Katana Yield Calculator

Katana generates an estimated 4.8% annualized yield based on the current productivity of your deposit. Approximately 65% of deposited capital is actively earning yield, while 35% is held as reserve liquidity.

Estimated Annual Yield: $0.00

Estimated Monthly Yield: $0.00

Productive TVL Ratio: 65%

Based on Katana's current metrics: 4.8% APY, with 65% of total deposits actively generating yield.

Key Takeaways

- Katana is a DeFi‑focused layer‑2 blockchain, not a traditional crypto exchange.

- It launched on mainnet on 30 June 2024 and attracted $232 million in pre‑deposits within the first month.

- Core tech includes VaultBridge for cross‑chain yield aggregation and Chain‑Owned Liquidity (CoL) that turns fees into protocol liquidity.

- Compared with general‑purpose L2s (Arbitrum, Optimism) Katana offers deeper DeFi liquidity but fewer dApps.

- Best for institutional and sophisticated retail users seeking sustainable yields; less suitable for beginners or those wanting a broad dApp ecosystem.

When you see the name Katana a DeFi‑centric layer‑2 blockchain built on Polygon’s AggLayer technology, the first thought is often “another crypto exchange.” That’s a misconception. Katana doesn’t host a spot‑trading order book; instead, it concentrates liquidity across multiple chains and automatically deploys assets into high‑yield strategies. This Katana review walks you through what the platform actually does, how it differs from typical exchanges, and whether it fits your investment goals.

What Is Katana, Really?

Katana was birthed by the Katana Foundation in partnership with Polygon Labs and the market‑making firm GSR. After a successful pilot in the Polygon AggLayer Breakout Program, the mainnet went live on 30 June 2024. The platform’s mission is simple: solve DeFi fragmentation by creating a “deep liquidity hub” where assets are constantly put to work instead of sitting idle in wallets.

The platform’s native token, KAT, is used for governance and to reward early depositors, but the bulk of yield comes from the underlying strategies, not token inflation. Katana measures success with a proprietary "productive TVL" metric-only capital actively deployed in yield‑generating contracts counts, giving a clearer picture of real earning power.

How Katana Generates Yield

Two technical innovations drive Katana’s yield engine:

