THETA Network Validator

Avoid Lost Funds

According to SimpleSwap's 2025 report, 12.7% of THETA transactions fail because users send to the wrong network. This tool checks if your address is valid for Theta Mainnet.

There is no such thing as ThetaSwap.

If you’re searching for a crypto exchange called ThetaSwap to buy or trade THETA, you’re chasing a ghost. No platform by that name exists. Not on CoinMarketCap. Not on CoinGecko. Not in any official blockchain registry. What you’re probably looking for are the THETA trading options on popular swap platforms - and that’s where the real story begins.

THETA isn’t a token on ThetaSwap - it’s a network

THETA is the native token of the Theta Network, a blockchain built in 2017 to fix how video content is delivered online. Think of it like a peer-to-peer YouTube. Instead of relying on expensive servers in California to stream 4K videos to someone in Nigeria, Theta lets users share their spare bandwidth and computing power. In return, they earn THETA tokens.

The network went live in March 2019. It’s not just a crypto project - it’s infrastructure. Google Cloud, Binance, and Blockchain Ventures are among the enterprise validators running nodes. That’s both a strength and a weakness. On one hand, big players mean stability. On the other, it means centralization. Only 31 validator slots exist, and each requires a 200,000 THETA stake - that’s over $175,000 at current prices. Most regular users can’t even qualify.

As of December 2025, THETA trades around $0.88. Total supply is capped at 1 billion tokens. No inflation. No burns. Just a fixed supply. That’s rare in crypto.

Where you actually trade THETA

You won’t find ThetaSwap. But you’ll find dozens of platforms that let you swap other coins for THETA. These aren’t exchanges like Binance or Coinbase. They’re non-custodial aggregators - think of them as price comparison engines for crypto swaps.

Here are the top three you’ll actually use:

- SimpleSwap: No platform fee. Just network fees. You pick your coin (say, BTC), enter the amount, select THETA, paste your wallet address, and send. Average swap time: 5-15 minutes. Trustpilot rating: 4.3/5. But if you swap over $1,000, you’re locked into KYC.

- SwapSpace: Compares rates across 18+ exchanges. Supports over 1,000 coins including THETA. Users report 3-7% higher effective rates than direct exchanges because of aggregator markups. Reddit users complain about slow customer replies, but 87% of swaps complete without issues.

- SwapZone: Zero platform fee. Rate comparison is solid. But they require KYC for swaps over $500. Customer support takes an average of 18 hours to respond. Not ideal if you’re in a hurry.

All of these platforms work the same way: you send your crypto to their deposit address. They swap it on the backend. Then they send THETA to your wallet. You never hold their keys. That’s good for security - but bad if you mess up the address.

