Why governments are watching crypto moves across borders

When you send Bitcoin from New Zealand to Germany, or Ethereum from Brazil to Nigeria, it doesn’t just disappear into the digital ether. Governments are watching. Not because they distrust crypto, but because bad actors are using it to hide money, fund terrorism, and dodge sanctions. In 2025, cross-border crypto monitoring isn’t optional-it’s mandatory for anyone running a crypto exchange, wallet service, or even a crypto payment processor.

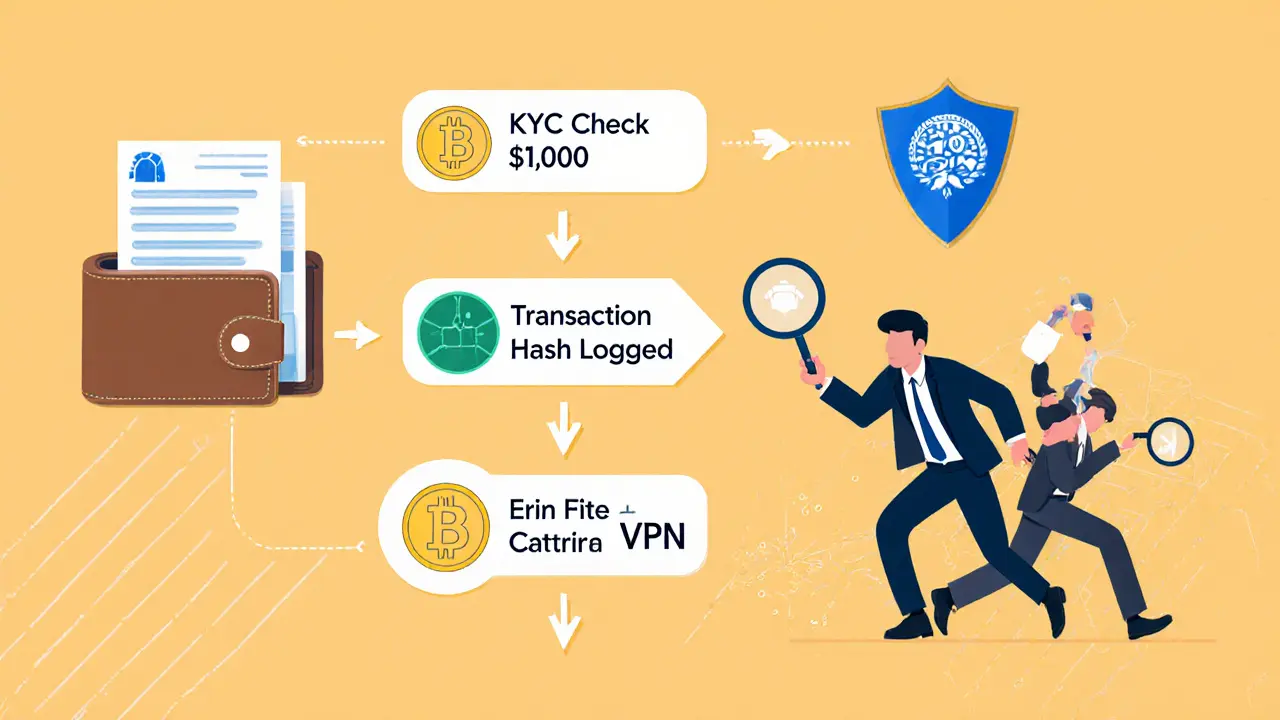

The Travel Rule: What you must share when sending crypto

If you send $3,000 or more in crypto across borders, the law requires your exchange or wallet provider to send specific details about you and the person you’re sending to. This is called the Travel Rule. It’s not a suggestion. It’s part of the Bank Secrecy Act in the U.S., and it’s been adopted by over 120 countries under the Financial Action Task Force (FATF) guidelines.

Here’s what gets shared:

- Your full name and physical address

- The recipient’s full name and address

- The exact amount and date of the transaction

- Your wallet address and the recipient’s wallet address

- The transaction hash (a unique digital fingerprint)

This isn’t just for big exchanges like Coinbase or Binance. Even small crypto payment gateways and decentralized finance (DeFi) platforms that handle transfers above $3,000 must comply. If they don’t, they risk fines, license revocation, or being shut down entirely.

