Bitcoin Mining Profitability Calculator

This calculator helps miners understand if their operation remains profitable after the Bitcoin halving. Based on your electricity costs, hash rate, and Bitcoin price, you'll see estimated daily revenue, costs, and whether you're making a profit.

Your Mining Setup

Halving Impact

When the Bitcoin halving is a protocol‑level event that cuts the block reward by 50% every 210000 blocks (roughly four years). At the same time, cryptocurrency miners are the machines and teams that keep the Bitcoin network running, earning new coins for each block they solve. If you’ve ever wondered why mining rigs sometimes go quiet after a halving, this guide breaks down the math, the energy bill, and the strategic moves miners make to survive.

What the Halving Actually Does

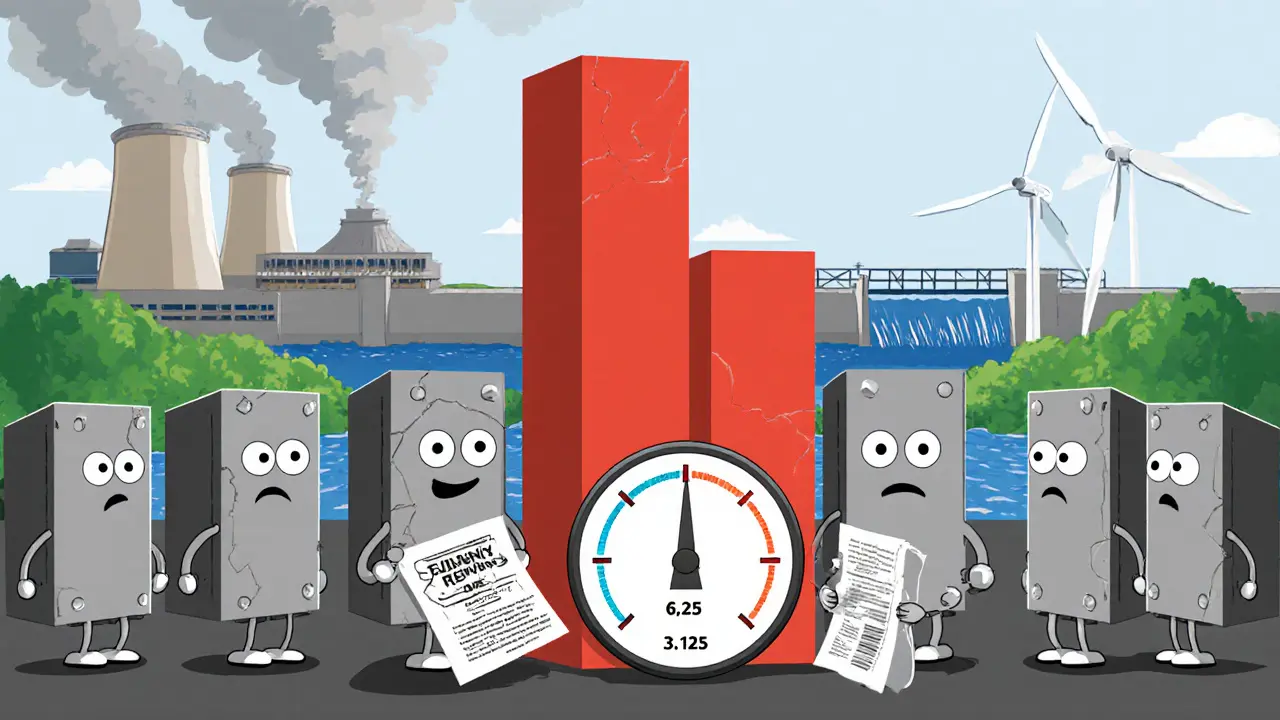

In plain English, the halving slashes the block reward is a set amount of Bitcoin paid to the miner who finds the next block. Before the April2024 event, that reward was 6.25BTC; after the cut it became 3.125BTC. The reward accounts for about 98% of miner revenue in a typical market, so the shock is immediate.

Why does the protocol do this? It’s a built‑in scarcity mechanism that caps Bitcoin at 21million coins. By slowing supply, the network hopes to let price rise over the long term, offsetting the lower payout.

Immediate Revenue Shock: Numbers That Matter

Right after the April2024 halving, big operations reported production drops of 20‑30% month over month. For example, Bitdeer fell 31%, Marathon Digital 28%, and Iris Energy 25% (WisdomTree, July2024). Those percentages line up perfectly with the 50% reward cut-miners simply earned half as many Bitcoins for the same work.

