State-by-State Crypto Regulations Checker

Select a state to see regulations

Choose your state to see what cryptocurrency rules apply to you.

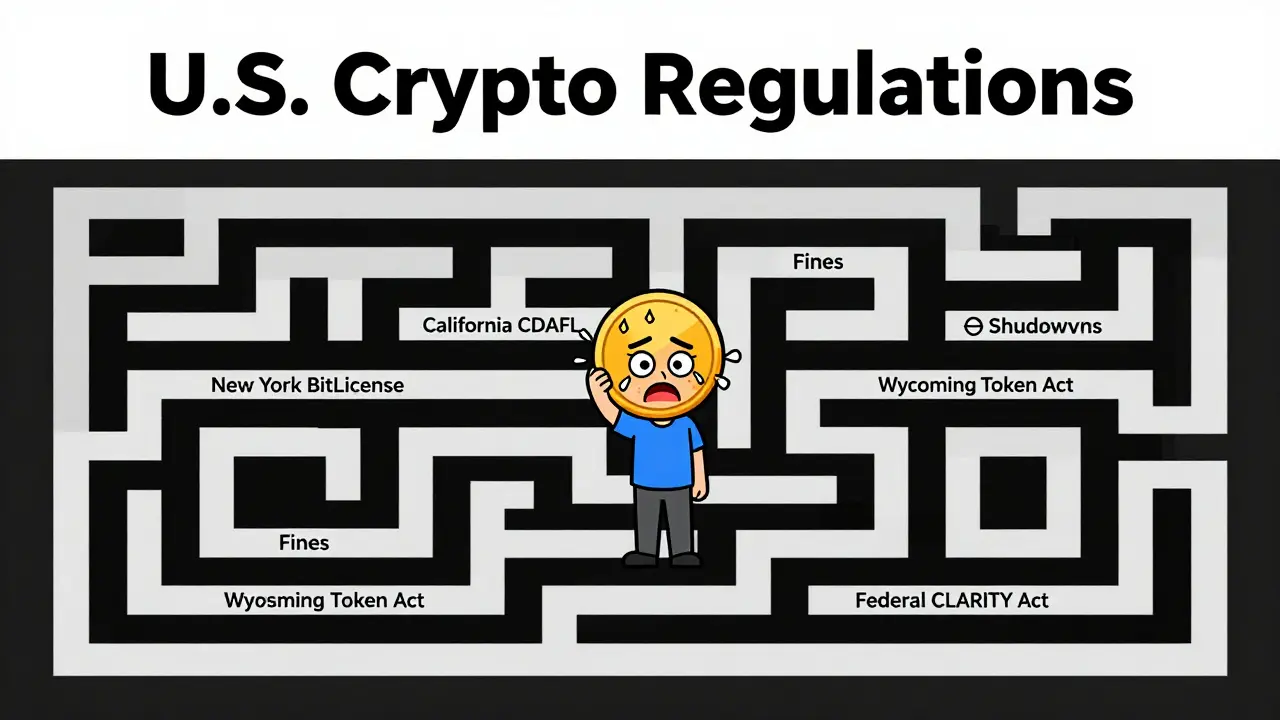

When it comes to cryptocurrency, there’s no single rulebook in the U.S. What’s legal in California might get you fined in New York. And that’s just the start. As of December 2025, the U.S. crypto landscape is a patchwork of state laws, federal signals, and enforcement actions that make compliance more like navigating a maze than following a map.

New York: The Strictest State for Crypto

New York doesn’t just regulate crypto-it controls it. The BitLicense system, created by the New York State Department of Financial Services (NYDFS), is the most demanding crypto licensing regime in the country. Any business that transmits, stores, or exchanges cryptocurrency in New York needs this license. It’s not just paperwork. You need detailed audits, anti-money laundering programs, cybersecurity plans, and proof of capital reserves. Many small crypto startups have walked away from New York because the cost and complexity aren’t worth it.

