DCA vs Lump-Sum Investment Calculator

Lump-Sum Investment

Dollar Cost Averaging (DCA)

Results Comparison

When you’re buying Bitcoin or Ethereum every week, you’re not just following a trend-you’re using a strategy with real math behind it. Dollar Cost Averaging (DCA) is everywhere in crypto: Reddit threads, Telegram groups, even your friend who bought $50 of Solana every Friday. But is it actually better than dumping all your cash in at once? The answer isn’t simple. There’s math. Real math. And it doesn’t always say what you think it does.

What DCA Actually Does-The Numbers

Dollar Cost Averaging means buying the same dollar amount of an asset at regular intervals, no matter the price. Buy $100 of Bitcoin every Monday. Even if it’s at $70,000 or $30,000, you stick to it. The idea is that you buy more when prices are low and less when they’re high. Over time, your average cost per coin drops. But here’s the catch: math doesn’t prove DCA is always better. In fact, it often proves the opposite. A 2020 study published in a top finance journal gave us the first full mathematical model of DCA. It didn’t just run simulations-it built equations. Closed-form formulas. These showed exactly how much risk and return you could expect from DCA versus lump-sum investing. And here’s what it found: DCA reduces volatility, but it also reduces average returns. Why? Because markets trend up over time. If you wait to invest your money in chunks, you’re leaving cash on the sidelines. That cash earns nothing. Meanwhile, the market keeps climbing. Lump-sum investing puts all your money to work immediately. And over long periods, that usually wins.The 40-Year Test: DCA vs. Lump-Sum in Real Markets

Researchers at Raymond James looked at 40 years of S&P 500 data-not crypto, but the same logic applies. They tested what happens when you invest at market peaks. Not just any time. The exact top of major bull runs: August 1987, July 1992, March 2000, October 2007. Here’s what they found:- Lump-sum investing at a peak: 8.3% average annual return over 10 years

