Crypto Liquidity Assessment Tool

Liquidity Assessment Calculator

Enter key liquidity metrics to determine if a crypto asset is safe to trade

Enter values to see liquidity assessment...

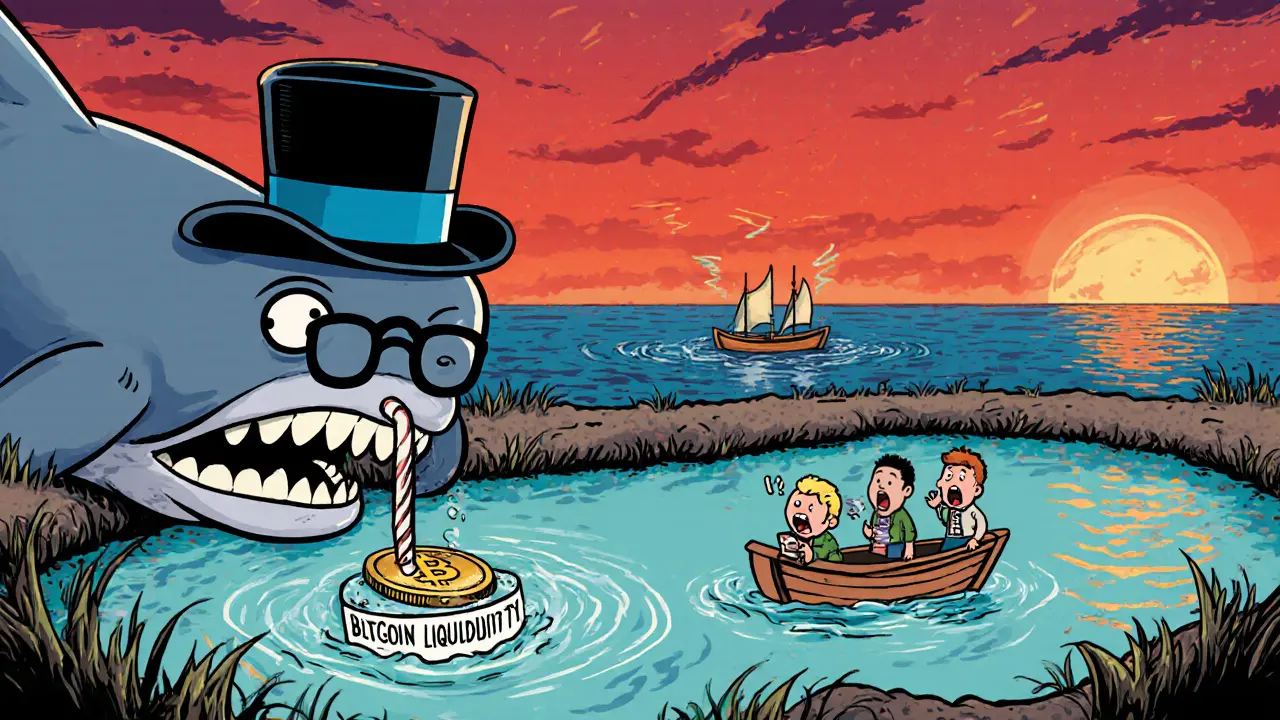

When you buy Bitcoin or Ethereum, you expect it to happen fast, at a price close to what you see on the screen. But what if you try to sell a lesser-known token and find no one’s buying? Or worse - you sell, but the price drops halfway through because there’s not enough demand? That’s where crypto liquidity comes in. It’s not just a buzzword. It’s the invisible force that keeps crypto markets running smoothly - or crashing chaotically.

What Is Crypto Liquidity?

