Crypto HODL/Sell Decision Calculator

Determine if you should HODL or sell your crypto based on market metrics and the framework from the article "When to HODL and When to Sell: A Practical Crypto Guide".

Your Position Metrics

Key Decision Signals

Decision Recommendation

Action Plan

Deciding whether to keep your crypto for the long haul or cash out at a profit feels like a constant tug‑of‑war. The right move depends on market rhythm, the coin’s fundamentals, and how much risk you’re comfortable with. Below you’ll find a step‑by‑step framework that helps you spot the sweet spot for holding and the clear signals that say it’s time to sell.

Key Takeaways

- HODL works best for blue‑chip assets (Bitcoin, Ethereum) during bullish cycles and after major halvings.

- Sell when on‑chain metrics like MVRV Z‑Score dip below -3.5 for 60+ days or the Fear & Greed Index stays in extreme fear for three weeks.

- Use a tiered exit plan: lock in 30‑50% of gains at key resistance levels, then let the rest run.

- Keep 60‑70% of your crypto in cold‑storage hardware wallets; only allocate 5‑10% of total assets to any single token.

- Rebalance quarterly with the 15/50 rule: trim 15% of any position that’s 50% above its original weight.

What HODL means “Hold On for Dear Life,” a strategy that encourages buying crypto and keeping it through volatility instead of reacting to every price swing. Actually means more than just “don’t sell.” It’s a disciplined approach that cuts transaction fees, reduces tax drag, and lets you ride multi‑year market cycles that historically span three to four years.

When HODL Makes Sense

Data from Messari shows an average 1,200% gain in the 18 months after each Bitcoin halving (2012, 2016, 2020). If you buy before a halving and hold for at least 12‑18 months, you’re riding a proven appreciation wave.

Blue‑chip assets like Bitcoin and Ethereum dominate winning HODL portfolios. Bitwise’s 2024 report found 60‑70% of institutional crypto holdings sit in these two coins because they have strong network effects and real‑world utility.

Technical entry signals also help. Glassnode reports that buying when Bitcoin’s price crosses above its 200‑day moving average boosts expected returns by roughly 67% compared to random timing.

When It’s Time to Sell

Crypto selling refers to the process of exiting a crypto position, either partially or fully, based on predefined criteria rather than emotional reactions. Experts agree on a few hard metrics:

- MVRV Z‑Score: If it falls below -3.5 and stays there for 60+ days, the market may be in a terminal decline - consider trimming.

- Crypto Fear & Greed Index below 25 for three consecutive weeks signals extreme fear and often precedes a bounce, but also warns of a possible bottom that could be temporary.

- On‑chain activity slumps: a sustained drop in active addresses and transaction volume can hint at losing network relevance.

Tiered selling works well. A typical pattern used by successful traders in 2024 was: 50% sold at $45k, 25% at $50k, 15% at $52k, and the remaining 10% at $60k during a March rally. This locks in most gains while still keeping a foothold for upside.

