Imagine selling a piece of real estate in 22 minutes instead of waiting seven months. That’s not science fiction-it’s what’s happening with tokenized real estate. For decades, owning property meant tying up tens or hundreds of thousands of dollars for years, with no easy way out unless you found a buyer willing to close a slow, expensive deal. Now, thanks to blockchain, you can own a fraction of a building in Miami, New York, or Sydney-and trade it like a stock, anytime, anywhere.

Why Real Estate Has Always Been Illiquid

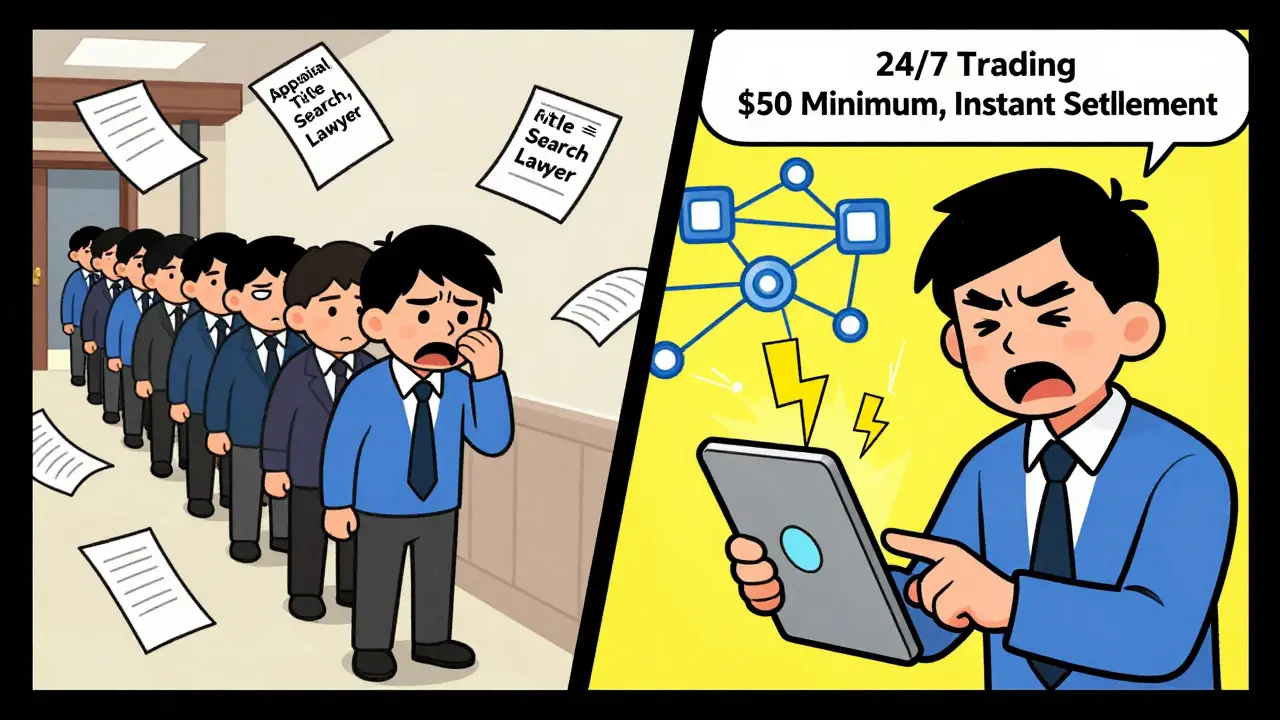

Traditional real estate has always been a slow-moving asset. Buying or selling a house or commercial building takes 60 to 90 days on average. You need appraisals, inspections, title searches, lawyers, banks, and multiple signatures. Minimum investments often start at $100,000, making it impossible for most people to diversify. Even REITs, which let you invest in real estate through the stock market, require $1,000 or more and only trade during market hours. And when you want to sell? You’re stuck waiting for the right buyer. This isn’t just inconvenient-it’s costly. Historically, illiquid assets like property carried a 15% to 30% discount just because they couldn’t be sold quickly. That’s money lost before you even start.How Tokenization Changes Everything

