When a single crypto exchange could face a $34 billion fine, you know the rules have changed. That’s not a typo. It’s not hyperbole. In early 2025, South Korea’s Financial Services Commission threatened Upbit-the country’s largest cryptocurrency exchange-with penalties that could have wiped out its entire value. The reason? Over half a million failed Know Your Customer checks. Not fraud. Not hacking. Just sloppy paperwork.

What Exactly Went Wrong?

Upbit, launched in 2017 by Dunamu, handles over $8 billion in trades every single day. It’s not some tiny startup. It’s the sixth-largest crypto exchange in the world. But size didn’t protect it. In late 2024, regulators dug into its customer verification records during a routine license renewal review. What they found was shocking: between 500,000 and 700,000 customer profiles had blurry, incomplete, or fake ID photos. Some were just screenshots. Others had faces cropped out. A few even had photos of pets. Under South Korea’s Special Financial Transactions Act, every user must be properly identified. That’s not optional. It’s the backbone of anti-money laundering rules. If you can’t prove who someone is, you can’t stop criminals from moving dirty money through your platform. Upbit’s system wasn’t just outdated-it was broken. And regulators didn’t just see a technical glitch. They saw a pattern of negligence. To make it worse, Upbit was also trading with unregistered overseas exchanges. That’s like running a bank that lets customers deposit cash from unknown ATMs in other countries. No oversight. No traceability. No accountability.How Did They Calculate a $34 Billion Fine?

The math behind the $34 billion figure sounds insane, but it’s legally valid. South Korean law allows fines of up to 100 million Korean won (about $68,500) per KYC violation. Multiply that by 500,000 violations? That’s $34.25 billion. It’s not a cap. It’s a ceiling. And regulators had the legal right to hit it. But here’s the catch: no one actually expected them to. Experts called it a “theoretical maximum”-a legal scare tactic. The real goal wasn’t to bankrupt Upbit. It was to send a message: no one is too big to fail compliance. Think of it like a speeding ticket. The law says you can be fined $10,000 for going 10 mph over the limit. But if you’re driving a Tesla and you’ve done it 500,000 times, the judge doesn’t hand you a $5 billion bill. They give you a $50,000 fine, community service, and a warning: “Don’t do this again.” That’s what happened here.What Did Upbit Actually Get Punished For?

On January 21, 2025, the Financial Services Commission announced its final decision. Upbit wasn’t shut down. But it wasn’t let off easy. - The exchange was ordered to stop accepting new deposits and withdrawals for three months. Existing users could still trade, but no new money could come in or out. That’s a brutal blow for a platform built on liquidity. - Upbit had to freeze new user registrations for six months. No onboarding. No marketing. No growth. - The company was forced to hire an independent compliance auditor to review its entire KYC system. They had to submit weekly progress reports. - Dunamu, Upbit’s parent company, was required to restructure its compliance team. Former managers were replaced. New hires had to have direct experience with financial regulations. The actual fine? Around $120 million. Still the largest ever for a crypto exchange in Asia. But it was less than 0.4% of the original threat. The real punishment wasn’t the money. It was the loss of trust.

Why This Matters Beyond Korea

This wasn’t just a Korean problem. It was a global wake-up call. Crypto exchanges in the U.S., Europe, and Asia started scrambling. Binance, Kraken, Coinbase-they all pulled internal audits. Compliance teams worked overtime. Some even hired former regulators as consultants. Why? Because Upbit proved that regulators don’t care if you’re the biggest player. If your KYC system is weak, you’re a target. And South Korea wasn’t bluffing. They had already set up a specialized crypto crime unit. In February 2025, they arrested a fraudster linked to a $48 million crypto scam. That wasn’t random. It was part of a broader crackdown. Countries watching this case realized: if you want to operate legally in a major market, you need real compliance-not just a checkbox on a form. The days of “we didn’t know” are over. Regulators now expect exchanges to have automated systems that flag bad IDs in real time. They want AI that detects fake documents. They want blockchain analytics tools that trace suspicious transactions.How Upbit Fixed It

