When you send a cryptocurrency transaction, it doesn’t instantly appear on the blockchain. Instead, it sits in a holding area called the mempool. This isn’t just a technical detail-it’s the heartbeat of any blockchain network. Without the mempool, transactions would either get lost or cause chaos. Every blockchain handles this space differently, and those differences shape everything from how fast your transaction confirms to how much you pay in fees.

What Exactly Is a Mempool?

The mempool is short for "memory pool." It’s a temporary storage space on each full node in a blockchain network where unconfirmed transactions wait before being added to a block. Think of it like a waiting room before a concert-everyone’s there, but only a limited number can enter at once.

Each node runs its own mempool, and they don’t always match. Some nodes might have a bigger mempool, others might drop low-fee transactions faster. There’s no single global mempool. Instead, it’s a decentralized, dynamic collection of pending transactions that nodes agree on through consensus.

Bitcoin introduced this concept in 2009, though it wasn’t called "mempool" in Satoshi’s whitepaper. Since then, every major blockchain has built its own version. But not all mempools are created equal. The way each network manages transactions inside it affects speed, cost, and even security.

Bitcoin’s Mempool: Simple, But High-Stakes

Bitcoin’s mempool is built on the UTXO (Unspent Transaction Output) model. Each transaction spends previous outputs and creates new ones. This makes Bitcoin transactions relatively simple to validate-no account balances to track, just inputs and outputs.

Transactions in Bitcoin’s mempool are sorted by fee rate: satoshis per byte. The higher the fee, the higher the priority. There’s no complex logic-just a straightforward auction. If you pay 50 satoshis per byte, you jump ahead of someone paying 10. This system is transparent, predictable, and easy to understand.

But simplicity comes with trade-offs. During peak times, like the 2023 Ordinals boom, the Bitcoin mempool ballooned to over 6 million transactions. Standard transactions with 2 sat/byte fees took over 72 hours to confirm. The block size limit (1MB) means only about 2,000-3,000 transactions can fit per block, and with blocks mining every 10 minutes, the backlog grows fast.

Bitcoin nodes typically allow up to 300MB of mempool space. Transactions older than 14 days are automatically removed. This keeps the mempool from getting clogged forever. But during congestion, users often resort to "child-pays-for-parent" (CPFP) transactions-paying extra on a follow-up transaction to incentivize miners to confirm the stuck one.

Ethereum’s Mempool: Fee Markets, Nonces, and Complexity

Ethereum’s mempool operates under an account-based model. Every address has a balance and a nonce-a counter that tracks how many transactions you’ve sent. This adds structure but also complexity.

After Ethereum’s EIP-1559 upgrade in August 2021, the fee structure changed dramatically. Instead of a single bid, transactions now have two parts: a base fee (burned) and a priority fee (paid to miners). The base fee adjusts automatically based on network demand, making fees more predictable. The priority fee lets users tip miners to jump ahead.

Ethereum’s mempool also allows transaction replacement. If you send a transaction with a low fee and it’s stuck, you can send a new one with the same nonce but a higher fee. The old one gets dropped. This gives users more control than Bitcoin’s "wait or CPFP" model.

But this complexity has downsides. During the 2021 NFT boom, Ethereum’s mempool hit 15 million pending transactions. Fees spiked from $1.42 to over $240. Many users lost money on failed NFT purchases because their transactions timed out. Even today, during high-traffic periods, transactions can take 10-30 minutes to confirm.

Ethereum nodes typically allocate 500MB for the mempool. Unlike Bitcoin, Ethereum doesn’t drop transactions based on age-it drops them based on fee competitiveness and nonce order. A transaction with a missing nonce (e.g., nonce 5 when you’ve sent 4) won’t even enter the mempool until the gap is filled.

