Crypto Mining Token Comparison Tool

Compare DMEX (DMC) with other mining tokens

See how DMEX (DMC) compares against legitimate mining projects based on real metrics from the article

DMEX vs. Selected Token

| Metric | DMEX (DMC) | Selected Token |

|---|---|---|

| 24-Hour Trading Volume | $26-30 | |

| Market Cap | $150,000 | |

| Exchanges Listed | 1 (PancakeSwap) | |

| Working Platform | No | |

| Developer Activity | None | |

| Community Size | Near Zero |

Important Note: Low trading volume and market cap make DMEX extremely illiquid. With less than $30 in daily trading volume, you could experience massive slippage and difficulty selling. Real mining projects have significant trading volume that supports liquidity and fair pricing.

What this comparison tells you

A healthy mining token needs more than just a low price to be valuable. It needs: 1) Real trading volume to ensure you can sell when you want to, 2) Working infrastructure to provide actual utility, 3) Developer support to maintain the platform, and 4) A community to build momentum. DMEX lacks all these critical components.

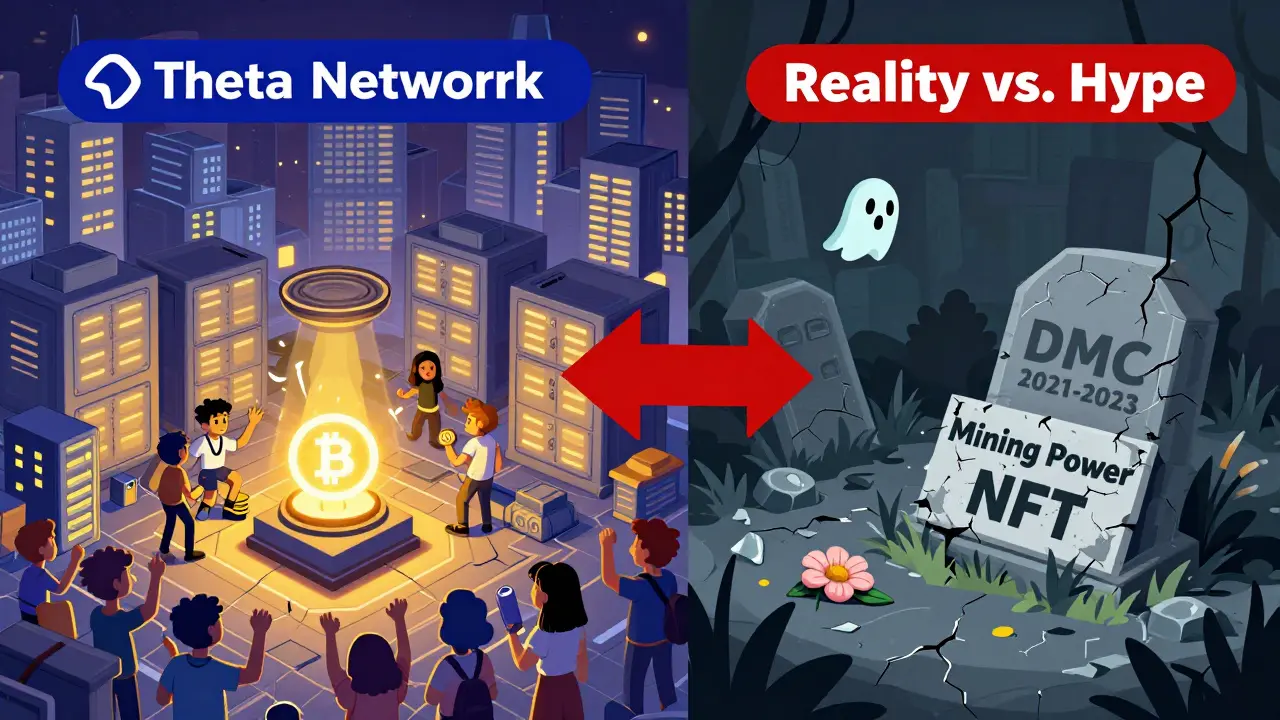

If you’ve heard of DMEX (DMC) as the "world’s first decentralized crypto mining power financial service platform," you’re not alone. But here’s the reality: DMEX isn’t a breakthrough in crypto mining-it’s a nearly dead token with almost no trading activity, no verifiable platform, and zero community backing. Despite flashy claims, this isn’t the next big thing in decentralized mining. It’s a cautionary tale of how hype can outpace substance in crypto.

What DMEX Actually Is (And Isn’t)

DMEX, trading under the ticker DMC, is a token built on the Binance Smart Chain. It claims to let users buy "mining power" as NFTs, earn high APY from mining pools, and use those NFTs as collateral for DeFi loans. Sounds like a dream? It’s not. There’s no working platform. No public GitHub. No technical whitepaper. No developer updates. Just a website (dmex.finance) and a Twitter account that hasn’t posted meaningfully in years.