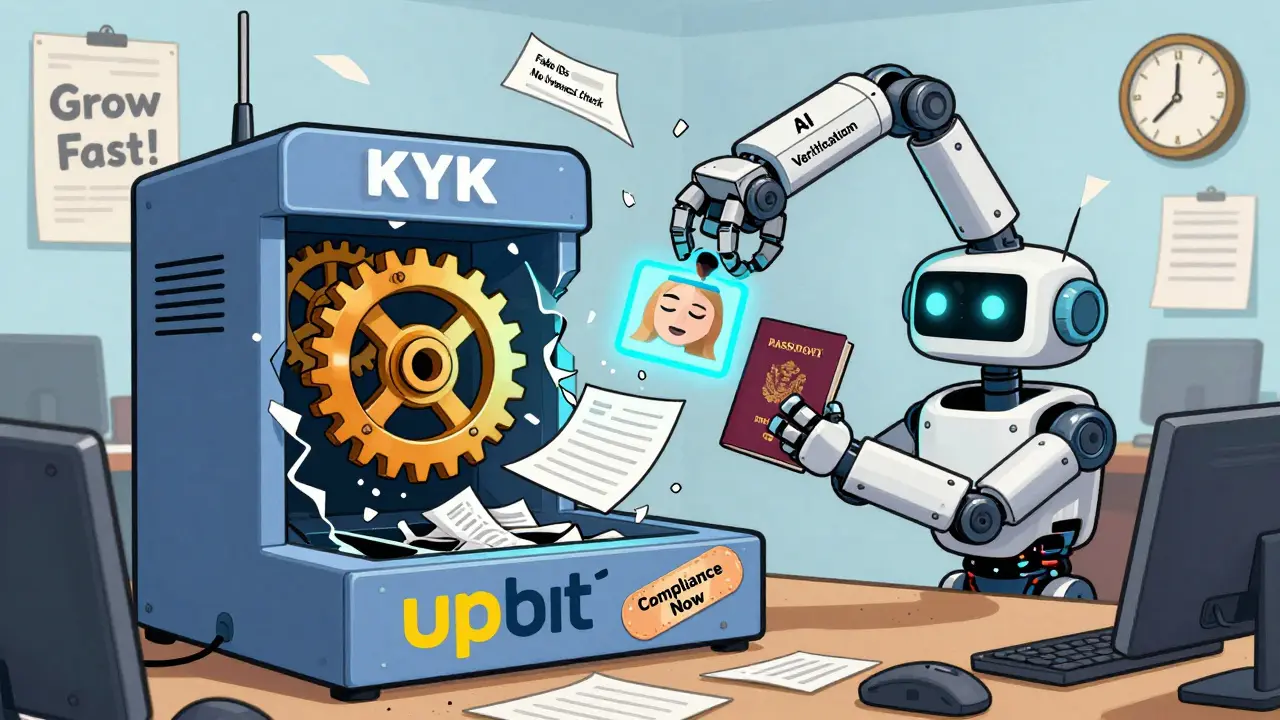

Upbit didn’t just pay the fine. They rebuilt. They replaced their old ID verification system with a new one built on AI-powered facial recognition and liveness detection. Now, when someone signs up, the system checks: - Is the ID real? (Uses government databases to validate authenticity) - Is the person in the photo actually there? (Uses blinking and head movement checks) - Is the photo tampered with? (Detects Photoshop, copy-paste, or AI-generated faces) They also built a real-time monitoring system that flags transactions linked to unregistered foreign exchanges. If money flows from a known risky wallet, the system freezes it and alerts compliance. They even started publishing quarterly compliance reports. Transparency became part of their brand. By October 2025, regulators lifted the restrictions. But Upbit’s user growth stayed flat for six months. People didn’t trust them anymore. And that’s the real cost.