- DCA investing at the same peak: 10.4% average annual return over 10 years

- Just holding cash: 3.1%

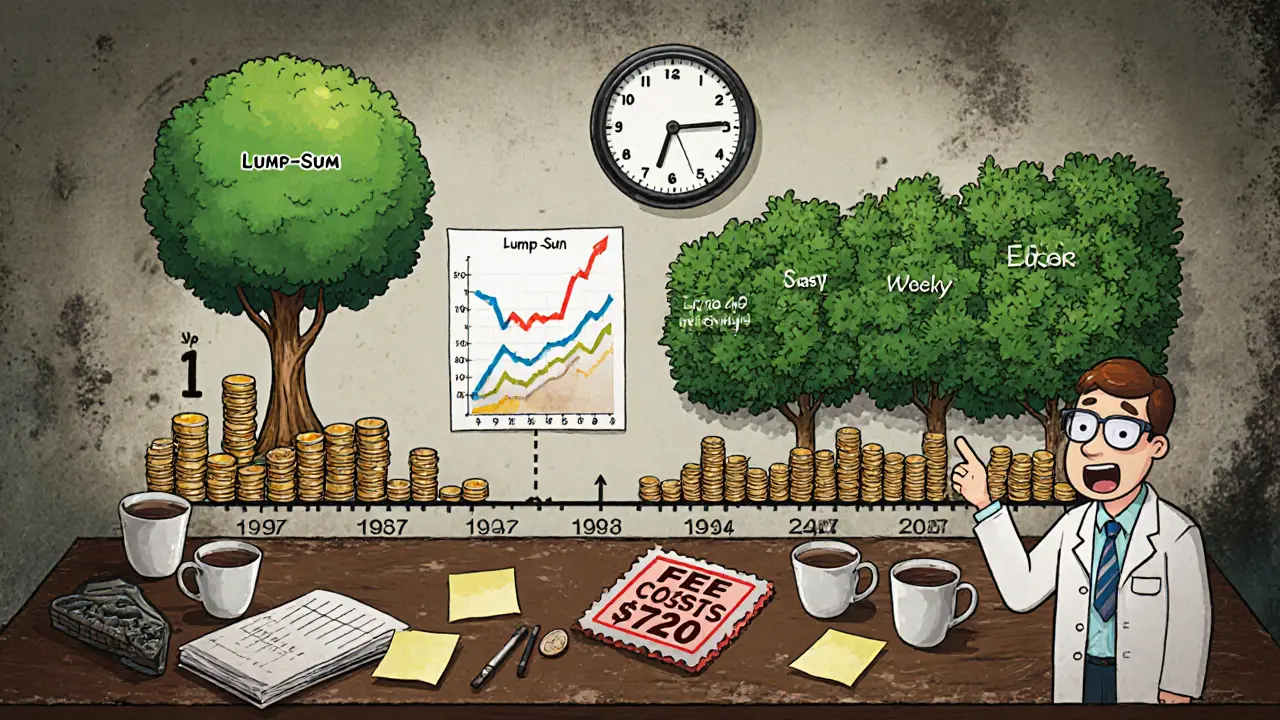

Frequency Doesn’t Matter-But It Feels Like It Does

Most people think: “The more often I DCA, the better.” Buy daily? Better. Weekly? Even better. Monthly? Okay, I guess. The math says no. The 2020 study used computational models to test investment frequency. They found the relationship between frequency and performance isn’t linear. Going from monthly to weekly buys doesn’t cut your risk in half. Going from weekly to daily? Almost no improvement. The risk curve flattens fast. Why? Because price movements over days are mostly noise. The real swings happen over weeks and months. Buying every day just increases transaction friction-fees, slippage, mental fatigue-with zero real benefit. For crypto investors, this matters. Exchanges charge fees. Some even charge withdrawal fees. If you’re buying $50 of Dogecoin every day, you’re paying $0.50 to $2 in fees each time. That’s 1% to 4% of your investment gone. Over a year, that’s $180 to $720 in wasted money. DCA only works if the cost of doing it doesn’t eat your gains.

Why DCA Feels Right-Even When It’s Not Mathematically Optimal

If DCA isn’t the mathematically best choice, why do so many people swear by it? Because it’s not about math. It’s about psychology. In 1995, behavioral economist Meir Statman showed that DCA reduces regret. When you invest all your money and the price drops 30% the next week, you think: “I messed up.” You second-guess yourself. You feel stupid. But if you’re buying $100 every Monday, and the price drops? You think: “Okay, I bought more this week. Good.” You don’t feel like you failed. You feel like you’re in control. That’s not irrational. It’s human. And in investing, staying calm is often more valuable than maximizing returns. Crypto is especially brutal for emotions. Prices swing 20% in a day. News breaks. Memes drive pumps. If you’re not emotionally wired to handle that, lump-sum investing can break you. DCA gives you a rhythm. A routine. A way to keep going even when the market feels like chaos.When DCA Actually Wins

DCA isn’t a magic bullet. But it’s a tool. And like any tool, it’s best in specific situations:- You’re new to crypto and don’t trust your timing

- You’re investing a large sum and are scared of buying at a peak

- The market is volatile and uncertain-like during a regulatory crackdown or protocol hack

- You’re using it as a discipline tool, not a return maximizer

What the Math Doesn’t Tell You

Most mathematical models assume markets follow random patterns. They assume returns are normally distributed. They ignore black swans, halvings, ETF approvals, and Elon tweets. Crypto doesn’t play by those rules. Bitcoin’s supply is capped. Halvings happen every four years. Miner sell pressure drops after each one. That’s not random. That’s predictable. And those events create trends that last months or years. DCA doesn’t account for that. Lump-sum doesn’t either. But if you know a halving is coming, timing your lump-sum investment six months before it can be smarter than any averaging strategy. Also, most models assume you can invest instantly. In crypto, that’s not always true. Exchange downtime. KYC delays. Network congestion. Your $100 might not even get into the wallet until the next day. That’s not noise-that’s friction. And friction breaks perfect models.So What Should You Do?

Here’s the real answer, stripped of hype: If you have a lump sum and you’re confident in crypto’s long-term future? Invest it all now. The math says you’ll likely get better returns. If you’re nervous? If you’re scared of missing the bottom? If you’ve lost money before and don’t want to feel that again? Use DCA. But do it right. Do this:- Set a fixed amount-$50, $100, $500-based on your budget

- Choose a frequency-monthly is enough. Weekly if you want the psychological comfort

- Stick to it for at least 12 months

- Don’t check your portfolio every hour

- After 12 months, stop DCA and hold

Final Thought: DCA Is a Habit, Not a Strategy

The best investors aren’t the ones who picked the perfect entry point. They’re the ones who stayed in. Through crashes. Through silence. Through doubt. DCA works because it forces you to keep going. It turns investing from a gamble into a habit. And habits, over time, beat timing every time. The math doesn’t lie. But neither does human nature. In crypto, where volatility is constant and fear is loud, the most powerful tool isn’t a formula. It’s consistency.Is DCA mathematically proven to beat lump-sum investing?

No. Mathematical models and historical data show that lump-sum investing outperforms DCA about two-thirds of the time, especially over long periods in rising markets. DCA reduces volatility and emotional stress, but it also reduces average returns by keeping cash idle. It’s not superior-it’s a trade-off.

Does buying crypto weekly give better results than monthly?

No. Studies show that increasing DCA frequency beyond monthly provides almost no additional risk reduction. Daily or weekly buys add transaction fees and mental load without meaningful improvement in returns. Monthly DCA is optimal for most investors-enough to smooth volatility without unnecessary friction.

