Fork Type Calculator

How to Determine Your Fork Type

A fork is a network change that determines whether transactions remain valid and whether old nodes can still validate new blocks. This tool analyzes key criteria to help you understand if your proposed change would require a soft fork or hard fork.

Results

Enter your scenario and click "Analyze Fork Type" to determine if your proposed blockchain change would be a soft fork or hard fork.

When a cryptocurrency network needs to change how it works, it doesn’t just update like your phone app. It has to make a decision that can split the entire community - or keep everyone together. That’s where hard fork and soft fork come in. These aren’t just technical terms. They’re political, economic, and sometimes emotional events that have shaped the entire history of Bitcoin, Ethereum, and dozens of other blockchains.

What’s a Fork, Really?

Think of a blockchain like a public ledger that everyone copies and updates. Every time a new transaction happens, it gets added to the end of the chain. But what if you want to change the rules? Like making blocks bigger, fixing a security flaw, or banning a type of transaction? You can’t just tell everyone to update. Some people won’t. Some can’t. Some won’t agree with the change. That’s when a fork happens. A fork means the blockchain splits into two paths. One path follows the old rules. The other follows the new ones. The difference between a hard fork and a soft fork is whether those two paths can still talk to each other.Soft Fork: The Quiet Upgrade

A soft fork is like tightening the rules without kicking anyone out. Imagine a highway with a new speed limit. Cars that don’t know about the new limit can still drive - they just might not realize they’re breaking the rules. The system still works. The old cars don’t crash. They just get ignored if they try to do something the new rules forbid. Technically, a soft fork makes the rules stricter. Older nodes still accept new blocks because they’re still valid under the old rules. But new nodes reject any block that doesn’t follow the updated rules. The key? All old transactions stay valid. You can’t spend money you didn’t have before. You can’t double-spend. The chain doesn’t break. Bitcoin’s SegWit upgrade in 2017 is the textbook example. It changed how transaction data was stored to fit more transactions in each block. Miners who upgraded got the benefit. Miners who didn’t? They kept mining. The network didn’t split. No new coin was created. People didn’t panic. It was smooth. Soft forks are preferred for small fixes: better privacy, improved security, minor efficiency gains. They’re the go-to for upgrades that don’t need a revolution. They’re also cheaper and faster to deploy because you don’t need everyone to upgrade at once. As long as most miners and nodes switch, the network moves forward.Hard Fork: The Big Split