Tokenized real estate turns ownership into digital tokens on a blockchain. Each token represents a share of a property-down to as little as $50 on platforms like Lofty.ai. These tokens can be bought, sold, or traded 24/7 on secondary markets, just like shares on a stock exchange. Settlements happen in minutes, not months. A transaction that used to take 45 to 90 days now clears in under 15 minutes on networks like Stellar or Polygon. That’s 47 times faster than traditional sales, according to Deloitte’s 2025 analysis.This isn’t just about speed. It’s about access. A nurse in Ohio can now own a slice of a luxury apartment building in Miami. A teacher in Berlin can invest in a warehouse in Singapore. No more needing a million-dollar net worth to get into commercial real estate. The barrier to entry has collapsed.

The Numbers Don’t Lie

The market is responding. In Q3 2025, the global value of tokenized real estate hit $9.5 billion-up 147% from just a year earlier. Daily trading volume for these tokens reached $12.7 million, and the average liquidity-how easily assets can be bought or sold-hit 2.3% of total market cap. Compare that to traditional REITs, which hover around 0.05%. That’s a 46x improvement in liquidity.Platforms like Lofty.ai and REENTAL are seeing real user stories. One investor sold $3,200 worth of Miami apartment tokens in 22 minutes during a market dip. Another used proceeds from token sales to cover emergency medical bills within 90 minutes. Trustpilot reviews for REENTAL highlight "instant liquidity during emergencies" as the top reason people use the platform.

How It Works Under the Hood

Tokenized real estate runs on blockchains like Ethereum, Polygon, and Polymesh. These networks use smart contracts to automate ownership transfers, enforce rules, and verify identities. You don’t need to be a tech expert-most platforms handle the complexity behind the scenes. You just need a digital wallet (like MetaMask or Ledger), pass KYC/AML checks (identity verification), and buy tokens through the platform’s interface.Standards like ERC-1400 ensure these tokens are compliant with securities laws. That means they’re not just crypto tokens-they’re regulated digital securities. Platforms like Polymesh even include built-in identity modules that lock transfers until compliance rules are met. This isn’t the Wild West of crypto. It’s a structured, auditable system.

Where It’s Working Best

Adoption isn’t spread evenly. Sixty-three percent of tokenized real estate activity happens in just four places: Switzerland, the UAE, Singapore, and parts of the U.S. like Wyoming and Florida. Why? Because these regions have clear, investor-friendly regulations. The SEC’s March 2025 Framework for Digital Asset Securities gave U.S. issuers clarity. MiCA, the EU’s Markets in Crypto-Assets regulation, rolled out in January 2025 and created a unified legal framework across 27 countries.Meanwhile, places like Germany still ban fractional ownership of property. That’s why global adoption is still limited to 0.17% of the total $7.3 trillion real estate market. But that’s changing fast. BlackRock’s Alchemy Platform now manages $4.2 billion in tokenized assets-44% of the institutional share. Fidelity added tokenized real estate to its 401(k) platform in September 2025. The Real Estate Token Exchange (RETX) in Singapore processed $847 million in its first 30 days.

The Trade-Offs: It’s Not Perfect

Liquidity sounds great, but it’s not universal. If you own tokens tied to a rural warehouse or a niche property type, you might wait weeks to find a buyer. On Reddit, one user took 17 days to sell $850 in tokens for a small commercial property-versus just 3 hours for tokens tied to a downtown apartment. The market depth for these assets is still thin.There’s also volatility. During the April 2025 market correction, tokenized real estate prices swung 31% on average, compared to just 4% for NYSE-listed REITs. That’s because there’s no central price discovery yet. Valuation models are still evolving. EY warns that without standardized methods, liquidity can feel fake during a crisis.

Gas fees used to be a nightmare. On Ethereum, a single transaction cost $15.75 in early 2024. Today, thanks to layer-2 solutions like Polygon, fees are down to $0.83. But not all platforms are equal. Lofty.ai responds to support tickets in under 24 hours. REENTAL takes up to 72 hours. KYC requirements vary too-some ask for five documents, others only three.

