ZG.com Trading Fee Calculator

Calculate Your ZG.com Trading Fees

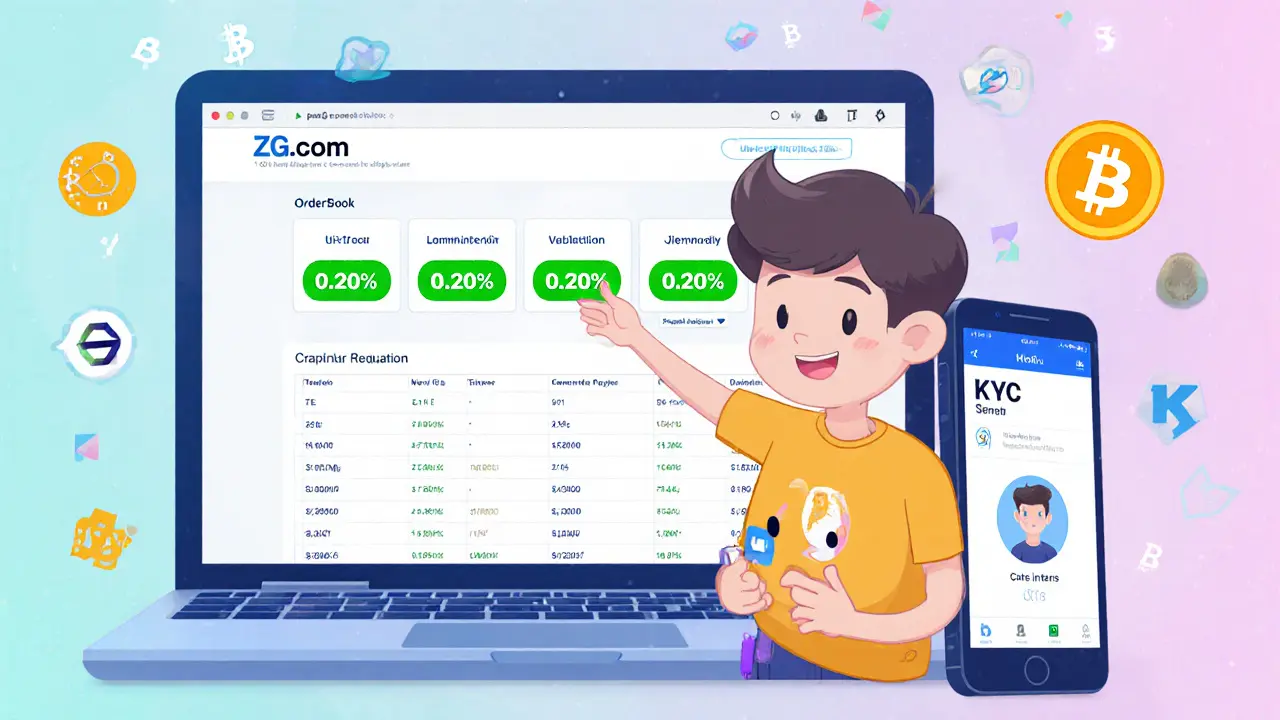

ZG.com charges a flat 0.20% fee for all trades (maker and taker). Calculate how much you'll pay for your trades based on your trade amount.

If you’re hunting for a low‑fee platform to dip your toes into crypto, you’ve probably seen ZG.com crypto exchange review pop up in the search results. This article cuts through the hype and tells you exactly what ZG.com offers, how its costs stack up, which coins you can trade, and whether it feels safe enough for your money.

What is ZG.com?

ZG.com is a centralized cryptocurrency exchange that positions itself as an entry‑level gateway for people moving from fiat money to digital assets. The platform launched before 2025 and has since built web, mobile, H5 browser, and WeChat interfaces to reach a broad audience, especially in Asian markets.

ZG.com focuses on simplicity: a single‑step KYC, a clean order‑book trading screen, and a fee model that tries to undercut the bigger players. It isn’t a full‑blown ecosystem like Binance, but it aims to be the cheapest, most straightforward on‑ramp for beginners.

Fee Structure - Where ZG.com Saves You Money

Fees are the headline that most traders check first. According to the 2025 Cryptowisser review, ZG.com charges a flat 0.20% maker and taker fee on every trade. That’s a shade lower than the industry average of roughly 0.25%.

- Trading fee: 0.20% flat for both sides.

- Bitcoin withdrawal fee: 0.0005 BTC, about 40% cheaper than the typical 0.000812 BTC charged elsewhere.

- Deposit fees: No charge for crypto deposits; fiat deposits via ACH, bank transfer, or debit/credit card are also free of hidden fees, though your bank may impose its own costs.

Those numbers make ZG.com attractive for high‑frequency traders who feel every basis point, and for casual users who only move funds occasionally.