Crypto liquidity is how easily you can buy or sell a digital asset without moving its price. Think of it like a busy supermarket. If the store is packed with shoppers, you grab your milk, pay, and leave without waiting. That’s high liquidity. Now imagine a tiny corner store with one person behind the counter and five items on the shelf. You ask for milk - they don’t have it. You wait. They call another store. You pay extra because they had to order it. That’s low liquidity. In crypto terms, high liquidity means lots of buyers and sellers trading the same coin. Bitcoin and Ethereum are the supermarket aisles - you can trade thousands of dollars in seconds. Low liquidity is that corner store. A small altcoin with only $50,000 in daily trading volume? One big sell order can tank its price by 20% in minutes. Liquidity isn’t about how many people own a coin. It’s about how many are actually trading it. A coin with 1 million holders but only 100 people buying or selling each day? That’s illiquid. And that’s dangerous.Why Liquidity Affects Your Trades

If you’ve ever placed a market order and got a worse price than expected, you’ve felt slippage. Slippage happens when there isn’t enough liquidity to fill your order at the price you want. You try to sell 10,000 units of a token priced at $0.10, but the buy orders only go up to $0.098. The rest of your order gets filled at $0.09, then $0.085. You lost 15% before your trade even finished. High liquidity = tight bid-ask spreads. That’s the gap between what buyers are willing to pay (bid) and what sellers want (ask). On Bitcoin, that spread might be 0.1%. On a low-volume token, it can be 5% or more. That’s a hidden tax. Every time you trade, you pay it. Liquidity also affects how fast your trades go through. On a high-volume exchange like Binance, your order executes in milliseconds. On a small DEX with thin order books, you might wait 10 seconds - or longer if the network is congested. In fast-moving markets, that delay can cost you hundreds of dollars.Who Keeps the Market Liquid?

You don’t need to be a market maker to help keep liquidity alive. Liquidity providers are everyday users who lock their crypto into smart contracts called liquidity pools. These pools power decentralized exchanges like Uniswap and SushiSwap. Instead of matching buyers and sellers like traditional exchanges, AMMs (Automated Market Makers) use these pools to set prices based on supply and demand. If you put $1,000 worth of ETH and USDC into a liquidity pool, you’re helping others trade ETH for USDC - and vice versa. In return, you earn a share of the trading fees. This is called yield farming. But it’s not free money. You risk impermanent loss - when the price of your deposited tokens changes, you could end up with less value than when you started. Market makers, on the other hand, are professionals. They actively buy low and sell high, keeping spreads tight. They’re the reason you can trade $100,000 of BTC on Kraken without the price jumping. Retail traders rarely interact with them directly, but they benefit from their work every time they click “buy.”

What Drives Liquidity in Crypto?

Liquidity doesn’t appear out of nowhere. It’s built by four big forces:- Trading volume - More people trading = more money flowing = better liquidity. Bitcoin’s $30 billion daily volume dwarfs most altcoins, which might trade $1 million or less.

- Exchange reach - Coins listed on Binance, Coinbase, and OKX get instant access to millions of traders. A token only on a tiny exchange? It’s isolated.

- Market sentiment - When fear spreads, traders pull out. Liquidity evaporates fast during crashes. During bull runs, everyone’s buying, and liquidity swells.

- Regulation - When countries crack down, institutional investors vanish. When they welcome crypto, big money flows in. The U.S. SEC’s stance on tokens directly impacts whether hedge funds will risk capital.

Why Liquidity Matters for Big Players

Retail traders care about slippage. Institutions care about scale. If a fund wants to buy $50 million of a token, they need deep liquidity. Otherwise, they’ll blow up the price and end up paying double. That’s why Bitcoin and Ethereum dominate institutional portfolios. They’re the only coins with enough depth to absorb massive trades without major price swings. A token with $20 million daily volume? No institutional investor will touch it. Not even for a 10x return. Liquidity also affects portfolio safety. If you’re holding a coin with low liquidity and the market turns, you can’t sell. You’re stuck. No matter how good the story, if you can’t exit, it’s not an asset - it’s a trap.

The Risks of Low Liquidity

Low liquidity isn’t just inconvenient. It’s risky.- Price manipulation - With few buyers, a single wallet can pump a token by buying up the small order book, then dump it on unsuspecting traders.

