MAKI Value Loss Calculator

Token Value Calculator

Calculate how much value you've lost with your MAKI tokens based on actual market data. Remember: MAKI has lost 99.76% of its value since peak.

Current Value Estimate

Projected Future Value

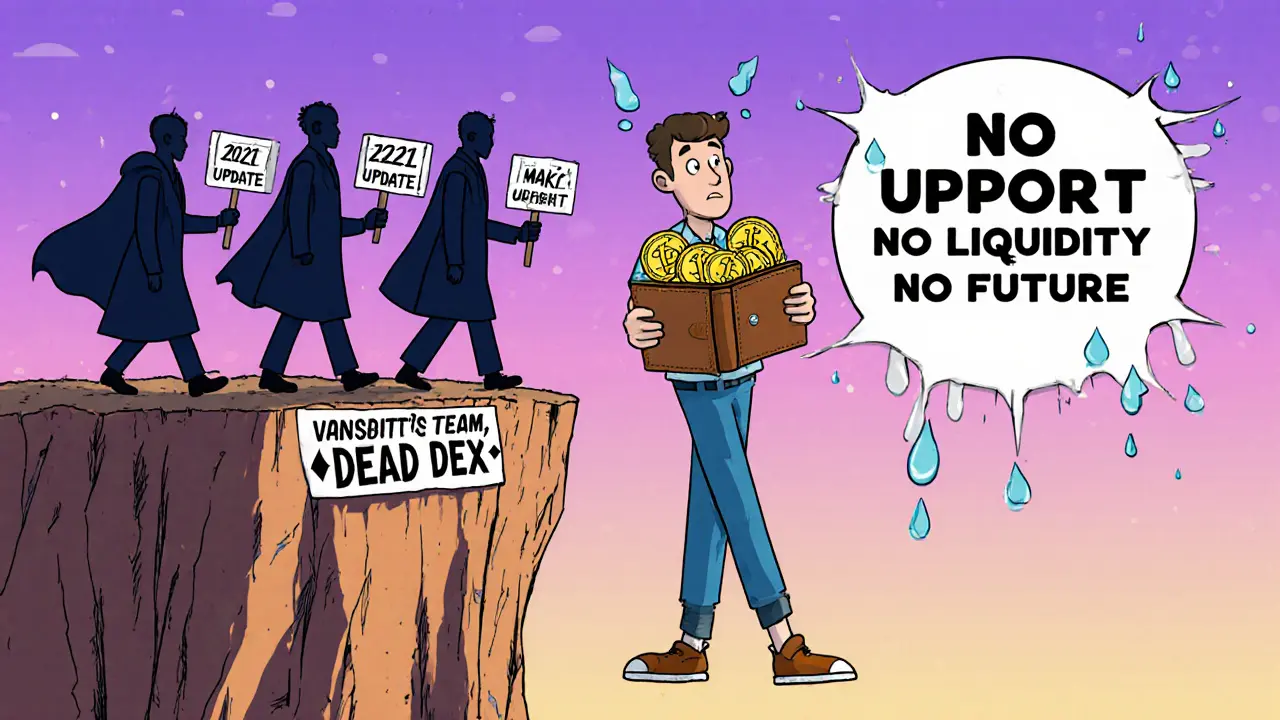

When you hear "MakiSwap," you might think it’s another promising decentralized exchange like Uniswap or PancakeSwap. But the reality is far different. As of October 2025, MakiSwap has zero active trading pairs and $0.00 in 24-hour trading volume. Its native token, MAKI, has lost 99.76% of its value since its peak. This isn’t a slow-moving project-it’s a ghost town. And if you’re thinking about depositing funds or farming yield here, you need to know the full story before you click "Connect Wallet."

What Is MakiSwap, Really?

MakiSwap is a decentralized exchange built on the Huobi Eco Chain (HECO), launched in 2021 by a team called Unilayer. It positions itself as a simple, low-cost platform for swapping tokens within the HECO ecosystem. The platform doesn’t hold your funds-you keep control of your private keys. That’s good in theory. But in practice, the lack of activity makes the whole setup meaningless.The trading fee is 0.2%, which matches industry standards. No deposit or withdrawal fees? Sounds great-until you realize no one’s trading. CoinGecko data shows zero volume. Zero liquidity. Zero active pairs. That means even if you swap MAKI for another token, there’s no one on the other side to take your trade. You’re not trading. You’re just sending money into a black hole.

The MAKI Token: A Dying Asset

The MAKI token is the heart of MakiSwap. It’s supposed to be used for governance and fee distribution. But right now, it’s worth about $0.0029. That’s down from a peak that’s long gone. The market cap is just $200,153. For comparison, even small DEX tokens like SushiSwap or Curve’s CRV have market caps in the hundreds of millions.Analysts aren’t optimistic. WalletInvestor predicts MAKI could drop to $0.001861 by the end of 2024. PricePrediction.net says it might hit $0.0009128. TradingBeast is slightly less bearish but still forecasts a continued slide. No one expects a rebound. The token’s year-over-year performance is down 3.22%. That’s not a correction-it’s a slow bleed.