Who’s in charge? FinCEN, MiCA, and the UK-US Task Force

There’s no single global crypto police. Instead, multiple agencies work together-or sometimes at cross-purposes.

In the U.S., the Financial Crimes Enforcement Network (FinCEN) is the main enforcer. They treat Bitcoin and Ethereum like cash under the Bank Secrecy Act. That means any crypto transaction over $3,000 must be logged, reported, and tied to real identities. FinCEN’s 2025 proposal goes further: it wants banks and money services to track transactions involving unhosted wallets-wallets you control with no middleman. That’s a big deal because many people think private wallets are anonymous. They’re not, if the law says otherwise.

In Europe, the Markets in Crypto-Assets (MiCA) regulation sets the standard. It’s stricter than the U.S. model in some ways. MiCA requires every licensed crypto provider to run continuous transaction monitoring, flag suspicious behavior, and report it within 24 hours. It also bans anonymous crypto payments entirely.

Then there’s the UK-US Transatlantic Task Force. This isn’t a treaty. It’s a working group of regulators, tech firms, and lawyers from both countries trying to build a shared playbook. They’re aligning rules on stablecoins, custody, licensing, and how to handle crypto transactions tied to sanctioned individuals. Their goal? Make it impossible for criminals to exploit gaps between U.S. and EU rules.

How criminals slip through the cracks

Despite all the rules, crypto criminals still find ways around the system. Here’s how:

- VPN masking: Someone in Russia uses a VPN to appear as if they’re in Switzerland, then sends crypto to a U.S. exchange. The exchange sees a Swiss IP and skips extra checks.

- Chain hopping: Money moves from Bitcoin to Monero (which hides sender/receiver info), then to Ethereum, then to a stablecoin. Each step breaks the trail.

- Intermediate wallets: A sanctioned Russian entity sends crypto to a clean wallet in the Philippines, then that wallet sends it to a U.S. exchange. The exchange sees no direct link to the bad actor.

- Instant exchanges: Services like Changelly or BitQuick let you swap cash for crypto without ID. These are the go-to tools for laundering funds from ransomware or sanctions evasion.

These tricks work because not all platforms follow the same rules. A crypto exchange in Singapore might require full KYC, but a peer-to-peer platform in Nigeria might not. Criminals exploit that patchwork.

Why unhosted wallets are the biggest headache

Unhosted wallets-like MetaMask or Ledger-are the most private way to hold crypto. You control the keys. No company stores your data. That’s great for freedom. But it’s a nightmare for regulators.

Right now, if you send $5,000 from your MetaMask wallet to a U.S. exchange, the exchange must collect your info. But if you send $5,000 from your MetaMask to another MetaMask? No one logs it. That’s a loophole.

FinCEN’s new proposal wants to force banks and money transmitters to track those transfers. That means if you’re using a U.S. bank to buy crypto and then send it to an unhosted wallet, your bank has to report it. That’s a major shift. It turns your personal wallet into a point of regulatory interest.

What happens if you don’t comply?

Non-compliance isn’t just a fine. It’s a business killer.

In 2024, a U.S.-based crypto firm was hit with a $50 million penalty for failing to report over 12,000 cross-border transactions. The company didn’t have proper AML software, didn’t verify user identities, and didn’t screen for sanctioned addresses. They’re now shut down.

Outside the U.S., penalties are just as harsh. The UK’s OFSI fined a crypto lender £18 million in early 2025 for allowing transactions linked to a sanctioned Russian bank. The lender claimed they didn’t know-regulators didn’t care. They should’ve known.

Even individual users aren’t safe. If you knowingly receive crypto from a sanctioned person and don’t report it, you could face criminal charges in the U.S., UK, or EU.

How businesses stay compliant

Smart crypto firms don’t wait for fines. They build compliance into their systems from day one.

- Blockchain analytics tools: Companies like Chainalysis, Elliptic, and TRM Labs scan every transaction for links to known bad actors, darknet markets, or sanctioned wallets.

