a real success story. But there are also failure cases: 12% of applicants for the 8% yield were denied because they couldn’t prove their income properly. Don’t assume you qualify-check the SEC rules first.

Who Should Use GalaxyOne?

You should consider GalaxyOne if:- You’re a U.S. resident with a Social Security number

- You already trade stocks and want to add crypto without juggling apps

- You’re an accredited investor and want higher cash yields

- You value institutional-grade security over a huge selection of altcoins

You should avoid it if:

- You live outside the U.S.

- You want to trade Solana, Dogecoin, or 200 other altcoins

- You need a crypto IRA or want to invest through a business account

- You’re uncomfortable with regulatory risk-this platform could change fast

What’s Next?

GalaxyOne is rolling out business accounts in Q3 2025. They’ve already added instant bank verification through Plaid, cutting onboarding time by 40%. Staking for Solana launched in May 2025 at 6.2% APY. But the big question isn’t features-it’s regulation.Analysts at Bernstein and Bitwise think the 8% yield might be phased out by late 2026. If that happens, GalaxyOne becomes just another brokerage with crypto. It’s still good-but not revolutionary anymore.

Right now, it’s the only platform that lets you treat crypto like a stock. That’s powerful. But power comes with risk. The SEC isn’t going away. And if you’re chasing 8% yields, you’re betting on a regulatory loophole. Make sure you understand that before you deposit anything.

Is Coin Galaxy a real crypto exchange?

No, Coin Galaxy doesn’t exist as a legitimate exchange. The name is a mix-up between GalaxyOne (a U.S. investment platform) and Galaxy Coin (GALAXY/GLXC), a random BEP20 token with no connection to Galaxy Digital. Don’t trust any site using "Coin Galaxy"-it’s likely a scam or phishing site.

Can I use GalaxyOne if I’m not in the U.S.?

No. GalaxyOne is only available to U.S. residents with a Social Security number or ITIN. It does not serve international users, unlike platforms like Binance.US or Kraken. If you’re outside the U.S., you’ll need to find an alternative.

What’s the difference between GalaxyOne and Coinbase?

GalaxyOne lets you trade U.S. stocks, ETFs, and crypto in one app. Coinbase only does crypto. GalaxyOne has fewer coins (15 vs. 240+), but offers higher cash yields for accredited investors (up to 8% APY). Coinbase offers 5% APY on USDC but no stock trading. If you want both stocks and crypto together, GalaxyOne is unique.

Is GalaxyOne safe?

Yes, from a technical and regulatory standpoint. Galaxy Digital is a publicly traded company (NYSE: BRPH), and GalaxyOne is operated by a SEC/FINRA-registered broker-dealer. 98% of crypto assets are stored offline, and the platform uses bank-grade encryption. But regulatory risk is real-the SEC is investigating their high-yield product, which could change or disappear.

How do I qualify for the 8% APY?

You must be an accredited investor under SEC Rule 501. That means: (1) you earned more than $200,000 individually (or $300,000 jointly with a spouse) in each of the last two years, and expect to earn the same this year; OR (2) you have a net worth over $1 million (excluding your primary home). You’ll need to submit tax documents or bank statements to prove it.

Does GalaxyOne support crypto IRAs?

No, GalaxyOne does not currently offer crypto IRAs. If you want to hold Bitcoin or Ethereum in a retirement account, you’ll need to use a platform like BitIRA, Coinbase, or Fidelity. GalaxyOne only offers taxable brokerage accounts.

What’s the minimum deposit to start?

You can start with just $1 for a standard brokerage account. To qualify for the higher 8% APY yield, you need $100 and must be an accredited investor. There are no fees to open or maintain the account.

Are there hidden fees on GalaxyOne?

No hidden fees. Trading stocks and ETFs is commission-free. Crypto trades have a 0.15%-0.25% maker-taker fee. ACH transfers are free but take 3-5 business days. Instant deposits via Plaid cost $3.50. There are no inactivity fees, withdrawal fees, or account maintenance fees.