The Bigger Picture: Regulation Is Here to Stay

Before Upbit, many crypto companies thought regulation was optional. They believed they could grow fast, then deal with rules later. Upbit proved that’s a fatal mistake. South Korea didn’t ban crypto. They didn’t crush innovation. They said: you can operate, but you must play by the rules. And those rules are now clear: KYC isn’t a formality. It’s the foundation. Other countries are following suit. Japan, Singapore, and the EU have all raised their standards. The U.S. is tightening rules too. The era of crypto’s Wild West is over. The frontier is now guarded by auditors, AI, and legal teams. For exchanges, the lesson is simple: compliance isn’t a cost center. It’s your license to operate. Skip it, and you risk losing everything-even if you’re the biggest name in the game.What This Means for You

If you’re a trader: know your exchange. Check if they’ve published recent compliance reports. Look for signs they use real ID verification-not just a photo upload. If you’re building a crypto product: don’t wait for regulators to come knocking. Build compliance into your product from day one. Use tools like Jumio, Onfido, or Sumsub. They’re not cheap, but they’re cheaper than a $120 million fine. If you’re an investor: don’t just look at trading volume. Look at the audit reports. Look at the team. Look at how they handle KYC. The companies that survive the next five years won’t be the ones with the flashiest apps. They’ll be the ones with the cleanest records.Why the $34 Billion Number Still Matters

The actual fine was $120 million. But the $34 billion threat? That’s what changed everything. It showed the world that regulators have the power to destroy even the biggest players. It forced exchanges to stop treating compliance as a legal afterthought. It made investors think twice before backing unregulated platforms. Upbit didn’t lose money because of a hack. They didn’t lose trust because of a scam. They lost it because they ignored the basics. And that’s the most dangerous risk of all. The crypto industry won’t die because of regulation. It will die because it refuses to grow up. Upbit’s case wasn’t a punishment. It was a lesson. And the world is still paying attention.Why was Upbit fined so heavily?

Upbit was fined for failing to verify the identities of hundreds of thousands of users, violating South Korea’s Know Your Customer (KYC) laws. Regulators found over 500,000 cases where ID documents were blurry, fake, or incomplete. Under local law, each violation could carry a fine of up to $68,500, leading to a theoretical maximum of $34 billion. The actual fine was $120 million, but the threat alone forced sweeping changes.

Did Upbit shut down?

No, Upbit didn’t shut down. But it was forced to stop accepting new deposits and withdrawals for three months and freeze new user registrations for six months. Existing users could still trade, but growth stopped. The exchange had to overhaul its compliance system and submit to ongoing audits before restrictions were lifted in late 2025.

Is this penalty unique to South Korea?

The scale of the penalty was unique, but the reasons weren’t. South Korea has some of the strictest crypto regulations in the world, especially around KYC. Other countries like Japan, the EU, and the U.S. are now moving toward similar standards. Upbit’s case set a global benchmark for how seriously regulators will treat compliance failures.

How did Upbit fix its KYC problems?

Upbit replaced its outdated system with AI-powered verification tools that check ID authenticity, detect fake photos, and confirm the user is physically present using liveness detection. They also built real-time monitoring to block transactions with unregistered overseas exchanges. They hired compliance experts, restructured their team, and began publishing public reports on their progress.

What does this mean for other crypto exchanges?

It means compliance is no longer optional. Exchanges worldwide started auditing their KYC systems after Upbit’s case. Many upgraded to automated verification tools, hired compliance officers, and stopped working with unregistered partners. The message was clear: even the biggest platforms aren’t immune. If your system is weak, you’re a target.

Can a crypto exchange survive a major fine?

Yes, but only if they change. Upbit survived because it admitted its mistakes and rebuilt properly. Many smaller exchanges that tried to hide violations or delay fixes have since shut down. The ones that survive now treat compliance as a core business function-not a legal burden. Trust is harder to rebuild than money.

Alison Fenske

December 22, 2025 AT 14:01Can we just take a second to appreciate how wild it is that a company could get fined more than the GDP of some small countries just for bad paperwork? I mean, pets in ID photos?? 😅

It’s like someone tried to game the system using MS Paint and a cat meme.

But honestly? The real win here is that regulators didn’t just slap a wrist-they made the whole industry sit up and smell the compliance coffee.

Upbit didn’t get crushed. They got upgraded.

And honestly? That’s the future of crypto.

No more flying under the radar.

Either you play by the rules or you get left behind.

And I’m here for it.