But revenue isn’t only about coins. Transaction fees are the extra satoshis users attach to get their transactions confirmed faster. In early2024 they made up under 5% of total miner income, meaning the bulk of cash flow still came from the block reward.

If the Bitcoin price stays flat, the lower reward forces many miners into the red. The key question becomes: can fees or other income sources fill the gap?

Hash Rate and Network Security

The hash rate is the total computational power securing the network. A sudden drop in miner profitability can lead to a hash‑rate dip of 15‑30% as high‑cost operations shut down (Fidelity Digital Assets, 2024). Lower hash rate means fewer machines defending against a 51% attack, which is why analysts watch post‑halving hash‑rate trends closely.

By July2024 the global hash rate recovered to 675EH/s, or about 92% of its pre‑halving peak, thanks to the surviving firms scaling up. Still, a permanently reduced hash rate could make the network more vulnerable if Bitcoin price stays below $40k for an extended period.

Electricity Cost: The Real Survival Factor

Energy is the biggest expense for miners. Studies show that operations paying less than $0.04/kWh stay profitable even if Bitcoin hovers around $35k, while those at $0.08/kWh need prices above $50k to break even (EY, 2024). After the halving, many miners rushed to renegotiate power contracts or move to cheaper sources.

Real‑world stories highlight the contrast. One Reddit user, “MiningGuru87,” shut down 40% of his Antminer S19j Pro fleet when his electricity bill jumped above $0.07/kWh, saying his break‑even price jumped from $28k to $49k overnight. Meanwhile, “HashRateHero” shifted to stranded natural‑gas sites in Texas, cutting electricity to $0.015/kWh and staying afloat.

Renewable energy isn’t just green; it’s cheap. Hydroelectric power in places like British Columbia can sit at $0.02‑$0.03/kWh, giving those miners a huge edge. Companies that pair mining with renewable projects are increasingly the ones that survive halving cycles.

Strategic Responses: Consolidation and Technology Upgrades

Faced with tighter margins, the industry has been consolidating. In the six months after the April2024 halving, 12 major mining firms closed over $1.2billion in mergers and acquisitions (WisdomTree, 2024). Larger pools like F2Pool and Foundry USA released “halving survival guides” that walk operators through cost‑cutting tricks, from co‑locating with data centers to re‑using waste heat.

Technology also matters. Immersion cooling, which submerges hardware in a non‑conductive fluid, can boost efficiency by 18% (Iris Energy Q22024 report). The average lifespan of mining rigs fell from 24months to 14months post‑halving, pushing miners to refresh hardware faster.

Some firms are diversifying beyond pure Bitcoin mining. About 22% of big players are now allocating excess hash power to AI compute or cloud services, turning idle capacity into revenue streams.

Long‑Term Outlook: Fees, Energy and the Next Halving

As block rewards keep shrinking-next halving is expected in August2028, dropping to 1.5625BTC per block-transaction fees will have to take a larger slice of miner income. Models suggest fees need to reach ~35% of total revenue to keep the network secure if Bitcoin price stays modest (Blockstream, 2024).

Fortunately, fee revenue is already climbing. The rise of BRC‑20 tokens boosted fees by 37% month‑over‑month in May2024, lifting their contribution to miner revenue from 3.2% to 6.8% (mempool.space analysis).

Energy consumption per Bitcoin transaction has also fallen dramatically, from 1,544kWh in 2021 to 782kWh in mid‑2024, thanks to more efficient ASICs and the push for greener power sources.

In short, each halving forces the ecosystem to become leaner, greener, and more fee‑reliant. That’s a challenge, but also a catalyst for innovation.

Practical Tips for Miners Heading into a Halving

- Build a six‑month cash reserve in stablecoins or fiat to survive the price dip.

- Audit your electricity cost and renegotiate contracts before the halving hits.

- Consider relocating to regions with cheap renewable energy-hydro or stranded gas are top choices.

- Invest in immersion cooling or direct‑current (DC) power setups to cut conversion losses by up to 12%.

- Explore secondary revenue streams: AI compute, cloud services, or selling excess heat back to nearby facilities.

- Stay agile with hardware upgrades; a 14‑month refresh cycle is becoming the norm.