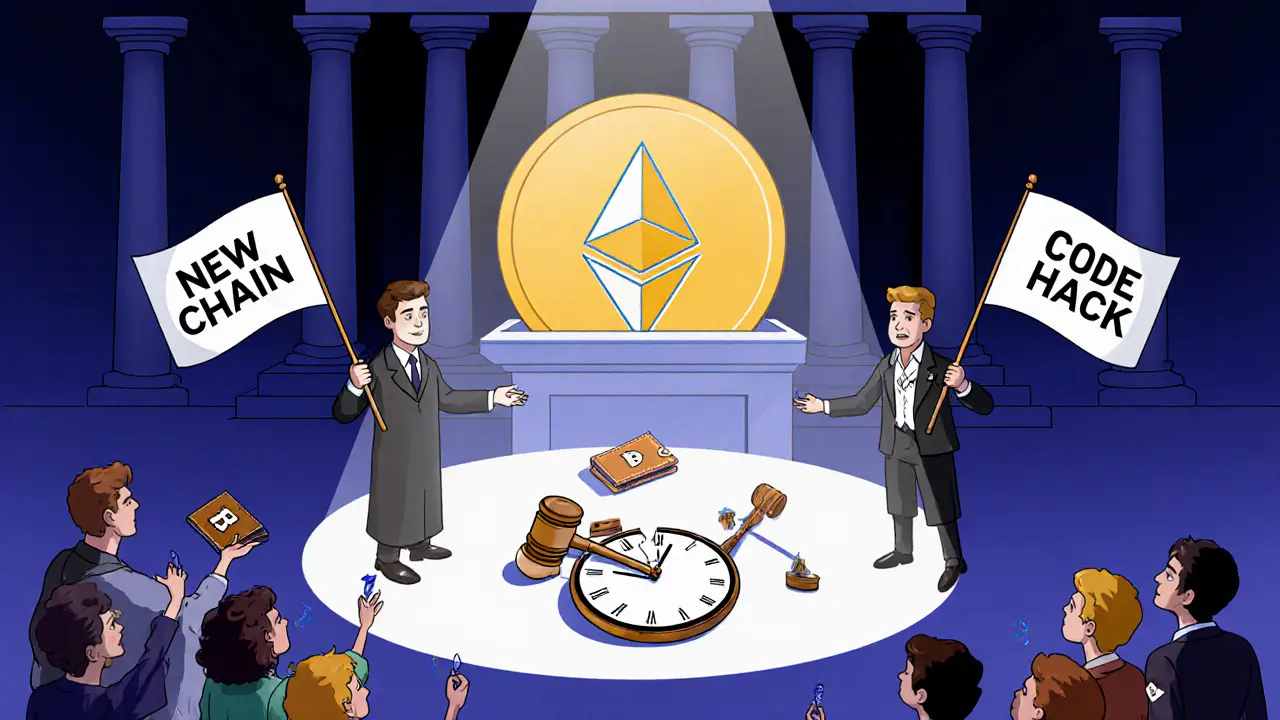

A hard fork is different. It’s like changing the entire road system - switching from driving on the right to driving on the left. Cars that don’t adapt? They crash. Or worse, they keep driving on the old side and cause chaos. In blockchain terms, a hard fork changes the rules in a way that makes old software incompatible. Blocks created under the new rules are invalid to old nodes. Old blocks might be invalid to new nodes. The chain splits. Two blockchains now exist. One follows the old rules. One follows the new. This is messy. It’s political. It’s emotional. People have to choose. Do you stay with the original chain? Or do you jump to the new one? The most famous hard fork? Bitcoin Cash in 2017. A group of developers and miners believed Bitcoin’s 1MB block size limit was too small. They wanted bigger blocks to handle more transactions. The Bitcoin core team disagreed. So they forked. Bitcoin Cash was born - with 8MB blocks. Suddenly, there were two Bitcoin networks. People who held Bitcoin before the fork got Bitcoin Cash too. Prices swung. Exchanges scrambled. Communities split. Another big one: Ethereum Classic. In 2016, hackers stole $60 million from a project called The DAO. The Ethereum community voted to reverse the transaction by rolling back the blockchain. But a portion of the community refused. They believed the code was law - no matter what. So they kept the original chain. That became Ethereum Classic. The new chain, with the hack reversed, became Ethereum as we know it today. Hard forks can fix major flaws. They can introduce new consensus mechanisms (like moving from Proof of Work to Proof of Stake). They can even rescue a network from collapse. But they come with risks: replay attacks (where a transaction on one chain gets copied to the other), confusion for users, and long-term community division.

Why It Matters: Stability vs. Innovation

You can’t have both. Not easily. Soft forks protect stability. They keep the network unified. They’re safer. They’re predictable. But they’re limited. You can’t add radical new features if they break backward compatibility. Want to change how mining rewards work? Change the total supply? Introduce a new token standard? You can’t do that with a soft fork. Hard forks give you freedom. You can redesign the whole system. But you risk splitting the network. You risk losing trust. You risk creating two coins that compete for attention, liquidity, and developers. Most major blockchains today use soft forks for 80% of their upgrades. Bitcoin has done over 20 soft forks since 2010. Ethereum’s transition to Proof of Stake was a hard fork - but only because it was unavoidable. The old system couldn’t scale. The cost of staying stuck was higher than the cost of splitting.Who Decides?

No one owns a blockchain. No CEO. No board. So who gets to say whether a fork happens? It’s messy. Miners used to hold the power - they could choose which chain to mine. Then came exchanges. If Coinbase, Kraken, and Binance support a fork, users follow. Then came developers. If the core team says “this is the future,” people listen. But in recent years, token holders and community votes have become more important. Bitcoin’s process is slow. Proposals go through BIPs (Bitcoin Improvement Proposals). They’re debated for months. Tested on testnets. Only if miners signal support do they activate. Ethereum uses EIPs (Ethereum Improvement Proposals) with more community input. But here’s the truth: if enough people want a hard fork, it happens. Even if the developers say no. Look at Bitcoin Cash. It wasn’t approved by Bitcoin’s core team. But enough miners, businesses, and users wanted it. So it happened.

What Happens to Your Coins?