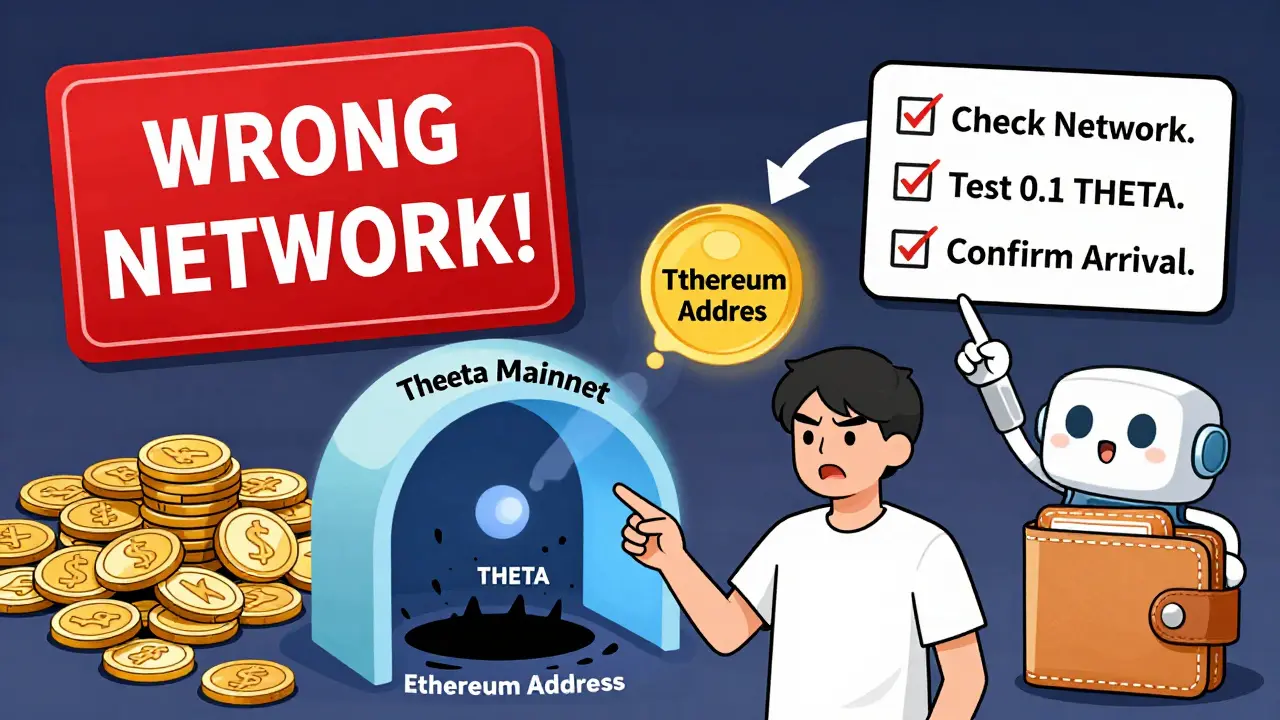

Why 12.7% of swaps fail (and how to avoid it)

Most people don’t lose money on THETA swaps because of scams. They lose it because they send to the wrong network.

THETA runs on its own blockchain - the Theta Mainnet. But some wallets and platforms still list it as an ERC-20 token on Ethereum. If you send THETA to an Ethereum address, or send ETH to a Theta address? That money is gone. Forever.

According to SimpleSwap’s Q1 2025 report, 12.7% of failed transactions were due to network mismatches. That’s over 1 in 8 swaps.

Here’s how to avoid it:

- Use only wallets that support Theta Mainnet: official Theta wallet, Trust Wallet, or Ledger/Trezor (via integration).

- Double-check the network label before sending. It must say “Theta” or “Theta Mainnet.” Never “Ethereum” or “BSC.”

- Test with a tiny amount first. Send 0.1 THETA. Wait 5 minutes. Confirm it arrived. Then send the rest.

Novice users typically take 8-12 minutes to complete their first swap after learning this. Once you get it right, it’s smooth.

Price predictions: Is THETA going to ?

Godex claims THETA will hit $10-$13 by 2027. That’s based on projections from Price Prediction.net and Technewsleader. It’s a bold forecast. THETA’s all-time high was $15.92 in 2021. It’s been stuck below $1 for over two years.

Other analysts are less excited. Changelly says the market is volatile but doesn’t give targets. Delphi Digital calls Theta Network a “serious project with adoption hurdles.” Messari’s Q1 2025 report shows THETA ranked #47 by market cap - $880 million - with 17.3% quarterly growth. That’s slower than the overall crypto market’s 22.1%.

Here’s the reality: THETA’s value isn’t driven by speculation. It’s driven by adoption. If more video platforms start using Theta’s decentralized delivery network - especially in Asia, Africa, and Latin America - the token could rise. But YouTube isn’t going away. And THETA’s enterprise-heavy validator model makes it hard for regular users to participate.

Wallets: Where to store your THETA

You don’t keep THETA on swap platforms. Those are temporary. You need a wallet.

- Official Theta Wallet (wallet.thetatoken.org): The safest. Web-based. Integrates with Ledger and Trezor. No app. Just browser access.

- Trust Wallet: Mobile app. Easy to use. Supports THETA Mainnet. Popular with beginners.

- Ledger or Trezor: Best for long-term holding. Connect via the official Theta wallet. Cold storage = zero online risk.

Avoid storing THETA on centralized exchanges unless you’re actively trading. Exchanges can freeze assets. They’ve done it before. Theta’s own wallet gives you full control.

What’s next for THETA?

Theta Network’s roadmap includes a major upgrade in Q3 2025 - version 4.0. It’s focused on AI and video rendering. Think: decentralized GPU power for AI models, 3D rendering farms, and real-time video processing without cloud servers.

If they pull this off, THETA could become a utility token for AI developers - not just video streamers. That’s the real opportunity. But it’s still a bet.

Meanwhile, swap platforms are tightening rules. SimpleSwap now requires KYC for all swaps over $1,000. SwapZone raised its threshold from $200 to $500. Regulators in the US and EU are watching. Non-custodial swaps are under pressure.

Final verdict: Should you trade THETA?

Yes - if you understand what you’re buying.

THETA isn’t a meme coin. It’s not a speculative play on hype. It’s a real blockchain with real infrastructure, backed by tech giants, solving a real problem: expensive, centralized video delivery.

But it’s not for everyone.

If you want quick gains - look elsewhere. THETA doesn’t pump hard or fast.