- Monitor transaction fee trends; a spike in mempool activity can offset a reward cut.

Quick Takeaways

- The halving cuts block rewards in half, instantly lowering miner cash flow.

- Hash‑rate usually dips 15‑30% after a halving, affecting network security.

- Electricity cost is the single biggest lever for profitability.

- Consolidation and tech upgrades (immersion cooling, DC power) are the main survival strategies.

- Future security will lean more on transaction fees and energy efficiency.

| Metric | Before Halving (Mar2024) | After Halving (Jul2024) |

|---|---|---|

| Block reward (BTC) | 6.25 | 3.125 |

| Average miner revenue share from rewards | ≈98% | ≈94% |

| Hash rate (EH/s) | 735 | 675 |

| Top‑10 pool share | 58% | 65% |

| Average electricity cost (USD/kWh) | $0.05 | $0.045 (after renegotiations) |

Frequently Asked Questions

What exactly does a Bitcoin halving do?

A halving automatically cuts the block reward that miners receive for solving a block in half. It happens every 210000 blocks (about four years) and is built into Bitcoin’s code to limit total supply to 21million coins.

Why do some miners shut down after a halving?

When the reward drops 50%, the income from each rig falls dramatically. If a miner’s electricity cost is high, the operation can become unprofitable overnight, forcing shutdowns to avoid losses.

How important are transaction fees after a halving?

Fees are still a small slice of revenue (under 5% in early 2024) but they act as a cushion. If Bitcoin price stays flat, a rise in fee volume can help offset the lower block reward.

What energy sources give miners the best chance to survive?

Cheap, stable power-hydroelectric, stranded natural gas, or dedicated renewable projects-keeps the cost per kilowatt‑hour below $0.04, which is the sweet spot for profitability at current Bitcoin prices.

Will the next halving be even more disruptive?

The next halving in 2028 will drop the reward to 1.5625BTC. Because the reward share will be even smaller, miners will rely heavily on fees and ultra‑efficient hardware. Companies that have already diversified their revenue streams will feel the impact the least.

Shikhar Shukla

September 21, 2025 AT 13:07While the exposition on halving mechanics is comprehensive, the analysis underestimates the resilience of miners who have diversified revenue streams beyond block rewards. It would be prudent to acknowledge that many operations already incorporate ancillary services such as AI compute, which mitigates abrupt profit declines. Moreover, the emphasis on electricity cost overlooks the strategic value of location-based subsidies that can offset higher tariffs. A more balanced perspective would consider both cost reduction and revenue diversification. The discussion would benefit from referencing real-world case studies that illustrate successful adaptation post-halving.

Deepak Kumar

October 1, 2025 AT 22:43Great rundown! If you're still in the game, lock in a six‑month cash reserve right now-trust me, it’ll be the difference between staying afloat and pulling the plug. Keep an eye on your power contracts; renegotiating before the next dip can shave off hundreds of dollars per month. Also, consider moving to a region with cheap renewable energy-hydro in BC or stranded gas in Texas are gold mines for miners. Upgrade to immersion cooling if you haven’t yet; the efficiency gains are real and can push you back into profit faster than you think. Stay aggressive, stay adaptable, and you’ll ride out any halving lull.

Matthew Theuma

October 12, 2025 AT 11:05That’s solid advice, and it’s worth noting that a miner’s break‑even point is a moving target; even a 5% shift in electricity rates can tilt the scales. 🌐 The interplay between fee volume and hash‑rate stability will become more pronounced as rewards shrink. Keep your hardware fresh-older ASICs waste power and erode margins faster than you expect. 📈

Carolyn Pritchett

October 22, 2025 AT 17:55Oh please, another “expert” telling us to hoard cash like it’s 2008. If you’re that scared of a 50% reward cut, maybe mining isn’t for you. Most big players have already survived three halvings without pretending to be broke. Stop whining and start innovating, or just quit whining about fees.

Jason Zila

November 2, 2025 AT 02:31One angle many overlook is the operational flexibility that comes from modular power agreements. Instead of locking into decade‑long contracts, negotiate short‑term, volume‑based rates that can be scaled up or down as hash‑rate fluctuates. This also opens the door for demand‑response programs where miners get paid to reduce load during peak grid times, effectively turning electricity costs into a revenue stream. Pair that with strategic hardware refresh cycles-aim for a 12‑ to 14‑month turnover-to stay ahead of the efficiency curve. The net effect is a more resilient operation that can withstand multiple halving events without blood‑letting.