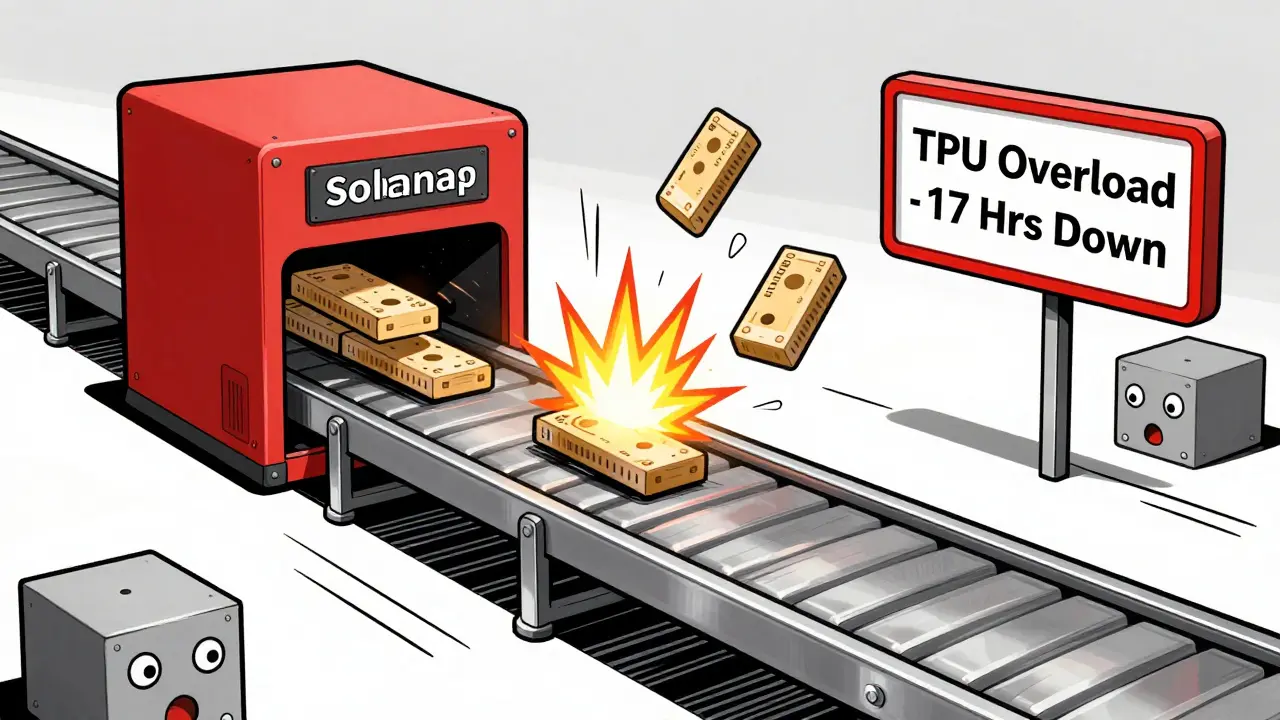

Solana: The Mempool That Doesn’t Exist (Almost)

Solana takes a radically different approach. It doesn’t have a traditional mempool. Instead, it uses a gossip-based system called the TPU (Transaction Processing Unit). Transactions are processed before they’re even grouped into blocks.

This design lets Solana handle up to 65,000 transactions per second. But it’s fragile. In September 2021, a network outage lasted 17 hours because the TPU couldn’t clear its backlog. No mempool meant no buffer-when traffic surged, the whole system stalled.

Solana’s lack of a mempool makes it fast under normal conditions, but risky under stress. There’s no way to prioritize transactions by fee. If your transaction gets dropped, you have to resend it. No replacement mechanics. No fee bidding. Just raw throughput-and no safety net.

BNB Chain and Polygon: Ethereum’s Faster Cousins

BNB Chain (formerly Binance Smart Chain) runs a modified version of Ethereum’s protocol. Its mempool is similar, but with one key difference: it prioritizes transactions from Binance exchange wallets. TRM Labs found that Binance-originating transactions confirmed 43% faster than others during Q3 2022. This isn’t a bug-it’s a feature. Binance wants its own trades to go through first.

Polygon, a Layer 2 solution built on Ethereum, uses Ethereum’s security but tweaks the mempool for speed. A 2023 ConsenSys audit showed 68% of Polygon transactions confirm within 2.3 seconds, compared to Ethereum’s 13.7-second average. How? Smaller block times (around 2 seconds), lower fees, and fewer users competing for space.

Both networks are popular for DeFi and NFTs because they offer Ethereum-like functionality without the congestion. But they inherit Ethereum’s fee structure quirks, just at a smaller scale.

Why Mempool Congestion Matters

When the mempool fills up, it’s not just about slow transactions. It’s about fairness, security, and usability.

High mempool congestion creates a "winner-takes-all" environment. Users with deep pockets pay high fees and get confirmed quickly. Others-especially those sending small amounts-get stuck. This creates a usability gap that excludes casual users.

It also opens the door to manipulation. Miners or validators can reorder transactions to extract value (known as MEV). During Ethereum’s peak congestion, some MEV bots made millions by front-running trades. The mempool is where these attacks begin.