Why No One Is Using It

MakiSwap’s biggest problem isn’t the interface. It’s not even the fee structure. It’s isolation. The platform only works on HECO, which accounts for less than 1% of total DeFi activity. Meanwhile, Uniswap runs on Ethereum. PancakeSwap runs on BSC. Both have billions in locked value and thousands of trading pairs. MakiSwap has none.Most DeFi users don’t want to bridge their assets to HECO just to trade on a dead exchange. Bridging costs gas. It’s complicated. And if you lose money doing it, there’s no one to help you. The platform offers no cross-chain support, no staking integrations, no liquidity mining programs that actually pay out. It’s a one-trick pony-and the trick doesn’t work anymore.

Red Flags Everywhere

Multiple crypto review sites have flagged MakiSwap as high-risk. WikiBit, a well-known crypto review platform, explicitly labels MAKI as an "air coin project" and warns users it’s likely a Ponzi scheme. They’ve received dozens of complaints from people who can’t withdraw funds or get answers from support.Reddit threads and crypto forums barely mention MakiSwap-except as a cautionary tale. Users report:

- Yield farming rewards never appear

- Customer support doesn’t reply to tickets

- Wallet connections fail randomly

- Token prices drop overnight with no explanation

The average user rating across platforms is 2.3 out of 5. The few positive comments praise the clean design-but that’s like praising a car’s paint job when the engine is gone.

Is It Safe to Use?

No. Not even close.MakiSwap is non-custodial, which sounds safe-but it’s a double-edged sword. You’re responsible for everything. If you send funds to the wrong address? Gone forever. If the smart contract has a bug? No one’s fixing it. The last code update was in 2021. No audits have been published since. No team members are publicly identified. No roadmap exists. No new features have been announced.

And here’s the kicker: if you’re a beginner, you shouldn’t even be near this platform. Connecting a wallet, configuring HECO network settings, bridging tokens-all of this requires technical knowledge. MakiSwap doesn’t offer tutorials, FAQs, or live help. If you mess up, you lose your money. And there’s no insurance. No recourse.

How It Compares to Real DEX Platforms

| Feature | MakiSwap | Uniswap | PancakeSwap |

|---|---|---|---|

| Blockchain | HECO (limited) | Ethereum | Binance Smart Chain |

| 24-Hour Trading Volume | $0.00 | $1.2B+ | $300M+ |

| Active Trading Pairs | 0 | 10,000+ | 8,000+ |

| Total Value Locked (TVL) | $0.00 | $1.8B+ | $4.1B+ |

| Trading Fee | 0.2% | 0.3% | 0.2% |

| Customer Support | None reported | Community-based | Active Discord & Help Center |

| Development Activity | None since 2021 | Regular updates | Regular updates |

| Security Audits | None published | Multiple public audits | Multiple public audits |

The table says it all. MakiSwap doesn’t just lag behind-it’s not even in the same game. The other platforms have real users, real volume, and real teams. MakiSwap has a website, a token, and a lot of silence.

Who Should Avoid MakiSwap?

If you fall into any of these categories, stay far away:- Beginners-you don’t have the skills to navigate a dead DEX safely.

- Long-term holders-MAKI has no future value.

- Yield farmers-there’s no liquidity to earn from.

- Anyone in a regulated country-this platform has no compliance, no licensing, and no accountability.

- People who value their money-if you’re not sure, don’t risk it.

The only people who might consider using MakiSwap are speculative traders looking to short the MAKI token. Even then, the lack of volume makes it hard to enter or exit positions without slippage.

Final Verdict: Don’t Touch It

MakiSwap isn’t broken. It’s abandoned. The team stopped updating. The community vanished. The token is collapsing. The exchange is empty. And the warnings from trusted crypto review sites aren’t just opinions-they’re based on real user experiences and hard data.If you’re looking for a decentralized exchange, there are dozens of better options. Uniswap, PancakeSwap, Curve, or even newer platforms like Trader Joe or Balancer all offer real liquidity, active development, and community trust. Why gamble on a dead project when you can use one that’s alive?

There’s no hidden genius here. No secret opportunity. Just a fading memory of a project that never delivered. Save your time. Save your crypto. Walk away.

Is MakiSwap a scam?

Multiple crypto review platforms, including WikiBit, have labeled MakiSwap and its MAKI token as a potential Ponzi scheme due to overwhelming user complaints about non-functioning rewards, lack of customer support, and sudden value collapses. While it’s technically a decentralized exchange, the absence of trading volume, development activity, and transparency makes it functionally equivalent to a scam in practice.

Can I make money trading MAKI?

It’s extremely unlikely. MAKI has lost over 99% of its value since its peak. Trading volume is zero, meaning there’s no liquidity to buy or sell without massive slippage. Price predictions from WalletInvestor, PricePrediction.net, and TradingBeast all point to further decline. Any short-term price movement is likely manipulation, not market-driven activity.

Why is MakiSwap still online if it’s dead?