Supported Cryptocurrencies - How Many Coins Can You Trade?

ZG.com lists 19 cryptocurrencies on its platform. While the exact lineup isn’t spelled out in every review, you can expect the major players: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and a handful of popular altcoins like Cardano (ADA) and Polkadot (DOT). The selection is far smaller than Binance or Coinbase, which each host hundreds of tokens.

If you need niche assets-think DeFi tokens, low‑cap meme coins, or new NFTs-you’ll quickly run out of options on ZG.com. The platform’s focus on a curated list helps keep liquidity tight and spreads thin, which can be good for price stability on the supported coins.

Deposit & Withdrawal Options - Getting Money In and Out

One of ZG.com’s selling points is its fiat onboarding. Users can fund their accounts via:

- ACH transfer (U.S. bank accounts)

- Standard bank wire

- Debit or credit card payments

- Crypto‑to‑fiat conversion on‑the‑fly

All crypto deposits are free, matching the industry norm of zero‑fee on‑chain transfers. Withdrawal fees vary by coin, with the standout being the cheap BTC withdrawal mentioned earlier. The platform doesn’t publish exact processing times, but most users report that fiat withdrawals take 1‑3 business days, while crypto withdrawals are usually confirmed within an hour.

Security & Verification - Is Your Money Safe?

ZG.com requires a mandatory single‑step verification that captures basic identity details (name, photo ID, and a selfie). This level of KYC is enough to satisfy most anti‑money‑laundering regulations without creating a multi‑step friction that scares newcomers.

While the reviews don’t list specific security protocols, the platform states that it follows “standard security measures.” In practice, that typically means:

- Two‑factor authentication (2FA) on login

- Encrypted data storage for personal info

- Cold‑storage for the majority of user funds

Without a public security audit or bug‑bounty program, it’s hard to claim ZG.com is top‑tier on safety, but the basic protections put it on par with most mid‑size exchanges.

Usability Across Devices - Trade Anywhere

ZG.com offers a responsive web portal, native iOS and Android apps, an H5 mobile browser version, and even a WeChat mini‑program. The WeChat integration is a clear nod to Chinese users, allowing them to sign in and trade without leaving the popular messenger.

Interface wise, the platform keeps things minimal: a simple dashboard that shows your balance, a trade box for market or limit orders, and a history tab. There’s no advanced charting suite built‑in, so if you rely on technical analysis you’ll need to open a separate charting tool like TradingView.

How ZG.com Stacks Up Against Competitors

| Feature | ZG.com | Binance | Coinbase |

|---|---|---|---|

| Trading fee (maker/taker) | 0.20% flat | 0.10%‑0.20% tiered | 0.50% flat |

| BTC withdrawal fee | 0.0005 BTC | 0.0004 BTC (network fee) | 0.0005 BTC + network |

| Supported coins | 19 | 500+ | 250+ |

| Fiat deposit methods | ACH, wire, card | Bank, card, PayPal | Bank, card, ACH |

| Mobile app | iOS / Android / H5 / WeChat | iOS / Android | iOS / Android |

The table shows that ZG.com wins on price for casual traders and on simplicity for newbies. It loses on the sheer number of trading pairs and advanced features like futures or margin trading, which Binance and Coinbase provide.

Who Should Consider ZG.com?

Based on the data, ZG.com is a solid fit for three main user groups:

- New investors who want a quick fiat on‑ramp without a lengthy KYC process.

- Cost‑conscious traders who trade the major coins daily and care about keeping fees low.

- Mobile‑first users in regions where WeChat is dominant, because the mini‑program makes trading as easy as sending a message.

If you’re an experienced trader chasing low‑liquidity altcoins, a larger exchange will probably serve you better.

Pros and Cons Checklist

- Pros

- Flat 0.20% trading fee - cheaper than many rivals

- Very low Bitcoin withdrawal fee

- Multiple fiat deposit options, including cards

- Simple, single‑step verification

- Mobile, web, and WeChat access

- Cons

- Only 19 cryptocurrencies - limited for advanced traders

- Lacks built‑in advanced charting tools

- No public security audit reports

- Geographic focus appears Asia‑centric, may restrict some fiat currencies

Bottom Line - Is ZG.com Worth Your Time?

ZG.com delivers exactly what it promises: a low‑fee, beginner‑friendly gateway to the big‑ticket crypto markets. If you’re just starting out, want to fund your account with a bank transfer or credit card, and plan to trade Bitcoin, Ethereum, or a few other major tokens, the exchange gives you a painless experience and saves you money on each trade.

However, don’t expect a massive catalog of altcoins or the sophisticated tools that day‑traders rely on. For those needs, you’ll likely graduate to Binance, Coinbase, or a specialized DeFi platform later on. In short, ZG.com is a good first stop on the crypto road, especially if price and ease of use outweigh variety.

