Blockchain Bridge Selector

Your Transfer Requirements

Bridge Type Comparison

2-5 min finality, $0.50-$2.00 fees, centralized validators

5-20 min finality, $1.00-$5.00 fees, no custodians

3-10 min finality, $0.50-$3.00 fees, decentralized verification

Recommended Bridge Type

Select your requirements

Your selection will be shown here

When you need to move assets from Ethereum to Bitcoin or from Solana to Polygon, you rely on a blockchain bridge. But not all bridges are built the same way. Some put a handful of entities in charge of every transfer, while others let the underlying blockchains do the heavy lifting. Understanding the trade‑offs between trusted and trustless designs can save you from losing money, time, or peace of mind.

What is a blockchain bridge?

A blockchain bridge is a Web3 protocol that links two otherwise isolated networks, enabling tokens, NFTs, or data to cross the divide. The basic workflow involves locking an asset on the source chain, minting a wrapped representation on the destination chain, and reversing the process when the user wants to retrieve the original. This “lock‑mint‑burn‑unlock” pattern keeps the total supply constant while giving users access to the liquidity of multiple ecosystems.

Trusted Bridge is a bridge that relies on a set of external verifiers such as federations, multi‑signature wallets, or oracle networks. These verifiers act as custodians: they sign off on each lock‑and‑mint transaction before the wrapped token is released. The design mirrors a traditional bank’s clearing house-fast, user‑friendly, but with a clear point of centralization.

Typical trusted bridges, like Binance Bridge or the Polygon POS Bridge, run a small validator set (often 5‑20 entities). Transactions usually finalize in 2‑5 minutes and fees range from $0.50 to $2.00. Because the custodial layer is managed by known organizations, onboarding is simple: users just connect a wallet and click “Transfer.” However, the hack of the Ronin Bridge in March2022-where four compromised validators allowed a $625million theft-highlighted the inherent risk of concentrating trust.

Trustless Bridge is a bridge that eliminates any external custodian and instead leverages the security guarantees of the connected blockchains themselves. It does this through smart contracts, cryptographic proofs, and light‑client verification. In other words, the bridge’s correctness depends only on the consensus mechanisms of the source and destination chains.

Trustless designs fall into two main families. Generalized message‑passing bridges-such as CosmosIBC or LayerZero’s omnichain protocol-use light clients to verify block headers and state roots, enabling arbitrary data beyond simple token swaps. Liquidity‑network bridges-like Connext, Hop, or Across-run pooled liquidity on each side and execute atomic swaps, achieving faster finality (5‑15minutes) without a custodian.

Because the bridge logic lives entirely on‑chain, users often face higher fees ($1‑$5) and longer settlement times, especially for optimistic message‑passing bridges that include a 30‑minute challenge period. Security‑wise, trustless bridges inherit the robustness of the underlying chains, but they introduce new attack surfaces: smart‑contract bugs (the Wormhole $326million exploit) and complex re‑org handling.

Key architectural differences at a glance

| Aspect | Trusted Bridge | Trustless Bridge |

|---|---|---|

| Custody Model | External validators/federations hold locked assets | On‑chain smart contracts escrow assets; no external custodian |

| Security Base | Validator honesty + multi‑sig security | Underlying blockchains’ consensus + contract correctness |

| Typical Finality | 2‑5minutes | 5‑20minutes (varies by subtype) |

| Fees (USD) | $0.50‑$2.00 | $1.00‑$5.00 |

| Network Reach | 15‑20+ chains (often via centralized APIs) | 2‑5 chains for message‑passing; liquidity pools for selected pairs |

| User Experience | Simple UI, 24/7 support | Technical UI, community‑driven support |

| TVL Share (Sep2024) | ≈68% of $15.2B total | ≈32% of $15.2B total |

Security trade‑offs you need to weigh

Trusted bridges gain speed by delegating verification to a handful of entities. That delegation creates a single point of failure-if a validator set is compromised, all assets under custody are at risk. The Ronin hack, where four of nine validators were taken over, demonstrated a loss of $625million in under two minutes.

Trustless bridges, on the other hand, shift the risk to code. A flaw in the bridge contract can be catastrophic, as seen with Wormhole’s $326million breach caused by an unchecked upgrade. Still, the attack surface is more transparent: anyone can audit the contracts, and the security model can be formally verified.

Regulators are taking notice. The U.S. Treasury’s 2023 report flagged cross‑chain bridges as high‑risk for money‑laundering, prompting the FATF to demand travel‑rule compliance for bridges moving over $1,000. Trusted bridges often already meet these requirements because they operate under existing Exchange‑Level KYC frameworks, while trustless bridges need additional on‑chain identity layers.

Developer and user experience considerations

From a developer standpoint, integrating a trusted bridge can be as easy as calling a REST endpoint. Most SDKs require 15‑25hours of work, and the learning curve is shallow-basic wallet interaction, a few API keys, and you’re good to go.

Adding a trustless bridge is more involved. You must understand light‑client verification, manage finality windows, and handle potential chain re‑organizations. The average effort climbs to 40‑60hours, and the documentation is often dense, targeting developers familiar with Solidity or Rust.

