Bitcoin doesn’t care if you’re sleeping, working, or on vacation. One minute it’s at $62,000, the next it’s down to $58,000 - and you didn’t even see it coming. That’s why setting a stop-loss for Bitcoin isn’t optional. It’s the difference between walking away with your capital intact and watching half your investment vanish in minutes.

What a Stop-Loss Actually Does

A stop-loss order is an automated instruction that sells your Bitcoin when the price hits a level you’ve chosen. It’s like setting a safety net below your position. You don’t have to stare at your screen 24/7. You don’t have to panic when the market drops. You just set it, walk away, and let the exchange do the work.

Here’s how it works: You buy Bitcoin at $60,000. You set a stop-loss at $57,000. If the price falls to $57,000, your order triggers and sells your Bitcoin at the next available price. Simple. But here’s the catch - that next price isn’t always $57,000. During fast moves, it could be $56,200. Or even $55,000. That’s called slippage. It’s normal in crypto. You need to plan for it.

Where to Place Your Stop-Loss

Don’t just pick a number out of thin air. That’s how beginners lose money. You need to base your stop-loss on what the market is actually doing.

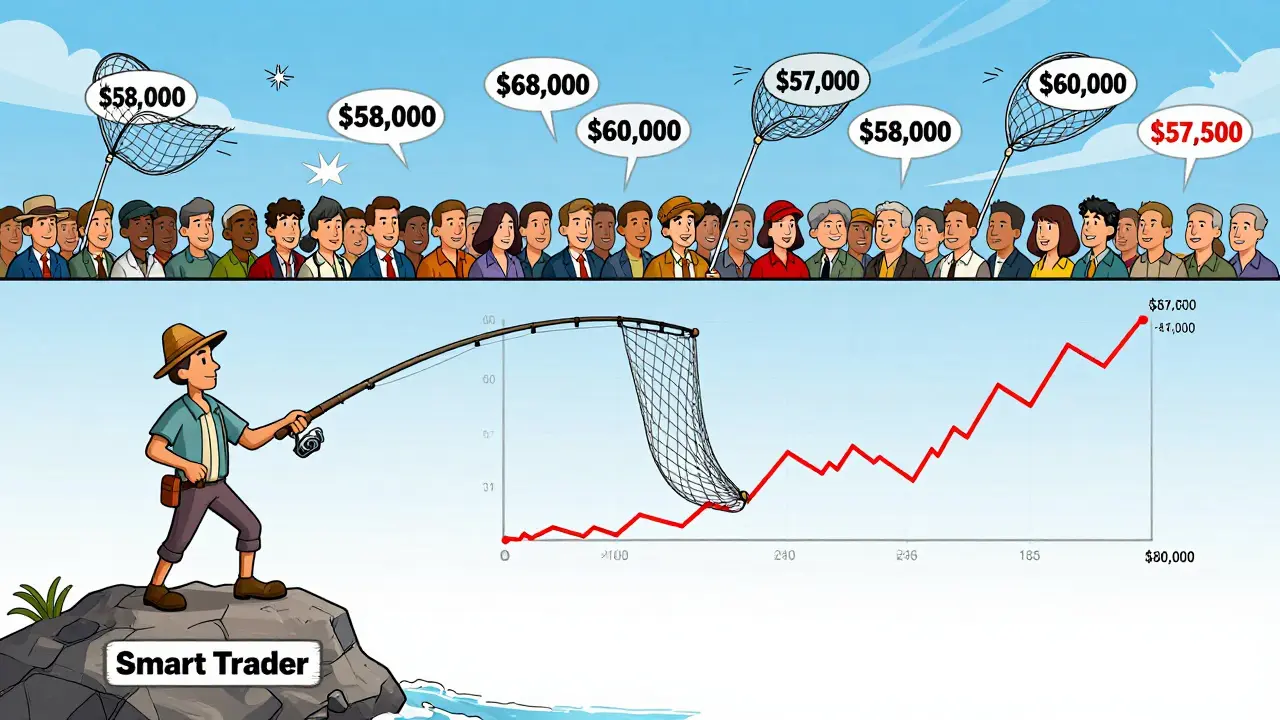

Look at recent price action. Where did Bitcoin bounce back before? Those are support levels. If Bitcoin kept rebounding from $58,000 over the last three weeks, then $58,000 is a strong support. Your stop-loss shouldn’t be right at $58,000. Put it below - say, $57,500. That gives room for normal noise without getting stopped out too early.

Think of it like this: If you’re fishing, you don’t cast your line right where the fish are jumping. You cast a little past them. Same with stop-losses. You want to be below the real support, not on top of it.

Round numbers like $50,000 or $60,000 are dangerous places to put stops. Why? Because thousands of other traders do the same thing. When Bitcoin hits $59,900, everyone’s stop-loss triggers at once. That creates a cascade - price drops fast, and you get filled at $58,500 instead of $59,800. Avoid obvious levels. Go just below them.

How Much Risk Are You Willing to Take?

