Can a business in Russia legally accept Bitcoin or Ethereum as payment? The short answer is: no - unless you’re one of a tiny fraction of giant companies with millions in capital and government ties. For 99.8% of Russian businesses, accepting crypto as payment for goods or services is illegal, risky, and can lead to frozen bank accounts, tax audits, or worse.

What’s Actually Allowed in Russia?

Russia doesn’t ban cryptocurrency outright. It’s recognized as property under the 2020 Digital Financial Assets law. But here’s the catch: it’s not money. The Bank of Russia has made it crystal clear - crypto cannot be used to pay for groceries, services, or even software subscriptions within Russia. Trying to do so breaks the law. The only legal way to use crypto in business is through the Experimental Legal Regime (ELR), a narrow exception created in 2024. This isn’t a loophole. It’s a gated system designed for international trade only. If you’re selling oil, gas, or metals to a foreign buyer and want to get paid in Bitcoin or Ethereum, the ELR lets you do it - if you qualify.Who Can Even Apply for the ELR?

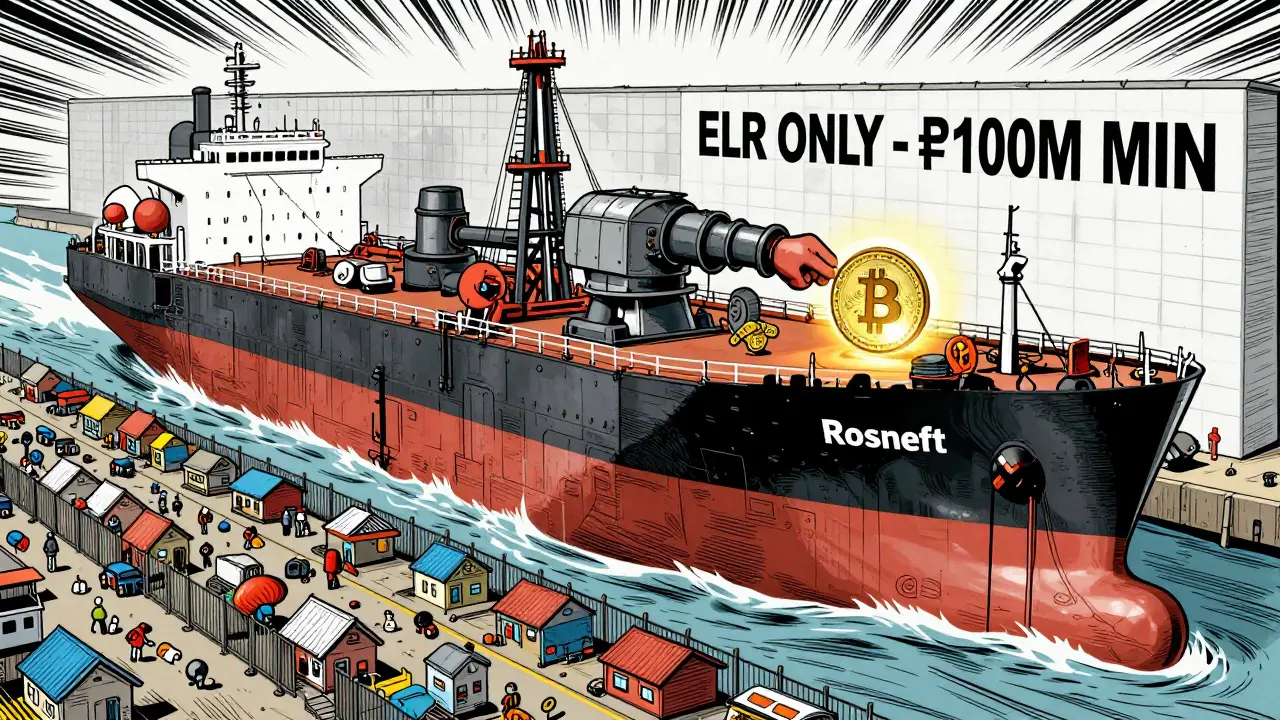

The ELR isn’t open to small shops, startups, or even mid-sized manufacturers. To qualify, a business must meet two brutal requirements:- At least ₽100 million (about $1.24 million) in securities or bank deposits

- At least ₽50 million (about $620,000) in annual income

What Crypto Can You Accept?

Even if you qualify for the ELR, you can’t just pick any cryptocurrency. The Bank of Russia has approved only three blockchain networks for use:- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

How Do You Actually Set Up a Legal Crypto Payment System?

If you’re one of the lucky few who qualify, here’s what you’re signing up for:- Apply for ‘qualified investor’ status through the Central Bank’s portal - takes 30 to 45 days.

- Register with Rosfinmonitoring as a virtual asset service provider.

- Buy and install approved blockchain analytics software - minimum cost: 1.2 million rubles ($14,800) per year.

- Integrate with one of only 17 licensed wallet providers like Finversity or BitRiver.

- Set up dual-factor authentication meeting GOST R 57580.1-2017 standards.