- Exit scams - Developers of low-liquidity tokens can drain liquidity pools and vanish. No one can sell. No one can trace the funds.

- High fees - On DEXs, low liquidity means higher slippage settings. You pay more in gas and price loss combined.

- False signals - A token with low volume can show fake momentum. A 50% spike might just be one whale buying - not real demand.

How to Check Liquidity Before You Trade

You don’t need a PhD to spot liquidity. Just look at three things:- 24-hour trading volume - Use CoinGecko or CoinMarketCap. Anything under $5 million? Proceed with caution. Under $1 million? Treat it like a gamble.

- Bid-ask spread - On your exchange, check the order book. If the spread is wider than 1%, liquidity is thin.

- Liquidity pool size - On DEXs, click “View Liquidity.” If the pool is under $500,000, you’re risking your capital on a fragile system.

The Future of Crypto Liquidity

Liquidity is getting smarter. Cross-chain bridges now let users move assets between Ethereum, Solana, and Polygon - pooling liquidity across networks. New protocols like LayerZero and Chainlink CCIP aim to make liquidity flow like water between blockchains. Institutional tools are catching up too. Prime brokers now offer crypto custody, lending, and execution services - bringing hedge funds and family offices into the space. That means more deep pockets, more volume, and more stability. Even central bank digital currencies (CBDCs) could reshape liquidity. If governments issue digital money that works like crypto, it could create new pathways for institutional flows - and maybe even stablecoin alternatives backed by real central bank reserves. But until then, the rule stays simple: crypto liquidity is your safety net. The deeper the pool, the safer your trade. Never ignore it. Never assume a coin is liquid just because it’s trending. Check the numbers. Know the risks. Trade with your eyes open.What is a good trading volume for crypto liquidity?

For most traders, a daily trading volume of at least $5 million is a safe minimum. Coins with $50 million or more are considered highly liquid and suitable for larger trades. Anything below $1 million is risky - especially for institutional investors or anyone trading more than a few hundred dollars.

Can you lose money by providing liquidity?

Yes. Liquidity providers face impermanent loss - a temporary drop in value when the price of the two assets in a pool changes. For example, if you deposit ETH and USDC and ETH’s price doubles, you’ll end up with less ETH than you started with when you withdraw, because the pool rebalances. This isn’t a loss if you hold long-term and the asset appreciates, but it can hurt if you exit during volatility.

Is Bitcoin more liquid than Ethereum?

Yes. Bitcoin consistently has higher trading volume across exchanges, deeper order books, and tighter bid-ask spreads. While Ethereum is the most liquid smart contract platform, Bitcoin remains the most liquid crypto asset overall - especially for large trades and institutional use.

Why do some tokens have low liquidity even if they’re popular?

Popularity doesn’t equal trading activity. Many people hold tokens as long-term bets or store value - they don’t trade them. Liquidity depends on how often people buy and sell. A token with 500,000 holders but only 10,000 active traders will have low liquidity. Hype without trading = illusion.

How do I know if a DEX has enough liquidity?

Check the liquidity pool size on the DEX’s website - look for the total value locked (TVL) in the token pair. A pool under $500,000 is risky. Also, check if the token is listed on major exchanges like Binance or Coinbase. If it’s only on a small DEX with no audit, avoid it.

Cyndy Mcquiston

October 28, 2025 AT 09:38Abby Gonzales Hoffman

October 28, 2025 AT 10:02Rampraveen Rani

October 29, 2025 AT 22:55Natasha Nelson

October 31, 2025 AT 02:40Sarah Hannay

November 1, 2025 AT 14:34Richard Williams

November 2, 2025 AT 23:00Prabhleen Bhatti

November 4, 2025 AT 07:30Elizabeth Mitchell

November 5, 2025 AT 10:47Chris Houser

November 7, 2025 AT 07:00