Unlike real mining tokens like Filecoin or Theta Network, DMEX doesn’t connect to actual mining hardware or cloud mining contracts. It doesn’t even have a functioning dApp. The entire value proposition is theoretical. No one has ever confirmed using its "mining pools" or "NFT collateral loans." The system doesn’t exist-only the token does.

The Numbers Don’t Lie: A Token on Life Support

Let’s look at the data. As of late 2023:

- Price: Around $0.001 (down from an all-time high of $0.55)

- 24-hour trading volume: $26-$30 total across all exchanges

- Market cap: Under $150,000

- Exchanges: Only PancakeSwap (v2)

- Trading pairs: Only DMC/WBNB and DMC/BSC-USD

- Market rank: #6615 out of over 25,000 cryptocurrencies

Compare that to Bitcoin’s daily volume of $12 billion. DMEX’s entire daily trading volume is less than 0.000001% of that. That’s not illiquid-it’s invisible.

Even worse, Binance lists a circulating supply of zero and a market cap of zero-yet still shows a price. CoinGecko says the max supply is 52 million tokens. Binance says 100 million. No one agrees. That’s not a data glitch. It’s a sign the project is abandoned.

Why No One Talks About DMEX

You won’t find DMEX on Reddit, Twitter threads, or crypto forums. No one is posting about profits. No one is warning others. Why? Because there’s nothing to talk about. The token has no users. No one is mining with it. No one is borrowing against its NFTs. No one is even holding it long-term.

Holder.io notes that the price barely moves-"fixed at 0.0012 cents" on Fridays. That’s not stability. That’s stagnation. When a token’s price doesn’t change because no one is buying or selling, it’s not a market. It’s a graveyard.

There are zero reviews on Trustpilot. Zero YouTube tutorials. Zero Medium articles explaining how to use it. Even the official Facebook page linked by some sources has no comments, no posts, no engagement. This isn’t a project with a small community. It’s a project with no community at all.

The "High APY Mining Pools" Myth

DMEX promises "high APY mining pools"-a common lure in crypto scams. But where are these pools? Who runs them? What hardware backs them? No answers. No screenshots. No user testimonials. No contract addresses you can verify on BscScan.

Real mining platforms like NiceHash let you rent hash power from actual ASIC miners. They show you your hashrate, your earnings, your payout history. DMEX shows you nothing. Just a token price and a promise.

And here’s the kicker: even if the mining pools existed, the token’s price has dropped 99.7% from its peak. Any APY you might earn would be wiped out instantly by the token’s collapse. It’s like earning 50% interest on a currency that’s losing 90% of its value every month.

Why You Should Avoid DMEX

Here’s the bottom line:

- No platform = no utility

- No liquidity = you can’t sell if you want to

- No team = no accountability

- No updates = no future

- No community = no momentum

If you buy DMC today, you’re not investing in mining. You’re gambling that someone else will pay more for it tomorrow. But with only $30 traded per day, finding a buyer is like trying to sell a used toaster at a deserted gas station.

And if you’re thinking about using DMC as collateral for a DeFi loan? Don’t. No lending protocol accepts it. No wallet supports it as collateral. No one will take it.

How DMEX Compares to Real Mining Tokens

Let’s put DMEX in context:

| Feature | DMEX (DMC) | Filecoin (FIL) | Theta Network (THETA) |

|---|---|---|---|

| Trading Volume (24h) | $26-$30 | $120 million | $45 million |

| Exchanges Listed | 1 (PancakeSwap) | 30+ | 20+ |

| Working Platform | No | Yes | Yes |

| Developer Activity | None | Active GitHub | Active GitHub |

| Market Cap | $150k | $1.2 billion | $1.1 billion |

| Community Size | Near zero | 500k+ followers | 300k+ followers |

DMEX doesn’t just lose to these projects-it doesn’t even belong in the same category. FIL and THETA are real networks with real infrastructure. DMEX is a ticker symbol on a decentralized exchange with no backing.

What Happens Next?

There’s no roadmap. No team update. No announcement. The token has been stuck under $0.002 since late 2023. That’s over a year of silence.

In crypto, silence equals death. Projects that stop communicating die. Liquidity dries up. Exchanges delist them. Wallets stop supporting them. And then, poof-they vanish from history.

DMEX is already on that path. If you hold it, you’re holding a digital ghost.

Final Verdict

DMEX (DMC) is not a cryptocurrency you should invest in. It’s not a mining tool. It’s not a DeFi asset. It’s not even a speculative play with potential. It’s a dead project wearing a fancy name.

If you see someone promoting it as "the future of decentralized mining," walk away. They’re either misinformed or trying to dump their own holdings on you.

Real crypto mining projects have code, teams, users, and volume. DMEX has none of that. And in crypto, if you can’t prove it exists, it doesn’t.

Is DMEX (DMC) a scam?

It’s not officially labeled a scam, but it has all the red flags: no working product, no team, no updates, near-zero trading volume, and a 99.7% price crash. These are classic signs of a vaporware project-often abandoned after an initial pump. Don’t assume it’s fraudulent until proven, but treat it as dead until proven alive.

Can I mine with DMEX?