- Train staff to report every transaction over 600,000 rubles ($7,400) to the Unified State Information System (ESIS) within five business days.

- Pay for quarterly compliance audits - around 350,000 rubles ($4,300) each.

What Happens If You Break the Rules?

A Moscow electronics store called TechnoPoint accepted Bitcoin payments in June 2025. Within weeks, all their bank accounts were frozen. For 45 days, they couldn’t pay suppliers, payroll, or rent. They lost over 20 million rubles ($247,000) in revenue. The same thing happened to Sakhalin, a restaurant chain that lost 18 million rubles ($222,000) when its crypto payment processor was shut down for “incomplete documentation.” Even advertising that you accept crypto can get you fined. Under Article 15.25 of the Administrative Offenses Code, businesses can be slapped with fines between 50,000 and 300,000 rubles ($620-$3,700) just for putting “We accept Bitcoin” on their website.Why Does Russia Even Allow This?

The answer is sanctions. When Western banks cut Russia off from SWIFT and dollar payments, the government needed a way to keep exporting oil, gas, and metals. Crypto became a workaround. The ELR wasn’t designed to help small businesses. It was built to help state-backed giants bypass financial isolation. Rosneft reported that 12% of its Q3 2025 exports were settled in cryptocurrency, cutting payment times from 14 days to just 4 hours. Norilsk Nickel used crypto to pay suppliers in Asia, avoiding intermediaries and currency conversion fees. It’s not about innovation. It’s about survival.

How Does This Compare to Other Countries?

The EU legalized crypto payments for all businesses under MiCA in December 2024. The U.S. lets companies accept Bitcoin with simple tax reporting. Even India, once as strict as Russia, has moved toward openness. Russia is the outlier. It’s not just restrictive - it’s designed to exclude. While the EU treats crypto as a payment tool, Russia treats it as a weapon for a handful of elite companies.What’s Changing in 2026?

There are signs of possible change. In November 2025, Deputy Finance Minister Ivan Chebeskov said the “superqual” investor requirement might be scrapped. A tiered system with lower thresholds could be coming. The Central Bank is also considering adding more blockchain networks to the ELR list. And starting January 1, 2026, tax authorities will fully integrate with financial institutions, creating a real-time monitoring system that tracks every crypto transaction. But don’t expect a shift toward small businesses. The Bank of Russia’s leadership still says crypto should be limited to “a very, very limited class of investors.”Bottom Line: Should You Accept Crypto in Russia?

If you’re a small or medium business? Don’t even think about it. The risk of account freezes, fines, and audits far outweighs any benefit. If you’re a large export company with state ties and millions in capital? Then the ELR might be worth the cost - if you can afford the setup, the audits, and the constant compliance grind. For everyone else, crypto in Russia isn’t a payment option. It’s a trap.Can I accept Bitcoin as payment for my online store in Russia?

No. Accepting Bitcoin or any cryptocurrency for domestic sales - whether online or in-store - is illegal under Russian law. Even if you use a third-party processor, the Bank of Russia considers this a violation. Businesses caught doing this face bank account freezes, tax audits, and fines up to 300,000 rubles. There are no exceptions for small businesses or e-commerce.

What if I only accept crypto for international sales?

You can only do this legally if you’re registered under the Experimental Legal Regime (ELR). That requires at least ₽100 million in assets, ₽50 million in annual income, and approval from the Central Bank. Even then, you can only use Bitcoin, Ethereum, or Ripple. All other cryptocurrencies are banned. If you’re not in the ELR, international crypto payments are still illegal.

Can I hold crypto as an asset in my business account?

Yes - but only as property, not as currency. You can buy and hold Bitcoin or Ethereum on your balance sheet, and you must report it as an asset for tax purposes. However, you cannot use it to pay employees, suppliers, or customers unless you’re in the ELR. Holding crypto without using it for payments is legal, but using it as money is not.

Are there any legal crypto payment processors in Russia?

Only 17 wallet providers are licensed by the Bank of Russia to handle crypto transactions under the ELR - companies like Finversity and BitRiver. These are not consumer-facing services. They’re enterprise-only platforms with strict KYC, mandatory reporting, and blockchain monitoring. No licensed provider will work with a small business or individual. If a company claims to offer “Russian crypto payments,” they’re either lying or operating illegally.

What happens if I accidentally accept crypto?

If you receive crypto by mistake - say, a customer sends Bitcoin thinking it’s allowed - you must immediately report it to Rosfinmonitoring and freeze the funds. You cannot convert it to rubles or use it to pay anyone. Failure to report can lead to penalties, even if you didn’t intend to break the law. The system is designed to punish unintentional violations just as harshly as intentional ones.

Will Russia ever allow small businesses to accept crypto?

It’s unlikely in the near term. The Central Bank has repeatedly stated that crypto should remain restricted to protect the ruble and financial stability. While the Ministry of Finance is exploring a tiered ELR system with lower thresholds, no official changes have been approved. Experts predict any expansion would be limited to larger exporters, not small retailers or service providers. The goal isn’t inclusion - it’s control.