Frequently Asked Questions

Is ZG.com safe for storing large amounts of crypto?

ZG.com follows standard industry security practices like 2FA and cold‑storage, but it doesn’t publish an independent audit. For modest balances it’s fine, but for large holdings you may want a hardware wallet or a more transparent exchange.

What fiat currencies can I deposit?

The platform supports U.S. dollars via ACH, wire transfers, and debit/credit cards. Other fiat options are limited and may depend on your geographic location.

How long do withdrawals take?

Crypto withdrawals are usually processed within an hour, while fiat withdrawals typically need 1‑3 business days.

Can I trade on margin or use futures on ZG.com?

No, ZG.com currently offers only spot trading. If you need leverage, you’ll have to look at larger exchanges that provide those products.

Is there a mobile app, and does it work on iOS and Android?

Yes, ZG.com offers native apps for both iOS and Android, plus a web‑based H5 version and a WeChat mini‑program for quick access.

Tom Glynn

October 20, 2025 AT 08:17When you step into crypto, the first thing to remember is that every trade is a small experiment in understanding value.

Think of fees as the friction that shapes how often you can move, and ZG.com’s flat 0.20% is surprisingly gentle.

For a beginner, simplicity beats endless options, so the streamlined KYC can feel like a friendly handshake rather than a gate.

💡 Keep your expectations realistic, and let the low‑cost structure free up mental bandwidth for learning the market.

In short, if you value ease over depth, the exchange fits the philosophy of “start small, iterate often.”

Johanna Hegewald

October 26, 2025 AT 18:33ZG.com’s fee schedule is easy to read: you pay the same 0.20% whether you buy or sell, and crypto deposits are free.

This makes budgeting simple for new traders who don’t want hidden costs.

The platform also supports the major coins, which covers most people’s needs without overwhelming choice.

Benjamin Debrick

November 2, 2025 AT 17:13One must first interrogate the ontological premise of what constitutes a “low‑fee” exchange, for fee structures are not merely commercial artifacts but epistemic signifiers of market philosophy; ZG.com, with its advertised flat 0.20 % maker‑taker rate, positions itself within a lineage of minimalist platforms, a lineage that can be traced back to the early days of electronic trading, when simplicity was a virtue almost lost in the labyrinthine corridors of regulatory compliance; yet, the ostensibly modest percentage conceals a cascade of ancillary costs, such as network fees on withdrawals, which, despite their nominal appearance, sculpt the effective marginal cost of each transaction with surgical precision. Moreover, the platform’s limited token roster-nineteen assets, to be exact-functions as both a pragmatic constraint and a curatorial statement, signaling to the user a deliberate focus on liquidity over diversification, a choice that mirrors the philosophical tension between depth and breadth. The absence of advanced charting tools, while possibly viewed as a deficiency by the seasoned technocrat, may be reinterpreted as an invitation to external analytical ecosystems, thereby fostering a modular approach to market analysis. In the realm of security, ZG.com’s invocation of “standard security measures” is, at best, a tautology; two‑factor authentication and cold storage have become de‑facto baselines, rendering the platform indistinguishable from its peers on that metric alone. The lack of a publicly disclosed security audit, however, imposes an epistemic opacity that would make any critical theorist wince at the unexamined trust placed in the custodial entity. From a geopolitical standpoint, the emphasis on WeChat integration underscores an orientation toward the Asian market, a strategic alignment that may inadvertently marginalize users outside that cultural sphere, thereby raising questions of inclusivity. The fiat onboarding options-ACH, wire, and card-remain conventional, yet their availability may be subject to jurisdictional constraints, a nuance often obscured in marketing gloss. While the exchange touts a single‑step KYC, the underlying data collection practices remain opaque, inviting speculation about data provenance and regulatory compliance. The transaction speed, particularly for crypto withdrawals within an hour, aligns with industry expectations, yet the variability of fiat withdrawal times, ranging from one to three business days, introduces a temporal friction that can affect liquidity planning. In the broader competitive tableau, ZG.com’s fee advantage over Coinbase’s 0.50 % flat rate is palpable, but its comparative disadvantage vis‑à‑vis Binance’s tiered structure may diminish its appeal to high‑volume traders seeking volume‑based rebates. The platform’s user interface, described as minimalistic, eschews the pedagogical scaffolding that many newcomers require, potentially accelerating the learning curve for the adept but alienating the novice. Ultimately, the decision to engage with ZG.com hinges upon a user’s prioritization matrix: low cost, simplicity, and regional accessibility versus token variety, advanced analytics, and transparent security governance. One must, therefore, calibrate personal risk tolerance and strategic objectives before committing capital to this exchange. Thus, ZG.com occupies a niche that is simultaneously alluring and limiting, demanding careful contemplation before adoption.

