Crypto Insights from October 2025: Forks, Exchanges, Airdrops, and Regulations

When you're trying to make sense of crypto exchange, a platform where you buy, sell, or trade digital currencies, often with varying levels of security, regulation, and transparency. Also known as crypto trading platform, it's the gateway most people use to enter the blockchain world. in 2025, not all platforms are created equal. Some promise low fees but block withdrawals. Others hide behind vague terms and disappear after a few months. That’s why October 2025 on CyberVEG focused on cutting through the noise—examining real user experiences, not marketing claims. From KickEX’s unverified volume to KoinBay’s lack of regulation, we showed you which exchanges raise red flags and which might still be worth a second look.

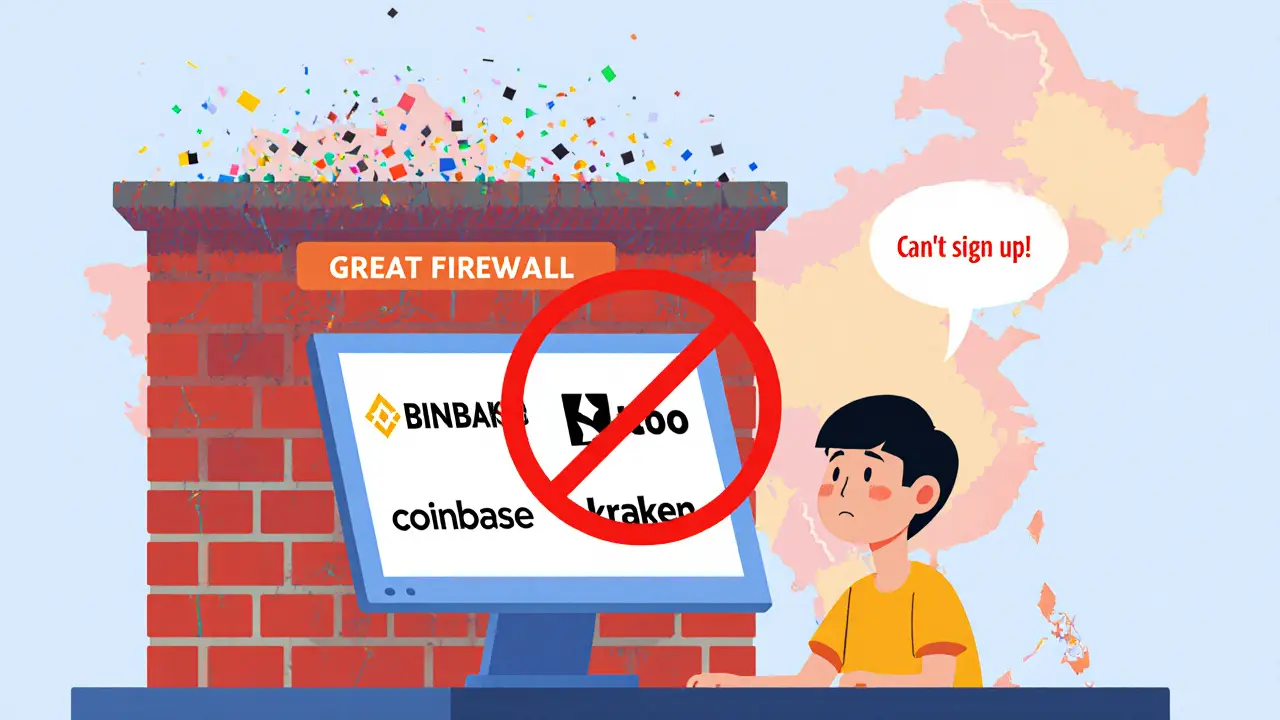

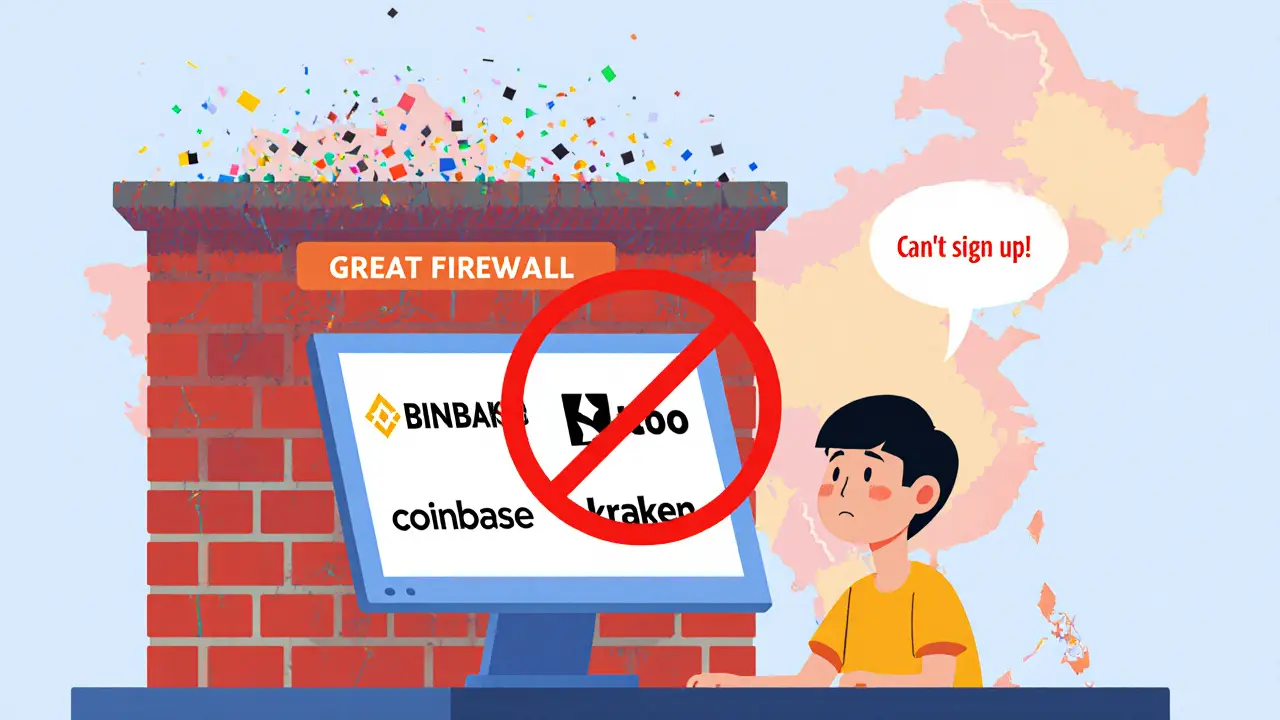

Behind every exchange is the network it runs on. That’s where hard fork, a permanent split in a blockchain that creates two separate chains, often due to major protocol changes. Also known as blockchain split, it can mean new coins in your wallet—or total loss if you’re not prepared. and soft fork, a backward-compatible upgrade that doesn’t split the chain, allowing older nodes to keep working. Also known as upgraded protocol, it’s how most blockchains evolve without chaos. matter. A hard fork isn’t just tech jargon—it’s what happened when Bitcoin Cash split off, and it’s what could happen again. In October, we broke down exactly how these changes affect your holdings, why some forks are safe and others are traps, and what you need to do before the next one hits. Meanwhile, governments worldwide are watching. The crypto regulation, government rules that require exchanges to track users, report transactions, and comply with anti-money-laundering laws. Also known as crypto compliance, it’s reshaping how you trade across borders. is tightening. The Travel Rule, OFAC sanctions, and MiCA rules mean your transactions are being logged—not just by exchanges, but by international agencies. Iranian traders turned to DEXs like Uniswap. Indians learned which platforms are FIU-registered. Germans checked BaFin licensing. This wasn’t theoretical—it was survival.

And then there’s the free money: crypto airdrop, a distribution of free tokens to wallet holders, often to grow a project’s user base. Also known as token giveaway, it sounds too good to be true—and sometimes it is. In October, we gave you step-by-step guides for YAE, TCT, PSWAP, TAUR, and POLYS. Not just how to claim them, but how to avoid scams. We told you what wallet types matter, what on-chain activity gets you picked, and why a snapshot taken on a fake site can steal your keys. These weren’t just tips—they were checklists you could use right away.