What’s Next? The Road to Mainstream

The future is accelerating. By 2028, experts predict tokenized real estate liquidity will hit 85% of traditional REIT levels. Three drivers will make this happen:- Institutional custody: JPMorgan’s Onyx platform is launching in Q2 2026 to hold tokenized assets for banks and pension funds.

- Regulatory harmony: The Financial Stability Board plans global standards by November 2026 to align rules across the U.S., EU, and Asia.

- Cross-chain interoperability: Polymesh’s Interlay integration, launching Q4 2025, will let tokens move between blockchains without losing compliance.

By 2030, the historical 15-30% illiquidity discount for real estate could shrink to just 1-3% for tokenized assets. That’s not a small change-it’s a revolution.

Who Benefits Most?

This isn’t just for tech insiders. It’s for:- Retirees who want to diversify beyond stocks and bonds without buying entire properties.

- Young investors who can start with $50 and build a portfolio over time.

- Business owners who need quick access to cash and can sell tokens instead of waiting months for a property sale.

- Global investors who want exposure to U.S. or Asian real estate without dealing with foreign ownership laws.

If you’ve ever felt locked out of real estate because of cost, complexity, or time-tokenization is your way in. It doesn’t replace traditional property ownership. But it gives you a new tool: one that turns frozen assets into fluid ones.

Can I really own a fraction of a building with tokenized real estate?

Yes. Tokenized real estate splits ownership into digital shares, often as small as $50. Each token represents a proportional stake in the property’s value, rent income, and future appreciation. Platforms like Lofty.ai and REENTAL handle the legal structure, so you don’t need to manage leases or repairs. You’re simply an owner of a digital share.

Is tokenized real estate safe?

It’s safer than it used to be, but not risk-free. Smart contracts are audited, and platforms use multi-signature wallets and on-chain identity checks. Many operate under securities regulations (like SEC or MiCA), which require transparency. But like any investment, you’re exposed to market risk, platform failure, and regulatory changes. Always use platforms with third-party audits and strong KYC processes.

How do I start investing in tokenized real estate?

First, choose a regulated platform like Lofty.ai, Polymesh, or REENTAL. Complete their KYC verification (usually 24-72 hours). Link a digital wallet (MetaMask or Ledger). Fund your account with fiat or crypto. Browse available properties, select your investment amount, and buy tokens. You can hold or sell anytime on their secondary market.

Do I get rental income from tokenized real estate?

Yes. Most tokenized properties generate rental income, which is distributed to token holders proportionally. For example, if you own 0.5% of a building, you receive 0.5% of the monthly rent. Payments are automated via smart contracts and sent directly to your wallet, usually monthly or quarterly.

Can I sell my tokens anytime?

On most platforms, yes-24/7. But liquidity depends on the property. Tokens for high-demand assets like downtown apartments sell quickly, sometimes within minutes. Tokens for niche properties (rural land, specialty commercial spaces) may take days or weeks to find buyers. Always check the trading volume history before investing.

Is tokenized real estate legal in my country?

It depends. The U.S., EU, Singapore, Switzerland, and UAE have clear frameworks. Countries like Germany and India still restrict fractional ownership. Always check local securities laws before investing. Reputable platforms only operate in compliant jurisdictions and will block users from restricted regions.

What’s the difference between tokenized real estate and REITs?

REITs are companies that own and manage real estate, and you buy shares in the company. Tokenized real estate lets you own a direct fractional stake in the actual property itself. REITs trade only during market hours, have minimums of $1,000+, and offer indirect exposure. Tokenized assets trade 24/7, start at $50, and give you direct ownership with transparent underlying assets.

What happens if the platform shuts down?

Your tokens are stored on the blockchain, not on the platform’s servers. Even if Lofty.ai or REENTAL disappears, your tokens remain in your wallet. You can still transfer them to another compatible platform or sell them on decentralized exchanges that support the token standard (like ERC-1400). The property itself still exists-you just need to find a new marketplace to trade it.