Cecilia Cecilia

November 12, 2025 AT 12:07Smart points on contracts. Also keep an eye on regional subsidies, they can tip the break‑even price by a few thousand dollars.

lida norman

November 22, 2025 AT 21:43💥Halving got me like 😱💸

Miguel Terán

December 3, 2025 AT 07:19Looking at the broader picture, the cultural shift toward sustainable mining is not just a buzzword; it’s becoming a competitive advantage. Countries that incentivize green energy are effectively offering lower operational costs, and miners savvy enough to relocate can capture that margin. For instance, the recent policy changes in the Andean region provide tax breaks for facilities powered by hydroelectricity, creating a sweet spot for operations targeting sub‑$0.03/kWh electricity. Moreover, immersion cooling, though initially pricey, reduces the need for ancillary cooling infrastructure and can improve ASIC lifespan, ultimately lowering total cost of ownership. When you layer these strategic moves-geo‑arbitrage, green incentives, and advanced cooling-you create a multi‑pronged defense against the reward contraction that halving imposes. It’s not just about surviving; it’s about thriving under tighter economic constraints.

Shivani Chauhan

December 13, 2025 AT 16:55Interesting breakdown! I’m curious about the exact fee thresholds that would make a marginal operation viable. From my experience, keeping the electricity cost below $0.04/kWh is crucial, but the real kicker is the ability to pivot to secondary revenue streams like AI compute. It’s also helpful to run a sensitivity analysis on price versus fee volume-see where the break‑even line actually sits. This kind of proactive planning can make the difference between a temporary dip and a permanent shutdown.

Deborah de Beurs

December 24, 2025 AT 02:31Seriously, you’re still talking about “sensitivity analysis” like it’s some exotic research project? Most miners just look at the electric bill and decide fast. If you can’t keep your numbers straight, you don’t belong in this game. Stop over‑complicating and get to the point-cheaper power or you’re out.

Sara Stewart

January 3, 2026 AT 12:07Solid points on diversification! Leveraging hash‑power for cloud services really does add a buffer, especially when block rewards thin out. I’d also suggest monitoring mempool congestion; a sudden spike in fee‑rich transactions can temporarily boost margins. Keep those upgrades coming, and the network stays secure.

Laura Hoch

January 13, 2026 AT 21:43The halving really forces a philosophical shift in how we view mining, doesn’t it? When rewards shrink, we’re reminded that the network’s security hinges not just on raw computational power but on the collective will of participants to sustain it. This is why the interplay between transaction fees and hash‑rate becomes a moral contract of sorts-miners are the custodians, and they must adapt or risk compromising the very system they support. Consider, for a moment, the long‑term implications of a fee‑driven security model. If fees rise to fill the revenue gap, we may see an influx of profit‑driven actors whose primary incentive is short‑term gain, potentially destabilizing the equilibrium. On the other hand, a disciplined focus on energy efficiency-through immersion cooling or renewable sourcing-creates a virtuous cycle where lower operating costs empower miners to endure lower rewards without resorting to aggressive fee extraction. This balance is delicate; it requires both technological innovation and strategic foresight. Moreover, the social dimension cannot be ignored. Communities that depend on mining for economic activity must be engaged, ensuring that the transition to greener energy sources does not disenfranchise them. By investing in local renewable projects, miners can secure a stable power supply while fostering goodwill. Such partnerships also mitigate the risk of regulatory backlash, which often stems from environmental concerns. In essence, the halving is less a crisis and more a catalyst for evolution. It pushes the industry toward sustainability, both ecologically and economically. Those who embrace this evolution will find themselves not only surviving but thriving in the next epoch of Bitcoin’s life. The lesson is clear: adaptability, efficiency, and community engagement are the new pillars of mining resilience.

Devi Jaga

January 24, 2026 AT 07:19Oh wow, another “must‑read guide” that just rehashes the same old hype. As if we needed a reminder that electricity bills hurt. Maybe next time write something that actually surprises us.

Hailey M.

February 3, 2026 AT 16:55Haha, love the sarcasm! 🙄 Still, it’s funny how the same old drill repeats each halving-your power bill goes up, you scramble for cheap juice, and you hope fees save the day. 🤦♀️ But seriously, those dramatic cost swings are no joke; they make us feel like we’re on a roller coaster without a seatbelt.