If you hold Bitcoin, Ethereum, or any coin before a hard fork, you usually get the new coin too. At the moment of the fork, your balance is copied to the new chain. So if you had 5 BTC before Bitcoin Cash forked, you now had 5 BTC and 5 BCH. But here’s the catch: you don’t automatically get access to the new coin. You need to move it from an exchange or wallet that supports the fork. If you left your coins on Coinbase before the Bitcoin Cash fork, you didn’t get BCH until Coinbase decided to support it - weeks later. If you held your own private keys, you could claim it yourself. Soft forks? Nothing changes for your coins. You don’t get extra coins. You don’t need to do anything. Your wallet keeps working.Which One Is Better?

There’s no right answer. It depends on what you value. If you want stability, predictability, and no drama - soft forks are the way to go. They’re the backbone of most blockchain upgrades. They keep the network running without breaking trust. If you want radical change, new possibilities, or to fix a broken system - hard forks are necessary. They’re risky. They’re loud. But sometimes, they’re the only way forward. Most serious blockchain projects today aim to use soft forks as much as possible. They build Layer 2 solutions (like the Lightning Network for Bitcoin or rollups for Ethereum) to handle scaling without touching the base layer. That way, they avoid hard forks unless absolutely needed.What’s Next?

The future of blockchain upgrades is about minimizing disruption. The best networks won’t be the ones that fork the most. They’ll be the ones that fork the least - and still keep evolving. We’re seeing more sophisticated soft forks now. New techniques let developers add complex features - like zk-SNARKs for privacy or new signature schemes - without breaking compatibility. That’s the real win. Innovation without fragmentation. Hard forks aren’t going away. But they’re becoming rarer. And when they do happen, they’re more likely to be emergencies - like fixing a critical vulnerability - rather than ideological battles. The lesson? Don’t fear forks. Understand them. Know when they’re a quiet upgrade - and when they’re a revolution.Can a soft fork turn into a hard fork?

No, a soft fork cannot turn into a hard fork. They are fundamentally different types of upgrades. A soft fork is backward-compatible by design. If a change requires breaking compatibility, it was never a soft fork to begin with. Once a network adopts a soft fork, it stays compatible. If a later change breaks that compatibility, it’s a new hard fork - not a progression of the soft fork.

Do I need to do anything during a soft fork?

Generally, no. If you’re using a standard wallet or exchange, you don’t need to do anything. Your coins stay safe. Transactions continue normally. The network upgrades automatically as long as enough miners and nodes adopt the new rules. You might notice slightly faster transactions or lower fees after a soft fork like SegWit, but you won’t need to take action.

What happens if I don’t upgrade during a hard fork?

If you don’t upgrade your software during a hard fork, you’ll keep following the old chain. You won’t be able to send or receive transactions on the new chain. Your coins on the old chain still exist, but they’re isolated. Most exchanges and wallets will stop supporting the old chain quickly. If you want to use the new version, you’ll need to move your coins to a wallet that supports the updated software.

Are hard forks more dangerous than soft forks?

Yes, in several ways. Hard forks can cause network splits, confusion over which chain is "real," replay attacks (where a transaction on one chain is copied to the other), and loss of trust. Soft forks are safer because they don’t split the network. They’re also less likely to cause price crashes or regulatory issues. But hard forks aren’t inherently bad - they’re just riskier and used only when necessary.

Can a hard fork be reversed?

No, once a hard fork happens and two chains are running independently, they can’t be merged back. The two blockchains are now separate entities with their own histories, miners, and communities. Even if one chain becomes less popular, the other continues. Ethereum and Ethereum Classic are still both active today - nearly a decade after the DAO fork.

Brett Benton

November 1, 2025 AT 22:09Man, I remember when SegWit dropped and everyone lost their minds. Now it’s just normal. That’s the magic of soft forks-quiet, effective, no drama. Hard forks are like breaking up with someone and then trying to stay friends. It never works out clean.

David Roberts

November 3, 2025 AT 02:22Actually, the premise is flawed. Soft forks aren't 'backward compatible' in the true sense-they're *forward compatible* with a consensus rule change. The old nodes don't validate the new rules, they just don't reject them. That's not compatibility, it's tolerance. And the term 'soft' is misleading-it's not about gentleness, it's about constraint.

Eric Redman

November 4, 2025 AT 02:38Soft forks? Please. That’s just the elite devs gaslighting the masses into thinking they’re not being controlled. Meanwhile, Bitcoin Cash was the real people’s blockchain. They didn’t ask for permission. They just took it. That’s how freedom works.

