BitLicense: What It Is, Why It Matters for Crypto Exchanges

When you use a crypto exchange, you might not think about the rules behind it—but if it’s based in New York or serves New York residents, there’s a good chance it’s holding a BitLicense, a state-issued permit that allows businesses to offer cryptocurrency services in New York. Also known as New York BitLicense, it’s one of the toughest regulatory frameworks for crypto in the United States. Unlike federal guidelines that move slowly, New York’s Department of Financial Services (NYDFS) started enforcing this in 2015, and it hasn’t let up since.

BitLicense isn’t just a form you fill out. It’s a full audit of your business: background checks on owners, anti-money laundering plans, cybersecurity protocols, capital reserves, and ongoing reporting. Many small exchanges never applied because the cost and complexity were too high. That’s why you won’t find every crypto platform available in New York—some just walked away. Others, like Coinbase and Kraken, spent years and millions to get approved. For users, that means fewer choices, but also more protection. If an exchange has a BitLicense, you know it’s been vetted by a government body that actually enforces penalties.

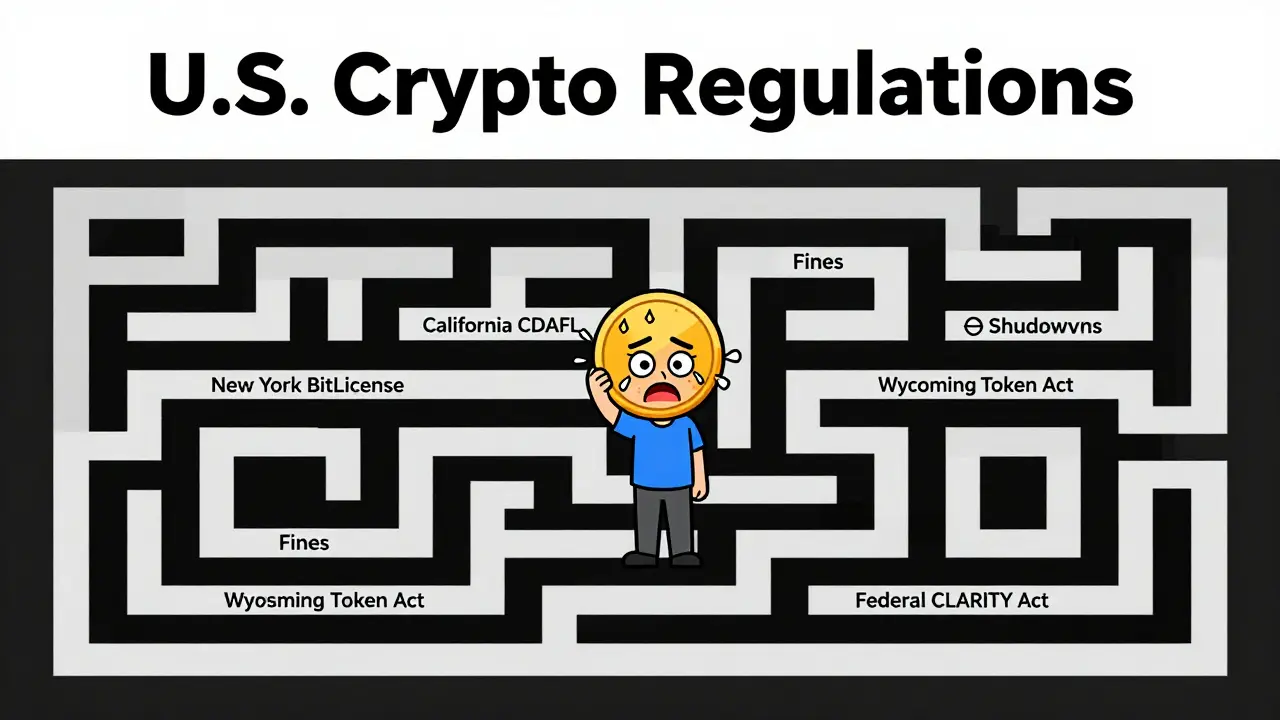

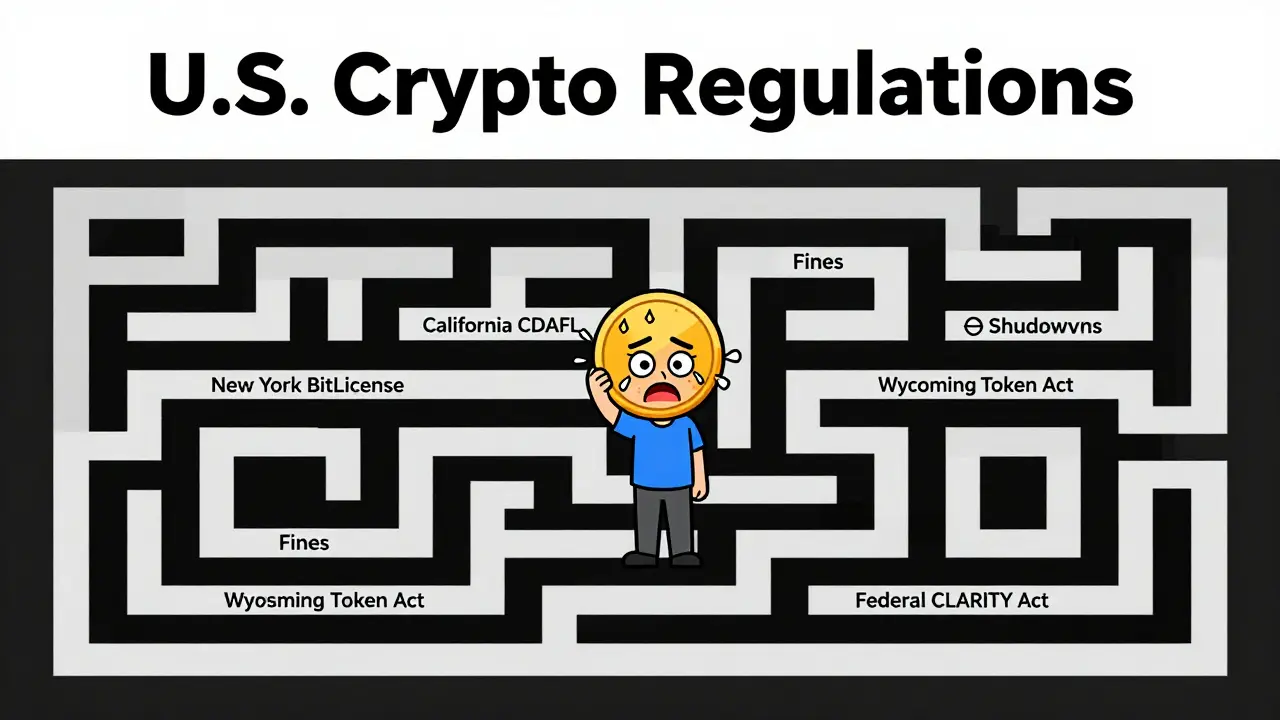