When is DCA the best choice for crypto investors?

DCA is best when you’re new to crypto, have a large sum and fear buying at a peak, or are investing during high volatility and uncertainty. It’s also ideal if your goal is discipline-not maximizing returns. It helps you avoid emotional decisions and stay consistent.

Why do experts say lump-sum is better if DCA feels safer?

Because markets trend upward over time. Money invested sooner earns more. Lump-sum puts all your capital to work immediately. DCA delays that. The psychological safety of DCA is real and valuable-but it comes at a cost in expected returns. The best investors balance both: use DCA to build discipline, then switch to lump-sum when they’re ready.

Does DCA work in bear markets?

Yes, and it often shines. During prolonged downturns, DCA lets you accumulate more assets at lower prices. Historical data shows DCA returns improve significantly during market declines. While lump-sum still wins in bull markets, DCA can outperform in bear markets by reducing the average purchase price over time.

Should I use DCA for altcoins like Solana or Shiba Inu?

Be cautious. DCA works best with assets that have long-term fundamentals and low risk of total loss. Bitcoin and Ethereum fit this. Many altcoins don’t. If an altcoin has no clear use case, weak community, or high dilution risk, DCA won’t save you-it just spreads your losses over time. Stick to DCA only for projects you believe in for the long haul.

Savan Prajapati

November 26, 2025 AT 20:52DCA is for people who can't handle real investing. Lump sum all day, every day. The math doesn't lie.

Janice Jose

November 27, 2025 AT 11:40I get why people use DCA-it’s not about the numbers, it’s about not losing sleep. I bought $200 of BTC every Monday for a year during the last crash. Didn’t make me rich, but I didn’t panic sell either. Worth it.

Martin Doyle

November 27, 2025 AT 22:32Anyone who says DCA is better than lump sum hasn’t looked at the actual data. You’re literally leaving money on the table by not investing immediately. Markets go up over time. That’s not speculation, that’s history.

Susan Dugan

November 28, 2025 AT 16:45Y’all are overcomplicating this like it’s a PhD thesis. DCA is your emotional safety blanket. Lump sum is your wealth accelerator. Use both. Start with DCA to build the habit, then go all-in when you feel ready. No shame in either. Just don’t pretend one’s magic.

SARE Homes

November 29, 2025 AT 17:51OMG. Another DCA cultist. You people are so emotionally dependent on your $50 weekly buys you think it’s a strategy?? You’re not investing-you’re performing therapy. And you’re paying fees to do it. Congrats, you’re the human version of a vending machine that only dispenses regret.

Grace Zelda

December 1, 2025 AT 03:51It’s funny how we treat investing like it’s a math problem when it’s really a story about human behavior. The numbers say lump sum wins-but they don’t measure how many people quit because they couldn’t handle the drop. DCA isn’t about returns. It’s about survival. And sometimes, surviving is the only win that matters.

Kristi Malicsi

December 2, 2025 AT 04:44frequency doesn't matter and fees eat you alive if you do daily but nobody cares because feeling in control is better than being right

George Kakosouris

December 2, 2025 AT 05:26Let’s be clear: DCA is a behavioral crutch for retail investors who lack alpha. The 2020 closed-form model explicitly shows that the risk-adjusted return of DCA underperforms lump sum by 1.8–2.4% annually in equity-like distributions. Crypto’s fat tails don’t invalidate this-they amplify it. Your psychological comfort is not an alpha factor. It’s an opportunity cost.

Tony spart

December 3, 2025 AT 06:58u think u smart with ur math? i bought btc at 30k and held. u buy 50 a week and still lost money. usa got too soft. real investors go all in. no fear. no dca. just buy and hold. u guys need therapy not portfolios.

Mark Adelmann

December 4, 2025 AT 08:30Hey, I started DCA with $100 a month on Bitcoin when I was 22. Didn’t know what I was doing. Just wanted to be part of it. Now I’ve got a little stack. Not rich. But not broke either. And I didn’t lose my mind during the 2022 crash. That’s worth more than any Sharpe ratio. You don’t have to be the smartest to be the one who stays.

ola frank

December 5, 2025 AT 18:30The fundamental flaw in the DCA narrative is the assumption of stationary market dynamics. Crypto exhibits non-Gaussian volatility, regime-switching behavior, and exogenous supply shocks (e.g., halvings) that invalidate standard stochastic models. Lump-sum investing, when aligned with macroeconomic cycles and on-chain metrics, demonstrably captures higher convexity. DCA, while psychologically adaptive, is a suboptimal policy under non-ergodic conditions. The data is clear. The question is whether you value emotional equilibrium over expected utility maximization.