Anna Kammerer

November 9, 2025 AT 15:53Oh great, another exchange that promises “no hidden fees” while quietly handing you a menu of only the biggest coins.

It’s like being served a gourmet meal with the side dishes taken away – you get the steak, but no salad or dessert.

If you’re happy with Bitcoin and Ethereum, you’ll feel right at home; if you crave the exotic, you’ll be left scrolling through the “sorry, we don’t have that” list.

Mike GLENN

November 16, 2025 AT 14:33The design philosophy behind ZG.com appears to be rooted in the idea that a user’s journey should be as frictionless as possible, which is reflected in the single‑step KYC and the clean trading interface; this approach certainly lowers the barrier to entry, especially for those who are intimidated by the labyrinthine verification processes of larger platforms.

However, the trade‑off for this simplicity is a constrained asset selection, limiting traders to just nineteen cryptocurrencies, which may suffice for newcomers but could become a bottleneck for those looking to diversify their portfolios.

Moreover, the decision to integrate a WeChat mini‑program signals a strategic focus on the Asian market, potentially at the expense of broader international appeal, as users outside that ecosystem might find the native apps more aligned with their habits.

The fee structure, with a flat 0.20 % maker‑taker rate, sits comfortably between the aggressive tiered discounts of Binance and the higher flat rates of Coinbase, offering a middle ground that appeals to cost‑conscious traders without demanding massive volume.

Security-wise, the standard 2FA and cold‑storage practices are reassuring, but the absence of a publicly available audit report leaves a lingering question about the depth of the platform’s risk management.

In practice, the withdrawal timelines-crypto within an hour, fiat taking one to three business days-are comparable to industry norms, meaning users won’t experience surprising delays.

All told, ZG.com presents a compelling package for the entry‑level trader who values ease over exhaustive features, but anyone seeking advanced tools or a broad token spectrum should consider graduating to a more robust exchange.

BRIAN NDUNG'U

November 23, 2025 AT 13:13Esteemed members of the community, allow me to submit a concise evaluation of ZG.com’s operational merits.

The exchange’s fee architecture, characterised by a uniform 0.20 % rate, demonstrates a commendable commitment to transparency, thereby obviating the need for tier‑based calculations.

Its custodial safeguards, namely two‑factor authentication and the employment of cold‑storage solutions, align with prevailing industry standards, providing a reasonable baseline of security.

Nevertheless, the paucity of publicly disclosed audit documentation may be perceived as a shortcoming in the realm of governance.

In summation, for investors prioritising cost‑efficiency and simplicity, ZG.com constitutes a viable option, albeit one whose limitations should be judiciously weighed against individual trading objectives.

Donnie Bolena

November 30, 2025 AT 11:53Wow-what a tidy little platform!; ZG.com really nails the “no‑frills” vibe; you get low fees, a handful of the big coins, and a straightforward sign‑up process; perfect for anyone who wants to jump in without getting lost in endless menus; just remember to keep an eye on those withdrawal times, but overall it’s a solid stepping stone!.

Elizabeth Chatwood

December 7, 2025 AT 10:33i think its kinda cool u can just use wechat lol and no big fees huh its good for beginners

Tom Grimes

December 14, 2025 AT 09:13I see what you’re saying about the simplicity, but let me tell you how that “friendly handshake” can actually feel like a trap once you realize you’re stuck with only nineteen coins and the platform might close tomorrow, which would leave you scrambling for your funds, and that uncertainty can weigh heavy on anyone’s mind, especially when you’re just starting out and every little decision feels huge, so while the low fees sound great, the hidden risk of limited options and possible lack of transparency should not be ignored, and it’s important to have a backup plan, maybe keep some assets on a hardware wallet just in case.

Paul Barnes

December 21, 2025 AT 07:53Honestly, the fee brag isn’t impressive when the exchange can’t prove its security.

Joy Garcia

December 28, 2025 AT 06:33This exchange is a glittering mirage that will vanish the moment you need something real.

mike ballard

January 4, 2026 AT 05:13From a fintech ecosystem perspective, ZG.com’s API latency is negligible, its order book depth for BTC/ETH pairs is respectable, and the integration with WeChat leverages a ubiquitous social‑commerce layer that streamlines KYC onboarding; overall, the platform offers a cohesive stack for entry‑level traders looking to dip their toes in the liquidity pool 😊.

Molly van der Schee

January 6, 2026 AT 12:46It’s encouraging to see an exchange that focuses on making the first steps less intimidating; the low fee model and simple verification can help newcomers build confidence without feeling overwhelmed; just stay aware of the limited coin list and consider diversifying elsewhere as you grow.

Mike Cristobal

January 10, 2026 AT 00:06While the platform touts a “cohesive stack,” it still falls short on transparency, and without a published security audit, any claim of safety is merely lip service; users deserve full disclosure before trusting their assets 😉.