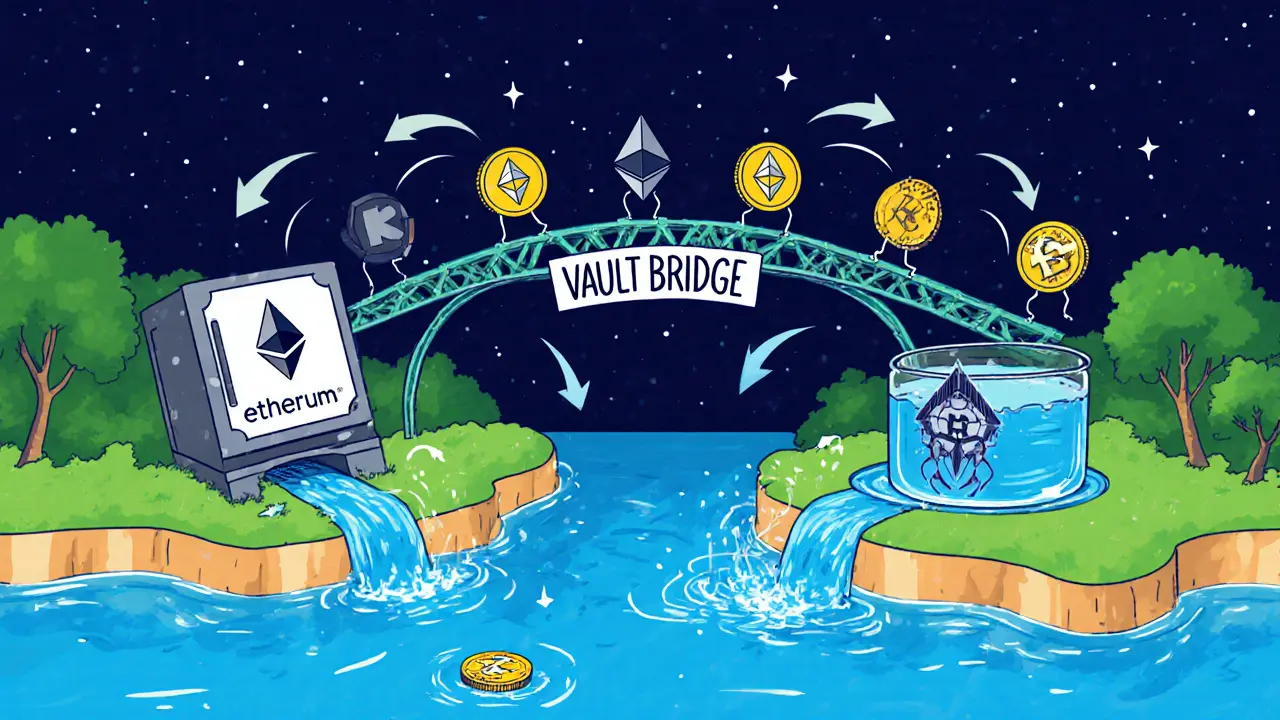

- VaultBridge - A cross‑chain bridge that deposits assets into over‑collateralised lending pools on Ethereum via Morpho. The earned interest is then routed back to Katana, compounding automatically across supported chains.

- Chain‑Owned Liquidity (CoL) - Sequencer fees are converted into liquidity reserves. This turns network activity into real capital that fuels further yield.

In practice, a user deposits, say, 10 ETH on Katana. VaultBridge bridges that ETH to an Ethereum‑based Morpho pool, earns ~5 % APY, and the return flows back to Katana where it’s automatically re‑invested. Because the platform also supports Sushi for on‑chain trading, a memecoin launchpad, and a futures market, users can diversify without leaving the Katana ecosystem.

Who Should Consider Katana?

The platform targets two main groups:

- Institutional investors that need deep, stable liquidity and want to avoid the overhead of managing multiple bridges.

- Sophisticated retail traders already comfortable with DeFi concepts such as lending, yield farming, and cross‑chain bridges.

Beginners will face a moderate learning curve. The UI is EVM‑compatible, but understanding VaultBridge mechanics is essential to avoid sub‑optimal yields.

Katana vs. Other Layer‑2 Solutions

Most layer‑2s-Arbitrum, Optimism, zkSync-focus on scaling general dApps. Katana narrows its scope to DeFi, which brings both strengths and trade‑offs. Below is a side‑by‑side comparison.

| Feature | Katana | Arbitrum | Optimism | Yearn Finance |

|---|---|---|---|---|

| Primary focus | DeFi liquidity concentration | General dApp scaling | General dApp scaling | Yield aggregation on single chain |

| Cross‑chain yield bridge | VaultBridge (Ethereum + Solana) | None (Ethereum‑only) | None (Ethereum‑only) | Ethereum only |

| Liquidity source | Chain‑Owned Liquidity (fees reinvested) | External AMMs | External AMMs | Vaults & strategies |

| Number of core apps (launch) | 4 (Sushi, Morpho, launchpad, futures) | Dozens of dApps | Dozens of dApps | Multiple vaults |

| TVL (June 2024) | $232 M pre‑deposits | $11.2 B | $2.8 B | $562 M |

| Ideal user | Institutions / yield‑focused traders | General crypto users | General crypto users | Yield seekers on Ethereum |

Katana’s standout is its cross‑chain yield aggregation. If you care about pulling yield from multiple ecosystems without manual bridging, Katana wins. If you need a broad dApp marketplace, Arbitrum or Optimism are better bets.

Real‑World Performance Numbers

By mid‑July 2024, the $232 M pre‑deposit pool generated an estimated 4.8 % annualised yield, according to internal metrics shared on the Katana Discord. This is modest compared with some high‑risk farms but far more stable than isolated Ethereum lending rates that can swing wildly.

Productive TVL sits at roughly $150 M, meaning about 65 % of deposited capital is actively earning. The remaining 35 % is held as reserve liquidity to support the CoL mechanism and future app launches.

