Crypto Trading Risk Calculator

This calculator estimates your risk level for engaging in underground crypto trading in China based on your trading volume, method, and security measures. Note: All underground trading carries significant legal and financial risk.

China officially banned cryptocurrency trading in 2021. Banks can’t touch it. Exchanges are shut down. Mining rigs are confiscated. Yet, somewhere between the surveillance cameras and the digital yuan apps, billions of dollars are still moving in secret. In just one year - July 2022 to June 2023 - Chinese traders moved $86.4 billion in crypto. That’s more than all of Hong Kong’s legal trading volume during the same period. How? And why? And most importantly - is it worth the risk?

It’s Not Illegal to Own Crypto - But Trading Is

Here’s the twist: owning Bitcoin or Ethereum in China isn’t technically against the law. You can hold it in a wallet. You can even receive it as a gift. But if you try to buy, sell, or trade it through any platform inside China - whether it’s an app, a website, or a person - you’re breaking the rules. The People’s Bank of China made that crystal clear in 2021. No exchanges. No payment processing. No banking support. No legal protection. But courts? They’ve sent mixed signals. In 2025, Chinese courts started calling cryptocurrencies “legal property.” That doesn’t mean you can trade freely. It means if someone steals your Bitcoin, you might have some legal standing to sue. It’s a loophole wrapped in contradiction. You can own it, but you can’t move it. You can hold it, but you can’t profit from it. That’s the gray zone where the underground market thrives.How Do People Actually Trade Crypto in China?

Forget centralized exchanges. They’re gone. What’s left is a patchwork of workarounds built by ordinary people who refuse to give up on crypto. First, peer-to-peer (P2P) platforms. These aren’t apps you download from the App Store. They’re Telegram groups, WeChat chats, and encrypted forums where buyers and sellers find each other. Someone in Shanghai wants to buy Bitcoin. Someone in Guangzhou has some. They agree on a price in yuan. The buyer sends cash via bank transfer. The seller releases the crypto from their wallet. No middleman. No oversight. Just trust - and risk. Then there’s OTC brokers. These aren’t licensed financial advisors. They’re traders with multiple bank accounts, often in Hong Kong, who act as intermediaries. They take yuan from mainland clients, buy crypto overseas, and send it back. In return, they charge a fee - sometimes 5% or more. For big players moving $100,000 or more, that’s a small price to pay for access. And then there’s the tech layer: VPNs. Thousands of traders use multiple virtual private networks to bypass China’s Great Firewall and access international exchanges like Binance or Kraken. Some use residential proxies. Others rent servers in Singapore or Thailand. It’s not foolproof - authorities have cracked down on popular VPN providers - but it’s still the most common way to get online access to global markets. Hong Kong is the critical bridge. Many Chinese traders set up bank accounts there. They open shell companies. They use Hong Kong’s legal crypto framework to move money in and out of China without triggering red flags. It’s not illegal in Hong Kong. And as long as the money doesn’t visibly cross the border as crypto, it slips through. Stablecoins like USDT and USDC are the glue holding it all together. Instead of buying Bitcoin directly, traders buy USDT with yuan, then trade USDT for other coins overseas. Stablecoins act as a digital bridge between the yuan and the crypto world. They’re less volatile. Easier to move. Harder to trace. And they’re everywhere in the underground system.Why Take the Risk?

If you’re wondering why anyone would risk jail, fines, or frozen assets for crypto - look at what’s happening in China’s official markets. In 2023, China’s main stock index, the CSI 300, dropped 35% over two years. Corporate earnings have missed forecasts for ten straight quarters. Savings accounts pay less than 1.5% interest. Real estate, once the go-to investment, is collapsing in value across dozens of cities. People are desperate for returns. Crypto isn’t just a gamble - it’s one of the few options left that offers any real upside. A Morgan Stanley report found that Chinese investors are turning to crypto not because they’re tech enthusiasts, but because they’re fleeing a broken system. The government’s plan to stabilize markets with 2 trillion yuan in stimulus hasn’t worked. Trust in the yuan is eroding. And crypto, despite its volatility, still offers a path out. This isn’t about teenagers buying Dogecoin. The average transaction size in China’s underground market is nearly double the global average. Most trades are between $10,000 and $1 million. These are wealthy individuals, business owners, and professionals using crypto as a hedge - not a hobby.