Here’s a rule every pro uses: Never risk more than 1-2% of your total trading account on one trade.

Let’s say you have $10,000 in your Bitcoin trading account. You’re willing to lose $200 on this trade - that’s 2%. You bought Bitcoin at $60,000. How much can it drop before you hit $200 in losses?

Divide $200 by your Bitcoin amount. If you bought 0.01 BTC, then $200 ÷ 0.01 = $20,000. That means your stop-loss must be at least $40,000 away from your entry. Wait - that’s too far. That’s a 33% drop. That’s not realistic.

That’s where position sizing comes in. If you want to risk only $200, and Bitcoin can drop $2,000 before hitting support, then you buy less Bitcoin. $200 ÷ $2,000 = 0.01 BTC. So you buy 0.01 BTC. Now your $2,000 drop = $200 loss. Perfect. Your stop-loss goes at $58,000. Your risk is locked in. You didn’t guess. You calculated.

Stop-Loss vs. Stop-Limit: Know the Difference

Most exchanges give you two choices: stop-loss and stop-limit.

A stop-loss becomes a market order when triggered. It sells immediately at whatever price is available. Fast execution, but you might get a worse price during a crash.

A stop-limit becomes a limit order. You set two prices: the stop price (trigger) and the limit price (minimum you’ll accept). If Bitcoin crashes past your limit price, your order doesn’t fill. You hold on - hoping it bounces. But it might not. You could be stuck with a losing position.

For most Bitcoin traders, stop-loss is better. Why? Because in a fast-moving market, getting out matters more than getting the perfect price. If you’re holding Bitcoin for the long term and don’t mind waiting, stop-limit might work. But if you’re trading, go with stop-loss.

Trailing Stops: Let Bitcoin Work for You

Imagine you bought Bitcoin at $55,000. It climbs to $65,000. You’re up $10,000. But now you’re scared it’ll drop back down. You don’t want to sell too early. You don’t want to lose all your profits.

This is where trailing stops shine.

A trailing stop follows the price up. You set a distance - say, 5%. When Bitcoin hits $65,000, your stop-loss moves up to $61,750. If it keeps rising to $70,000, your stop moves to $66,500. If it suddenly drops to $66,000, your order triggers and sells. You locked in $11,000 profit. You didn’t have to think about it.

Most exchanges let you set trailing stops as a percentage or in dollars. For Bitcoin, 5-8% trailing works well. Too tight (like 2%) and you get shaken out during normal pullbacks. Too wide (like 15%) and you give back too much.

Adjusting Stops as the Market Moves

Setting a stop-loss and forgetting it is a mistake. Markets change. Your stop should too.

If Bitcoin rallies after you buy, move your stop up. Not to lock in profit - to protect it. If you bought at $58,000 and it’s now at $62,000, move your stop from $56,000 to $60,000. Now you’re not risking anything. You’re playing with the house’s money.

What if Bitcoin stalls? Maybe it’s stuck between $61,000 and $62,000 for days. That’s consolidation. Don’t tighten your stop. Don’t panic. You’re not trading the short-term noise. You’re trading the trend. If your original stop was at $57,000, leave it there. Let the market breathe.

Before big events - like Fed rate decisions, Bitcoin ETF approvals, or major regulatory news - many traders widen their stops. Why? Because volatility spikes. A 3% drop in normal times might be a 10% drop during news. If you’re bullish, widen your stop to 8-10%. If you’re cautious, tighten it to 1-2%. But don’t ignore it. Adjust before the event, not after.

Common Mistakes (And How to Avoid Them)

Most people lose money on stop-losses not because they’re broken - but because they use them wrong.

- Setting stops too tight: If you put your stop at 2% below entry, you’ll get stopped out every time Bitcoin dips 3%. That’s normal. You’re not trading - you’re just paying fees and losing confidence.

- Placing stops at round numbers: $50,000, $60,000 - these are magnet levels. Everyone’s watching. Don’t be part of the herd.

- Ignoring volatility: Bitcoin swings 5-10% daily. Your stop needs room. Use the Average True Range (ATR) indicator. If ATR is 4%, don’t set a 2% stop. Set it at 5-6%.

- Not using position sizing: If you risk 10% of your account on one trade, one bad stop-loss wipes you out. Keep it at 1-2%.

What Exchanges Offer

Most major exchanges - Binance, Coinbase, Gemini, Bitstamp - all have stop-loss and trailing stop features. The interface varies, but the function is the same. You pick your order type, set the trigger price, and confirm.

DeFi platforms like Uniswap or dYdX have limited stop-loss support. Some use third-party bots. If you’re trading on DeFi, you might need to use a tool like 3Commas or GoodCrypto to automate stops.

Don’t overcomplicate it. Start with the exchange you already use. Learn how to set a basic stop-loss there. Then try trailing stops. Then adjust based on price action.

Real-World Example

Let’s say you bought 0.02 BTC at $59,500. Your account size is $12,000. You’re willing to risk 1.5% - that’s $180.