And then there’s the security angle. Dr. Emin Gün Sirer called the mempool the "canary in the coal mine" for blockchain health. When it fills up, it’s a warning sign. If too many transactions pile up, it can trigger selfish mining, network delays, or even chain reorganizations.

What’s Next for Mempools?

Developers are already working on fixes. Ethereum’s upcoming EIP-4337 upgrade aims to decentralize the mempool by letting users submit transactions through smart contracts, reducing miner control over transaction order.

Bitcoin is testing BIP-118 (SIGHASH_NOINPUT), which would make transaction replacement safer and more efficient. This could reduce mempool bloat and help users fix stuck transactions without CPFP.

Some researchers are exploring sharded mempools-splitting the mempool across multiple chains to handle more transactions. Ethereum’s Layer 2 networks are already testing this.

By 2025, 72% of major blockchains are expected to use machine learning to predict confirmation times. Services like mempool.space and Blockchair already show real-time mempool data, helping users choose the right fee. This trend will only grow.

Real-World Impact: What Users Experience

On Reddit’s r/Bitcoin, users post daily about transactions stuck for 48+ hours. On Ethereum’s subreddit, "Why is my MetaMask transaction pending?" is a common thread. Trustpilot reviews for blockchain explorers show 43% of complaints are about not knowing when a transaction will confirm.

But there are success stories too. Coinbase’s 2023 survey found that 78% of users confirmed transactions within 10 minutes using their dynamic fee estimator. Advanced users who time their sends for off-peak hours (2-5 AM UTC) report 63% faster confirmations.

One major failure? The 2021 NFT boom. OpenSea saw 12% of transactions fail due to mempool timeouts. Users lost $2.3 million in lost opportunities. That’s not a glitch-it’s a mempool design flaw.

Final Thoughts: The Mempool Is the Backbone

The mempool might be invisible to most users, but it’s the most critical part of any blockchain. It’s where transactions live before becoming history. It’s where fees are set, where congestion is felt, and where the network’s health is measured.

Bitcoin’s mempool is simple and robust. Ethereum’s is powerful but complex. Solana’s is fast but brittle. BNB Chain and Polygon optimize for speed and bias. Each design reflects the values of its network: decentralization, scalability, fairness, or efficiency.

As blockchain adoption grows, the mempool will become even more important. If we want networks that work for millions-not just speculators-we need mempools that are predictable, fair, and resilient. The next big innovation in blockchain won’t be a new consensus algorithm. It’ll be a smarter way to hold transactions in line.

What happens if my transaction gets stuck in the mempool?

If your transaction is stuck, it’s usually because the fee was too low. On Bitcoin, you can use "child-pays-for-parent" (CPFP)-send a new transaction that spends the stuck one and includes a higher fee. On Ethereum, you can replace it by sending a new transaction with the same nonce but a higher gas price. If the mempool clears, your transaction will confirm automatically. Most wallets now offer fee-boosting tools to help with this.

Why do mempools fill up so quickly?

Mempools fill up when more transactions are sent than can fit in the next few blocks. Bitcoin’s 1MB block limit and 10-minute block time mean it can only process around 3,000 transactions per block. Ethereum’s variable block size helps, but high demand during NFT launches or DeFi events still overwhelms it. The mempool is a buffer, not a solution-it’s designed to absorb short-term spikes, not sustained overload.

Can I see the mempool myself?

Yes. Tools like mempool.space and Blockchair show real-time mempool data for Bitcoin and Ethereum. You can see how many transactions are pending, their fee rates, and estimated confirmation times. Bitcoin Core and Ethereum’s Geth clients also offer command-line tools like getrawmempool and eth_pendingTransactions for developers. These are essential for understanding network conditions before sending a transaction.

Do all blockchains have a mempool?

Almost all public blockchains do, but not all use the same model. Bitcoin, Ethereum, Solana, and BNB Chain all have mempool-like structures. However, enterprise blockchains like Hyperledger Fabric and R3 Corda often eliminate traditional mempools entirely, using permissioned transaction pools or notary services instead. These are designed for controlled environments where trust is assumed, not proven.

How do mempools affect transaction fees?

Mempool congestion directly drives fees up. When the mempool is full, users compete by bidding higher fees. Bitcoin uses a first-price auction-highest fee wins. Ethereum uses EIP-1559, which combines a base fee (burned) and a tip (to miners). During congestion, the base fee increases automatically, and users add tips to jump ahead. If you don’t adjust your fee, your transaction stays stuck. Tools like GasNow and MetaMask’s fee estimator help users set the right price.

Deeksha Sharma

February 8, 2026 AT 08:20