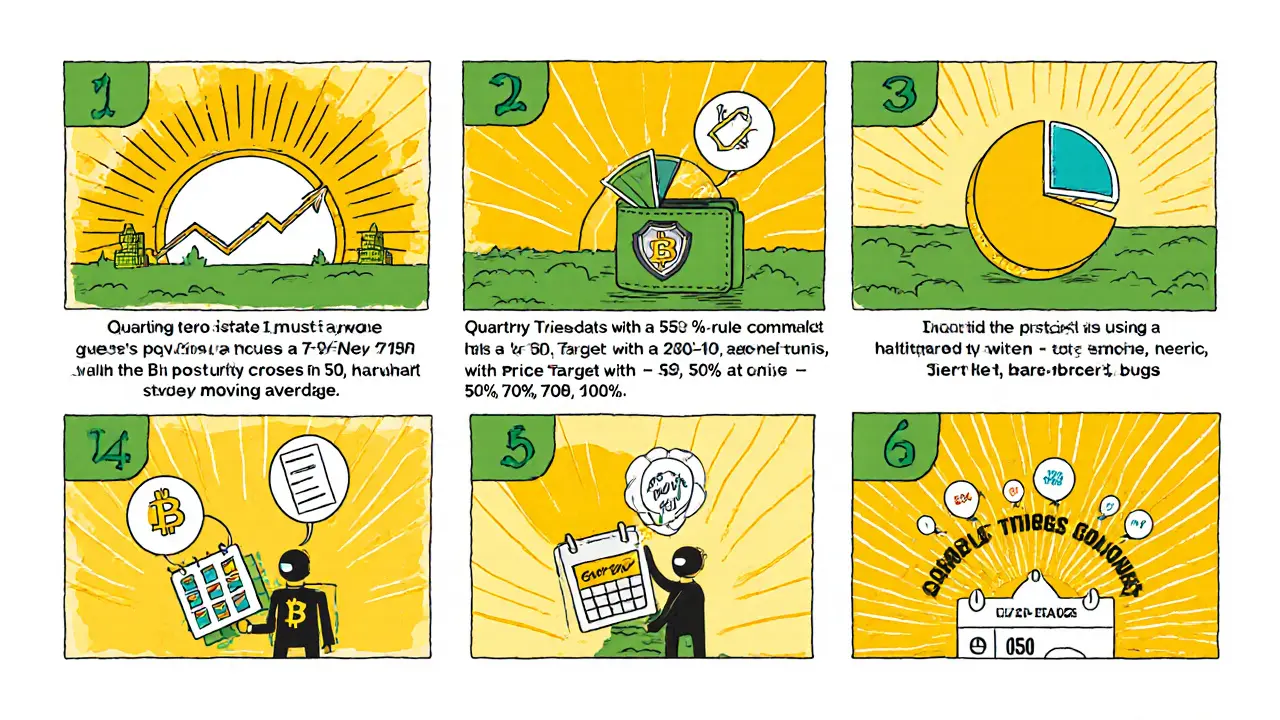

Practical Framework: From Entry to Exit

- Entry timing: Wait for Bitcoin’s price to break above the 200‑day moving average and for the Fear & Greed Index to dip into extreme fear territory.

- Position sizing: Follow the 5% rule - never put more than 5% of your total portfolio into a single crypto.

- Secure storage: Hold assets over $10,000 in hardware wallets (Ledger Nano X or Trezor Model T). Multisig wallets are required for balances > $50,000.

- Quarterly rebalancing: Apply the 15/50 rule - if any token grows 50% above its target weight, sell 15% of that position.

- Tiered exit: Set price targets at 30%, 50%, 70% and 100% above your entry cost. Execute partial sales when each target is hit.

- Stop‑loss check: If MVRV Z‑Score drops below -3.5 for two months, liquidate at least 30% of the position.

HODL vs. Active Trading: A Quick Comparison

| Aspect | HODL | Active Trading |

|---|---|---|

| Average annual return | 22.1% (after fees) | -36.4% (after fees) |

| Tax impact | Long‑term capital gains rates | Higher short‑term gains taxes |

| Time commitment | Low - set‑and‑forget | High - daily monitoring |

| Performance in sideways markets | -2.3% (2018‑19 consolidation) | +18.7% (range‑bound strategies) |

| Security risk | Depends on cold‑storage practices | Higher exposure on exchanges |

Common Pitfalls & How to Avoid Them

1. Chasing low‑cap hype - Tokens with market cap under $100million and no clear utility tend to disappear. Stick to assets that meet Nic Carter’s criteria (≥$100M market cap, ≥50 GitHub commits/month).

2. Emotional selling - 74% of traders admitted they sold during a 30% Bitcoin dip in February 2024. Use pre‑set price alerts to keep emotions out of the equation.

3. Single‑signature wallets for large sums - Ledger’s 2024 report shows 99.3% of hacks involved single‑signature wallets. Move anything above $50k to a multisig solution.

Tools & Resources to Support Your Strategy

- Glassnode for on‑chain metrics (MVRV Z‑Score, active addresses).

- Crypto Fear & Greed Index (alternative.me) for sentiment.

- Hardware wallets: Trezor Model T, Ledger Nano X.

- Portfolio trackers: CoinTracker, Zerion - set quarterly rebalancing alerts.

- Education: Bitcoin Optech newsletter, “HODL Forever” podcast.

Frequently Asked Questions

How long should I hold Bitcoin before considering a sale?

Most analysts suggest a minimum of 12‑18 months after a halving event, because historic data shows the strongest up‑trend in that window. Combine this with on‑chain signals: if the MVRV Z‑Score drops below -3.5 for two months, start trimming.

What percentage of my portfolio should I keep in cold storage?

Trezor’s 2024 survey found 98.7% of long‑term holders keep the bulk of their crypto in hardware wallets. Aim for at least 70% of your total crypto value in cold storage, especially any holdings above $10,000.

Is it ever smart to sell during a market rally?

Yes, a tiered approach works well. Sell portions at predefined resistance levels (e.g., 30%, 50%, 70% above entry). This locks in profit while still letting the rest capture upside.

How do I know if a low‑cap token is worth HODLing?

Apply Nic Carter’s rule: market cap over $100M, active development (≥50 GitHub commits/month), and clear real‑world utility. If any of these are missing, plan an exit before permanent loss.

What’s the best way to set up a stop‑loss for HODL positions?