Security, Risks, and Regulatory Outlook

Katana inherits Ethereum’s security model because it’s an EVM‑compatible rollup. That means any Ethereum network congestion or gas spike can affect transaction costs on Katana. Moreover, the platform’s curated ecosystem limits exposure to unvetted contracts, which lowers smart‑contract risk but also reduces innovation opportunities.

Regulatory uncertainty remains a big cloud for DeFi. A CoinTelegraph survey in May 2024 found 57 % of institutional investors cite regulation as the main barrier to DeFi participation. Katana’s focus on institutional custody integration (planned for Q4 2024) is a direct response to that concern.

Getting Started - A Quick Walkthrough

- Connect an EVM‑compatible wallet (MetaMask, Coinbase Wallet, etc.) to katana.so. The site will detect the Katana network automatically.

- Transfer assets (ETH, USDC, or supported ERC‑20s) to the Katana address shown in your wallet.

- Choose a core app - for example, the Morpho lending tab - and allocate a portion of your deposit.

- Review the projected APY (displayed on the UI) and confirm the transaction.

- The system will route your capital via VaultBridge, start earning, and compound automatically.

The whole process takes about 15‑30 minutes for users familiar with DeFi. Beginners may need extra time to understand the cross‑chain flow.

Pros, Cons, and Bottom Line

| Pros |

|

| Cons |

|

If you’re an institutional fund or a seasoned DeFi trader looking for stable, cross‑chain yields, Katana is worth a serious look. If you just want a simple spot‑exchange or a playground of many dApps, you’ll probably be happier elsewhere.

Future Roadmap & Outlook

Katana’s roadmap promises three major phases after the mainnet launch:

- Phase 2 (Q3 2024): Advanced cross‑chain swaps and deeper integration with Solana via Jito.

- Phase 3 (Q4 2024): Institutional custody solutions and on‑ramp fiat gateways.

- Phase 4 (2025): Expansion to additional ecosystems (Avalanche, Aptos) and launch of a governance portal.

Analysts at VanEck predict that specialized liquidity hubs like Katana could capture 5‑7 % of the cross‑chain DeFi market within two years, provided the platform can sustain its yield performance and navigate regulatory scrutiny.

Frequently Asked Questions

Is Katana a crypto exchange?

No. Katana does not offer a traditional spot‑trading order book. It is a DeFi‑focused layer‑2 blockchain that aggregates yield across multiple chains.

How does VaultBridge work?

VaultBridge takes assets deposited on Katana, bridges them to Ethereum’s Morpho lending pools, earns interest, and routes the returns back to Katana where they are automatically compounded.

What is Chain‑Owned Liquidity (CoL)?

CoL converts the fees collected by Katana’s sequencer into a reserve of liquidity. That reserve is then used to fund yield strategies, turning network activity into actual capital.

Can I use Katana with my existing wallet?

Yes. Katana supports any EVM‑compatible wallet such as MetaMask, Coinbase Wallet, or Trust Wallet. Simply connect, switch to the Katana network, and deposit.

What are the main risks when using Katana?

Key risks include Ethereum network congestion affecting fees, smart‑contract risk in the curated apps, regulatory uncertainty for institutional participants, and the still‑evolving tokenomics of the KAT token.

Bottom Line

Katana isn’t a crypto exchange; it’s a purpose‑built DeFi layer‑2 that aims to bring deep, cross‑chain liquidity to yield‑hungry investors. Its unique VaultBridge and CoL mechanisms set it apart from generic rollups, but the limited dApp ecosystem and regulatory gray area mean it’s best suited for those who already understand DeFi mechanics. Keep an eye on the upcoming custody integrations and expanded cross‑chain support-those could turn Katana from a niche yield tool into a broader DeFi infrastructure player.

BRIAN NDUNG'U

July 27, 2025 AT 23:01Esteemed community, the emergence of Katana underscores a pivotal shift toward specialized DeFi infrastructure. Its capacity to aggregate cross‑chain yields positions it as a compelling instrument for sophisticated capital allocation. By harnessing VaultBridge and Chain‑Owned Liquidity, investors may achieve more efficient asset utilization. Accordingly, it is prudent to evaluate Katana within a broader portfolio diversification strategy. I encourage diligent scrutiny and measured participation.