For end users, the difference shows up in onboarding time. A survey by Liminal Custody in 2023 found that 92% of respondents completed a trusted‑bridge transfer within 10minutes of first use, whereas only 58% felt comfortable with a trustless bridge after the same period. On the flip side, confidence in security was higher for trustless solutions (84% of respondents felt “very safe”), reflecting the community’s preference for lower trust assumptions on larger sums.

Hybrid and emerging designs

The industry is moving toward “trust‑minimized” hybrids that combine custodial speed with on‑chain verification. LayerZero’s v2 protocol, launched in April2024, uses decentralized oracles to attest to block headers while still offering a familiar UI. Chainlink’s Cross‑Chain Interoperability Protocol (CCIP) similarly blends off‑chain relayers with on‑chain validation, giving enterprises a compliant, fast bridge without a single custodian.

These hybrids aim to capture the best of both worlds: sub‑5‑minute finality, moderate fees, and a security model that leans on the underlying chains. Early adopters report that hybrid bridges already hold about 12% of total bridge TVL, a number that is expected to double by 2027 as more DeFi protocols demand both speed and auditability.

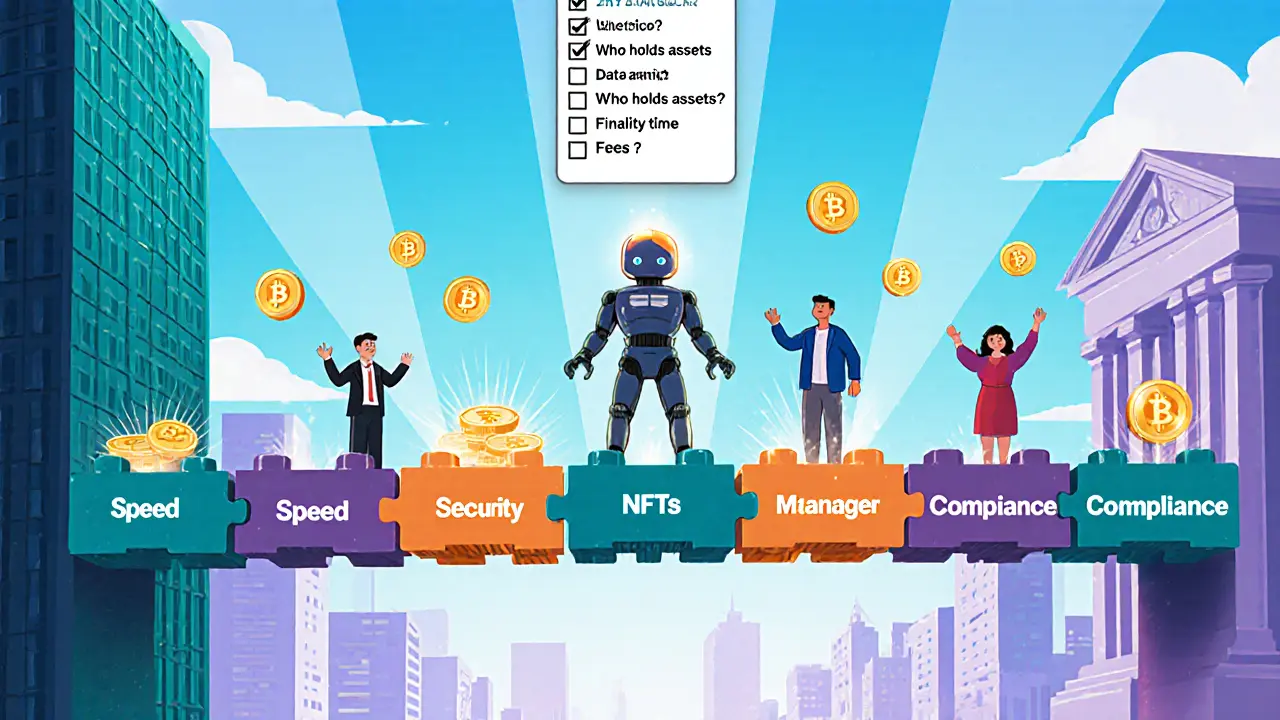

Choosing the right bridge for your use case

- Small, frequent retail swaps (<$5,000): Trusted bridges win on speed and UI simplicity.

- High‑value transfers (>$50,000) or institutional custody: Trustless or hybrid bridges reduce exposure to single‑point failures.

- Cross‑chain smart‑contract interactions: Message‑passing bridges like CosmosIBC or LayerZero are necessary.

- Asset types beyond ERC‑20 (e.g., NFTs, complex data): Trustless designs that support arbitrary payloads are required.

Ultimately, ask yourself three questions before clicking “Transfer.” Who holds the assets during the bridge? How long will the transaction take? And what fees am I willing to absorb for that speed and security level?