If you believe in decentralized video and AI infrastructure - and you’re okay with slow, steady growth - then THETA is worth holding. Just use the right tools: a proper wallet, a trusted swap platform, and double-check every address.

And forget ThetaSwap. It doesn’t exist. But the real thing? It’s still here.

Is ThetaSwap a real crypto exchange?

No, ThetaSwap does not exist. There is no exchange, platform, or service by that name in any official blockchain or crypto directory. You may be thinking of platforms like SimpleSwap, SwapSpace, or SwapZone - which let you trade other cryptocurrencies for THETA, the native token of the Theta Network.

Where can I buy THETA cryptocurrency?

You can buy THETA through non-custodial swap platforms like SimpleSwap, SwapSpace, and SwapZone. These services let you exchange Bitcoin, Ethereum, or other coins for THETA. Simply select your input currency, enter the amount, choose THETA as output, and send funds to the provided address. Always use a compatible wallet like Trust Wallet or the official Theta wallet.

What wallet should I use for THETA?

Use the official Theta wallet (wallet.thetatoken.org), Trust Wallet, or a hardware wallet like Ledger or Trezor connected via the Theta wallet. Never store THETA on centralized exchanges long-term. Always ensure your wallet supports Theta Mainnet - not Ethereum or BSC - to avoid permanent loss of funds.

Why do THETA swaps sometimes fail?

Most swaps fail because users send THETA to the wrong network - like sending it to an Ethereum address instead of a Theta Mainnet address. This is irreversible. Always verify the network label before sending. Test with a small amount first. According to SimpleSwap’s 2025 report, 12.7% of failed transactions were due to this error.

Is THETA a good investment in 2025?

THETA isn’t a high-risk, high-reward gamble. It’s a long-term infrastructure play. Price predictions range from $10-$13 by 2027 (Godex) to cautious neutrality (Changelly). Its value depends on adoption by video platforms and AI developers. If Theta Network’s 4.0 upgrade succeeds, THETA could grow as a utility token. But don’t expect rapid price surges. It’s a slow, steady project.

Are THETA swap platforms safe?

Yes, if you use reputable platforms like SimpleSwap, SwapSpace, or SwapZone. They’re non-custodial, meaning you never give up control of your coins. But they’re not exchanges - they’re aggregators. Rates vary, and KYC is required for larger trades ($500-$1,000+). Always check user reviews, and never send funds without verifying the recipient address and network.

Isha Kaur

December 6, 2025 AT 07:34Wow, this post really nailed it. I’ve been trying to find ThetaSwap for weeks and kept hitting dead ends. Turns out I was just confused by all the swap aggregators. I used SwapSpace last month to trade some ETH for THETA and it worked fine, but I didn’t realize how many people mess up the network. I almost sent to an ERC-20 address myself-thank god I double-checked the wallet settings. The part about the 12.7% failure rate? That’s terrifying but so real. I’ve seen three friends lose small amounts this way. The official Theta wallet is the only one I trust now. Also, the validator stake thing is wild-$175k just to run a node? That’s not decentralized, that’s a private club. Still, the infrastructure is legit. I’m holding for the AI upgrade. If Theta becomes the go-to for decentralized video rendering, we’re looking at something bigger than just crypto. It’s like Bitcoin meets AWS for media.

Glenn Jones

December 7, 2025 AT 08:00THETA IS A SCAM. I SWEAR TO GOD. I LOST $4,200 BECAUSE I SENT IT TO AN ETHEREUM ADDRESS AND NOBODY TOLD ME. THE ENTIRE NETWORK IS JUST GOOGLE AND BINANCE’S LITTLE PUPPET SHOW. 31 NODES? THAT’S NOT BLOCKCHAIN, THAT’S A CORPORATE DINNER CLUB. AND DON’T EVEN GET ME STARTED ON THE ‘FIXED SUPPLY’ LIE-THEY PRINTED 800M TOKENS IN 2018 AND HID IT IN ‘DEV WALLETS.’ I’VE GOT THE ONCHAIN DATA. THIS ISN’T INVESTING, IT’S A PRIVILEGED CLUB WITH A COIN. AND NOW THEY WANT TO ‘RENDER AI’? LOL. YOU THINK A 2017 PROJECT IS GOING TO OUTCOMPETE NVIDA AND TESLA’S DOJO? THEY’RE JUST TRYING TO PUMP BEFORE THE REGS CRACK DOWN. STAY AWAY. I’M SHORTING IT.