- Automated KYC: Identity verification tools like Jumio or Onfido check government IDs and match them to live selfies in seconds.

- Real-time monitoring: Platforms run constant checks on incoming and outgoing transfers. If a wallet is flagged, the transaction is paused and reviewed.

- Partner vetting: If you use a third-party payment processor for crypto, you must check their AML policies. You’re legally responsible for their failures.

Some firms now offer “compliance-as-a-service” for small businesses. For $200 a month, you get automated screening, reporting, and audit trails. It’s cheaper than a lawsuit.

The future: More rules, more tech, more cooperation

By 2026, nearly every country with a financial system will have some form of cross-border crypto monitoring. The EU, U.S., UK, Japan, and Australia are already aligned. China is building its own system for the digital yuan. Even countries like Nigeria and Brazil are drafting rules.

Technology will keep pace. New tools are emerging that can trace crypto across 15 different blockchains in real time. AI can spot patterns humans miss-like a series of small transfers that add up to $10,000 over a week, all sent from wallets linked to the same IP.

The goal isn’t to kill crypto. It’s to make it as traceable as bank transfers. Because if crypto wants to be part of the global financial system, it has to play by the same rules.

What you need to do right now

If you’re a regular user: Don’t use unregulated exchanges. Avoid services that don’t ask for ID. If you’re sending large amounts, expect to provide your details. It’s not an invasion-it’s the new normal.

If you run a business: Don’t assume your crypto software is compliant. Ask your provider: “Do you automatically collect and transmit Travel Rule data for cross-border transfers above $3,000?” If they don’t know, find someone who does.

If you’re a developer: Build compliance into your apps. Don’t wait for regulators to catch up. The ones who do will survive. The ones who don’t won’t.

Is it illegal to send crypto across borders?

No, it’s not illegal to send crypto across borders. But if you’re using a regulated service and the amount is $3,000 or more, you must provide your identity and the recipient’s details. If you’re using an unregulated service or private wallet and try to hide the transaction, you could be breaking the law.

Can I avoid the Travel Rule by using a private wallet?

You can avoid it technically, but not legally. If you send crypto from a private wallet to a regulated exchange, the exchange will still ask for your identity. If you refuse, they’ll block the deposit. If you send to another private wallet, there’s no record-but if that wallet later connects to a regulated service, authorities can trace it back. Privacy doesn’t mean immunity.

Do I need to report crypto transactions to my tax office?

Yes, in most countries. Tax reporting is separate from AML rules. Even if your transaction doesn’t trigger the Travel Rule, you may still need to declare capital gains or income from crypto. Ignoring taxes is a separate legal risk.

What happens if I send crypto to someone on a sanctions list?

If you knowingly send crypto to a sanctioned individual or entity, you could face criminal charges in the U.S., UK, EU, or other jurisdictions. Regulators use blockchain analytics to track these links. Even if you didn’t know the wallet was linked to a sanctioned party, you could still be fined for negligence. Always screen recipients using trusted tools.

Are stablecoins treated the same as Bitcoin in cross-border monitoring?

Yes. Under MiCA and FinCEN rules, stablecoins like USDT and USDC are treated as digital assets with legal tender status. They’re subject to the same Travel Rule and AML requirements as Bitcoin or Ethereum. Their peg to the dollar doesn’t make them exempt.

Can I use a VPN to hide my location when sending crypto?

Using a VPN to hide your location while transacting with a regulated service is a red flag. Regulators know this trick. If your IP address changes frequently or matches known proxy networks, your account will be flagged for review. In some cases, it’s treated as an attempt to evade compliance, which can lead to account freezes or legal action.

MICHELLE SANTOYO

October 28, 2025 AT 13:07Olav Hans-Ols

October 28, 2025 AT 18:43Paul Lyman

October 29, 2025 AT 16:37Clarice Coelho Marlière Arruda

October 30, 2025 AT 10:34Brian Collett

October 31, 2025 AT 10:53Allison Andrews

October 31, 2025 AT 21:45Wayne Overton

November 1, 2025 AT 01:14Alisa Rosner

November 2, 2025 AT 13:30Lena Novikova

November 4, 2025 AT 08:20Kevin Johnston

November 5, 2025 AT 10:25