The Hidden Costs of Underground Trading

Let’s be clear: this isn’t free money. It’s high-stakes survival. First, legal risk. The government doesn’t need to prove you’re a professional trader. Just one suspicious bank transfer, one flagged VPN connection, one whistleblower - and your assets can be seized. In 2024, over 300 people were investigated for crypto-related violations. Some got fines. Others got prison time. No one talks about it publicly, but the crackdowns are real. Second, counterparty risk. If you trade P2P, you’re trusting a stranger. What if they take your yuan and disappear? What if they send you fake USDT? There’s no customer service. No chargeback. No regulator to call. You’re on your own. Third, technical risk. VPNs get blocked. Wallets get hacked. Phone numbers get linked to illegal activity. One misstep - using the same device for banking and crypto, logging into a trading group on your work phone - and you could be flagged. And fourth, psychological stress. Traders describe living in constant fear. Checking their bank statements daily. Avoiding conversations about crypto even with close friends. Worrying that their kid’s school might report them for “financial irregularities.” It’s not just about money - it’s about safety.What’s Next? The Signs of Change

The government isn’t blind to this. They know it’s happening. And they’re watching. In early 2025, Shanghai regulators started talking about regulating stablecoins. Not banning them. Regulating them. That’s a big deal. It suggests the government might be preparing to bring crypto under control - not eliminate it. Think of it like the digital yuan: state-backed, traceable, and tightly managed. There’s also growing pressure from abroad. International exchanges still want access to Chinese users. They’re building Chinese-language interfaces, offering yuan deposits, and designing products for the market - even if it means bending rules. The global crypto industry isn’t going away. And China can’t isolate itself forever. The contradiction between courts calling crypto “legal property” and the PBOC banning trading is unsustainable. At some point, the government will have to choose: either fully criminalize ownership - which would be politically messy - or create a controlled, licensed system. The latter is far more likely.

Who’s Really Playing This Game?

It’s not the average person. It’s not students or factory workers. It’s the ones with capital, connections, and tech savvy. - High-net-worth individuals use Hong Kong corporate structures and private banking to trade legally offshore. - Small business owners use OTC brokers to convert profits into crypto and store wealth outside the banking system. - Professional traders run multi-layered networks with encrypted channels, burner phones, and rotating bank accounts. - Family networks - a cousin in Canada, a sister in Singapore - help move funds across borders without triggering alerts. The underground market isn’t chaotic. It’s organized. It’s resilient. And it’s growing because the alternatives are worse.The Bottom Line