Future outlook

Electric Capital predicts that trustless bridges will capture about 55% of the market by 2027, driven by institutional demand for auditability. Meanwhile, Delphi Digital foresees trusted bridges retaining roughly 60% market share through 2026, thanks to integration with major exchanges and smoother user experiences. The gap will likely narrow as hybrid solutions prove their reliability and regulators provide clearer frameworks for cross‑chain compliance.

For now, the safest strategy is diversification: keep a portion of your assets on a familiar, well‑audited trusted bridge for daily moves, and allocate larger or mission‑critical funds to a vetted trustless or hybrid bridge. Monitoring bridge security audits, validator decentralization metrics, and fee structures will keep you ahead of the next wave of bridge evolution.

Frequently Asked Questions

What is the main security difference between trusted and trustless bridges?

Trusted bridges rely on a limited set of external validators or custodians, so a breach of those entities can compromise all locked assets. Trustless bridges keep assets in on‑chain contracts and depend on the consensus security of the source and destination blockchains, shifting risk to smart‑contract bugs and protocol-level attacks.

Which bridge type is faster for everyday transfers?

Trusted bridges usually finalize in 2‑5minutes, making them the quicker choice for low‑value, high‑frequency swaps. Trustless and liquidity‑network bridges can take 5‑20minutes, depending on finality periods and network congestion.

Do trustless bridges require KYC or AML compliance?

Because trustless bridges are often decentralized, they don’t enforce KYC at the protocol level. However, regulators are pushing for on‑chain identity solutions, and many bridges will need to integrate travel‑rule checks for large transfers to stay compliant.

Can I use a bridge to move NFTs across chains?

Yes, but you need a trustless or hybrid bridge that supports arbitrary payloads. Trusted bridges generally focus on ERC‑20 tokens, whereas protocols like CosmosIBC or LayerZero can wrap NFTs and preserve metadata.

What are “hybrid” bridges and should I trust them?

Hybrid bridges blend custodial speed with on‑chain verification-think LayerZero or Chainlink CCIP. They reduce single‑point risk while keeping transaction times low. As with any new tech, review audits and monitor adoption before moving large sums.

Pierce O'Donnell

October 3, 2025 AT 20:58Trusted bridges sound convenient, but speed always comes with a hidden cost-centralized trust is a single‑point failure. The Ronin hack is a textbook reminder.

Vinoth Raja

October 13, 2025 AT 23:58Look, the whole trusted vs trustless debate is really a matter of trust assumptions baked into the protocol stack. When you hand over custody to a validator set you’re essentially re‑introducing a traditional clearing house on chain, which raises latency but cuts down on user‑level complexity. On the other hand, trustless designs push verification into smart contracts and light‑client proofs, which means you pay for gas and endure longer finality windows. The trade‑off is classic-security vs UX, and the math is hidden under layers of cryptographic jargon.

Kaitlyn Zimmerman

October 24, 2025 AT 02:58if you’re looking for a quick win try a trusted bridge for small swaps it’s easier to get started and you don’t need to audit complex contracts just follow the UI and you’ll be fine

DeAnna Brown

November 3, 2025 AT 04:58Everyone acts like trustless is the holy grail, yet nobody mentions how much messier the UI gets! I’ve tried a few of those liquidity‑network bridges and the error messages read like a novel. Trust the home‑grown solutions from our own country-they’ve been battle‑tested and the community backs them.

Chris Morano

November 13, 2025 AT 07:58i appreciate the perspective you bring it’s true that user experience matters and the community support can’t be ignored we should keep an eye on both security and ease of use

Ikenna Okonkwo

November 23, 2025 AT 10:58Optimism is key when evaluating bridges: a trustless system may seem intimidating, but once you understand the consensus guarantees, the risk profile often looks better than a handful of validators who could collude. Think of it as moving from a single vault to a decentralized vault network.

Bobby Lind

December 3, 2025 AT 13:58Absolutely, the shift to on‑chain escrow, the reduction in custodial risk, the clarity of open‑source code, the community audits-these all add up to a more resilient ecosystem, especially for larger moves.

Jessica Cadis

December 13, 2025 AT 16:58From a cultural standpoint, it’s crucial we don’t just copy Western bridge models; we need solutions that respect local regulatory nuances while still leveraging global security standards.

Katharine Sipio

December 23, 2025 AT 19:58We appreciate the insight. It is indeed advisable to adopt a formal risk‑assessment framework when selecting a bridge, ensuring compliance without sacrificing performance.

Matthew Theuma

January 2, 2026 AT 22:58Totally agree 😊 the balance between compliance and speed is delicate, but with proper audits the bridge can be both secure and user‑friendly. Oops i missed a typo there but the point stands.

Jason Zila

January 13, 2026 AT 01:58There's no point in sugar‑coating the reality: if you can't tolerate a 20‑minute finality window, stick with a trusted bridge and accept the centralized risk.

Cecilia Cecilia

January 23, 2026 AT 04:58I understand the concern about latency and respect the need for clarity.

lida norman

February 2, 2026 AT 07:58Wow, the contrast is striking! 😮 Trustless bridges feel like the future, but trusted ones still have their place for everyday swaps. Let’s keep the discussion balanced.