Tyler Porter

December 23, 2025 AT 07:46Wow. Just wow. This is such a clear example of why you can’t cut corners.

People think crypto is all about speed and growth, but no-

trust is everything.

And if your KYC is broken, you don’t have trust.

Upbit got lucky they didn’t get shut down.

They fixed it.

And now they’re stronger.

Lesson learned.

Don’t skip the boring stuff.

It’s the foundation.

Period.

Luke Steven

December 25, 2025 AT 06:09It’s funny how we treat compliance like a chore, but it’s really the only thing keeping this whole house from collapsing.

Upbit didn’t fail because they were evil.

They failed because they thought scale meant immunity.

But laws don’t care about your user count.

They care about whether you can prove who someone is.

That’s not regulation.

That’s basic human responsibility.

And if we keep pretending crypto exists outside of society, we’re not building a future.

We’re building a ghost town.

AI verification? Real-time monitoring?

That’s not innovation.

That’s just catching up to 2015.

And honestly?

It’s about time.

🙂

Ellen Sales

December 25, 2025 AT 13:08so like... upbit got fined for letting people use their dog as id? lmao

but also??

the fact that they didn’t just get erased from existence??

kinda makes me respect them??

like... yeah you messed up.

but you fixed it.

and now you’re publishing reports??

who even are you??

the crypto version of a reformed addict who started a support group??

idk i’m lowkey impressed.

also why is everyone so shocked??

we all knew this was coming.

the wild west is over.

now it’s just... the well-lit library with a 24/7 security guard.

and honestly?

it’s kinda hot.

Vijay n

December 26, 2025 AT 07:29There is no such thing as a $34 billion fine. This is a psyop by western intelligence agencies to destabilize Asian crypto markets.

South Korea is a puppet state.

They do not have the authority to impose such penalties.

Upbit is a victim of global financial warfare.

The real criminals are the regulators who want to control every transaction.

They fear decentralized systems.

They fear freedom.

They fear anonymity.

And so they invent fake laws to crush innovation.

Do not be fooled.

This is not about compliance.

This is about control.

And they will come for you next.

They already have your data.

They are watching.

They are always watching.

Earlene Dollie

December 28, 2025 AT 07:08okay but imagine being the intern who uploaded the pet photo.

just... one day you’re making coffee.

next day you’re the reason your company almost got erased from the map.

did they give you a gold star?

did they give you a raise?

did they at least send you to therapy?

no.

they just fired you and put up a press release.

and now the whole world knows you used a cat as an ID.

the trauma.

the shame.

the cat will never forgive you.

and neither will your future self.

rest in peace, innocent intern.

you were the real MVP of this mess.

Dusty Rogers

December 29, 2025 AT 03:00People act like $120 million is nothing.

It’s not.

That’s enough to buy a small island.

Or fund a hundred startups.

Or pay a thousand employees for five years.

That’s not a fine.

That’s a reset.

And Upbit didn’t just pay it.

They rebuilt their entire culture.

That’s what matters.

Money comes and goes.

Trust? That’s the only thing you can’t buy back.

They lost it.

And they earned it back.

That’s real growth.

Kevin Karpiak

December 30, 2025 AT 13:57South Korea has no right to punish a global platform.

They are a small country with outdated laws.

This is protectionism disguised as regulation.

Upbit serves millions worldwide.

Why should they answer to Seoul’s bureaucracy?

Let them operate freely.

Regulation is censorship.

Compliance is surrender.

Crypto is freedom.

And freedom doesn’t need ID photos.

Let the market decide.

Not bureaucrats.

Amit Kumar

January 1, 2026 AT 04:29Let me tell you something about KYC in India-we’ve been doing this for years.

Every bank, every fintech, every wallet requires biometrics, Aadhaar, video liveness checks.

It’s not optional.

It’s not a burden.

It’s the price of doing business in the modern world.

Upbit? They were late.

Not because they were evil.

Because they thought they were special.

They weren’t.

And now they’re better.

Good.

Because if you’re building something global?

You don’t pick and choose which laws to follow.

You follow them all.