October 2025 wasn’t about hype. It was about clarity. You got real reviews of exchanges that vanished (Nanex), meme coins with no liquidity (BRETTA, BSOP, CHINU), and tools to spot the next risky token before you buy. You learned how liquidity affects your trades, why China’s ban still echoes in global markets, and how risk management isn’t optional—it’s the only thing keeping your portfolio alive. Below are the posts that made October matter. No fluff. No guesswork. Just what you needed to know, when you needed it.

31

Oct

Understand the difference between hard forks and soft forks in cryptocurrency. Learn how they affect network upgrades, your coins, and why some changes split blockchains while others don't.

Read More

30

Oct

KickEX claims low fees and easy trading, but its unverified volume, blocked fiat withdrawals, and conflicting reports make it risky. Learn the real truth about fees, US access, and whether it's a scam in 2025.

Read More

29

Oct

Iranian citizens face strict crypto controls, but decentralized exchanges offer a way to trade without government oversight. Learn how DEXs like Uniswap and Curve, along with DAI on Polygon, are becoming the safest option for Iranians in 2025.

Read More

28

Oct

Governments worldwide now require crypto exchanges to track cross-border transactions over $3,000. Learn how the Travel Rule, FinCEN, and MiCA are shaping global crypto compliance-and what you need to do to stay legal.

Read More

27

Oct

Crypto liquidity determines how easily you can buy or sell digital assets without crashing prices. Learn why high liquidity means safer trades, lower fees, and less risk - and how to spot illiquid coins before you invest.

Read More

27

Oct

DODO (BSC) is a decentralized exchange with a unique PMM algorithm that reduces slippage and impermanent loss. In 2025, it's still efficient for advanced traders but struggles with low liquidity and declining adoption. Is it worth using?

Read More

26

Oct

A clear, no‑fluff look at Chinu (CHINU) crypto coin: its Solana basis, wildly different market data, extreme liquidity risk, and why most investors should stay away.

Read More

25

Oct

A clear guide on which crypto exchanges are banned in China, how the ban works, work‑arounds, and its market impact, all in plain language.

Read More

24

Oct

Aperture Finance (APTR) is an AI-powered DeFi platform launched in 2024 that simplifies complex crypto trading with automated tools. With low liquidity and limited exchange listings, it's a high-risk project still in early stages.

Read More

24

Oct

Learn practical crypto risk management tactics for volatile markets, covering frameworks, tools, regulatory compliance, and actionable checklists for 2025.

Read More

23

Oct

Learn how to claim the YAE (Cryptonovae) airdrop, check eligibility, follow a step‑by‑step guide, and stay safe from scams in 2025.

Read More

22

Oct

Learn the exact criteria that decide if you get free crypto tokens, from snapshot timing and wallet type to on‑chain activities and security steps.

Read More