You look at the chart. The last strong support was at $57,200. You set your stop-loss at $57,000. That’s a $2,500 drop per BTC. For 0.02 BTC, that’s $50 in potential loss. Too low? You’re risking less than 1% - perfect.

Two days later, Bitcoin hits $63,000. You move your stop to $61,000. Now you’re protected. If it drops to $61,000, you walk away with $3,500 profit.

Then, a big news drop hits. Bitcoin crashes to $59,000 in an hour. Your stop triggers. You sold at $59,100. You made $1,100. You didn’t panic. You didn’t wait for a rebound. You followed your plan.

That’s how pros trade.

Final Thought: Discipline Beats Prediction

No one can predict Bitcoin’s next move. Not even the experts. But anyone can set a stop-loss. That’s the power of it.

Stop-losses don’t make you right. They keep you in the game when you’re wrong. They turn emotion into action. They turn fear into structure.

Set your stop-loss before you buy. Write it down. Stick to it. Adjust it only when the market gives you a clear reason. And never, ever remove it because you’re ‘sure’ it won’t hit.

Bitcoin doesn’t care how sure you are. It only cares about price. Your stop-loss is your only real ally in that fight.

Can you set a stop-loss on Bitcoin without an exchange?

No, you can’t set a stop-loss directly on a hardware wallet or non-custodial wallet. Stop-loss orders require the exchange to monitor price and execute the sell. To use stop-losses, you need to hold Bitcoin on a centralized exchange like Binance, Coinbase, or Gemini. Some DeFi tools and bots (like 3Commas) can automate stops on decentralized platforms, but they still rely on exchange APIs to execute trades.

Why does my stop-loss sometimes trigger and Bitcoin immediately goes back up?

This is called a ‘false breakout’ or ‘whipsaw.’ It happens because stop-losses cluster around obvious levels - like $60,000 or $58,000. When the price hits those levels, automated systems trigger, forcing a quick sell. That drives the price down further, but once the selling pressure clears, buyers step in and push it back up. To avoid this, place your stop-loss below clear support levels, not right on them. Use volatility filters like ATR to give your stop more breathing room.

Should I use a percentage-based stop or a price-based stop?

Both work, but percentage-based stops are better for Bitcoin. Bitcoin moves fast and unpredictably. A fixed $2,000 stop might be too wide when Bitcoin is at $40,000 and too tight when it’s at $70,000. A 5% stop adjusts automatically with price. It keeps your risk consistent. For beginners, start with 5-8% stops. As you gain experience, combine percentage stops with technical levels for better precision.

Is a stop-loss guaranteed to protect me from big losses?

No. A stop-loss reduces risk, but it doesn’t eliminate it. In extreme cases - like flash crashes or exchange outages - your stop-loss might execute far below your trigger price due to slippage. In 2024, Bitcoin dropped over $10,000 in under 10 minutes during a liquidity crunch. Traders with stops at $58,000 got filled at $47,000. That’s why you should never risk more than 1-2% per trade. Even if your stop fails, your total loss stays small.

How long should I keep a stop-loss on my Bitcoin position?

Keep it on until you close the trade. Whether you’re holding for days, weeks, or months, your stop-loss should stay active. If you remove it because you’re ‘waiting for a rebound,’ you’re gambling. The whole point of a stop-loss is to remove emotion from your exit. Only remove it if you’re closing the position entirely or switching to a different strategy.

Christopher Michael

January 29, 2026 AT 10:33Stop-losses aren’t just for crypto-they’re for life. Set boundaries, walk away, and let the universe handle the rest. I’ve seen traders with perfect entries blow up because they couldn’t let go. Your stop-loss is your discipline made visible. Don’t treat it like a suggestion. Treat it like your last breath.

Parth Makwana

January 29, 2026 AT 10:47One must appreciate the strategic profundity embedded within this exposition on risk mitigation protocols. The utilization of trailing stops, calibrated against the Average True Range (ATR) metric, exemplifies a paradigm shift from reactive trading to anticipatory capital preservation. One must not conflate volatility with weakness; rather, one must harness it as a quantifiable variable in the stochastic calculus of positional integrity.

Elle M

January 31, 2026 AT 00:11Wow. Someone actually wrote a 2,000-word essay on how to not lose money. And you’re surprised people still get wiped out? Maybe if you didn’t treat Bitcoin like a casino game, you wouldn’t need a stop-loss in the first place.

Rico Romano

January 31, 2026 AT 17:38Let’s be honest-most of you are using 5% trailing stops because you read it on Reddit. Real traders use volatility-adjusted dynamic bands based on multi-timeframe volume profiles. If you don’t know what a VWAP convergence is, you shouldn’t be holding BTC at all. You’re just a liquidity provider for the whales.

Crystal Underwood

February 2, 2026 AT 16:15Ugh. Another ‘set your stop-loss’ post. Like that’s gonna fix your emotional attachment to your bag. You think you’re being smart by using ATR? You’re just delaying the inevitable. Bitcoin doesn’t care about your risk management. It cares about your desperation. And you’re feeding it.