Beth Devine

November 4, 2025 AT 12:39Great breakdown. I’ve been holding BTC since 2016 and never had to do a thing during SegWit. That’s the beauty of it-progress without panic. Keep the upgrades smooth, folks.

Hanna Kruizinga

November 5, 2025 AT 10:52Hard forks are just the government’s way of testing blockchain control. You think they let Bitcoin Cash happen by accident? Nah. They wanted a split. Now they can regulate one chain and ignore the other. Wake up.

Jessica Hulst

November 6, 2025 AT 02:11It’s funny how we treat blockchains like they’re living organisms. We anthropomorphize them-‘the community wants,’ ‘the network chose,’ ‘the code is law.’ But it’s just code. Run by humans. With egos. With greed. With fear. A soft fork isn’t a quiet upgrade-it’s a quiet coup. A hard fork isn’t a revolution-it’s a messy divorce. We’re not building decentralized systems. We’re just building new religions with different prophets.

Phyllis Nordquist

November 6, 2025 AT 02:53Thank you for this exceptionally clear and well-structured exposition. The distinction between soft and hard forks is often muddled in popular discourse, leading to unnecessary anxiety among non-technical users. Soft forks, as described, preserve network cohesion and minimize disruption-a critical consideration for financial infrastructure. Hard forks, while powerful, introduce systemic fragility and should be reserved for cases where backward compatibility is fundamentally incompatible with the desired outcome. The governance models you referenced-BIPs and EIPs-demonstrate that decentralized systems can evolve with deliberation, even without centralized authority.

Brian McElfresh

November 6, 2025 AT 05:59They told us SegWit was safe. Then they quietly added Taproot. Now they’re talking about Schnorr signatures and confidential transactions. Next thing you know, they’ll be changing the 21 million cap under the guise of ‘efficiency.’ They’ve been slowly soft forking us into a centralized system. You think you’re safe? You’re not. They’re already rewriting the rules while you sleep.

Jason Coe

November 6, 2025 AT 21:19Look, I get why people love soft forks-they’re clean, they’re safe, they don’t cause drama. But let’s be real: the reason we don’t see more hard forks isn’t because they’re bad. It’s because the core devs and big miners control the narrative. If you’re not part of the inner circle, you don’t get to propose a fork. Bitcoin Cash? That was a rebellion. Ethereum Classic? That was principle. And yeah, both still exist. That’s not failure-that’s resilience. The system isn’t designed to be fair. It’s designed to be stable. And stability often means silencing dissent. I don’t blame people for wanting to fork. I blame the system for making it so damn hard.

Layer 2s? Sure, they’re cool. But they’re just hiding the real problem: we’re not actually decentralized. We’re just outsourcing control to a few exchanges and a handful of devs who talk like they’re prophets. The real innovation isn’t in the tech. It’s in the people who refuse to accept the status quo.

Shaunn Graves

November 7, 2025 AT 21:50Who even cares about soft forks? You’re all obsessing over technicalities while the real threat is centralized custody. If your coins are on an exchange, you don’t own them. You’re just a tenant. Whether it’s a soft fork or hard fork, if Coinbase decides not to support a new chain, you lose. That’s not decentralization. That’s slavery with a blockchain logo.

Kaela Coren

November 8, 2025 AT 09:42While the post accurately delineates the technical distinctions, one critical omission is the role of economic consensus versus technical consensus. A soft fork may be technically backward-compatible, but its activation depends on miner signaling and economic adoption. The network’s stability is not an emergent property of code alone-it is a social contract enforced by economic incentives. The real innovation lies not in the fork type, but in the mechanism by which decentralized actors coordinate under uncertainty.

Monty Tran

November 9, 2025 AT 17:58Hard forks are chaos. Soft forks are control. Either way, you’re still just a node in someone else’s system. The real fork is between those who believe in code and those who believe in people. Spoiler: code always loses.

Eliane Karp Toledo

November 10, 2025 AT 20:04They’re not upgrading the blockchain. They’re upgrading the narrative. SegWit? It was never about scaling. It was about killing off the miners who didn’t bow to the core team. Bitcoin Cash wasn’t a fork-it was a rebellion. And now they’re calling it ‘altcoin trash’ while they quietly backdoor surveillance features into Taproot. They want you to think it’s all technical. It’s not. It’s power. And you’re being played.

David James

November 12, 2025 AT 04:50Good info. I didn’t know soft forks didn’t create new coins. That’s useful. I just keep my coins in a wallet and hope for the best. Thanks for explaining it simple.