The website remains up because it costs almost nothing to maintain a static page. The smart contracts are still live, but no one is using them. This is common with abandoned crypto projects-they don’t shut down-they just fade away. The team likely moved on, leaving the site as a ghost to attract new, unsuspecting users.

Is MakiSwap compatible with MetaMask?

Yes, you can connect MetaMask to MakiSwap-but only after manually adding the HECO network details. This isn’t plug-and-play like with Ethereum or BSC. You need to input the correct RPC URL, chain ID, and currency symbol. Even then, you’re connecting to a dead platform with no liquidity. It’s technically possible, but practically useless.

What should I use instead of MakiSwap?

For Ethereum users, Uniswap is the safest and most liquid option. For Binance Smart Chain users, PancakeSwap offers lower fees and higher volume. If you want cross-chain flexibility, try Trader Joe or Curve. All of these platforms have active teams, published audits, and real user traffic. Avoid single-chain DEXes with no volume-especially ones flagged by multiple review sites.

Has MakiSwap ever been audited?

There are no publicly available audit reports for MakiSwap’s smart contracts. Leading DEX platforms like Uniswap and PancakeSwap publish multiple third-party audits from firms like CertiK and SlowMist. MakiSwap’s lack of audits is a major red flag-it means the code could have critical vulnerabilities that no one has checked.

Can I withdraw my funds from MakiSwap?

Technically, yes-if you control your private keys, you can send tokens out of your wallet. But if you’ve deposited into liquidity pools or staking contracts, you may not be able to withdraw because those contracts have no liquidity. Users have reported being unable to claim rewards or exit positions, even though the platform claims to be non-custodial. This is a common trap in abandoned DeFi projects.

Kaitlyn Boone

November 20, 2025 AT 17:09MakiSwap is a ghost. Zero volume, zero updates, zero future. I saw someone try to farm MAKI last year and their wallet got stuck with $3 worth of nothing. Don't even open your wallet near it.

diljit singh

November 21, 2025 AT 23:44why are you even writing this like its news lol its 2025 and people still fall for this shit. HECO is dead, MAKI is dead, the team is on vacation in Bali. wake up.

Phil Taylor

November 22, 2025 AT 16:42US users keep acting like they discovered crypto. We had this exact same garbage in 2021 on BSC. Now we're getting it on HECO. Pathetic. No audits, no team, no liquidity. Just a website hosted on a $5 VPS with a fake 'community' on Discord that's just bots.

Devon Bishop

November 23, 2025 AT 07:30Just to clarify something: MakiSwap isn't a scam in the legal sense - it's just dead. No fraud, no theft, no rug pull. Just abandonment. The smart contracts are still there, and you can technically withdraw your funds if you deposited directly. But if you staked or farmed? You're screwed. No liquidity means no exit. That's not malicious - it's negligent. And negligence in DeFi costs people real money. If you're reading this and thinking 'maybe it'll bounce back' - it won't. The team hasn't posted since 2022. No GitHub commits. No Twitter updates. No Discord activity. It's a digital tombstone.

jack leon

November 24, 2025 AT 02:20THIS IS WHY WE CAN'T HAVE NICE THINGS. Some dude in a hoodie coded this on a laptop in his basement, slapped a 'DeFi' label on it, and thought he'd be rich by Christmas. Now the whole thing is a graveyard with a .com domain. I've seen dead projects, but this one? It's not even decomposing - it's fossilized. And people still try to 'invest'? Bro, your wallet is a haunted house and you're the ghost.

Chris G

November 24, 2025 AT 17:20Uniswap has 1.2B volume MakiSwap has 0 thats it

Mike Stadelmayer

November 25, 2025 AT 23:23I used to think every new DEX had potential. Then I saw MakiSwap. It's not even a cautionary tale - it's a museum exhibit. Like that one fossilized dinosaur bone they put in the corner of the science center with a sign that says 'what went wrong'. I'm glad someone took the time to document this. Maybe it'll save someone else from losing their last $500 trying to 'get in early'.

Abhishek Anand

November 25, 2025 AT 23:43The tragedy of MakiSwap isn't the lack of volume - it's the illusion of agency. We think blockchain gives us control, but when the team vanishes, the smart contract becomes a silent oracle. You can send your ETH in, but you can't hear its answer. The decentralization myth dies not with a bang, but with a 404 error. We built a temple to autonomy - and then forgot to light the candles.

Khalil Nooh

November 27, 2025 AT 17:37Listen. If you're still thinking about connecting your wallet to MakiSwap, stop. Right now. Close the tab. Walk away. This isn't a gamble - it's a funeral. You're not investing. You're donating to a dead project's hosting bill. There are 500+ active DEXes with real teams, real audits, and real communities. Why pick the one with no pulse? Your money deserves better than a digital ghost story.

sammy su

November 29, 2025 AT 07:39thanks for the breakdown. i almost connected my wallet yesterday thinking 'maybe its undervalued'. now i know better. no one is trading, no one is updating, and no one cares. dont be the last one to leave the party.