But BitLicense doesn’t just affect exchanges. It ripples through DeFi platforms, wallet providers, and even crypto ATMs that touch New York customers. If you’re trading on a platform that says it’s "not available in New York," chances are it’s avoiding BitLicense—not because it’s shady, but because it can’t afford the burden. Meanwhile, states like Wyoming and Texas are building lighter frameworks to attract crypto firms. That’s creating a patchwork of rules across the U.S., and BitLicense remains the strictest benchmark.

What’s interesting is that BitLicense didn’t stop crypto—it forced it to grow up. Platforms that made it through had to build real compliance teams, secure infrastructure, and transparent reporting. That’s why you’ll see more stablecoin issuers, custodians, and trading platforms with NYDFS approval than ever before. It’s not perfect, but it’s the closest thing the U.S. has to a real crypto regulatory standard.

Below, you’ll find reviews and deep dives into exchanges that either hold a BitLicense or avoid it entirely. Some are legitimate platforms navigating the rules. Others are scams pretending to be compliant. You’ll see how BitLicense shapes who’s in the game, who’s out, and what it means for your money.

3

Dec

As of 2025, U.S. crypto regulations vary wildly by state. New York demands strict licenses, California balances innovation with oversight, and most states wait for federal clarity. Know where you stand before trading or building a crypto business.

Read More