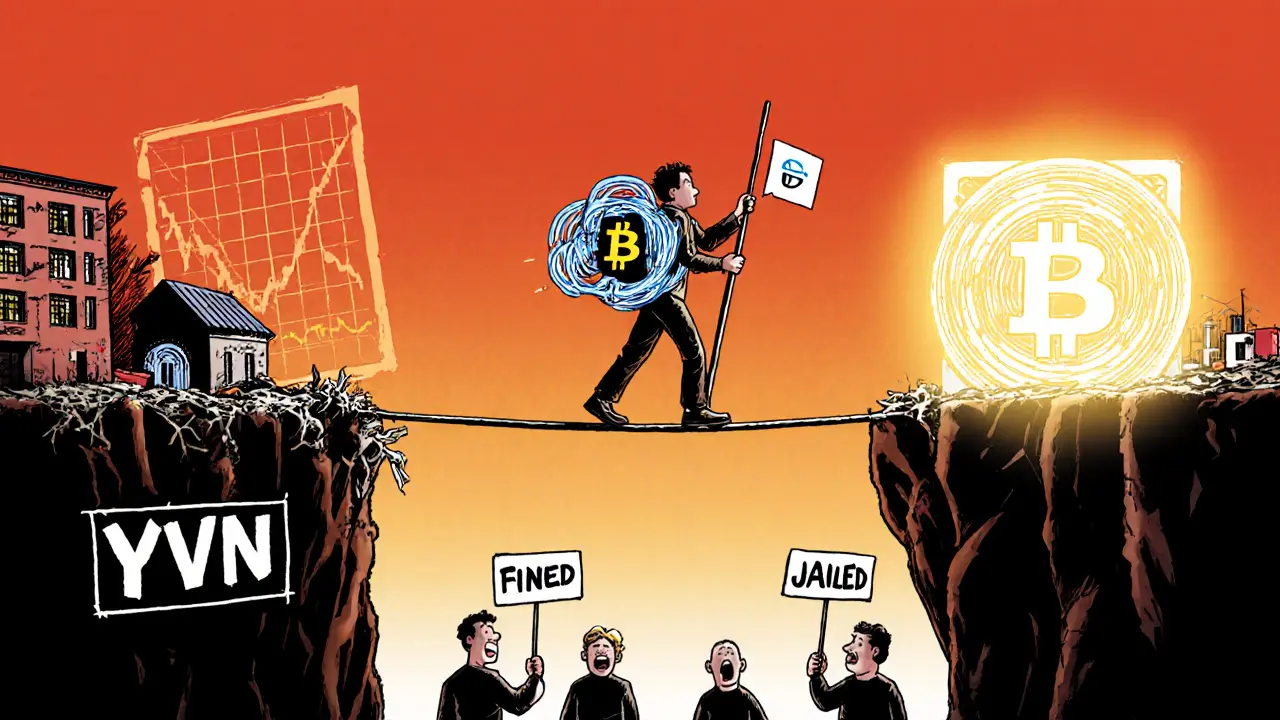

China’s underground crypto market isn’t going away. It’s adapting. It’s evolving. And it’s bigger than most people realize. The government wants control. The people want opportunity. Crypto sits right in the middle. Right now, trading crypto in China is like walking a tightrope over a canyon. One wrong step - a careless message, a flagged transfer, a compromised VPN - and you fall. But for many, the risk is worth it. Because the system they’re trying to escape is failing them. The future? It won’t be all-out bans. It won’t be open markets. It’ll be something in between: a tightly controlled, state-monitored version of crypto - maybe tied to the digital yuan - where only the government gets to decide who trades, how much, and when. Until then, the underground will keep running. Quietly. Carefully. And at massive scale.Is it legal to own Bitcoin in China?

Yes, owning Bitcoin or other cryptocurrencies is not explicitly illegal in China. You can hold them in a personal wallet. However, trading, exchanging, or using them for payments is banned. The legal status is confusing - courts have called crypto "legal property," but the central bank forbids any financial institutions from handling it.

Can Chinese banks process crypto transactions?

No. Since 2021, Chinese banks are strictly prohibited from handling any cryptocurrency-related transactions. This includes deposits, withdrawals, or even recognizing crypto as an asset on bank statements. Any bank account linked to crypto trading may be frozen or investigated.

How do people bypass China’s crypto ban?

Traders use a mix of tools: VPNs to access foreign exchanges, peer-to-peer (P2P) platforms via WeChat or Telegram, over-the-counter (OTC) brokers, and Hong Kong bank accounts to move money legally across borders. Stablecoins like USDT are commonly used as intermediaries to avoid direct yuan-to-crypto conversions.

What are the biggest risks of trading crypto in China?

The biggest risks include asset seizure by authorities, criminal prosecution for commercial trading, counterparty fraud in P2P deals, VPN blocks, wallet hacks, and psychological stress from operating in legal gray areas. There’s no legal recourse if something goes wrong.

Is the underground crypto market shrinking or growing?

It’s growing. Despite the ban, China accounted for $86.4 billion in crypto transactions between July 2022 and June 2023 - more than Hong Kong’s legal market. Demand remains high due to poor returns in stocks and real estate. As long as traditional investments underperform, the underground market will persist.

Will China ever legalize crypto?

Full legalization is unlikely. But controlled integration is possible. Shanghai regulators have begun discussing stablecoin rules, hinting at a future where the government permits regulated, state-monitored digital assets - possibly tied to the digital yuan. The goal isn’t to allow decentralized crypto, but to replace it with something the state can control.