Even worse, the BitLicense doesn’t just cover exchanges. It applies to wallets, mining operations, and even peer-to-peer platforms that facilitate transfers. The state also uses its Attorney General’s office to go after companies that slip through the cracks. In 2024, the NYAG settled with two decentralized finance (DeFi) platforms for operating without a license, forcing them to pay $2.5 million in penalties and shut down access to New York residents.

California: Innovation With Oversight

California takes the opposite approach. The Department of Financial Protection and Innovation (DFPI) doesn’t require a blanket license like New York. Instead, it uses existing money transmission laws to regulate crypto businesses-but with flexibility. If you’re a crypto exchange or wallet provider, you can register as a Money Transmitter under the California Finance Lenders Law. The process is faster, cheaper, and less invasive than the BitLicense.

But don’t think California is lax. The state has passed its own digital asset framework, the California Digital Financial Assets Law (CDAFL), which took effect in January 2025. It requires custodians to hold client assets in segregated accounts, disclose fees upfront, and maintain cyber insurance. The goal? Encourage innovation without sacrificing consumer safety. As a result, over 60% of U.S.-based crypto startups now have a legal presence in California, even if they don’t serve customers there.

Federal Shifts Are Changing the Game

While states fight over rules, Washington is finally stepping in. In July 2025, President Trump signed the GENIUS Act into law, creating the first federal rules for stablecoins. Now, issuers must back every stablecoin with cash, short-term Treasuries, or other liquid assets-and they must publish monthly audits. This killed off dozens of shady stablecoin projects that were just打着“1:1 USD” claims without real reserves.

Meanwhile, the CLARITY Act is moving through the Senate. If passed, it would shift oversight of most cryptocurrencies from the SEC to the CFTC. That’s a big deal. The SEC has spent years trying to label crypto tokens as securities, which meant heavy restrictions. The CFTC, on the other hand, treats crypto like commodities-think gold or oil. That means fewer compliance hurdles for exchanges and more room for innovation.

And then there’s the OCC. In March 2025, the Office of the Comptroller of the Currency issued Interpretive Letter 1183, which told national banks they can custody crypto, issue stablecoins, and run blockchain nodes-no permission needed. That overturned the Biden-era rule that required banks to ask for approval first. Now, JPMorgan, Wells Fargo, and even regional banks can offer crypto services without jumping through regulatory hoops.

Most States: Waiting and Watching

Of the 50 states, fewer than 15 have passed specific crypto laws. The rest rely on old financial regulations-money transmitter laws, securities acts, or anti-fraud statutes-to handle crypto cases. That creates confusion. A company in Texas might think it’s fine selling crypto to customers in Arizona, but Arizona’s attorney general could still sue them under consumer protection laws.

Some states are starting to act. Texas passed the Digital Asset Transparency Act in 2024, requiring exchanges to disclose how they hold customer funds. Florida banned crypto mining operations that use more than 50 megawatts of power, citing energy concerns. Wyoming, long a crypto-friendly state, passed the Token Classification Act in 2023, which says certain tokens aren’t securities-and it’s now the only state that explicitly protects crypto holders from being taxed on staking rewards.

But most states haven’t even begun to draft bills. They’re waiting to see what the federal government does. And with the CLARITY Act and the White House’s new Digital Financial Technology Working Group pushing for a unified system, many states are holding off on major changes.

Enforcement Is Everywhere

Even if your state doesn’t have crypto laws, you’re not safe. State attorneys general don’t need new laws to act. They use existing consumer protection and fraud statutes to go after crypto companies. In 2025 alone, state AGs filed over 40 enforcement actions against crypto platforms. Most were for misleading ads, unlicensed trading, or failing to disclose risks.

One case in Illinois involved a crypto lending platform that promised 12% annual returns. The state sued, saying it was an unregistered security. The company paid $1.8 million in fines and had to refund all Illinois customers. The lesson? You don’t need a state crypto law to get in trouble. If you mislead customers, the state will come for you.

What This Means for You

If you’re a crypto investor: You have more access now than ever. Exchanges can legally offer margin trading and leverage in most states thanks to the SEC-CFTC joint statement from September 2025. But you still need to know where you live. If you’re in New York, you can’t use some DeFi apps. In Texas, you can. Always check your state’s stance before investing.