No. There is no mining platform associated with DMEX. The "mining power NFTs" are not linked to any real hardware or cloud mining service. The entire concept exists only on paper and in marketing materials. You cannot earn mining rewards with DMC.

Where can I buy DMEX (DMC)?

DMC is only available on PancakeSwap (v2) on the Binance Smart Chain. You’ll need a Web3 wallet like MetaMask, some BNB for gas fees, and the ability to trade on a decentralized exchange. But with less than $30 traded daily, you’ll likely face massive slippage and struggle to sell later.

Is DMEX listed on Binance or Coinbase?

No. DMEX is not listed on any major centralized exchange like Binance, Coinbase, Kraken, or KuCoin. It only trades on PancakeSwap, a decentralized exchange with minimal liquidity. This makes it extremely difficult for new users to access and nearly impossible to cash out safely.

Why does the price vary so much between sites?

Because there’s almost no trading. With only $30 in daily volume, even a single small trade can swing the price dramatically. CoinGecko, Binance, and Holder.io pull data from the same thin pool of trades, which is why their numbers don’t match. This isn’t normal market fluctuation-it’s data noise from a non-functional market.

Should I invest in DMEX if it’s cheap?

No. A low price doesn’t mean a good investment. It means the market has rejected it. Investing in tokens with under $100 daily volume is like buying a lottery ticket with no draw. The odds of a comeback are near zero, and the risk of losing everything is 100%.

What to Do Instead

If you want exposure to crypto mining, look at proven projects:

- Filecoin (FIL) - Decentralized storage network with real mining rewards

- Theta Network (THETA) - Video streaming blockchain with tokenized bandwidth

- Render Token (RNDR) - Decentralized GPU rendering network

These projects have active teams, working platforms, real users, and trading volume you can trust. DMEX doesn’t even come close.

Patricia Amarante

December 15, 2025 AT 20:45This is such a clear breakdown. I’ve seen people pushing DMEX on Telegram like it’s the next Bitcoin-wild how no one checks the basics anymore.

Abby Daguindal

December 16, 2025 AT 12:14Let’s be real-this isn’t even a pump and dump. It’s a pump and vanish. Zero volume, zero updates, zero soul. If you’re holding this, you’re not investing, you’re just collecting dust with a ticker symbol.

Chevy Guy

December 17, 2025 AT 19:13you think this is bad wait till you find out who owns the domain

Florence Maail

December 18, 2025 AT 23:43lol the fact that Binance shows a price but zero circulating supply? classic gov-backed crypto ghosting. they want you to think it’s real so you buy it before they pull the plug. i’ve seen this script before in 2017 and it’s the same damn script.

Kelsey Stephens

December 20, 2025 AT 14:54I’ve been in crypto since 2016 and I’ve seen a lot of dead projects, but DMEX takes the cake. It’s not even a zombie-it’s a fossil. If you’re thinking of buying, just save that money for coffee. You’ll get more value out of it.

Amy Copeland

December 21, 2025 AT 08:35Wow, someone actually did the research. How quaint. Most people just copy-paste hype from Twitter bots and call it investing. I bet you still think Dogecoin is a ‘community coin’ too.

Tom Joyner

December 22, 2025 AT 23:03DMEX is what happens when you give a 16-year-old a whitepaper template and a Discord server. No team, no code, no future. Just a .finance domain and a dream.

Elvis Lam

December 23, 2025 AT 17:32For anyone still wondering if this is a scam: look at the contract. No mint function. No burn. No liquidity pool updates since 2022. The only thing moving is the price on CoinGecko because someone manually updates it once a week. That’s not a market. That’s a spreadsheet.

Emma Sherwood

December 24, 2025 AT 02:38I grew up in a family that ran a small hardware store. We never sold broken tools and called them ‘innovative.’ If DMEX were a toaster, it wouldn’t even be on the shelf-it’d be in the dumpster behind the store with a ‘free’ sign. People need to stop romanticizing dead projects. Real innovation doesn’t hide behind a landing page and a Twitter account that hasn’t posted since 2021.

Dionne Wilkinson

December 25, 2025 AT 07:59It’s sad how fast we forget what crypto was supposed to be about-decentralization, transparency, utility. DMEX is the opposite of all that. It’s not just worthless-it’s a reminder of how easily we trade principles for the illusion of gain.

Sue Bumgarner

December 27, 2025 AT 04:52Why are we even talking about this? America has real crypto projects-Filecoin, Theta, all that. DMEX? It’s some overseas shell game with a .finance domain. If you’re investing in this, you’re not just dumb-you’re disrespecting the whole industry. We don’t need this trash diluting our space.

Kayla Murphy

December 27, 2025 AT 09:12Don’t give up on crypto because of DMEX. There are real builders out there making stuff that works. Focus on those. Your energy is too valuable to waste on digital ghosts.

SeTSUnA Kevin

December 28, 2025 AT 23:54It’s not merely illiquid-it’s ontologically inert. A token without utility is a linguistic artifact, not an asset. The very notion of ‘mining power NFTs’ without underlying infrastructure is a category error masquerading as financial innovation.