Jennifer MacLeod

November 26, 2025 AT 06:09Been watching this for years. The fact that people are still moving $86B underground is wild. It’s not about tech-it’s about survival. When your savings lose value faster than your phone battery, you do what you gotta do.

No judge. Just respect.

Linda English

November 26, 2025 AT 07:14I find it deeply troubling-yet strangely understandable-that people are being forced into these shadow economies simply because their own government has failed to provide reliable, stable, or fair financial alternatives. The contradiction between courts recognizing crypto as 'legal property' and the central bank banning all transactional activity creates a legal limbo that’s not just confusing-it’s cruel. People aren’t rebels; they’re rational actors in a broken system. And yet, we still call them criminals? That’s the real tragedy here.

asher malik

November 27, 2025 AT 07:59people aren’t trading for fun

they’re trading because the system’s on fire and someone handed them a bucket

and now the government’s trying to take the bucket away

but the fire’s still burning

Julissa Patino

November 27, 2025 AT 18:26Omkar Rane

November 27, 2025 AT 20:12As someone from India, I see parallels here. Our own crypto crackdowns in 2018 made people go underground too. We used WhatsApp groups, cash transfers, and even gold traders to move value. The human instinct to preserve wealth doesn’t care about borders or laws. What’s fascinating is how decentralized networks become the new social safety net. The state wants control, but people want dignity. And dignity doesn’t need permission to exist.

Also, USDT is the unsung hero of global finance now. Who knew stablecoins would become the global lingua franca of desperation?

Emily Michaelson

November 28, 2025 AT 11:01One thing no one talks about: the psychological toll. I know traders who check their bank balances three times a day, avoid using their real names on any device linked to crypto, and never talk about it even with spouses. The fear isn’t just about losing money-it’s about losing freedom. That’s the real cost.

And it’s not just China. This is happening in Iran, Nigeria, Argentina. It’s a global symptom.

Anne Jackson

November 29, 2025 AT 01:00David Hardy

November 29, 2025 AT 14:25Bro this is wild 😳

People are out here turning crypto into a survival game and I’m just here trying to remember if I paid my cable bill

but seriously-respect to anyone playing this high-stakes chess with the state

you’re not a criminal-you’re a realist

🔥🫡

John Borwick

December 1, 2025 AT 08:09It’s not about crypto. It’s about trust.

The Chinese government built a system where your money can disappear overnight-real estate crashes, stocks tank, banks freeze accounts-and now people are using Bitcoin like a life raft.

They’re not trying to get rich quick. They’re trying not to lose everything.

That’s not gambling. That’s dignity.

And if you’re calling them criminals-you’ve never had your savings wiped out by policy.

Matthew Prickett

December 3, 2025 AT 01:50Wait… what if this is all a psyop? What if the Chinese government is secretly running these underground markets to gather biometric data on crypto users? They’ve got facial recognition everywhere. Every VPN connection. Every bank transfer. Every Telegram group. They’re not trying to stop crypto-they’re harvesting the entire financial DNA of the elite. This isn’t a ban. It’s a surveillance goldmine. And the US is next. I’ve seen the patterns. They’re coming for your crypto wallet next. Don’t sleep on this.

They’re watching you right now. 😳

Caren Potgieter

December 3, 2025 AT 20:51This made me cry a little. Not because of the money. But because of the quiet courage. People holding onto hope in a system that tells them to give up. I’ve seen this in South Africa too-when inflation eats your salary, you find a way. Crypto isn’t magic. It’s just the only thing left that doesn’t lie.

Keep going. You’re not alone.

Jenny Charland

December 5, 2025 AT 13:47preet kaur

December 7, 2025 AT 01:19As someone who grew up in a country where the currency was unstable, I get it. Crypto isn’t about speculation-it’s about preserving dignity. The fact that courts recognize it as property but banks can’t touch it? That’s not a loophole. That’s a confession. The system knows it’s broken. They just don’t know how to fix it without losing control.

And honestly? I hope they don’t. Because if crypto gets fully regulated, it’ll lose its soul. The underground isn’t a flaw-it’s the feature.