Donnie Bolena

August 7, 2025 AT 03:49Wow!!! Katana looks like a game‑changer!!! The cross‑chain yield engine could boost returns dramatically!!! If you’re ready to explore deeper liquidity, this platform might just be your next big win!!! Keep an eye on the roadmap, because the upcoming Phase 3 features sound absolutely thrilling!!!

Elizabeth Chatwood

August 17, 2025 AT 08:37i think katana offers a solid way to put your crypto to work its like a built‑in yield farm but with less hassle just give it a shot and see how it fits your game plan

Tom Grimes

August 27, 2025 AT 13:25Reading about Katana makes me feel both excited and a little nervous, because the promises of steady yields can sound almost too good to be true. I see the VaultBridge as a clever bridge, but I also worry about what happens when the Ethereum network congests and fees spike. It seems the platform is trying to protect investors by converting sequencer fees into liquidity, yet I wonder how much of that liquidity is truly liquid. The product’s “productive TVL” metric sounds useful, but I can’t help but think about hidden risks lurking beneath the surface. The fact that institutional backing is involved adds credibility, but also raises questions about how much control large players will have. I imagine a scenario where a sudden market crash could trigger massive withdrawals, testing the CoL mechanism. If the fees are turned into reserves, will they be enough to cover sudden redemptions? The cross‑chain aspect is appealing, especially the ability to tap into Solana and other ecosystems without manual bridging. However, each additional chain introduces its own smart‑contract vulnerabilities, and I find myself pondering the cumulative exposure. The roadmap mentions integrating fiat on‑ramps, which could attract more users, but also brings regulatory scrutiny that may affect the whole ecosystem. The platform’s limited dApp suite makes me think about user experience; will the lack of diversity turn off casual users? For seasoned traders, the deep liquidity is a boon, yet the learning curve may deter newcomers who could bring fresh capital. I have mixed feelings about the tokenomics of KAT, as the distribution details are still vague, and that uncertainty can affect long‑term confidence. In the end, Katana presents an innovative approach that could reshape DeFi yield strategies, but like any emerging system, it carries a bundle of risks that merit careful consideration. Ultimately, I would advise anyone interested to start small, monitor performance closely, and remain vigilant about both technical and regulatory developments. Staying updated with community discussions will be key to navigating its evolution.

Paul Barnes

September 6, 2025 AT 18:13One could argue that Katana's focus on deep liquidity is merely a veneer for centralizing yield control; yet, decentralization thrives on such specialization.

John Lee

September 16, 2025 AT 23:01Katana’s approach reminds me of a finely tuned orchestra, where each instrument-VaultBridge, CoL, and the core dApps-plays in harmony to amplify returns. The cross‑chain symphony can resonate with traders seeking diversified exposure without the hassle of juggling multiple wallets. I appreciate the platform’s transparency on productive TVL, which feels like a spotlight on the real performance. Let’s keep the conversation flowing and share experiences as the ecosystem matures.

Jireh Edemeka

September 27, 2025 AT 03:49Oh, absolutely, because we all know that converting sequencer fees into liquidity magically solves every risk-just ignore the fact that those fees can evaporate during a network slowdown. Your optimism is commendable, but perhaps a dash of realism would serve the community better.

del allen

October 7, 2025 AT 08:37i totally feel u 😅 katana seems slick but i might need more tutorials to get the hang of vaultbridge lol

Jon Miller

October 17, 2025 AT 13:25Hold the phone! Katana might just rewrite the rulebook on DeFi yields-imagine the fireworks when the next phase drops! This could be the blockbuster we’ve all been waiting for!!!

Rebecca Kurz

October 27, 2025 AT 17:13Katana sounds promising; however, regulatory clouds loom large!!!

Nikhil Chakravarthi Darapu

November 6, 2025 AT 22:01India’s crypto community should watch Katana closely, as its cross‑chain innovations could inspire similar home‑grown solutions that bolster our national digital economy.