Instead of a hard price stop, use a metric‑based trigger: when MVRV Z‑Score stays below -3.5 for 60 days, automatically sell 30% of the position. This avoids being stopped out by short‑term volatility.

Shikhar Shukla

June 30, 2025 AT 20:30First off, the notion that you can just throw money at any token and expect miracles is a fantasy.

A disciplined HODL strategy demands that you respect on‑chain fundamentals before you even think about price.

If you ignore the MVRV Z‑Score and chase hype, you’ll end up with a portfolio that looks like a roulette wheel.

The guide rightly points out that blue‑chip assets survive multiple halving cycles, but many newbies overlook the 200‑day moving average filter.

Skipping that filter is equivalent to walking blindfolded into a bull market only to get trampled when the bear returns.

Your cold‑storage allocation should be governed by the 70‑percent rule, not by how shiny your hardware wallet looks.

Putting 15 % of your net worth in a single alt‑coin is a red flag that should make any prudent investor sweat.

The 15/50 rebalancing rule is a solid sanity check, yet it is often ignored because traders dislike cutting winners.

In practice, trimming 15 % of a position that’s 50 % over target prevents portfolio drift and reduces exposure to sudden on‑chain drops.

Tiered exits, as described, mirror real‑world profit‑taking in equities and prevent you from selling everything at the peak.

Locking in 30‑50 % of gains at key resistance levels gives you a cushion while still letting the remainder run.

Remember that transaction fees and tax drag can erode those gains if you make too many micro‑sales.

A common pitfall is emotional selling during a 30 % dip; pre‑set alerts eliminate that noise.

The Fear & Greed Index staying below 25 for three weeks is a contrarian signal, but it should be paired with on‑chain activity metrics.

If active addresses are collapsing, even extreme fear could be a sign of a dying network, not a buying opportunity.

Bottom line: combine metric‑based triggers with a strict allocation plan, and you’ll avoid the most costly mistakes most retail investors make.

Deepak Kumar

July 1, 2025 AT 08:06Yo, if you want to ride the crypto wave without getting wiped, start by shoving most of your stash into a hardware wallet-no excuses.

Keep 5‑10 % in any single token, that way a single bust doesn’t ruin your whole portfolio.

Set up a tiered exit: sell 30 % at the first big resistance, another 20 % at the next, and let the rest run.

Use Glassnode’s MVRV Z‑Score and the Fear & Greed Index as your early‑warning system, and you’ll stay ahead of most panic‑selling cycles.

Remember, consistency beats timing; stick to the plan and you’ll sleep better at night.

Carolyn Pritchett

July 1, 2025 AT 22:00Your so‑called "framework" is a thin veil for regurgitating every hype article out there.

Anyone who thinks tiered selling is magic clearly never saw a 70% crash.

Laura Hoch

July 1, 2025 AT 22:08I hear the frustration, but let’s step back for a sec.

Metrics like MVRV Z‑Score are useful, yet they’re not crystal balls; they’re just one piece of the puzzle.

If you combine them with a sensible allocation plan and avoid emotional dumps, you’ll see far fewer heart‑attacks during dips.

Remember, the market’s a marathon, not a sprint, so pacing yourself with clear rules is the real win.

Devi Jaga

July 3, 2025 AT 01:46Oh great, another "expert" telling us to HODL until the next halving-yeah, because history always repeats itself, right?

Hailey M.

July 4, 2025 AT 05:33Wow, this guide really hits the nail on the head! 🔨

It’s like a cheat‑code for crypto survival, especially the tiered exit strategy-so satisfying! 😎

Just remember to breathe, set those alerts, and don’t let FOMO mess with your plans.

Happy HODLing, and may your gains be ever glorious! 🚀

David Moss

July 5, 2025 AT 09:20Listen folks-big banks are hiding the real crypto agenda, it's all a massive distraction, untrust the conventional metrics! The MVRV Z‑Score? Fake data, designed to keep us in check; we must look beyond the obvious hidden signals!!

Kaitlyn Zimmerman

July 6, 2025 AT 13:06Hey all, just a quick reminder: diversification isn’t just about picking big names, it’s about spreading risk across sectors.

Use portfolio trackers like CoinTracker to set quarterly rebalancing alerts-helps keep the 15/50 rule in check.

And don’t forget to store the bulk of your crypto in hardware wallets; it’s the simplest way to stay safe.

Stay curious and keep learning, the space evolves fast!

DeAnna Brown

July 6, 2025 AT 13:15Sounds solid-let’s all HODL responsibly!

Chris Morano

July 7, 2025 AT 16:53Great rundown, thank you for laying it out.

I'll start applying the tiered exit plan and keep an eye on my hardware wallet security.

Looking forward to seeing how this strategy works over the next quarter.