If you’re running a crypto business: You need a state-by-state compliance plan. Don’t assume federal rules override state ones. You might be fine under the CLARITY Act, but if you’re accepting deposits from New York customers, you still need a BitLicense. Many companies now use compliance platforms like Chainalysis or Elliptic to track where their users are and block access where required.

If you’re just starting out: Wyoming and Florida are the easiest places to set up a crypto company. Wyoming has no corporate income tax, no sales tax, and clear crypto protections. Florida has no state income tax and is building crypto-friendly infrastructure. Avoid New York unless you have deep pockets and legal teams.

What’s Next?

The next 12 months will be critical. If the CLARITY Act passes, it will force most states to align with federal rules-or risk being preempted. The CBDC Anti-Surveillance State Act could block the Federal Reserve from launching a digital dollar, which would keep private crypto alive as a real alternative.

For now, the message is clear: Crypto isn’t going away. The U.S. government is finally trying to build a real framework. But until federal law fully takes over, you’re still stuck playing by state rules. And those rules? They’re different in every state.

Is crypto legal in all 50 states?

Yes, owning and using cryptocurrency is legal in all 50 states. But how you use it-like trading, mining, or running a business-is heavily regulated in some states. New York requires a BitLicense. Others treat crypto like securities or money transmission. So while you can hold Bitcoin anywhere, you might not be allowed to trade it on certain platforms depending on where you live.

Can I use Coinbase in New York?

Yes, Coinbase is licensed in New York and holds a BitLicense. That means you can buy, sell, and store crypto on Coinbase in New York. But many other exchanges-especially DeFi platforms and smaller wallets-are blocked because they never applied for or were denied a BitLicense. If a platform says it’s not available in New York, it’s usually because of this licensing barrier.

Do I have to pay state taxes on crypto gains?

Yes. All states that have income taxes treat crypto gains like capital gains. California, New York, and Washington tax crypto profits at their top income tax rates-up to 13.3%, 10.9%, and 11%, respectively. Wyoming and Florida have no state income tax, so you only pay federal taxes. Some states, like Texas and Nevada, don’t tax crypto at all because they don’t tax any investment income. Always check your state’s rules before filing.

What happens if I move to a new state with crypto?

Moving doesn’t automatically change your legal obligations. If you held crypto in New York and moved to Texas, you still owe taxes on past gains. But if you start a crypto business, you’ll need to comply with your new state’s rules. Texas doesn’t require a license for crypto exchanges, so you can operate there without a BitLicense. But if you still serve New York customers, you’ll need to keep your license or stop serving them.

Are mining operations legal everywhere?

Most states allow crypto mining, but some are cracking down. Florida banned large-scale mining that uses over 50 megawatts of power in 2025, citing grid strain. New York has a de facto ban because of its high electricity costs and environmental rules. Wyoming and Kentucky are the most mining-friendly states, offering tax breaks and access to cheap renewable energy. Always check local zoning and energy laws before setting up a mining rig.

Bottom line: Crypto regulation in the U.S. isn’t about whether it’s legal-it’s about how much hassle you’re willing to deal with. The federal government is finally giving the industry a roadmap. But until that map becomes the only one you need, you’re still stuck reading 50 different versions of the same story.

Mohamed Haybe

December 5, 2025 AT 05:08Althea Gwen

December 5, 2025 AT 11:46Sarah Roberge

December 5, 2025 AT 18:07Steve Savage

December 7, 2025 AT 06:09Layla Hu

December 9, 2025 AT 02:02Philip Mirchin

December 10, 2025 AT 01:48ashi chopra

December 11, 2025 AT 06:26Heather Hartman

December 11, 2025 AT 20:48Greer Dauphin

December 12, 2025 AT 07:05Mark Stoehr

December 13, 2025 AT 16:07Shari Heglin

December 14, 2025 AT 14:03Murray Dejarnette

December 16, 2025 AT 13:34Britney Power

December 18, 2025 AT 09:12Maggie Harrison

December 19, 2025 AT 09:19Akash Kumar Yadav

December 20, 2025 AT 07:45alex bolduin

December 20, 2025 AT 12:18