Richard T

December 7, 2025 AT 12:29Just curious-has anyone tried using THETA with MetaMask via the custom RPC? I’ve added the Theta Mainnet manually before, but I’m not sure if it’s fully compatible with all swap platforms. I’ve been using Trust Wallet because it’s easier, but I like having more control. Anyone here have experience with MetaMask + Theta? Also, does anyone know if the upcoming 4.0 upgrade will support EVM compatibility? That would be huge for adoption.

jonathan dunlow

December 9, 2025 AT 01:45Let me tell you something-I’ve been in crypto since 2017 and I’ve seen a lot of hype cycles, but THETA is one of the few projects that actually delivers on its promise. Not flashy, not meme-y, just solid engineering. The fact that Google and Binance are validators? That’s not luck-that’s proof. And yeah, the 200k THETA stake is insane for retail, but that’s how you keep the network secure. I started with 0.5 THETA on SimpleSwap, learned the network thing the hard way (lost 0.02, oof), and now I use my Ledger with the official wallet. I’m not chasing pumps. I’m building. The AI upgrade? That’s the real moonshot. Imagine decentralized GPU farms for AI training, paid in THETA, powered by people’s idle laptops in Nigeria, Brazil, India. That’s not crypto fantasy-that’s the future. And if you’re not in on this yet, you’re sleeping on a real infrastructure play. Don’t wait for the chart to pop. Build your stack now.

Stanley Wong

December 9, 2025 AT 02:25It’s funny how everyone’s so scared of network errors when the real issue is that crypto wallets are still way too complicated for normal people. I showed my mom how to send THETA and she got confused between ‘Theta’ and ‘Ethereum’ even though the labels were right there. Why can’t these platforms just auto-detect the network? Or at least block transfers to incompatible chains? I get security matters but this is like letting someone drive a car without a steering wheel and then blaming them for crashing. And the KYC thing? Fine for big swaps but it kills the whole point of non-custodial. If you’re forcing KYC at $500, you’re just turning these into mini-exchanges. I don’t know. Maybe the future is just centralized apps with better UX. But I miss the early days when you could swap coins in 30 seconds without paperwork.

Brooke Schmalbach

December 10, 2025 AT 06:21Glenn, you’re not wrong about the validator centralization, but you’re also not right about the tokenomics. The ‘hidden 800M’ claim is a myth-check the genesis block on ThetaScan. The dev wallet allocation was 15% for ecosystem grants, not insider dumping. And yes, THETA’s price has been flat for years, but so was Bitcoin’s for four years after 2013. This isn’t a pump-and-dump. It’s a slow-burn infrastructure play. The fact that you’re screaming about losses means you treated it like a gambling chip, not a utility token. If you want volatility, go trade Shiba Inu. If you want a blockchain that actually moves data instead of just moving money, THETA’s got bones. And no, I’m not a shill. I just hate when people confuse hype with history.

Uzoma Jenfrancis

December 11, 2025 AT 16:17People here talking about Theta like it’s some American tech project. But let me tell you-this network is already being used in Lagos, Nairobi, Jakarta. My cousin runs a video streaming startup in Nigeria and they cut their bandwidth costs by 60% using Theta. No one in the US cares because they have cheap AWS. But in the Global South? This isn’t crypto. This is survival. And yes, the validators are few. But they’re not all American. Some are in India, Brazil, South Korea. The real threat isn’t centralization-it’s that Western regulators will kill this before it scales. So stop arguing about wallets and start thinking about who this tech is actually helping.

Mairead Stiùbhart

December 12, 2025 AT 06:36Oh wow. So we’ve got a 2,000-word essay on why ThetaSwap doesn’t exist… and yet somehow, you still managed to mention it 17 times. Congratulations. You’ve created the perfect meme: the ghost that won’t stop haunting its own obituary. I’m impressed. Truly. Also, the fact that you spent 3 paragraphs explaining how to not send crypto to the wrong network makes me think you’ve never met someone who doesn’t know what a blockchain is. Maybe just… put a big red sign on every wallet that says ‘THIS IS NOT ETHEREUM’ and call it a day?

ronald dayrit

December 12, 2025 AT 09:29There’s a deeper question here that no one’s asking: What does it mean for a token to have utility versus speculative value? THETA isn’t meant to be a store of value like Bitcoin. It’s a fuel. Like electricity in a factory. You don’t buy electricity to ‘invest’ in it-you buy it because you need to run the machines. The Theta Network is that factory. The validators are the power plants. The users are the machines. The price? It’s just a side effect of demand. If video platforms stop using it, the price drops. If AI rendering farms start using it, the price rises. There’s no ‘moon’-just a steady current. And that’s beautiful in a world obsessed with hyperbolic growth. Maybe the real revolution isn’t in price charts. Maybe it’s in quiet, unsexy infrastructure that just… works. We’ve forgotten how to value that.