Or you don’t play.

chris yusunas

January 1, 2026 AT 04:52you know what’s wild?

the fact that people still think crypto is about getting rich quick.

but the real winners?

the ones who build systems that last.

upbit didn’t get rich from trading volume.

they got respected from fixing their mess.

that’s the quiet power move.

no hype.

no airdrops.

just cleaning up your backyard.

and now people trust them again.

that’s the real crypto win.

not mooning.

not memes.

just doing the damn work.

Mmathapelo Ndlovu

January 2, 2026 AT 02:09It’s like watching someone finally clean their room after years of ignoring it.

It’s messy.

It’s painful.

It takes forever.

And you’re like… why didn’t you just do this sooner?

But then… you walk in.

And it’s actually nice.

There’s light.

There’s space.

There’s peace.

Upbit didn’t just fix KYC.

They fixed their soul.

And honestly?

That’s more valuable than any coin.

💛

Jordan Renaud

January 2, 2026 AT 12:02It’s not about the money.

It’s about the message.

Regulators didn’t want to destroy Upbit.

They wanted to save the entire ecosystem.

Because if one giant falls because of lazy compliance?

Everyone loses.

Trust evaporates.

Investors flee.

Governments panic.

And suddenly, crypto gets banned everywhere.

Upbit got the warning shot.

So the rest of us didn’t have to get the cannonball.

Thank you, Upbit.

You took the hit so we could keep going.

roxanne nott

January 3, 2026 AT 04:17120 million? That’s a joke.

They should’ve been fined 500 million.

And shut down for a year.

And forced to publish every single transaction.

And make their CEO do a TED Talk apologizing.

And donate to crypto literacy nonprofits.

And hire 50 compliance officers from MIT.

And install blockchain monitors in every office.

And have their CEO live-stream KYC checks every Thursday.

Until then? This is just a slap.

And the industry still doesn’t get it.

Rachel McDonald

January 5, 2026 AT 00:08can we talk about how sad it is that the CEO probably cried in the shower after this?

like... imagine waking up one day and realizing your entire life’s work is built on a house of cards made of blurry selfies and pet photos.

you thought you were building the next big thing.

but you were just a glorified photo uploader.

and now your company is a cautionary tale.

and your employees are scared.

and your investors are gone.

and your dog? still in the ID database.

the trauma is real.

send help.

and also... i’m still mad about the cat.

Collin Crawford

January 6, 2026 AT 18:02Regulatory overreach. Pure and simple.

The $34 billion figure is mathematically absurd.

It is not a fine.

It is a threat.

And threats are not law.

Law is codified, transparent, and proportionate.

This was theatrical.

This was performative.

This was designed to instill fear.

And fear is not governance.

It is tyranny dressed in compliance clothing.

Upbit should have appealed.

They should have fought.

They surrendered.

And now the precedent is set.

Next time, it will be you.

Jayakanth Kesan

January 8, 2026 AT 06:39Honestly? I’m proud of Upbit.

They made a mistake.

Big one.

But they didn’t hide.

They didn’t blame the users.

They didn’t say ‘it’s the tech’s fault.’

They fixed it.

They got better.

And now they’re teaching others how to do it right.

That’s leadership.

Not perfect.

But real.

And in crypto?

That’s rarer than a legit airdrop.

Aaron Heaps

January 10, 2026 AT 06:27They got off easy.

120 million? For 500k violations?

That’s $240 per violation.

That’s cheaper than a Starbucks.

They should’ve been fined $1000 per violation.

That’s $500 billion.

Then maybe people would take KYC seriously.

As it stands?

This is a tax.

And the industry just paid it.

And now they’ll keep doing the same thing.

Because the penalty is still too low.

And greed always wins.

Until it doesn’t.

Tristan Bertles

January 11, 2026 AT 11:51Look.

Regulation isn’t the enemy.

Ignorance is.

Upbit didn’t fail because they were greedy.

They failed because they thought ‘good enough’ was enough.

But in finance?

Good enough is the same as broken.

And broken systems don’t just hurt users.

They hurt the whole industry.

They didn’t just fix their tech.

They fixed their mindset.

And that’s the real win.

Not the fine.

Not the audit.

But the change.

That’s what matters.