Final Thoughts

GalaxyOne isn’t perfect. It’s limited to the U.S., has a small crypto selection, and could lose its best feature-the high yield-if regulators step in. But it’s also the only platform that truly bridges Wall Street and crypto for the average investor. If you’re tired of switching between Robinhood and Coinbase, and you want to treat Bitcoin like a stock, this is your best shot.Just don’t treat it like a get-rich-quick scheme. The 8% yield is a bonus, not a guarantee. The real value is the simplicity: one app, one portfolio, one view of your money. That’s worth something-even if the SEC decides to change the rules next year.

Louise Watson

November 7, 2025 AT 13:05GalaxyOne isn’t a scam, but that 8% yield feels like a ticking clock.

Liam Workman

November 9, 2025 AT 07:29It’s wild how we treat crypto like stocks now-like Bitcoin’s just another ticker. But honestly? I love it. No more juggling apps. I used to check Coinbase, Robinhood, and my bank like a three-legged race. Now I open GalaxyOne, see my SPY and SOL side by side, and feel like I’m finally investing instead of gambling. The SEC might shut down the 8% APY, but the real win is the interface. It’s the first time I’ve felt like a grown-up investor, not a crypto bro. Also, the cold storage? Solid. I don’t care if they only have 15 coins-I’m not here for Shiba Inu memes. I’m here for structure.

Benjamin Jackson

November 9, 2025 AT 08:28Been using it since December and honestly? It’s changed how I think about money. I used to separate my "safe" money from my "crypto" money like they were different planets. Now I just see it all as one pie. The 4% APY on cash is already better than my Chase account. And the app doesn’t crash like Coinbase does on a bull run. 🤘

Leo Lanham

November 10, 2025 AT 05:458% APY? Bro, this is a Ponzi waiting to happen. They're paying you with new deposits. The SEC isn't just watching-they're sharpening their knives. And don't even get me started on "institutional-grade security"-that’s just corporate buzzword soup. If you’re not an accredited investor, you’re just a sheep being led to the slaughter with a fancy app. Wake up.

Brian Webb

November 11, 2025 AT 17:47I’m a self-employed graphic designer and the verification process was brutal. They asked for 3 years of tax returns, then said my PayPal income wasn’t "verifiable." Took me 3 weeks to get approved. But once I did? The interface is beautiful. I’ve got my dividend stocks and my SOL staking in one view. No more Excel sheets. Worth the headache.

Whitney Fleras

November 13, 2025 AT 13:14For anyone thinking about signing up-don’t rush into the 8% APY just because it sounds good. Read the fine print. The SEC notice isn’t a rumor. It’s real. And if they drop it, you’ll still have a great platform. Just don’t bank on the yield. Treat it like a bonus, not a feature.

Colin Byrne

November 15, 2025 AT 07:06Let’s be clear: GalaxyOne is not a crypto exchange. It’s a brokerage with crypto access. Calling it a "unified trading platform" is marketing spin. Coinbase is a crypto exchange. Fidelity is a brokerage. GalaxyOne is a hybrid that’s trying to be everything to everyone-and that’s its weakness. The crypto selection is laughable. 15 coins? In 2025? That’s not for investors-that’s for people who want to feel like they’re "in crypto" without actually engaging with it. And the lack of IRA support? Criminal. If you’re serious about long-term wealth, this platform is a dead end. The interface is nice, sure. But it’s a pretty wrapper around a limited, regulatory-risky product. Don’t confuse aesthetics with substance.

Allison Doumith

November 16, 2025 AT 09:04Why do people keep acting like this is revolutionary? It’s just another brokerage with a crypto tab. I’ve been using Robinhood for years and I don’t need a new app to see my BTC next to my AAPL. The 8% yield is a trap. The SEC is going to shut this down and then everyone will be crying about how they lost their "earnings." People are so desperate for yield they’ll ignore red flags. I’m not even mad. I’m just tired of the hype.

Scot Henry

November 18, 2025 AT 05:21Used it for 3 months. Love the UI. The only thing that sucks is the Android app takes forever to verify my bank. Like 72 hours. I switched to iOS and it was instant. Also, the 4% APY is solid. I keep my emergency fund there now. No complaints.

Sunidhi Arakere

November 18, 2025 AT 07:39As someone from India, I appreciate the detailed review. Unfortunately, I cannot use GalaxyOne due to geographic restrictions. However, the comparison table is very helpful for understanding the differences between platforms. Thank you for the clarity on Coin Galaxy being a scam.

Vivian Efthimiopoulou

November 19, 2025 AT 05:03It is imperative to recognize that the regulatory risk inherent in GalaxyOne’s high-yield product is not merely speculative-it is a material, quantifiable, and imminent threat to investor capital. The Wells Notice issued by the SEC in April 2025 is not a bureaucratic formality; it is a formal indication that the Commission has established a prima facie case against the firm for offering unregistered securities under Section 5 of the Securities Act of 1933. The 8% APY is not a feature-it is a liability. To suggest that the platform retains value absent this yield is to ignore the very mechanism that has driven its user acquisition. Institutional-grade custody does not mitigate regulatory risk. It merely delays the inevitable. Investors must proceed with extreme caution, and those who have deposited funds under the assumption of yield stability are, in fact, exposed to systemic counterparty risk. This is not investing. It is speculation dressed in compliance.

Fred Kärblane

November 20, 2025 AT 13:00GalaxyOne is the future of hybrid finance. You’ve got tokenized assets, real-time settlement, and institutional-grade infrastructure-all under one roof. The 15 coins? That’s intentional. They’re curating for stability, not hype. And the APY? That’s yield optimization through DeFi integration, not a loophole. The SEC’s pushback? That’s just legacy finance throwing tantrums. This is the next evolution. If you’re not on this platform, you’re not just behind-you’re obsolete.

gerald buddiman

November 21, 2025 AT 10:55I just got approved for the 8% APY and I’m so nervous! I submitted my tax docs, got the green light, and now I’m like… what if they change it tomorrow? I put $5k in. I’m not rich, but it’s my savings. I feel like I’m walking on a tightrope, but the interface is so smooth. I don’t want to lose it. I just… I just want to sleep at night, you know?

Arjun Ullas

November 22, 2025 AT 07:06The analysis presented is superficial. The absence of crypto IRA support is not merely an inconvenience-it is a fundamental flaw for retirement-oriented investors. Furthermore, the claim that GalaxyOne offers "institutional-grade security" is misleading without disclosing that the custody infrastructure is not independently audited by third parties such as SOC 2 Type II or ISO 27001-certified firms. The regulatory risk is not speculative; it is structural. The SEC’s Wells Notice indicates that the 8% yield product is likely a security under Howey Test criteria. Any investor relying on this yield is engaging in a high-risk speculative activity disguised as savings. This platform is not for the average retail investor. It is for accredited speculators with high risk tolerance and legal counsel. Proceed with extreme caution.

Steven Lam

November 23, 2025 AT 07:39Why are people so obsessed with this app? Just use Coinbase and Robinhood. It’s free. It works. You don’t need some fancy dashboard to feel rich. The SEC is gonna shut this down and then everyone’s gonna be mad because they put their life savings into a 8% yield that was never real. People are so gullible.

Noah Roelofsn

November 24, 2025 AT 20:03Most people don’t realize that GalaxyOne’s real innovation isn’t the interface-it’s the data aggregation. They’re pulling in your external accounts (even non-Galaxy ones) to show you a holistic net worth. That’s why the sync issues happen. It’s not a bug-it’s a feature. They’re building a financial OS. The 8% yield? Yeah, it’s risky. But the platform’s architecture? It’s years ahead of Fidelity’s clunky portal. If you’re still using Mint or Personal Capital… you’re living in 2015.

Sierra Rustami

November 25, 2025 AT 15:52Why should Americans trust this when it’s not even available to the rest of the world? It’s just another Wall Street monopoly. If you’re not a U.S. citizen with a Social Security number, you’re invisible to them. This isn’t finance-it’s nationalism with a mobile app.