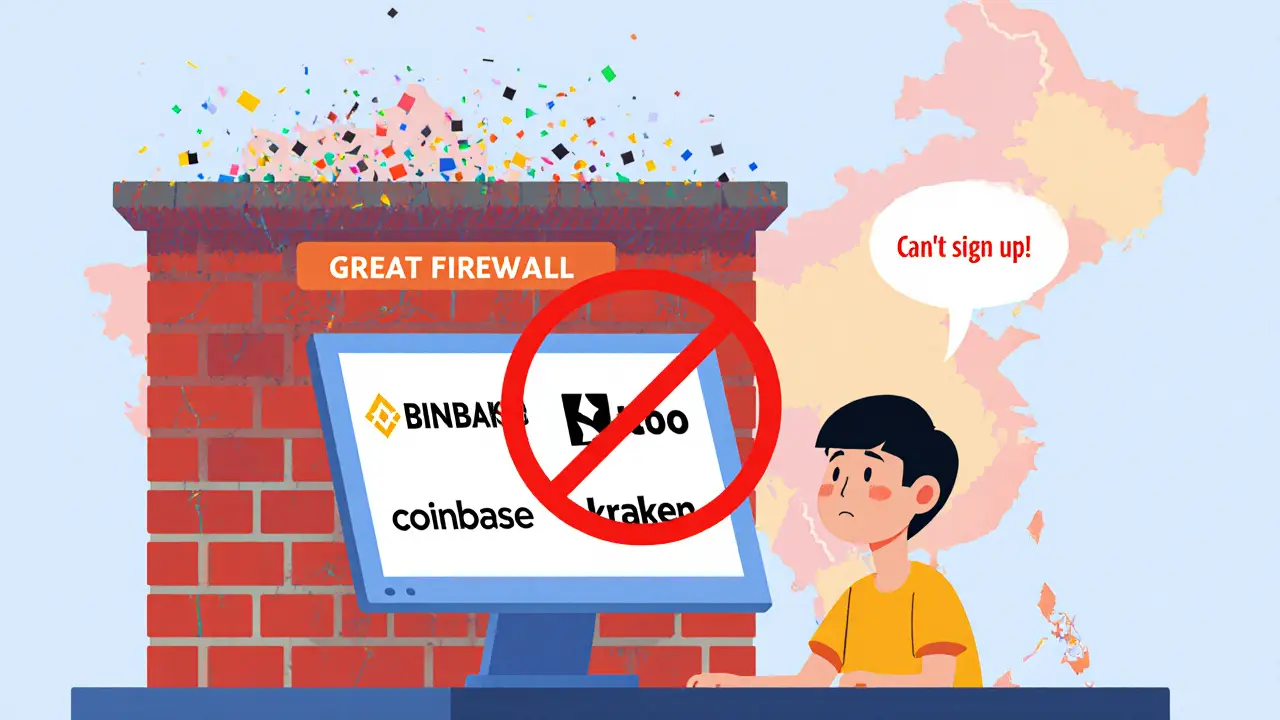

Ever tried to sign up for a popular crypto platform only to hit a wall when you’re in China? You’re not alone. Since 2017 the Chinese government has tightened its grip on digital assets, and today the list of crypto exchanges banned in China reads like a who’s‑who of the global market. This guide walks you through which exchanges you can’t legally use, how the ban works, and what traders in China are doing to stay in the game.

How the ban started and why it matters

People's Bank of China the country’s central bank issued the first crackdown in September 2017, declaring that all centralized cryptocurrency exchange platforms where users buy, sell, or trade digital assets were illegal within its borders. The move was meant to curb capital flight and protect financial stability. Over the next few years the ban expanded, finally becoming a blanket prohibition in 2021 that covered not just exchanges but also ICOs, mining, and even foreign platforms that tried to serve Chinese customers.

List of major exchanges you can’t access

Below is a quick snapshot of the biggest names that are officially blocked. The table shows their status, when they were added to the restriction list, and a common work‑around that users still try (though it carries risk).

| Exchange | Status in China | Year Blocked | Typical Work‑around |

|---|---|---|---|

| Binance | Blocked | 2018 | VPN + offshore account |

| Coinbase | Blocked | 2019 | VPN + US‑based entity |

| Kraken | Blocked | 2020 | VPN + peer‑to‑peer trades |

| Huobi | Blocked | 2017 | Domestic sister platform (now limited) |

| OKX | Blocked | 2021 | Tor network access |

| KuCoin | Blocked | 2021 | Decentralized exchange bridge |

| Gate.io | Blocked | 2022 | VPN + offshore entity |

| Bitfinex | Blocked | 2022 | OTC desk via third‑party |

Technical ways the government blocks access

The enforcement engine is a mix of the Great Firewall of China and direct orders to ISPs. The firewall drops DNS queries and IP packets for exchange domains, while financial institutions are told not to process any crypto‑related payments. VPN services are regularly cracked or black‑listed, and even cloud‑based proxies can be flagged by the state’s KYC monitoring system, which scans ID documents used on foreign sites. In practice, this means a Chinese resident who tries to log into Binance will see a timeout or a generic “service unavailable” page.

What traders actually do to stay in the market

Even with heavy blocking, many Chinese crypto enthusiasts still find ways to trade. The most common routes are:

- VPNs and proxy services: despite crackdowns, reputable VPNs still offer enough speed for casual trading.

- Over‑the‑counter (OTC) desks: peer‑to‑peer deals arranged through chat groups on WeChat or Telegram.

- Decentralized exchanges (DEXs): platforms like Uniswap run on smart contracts and can’t be shut down by a single government.

- Stablecoin swaps: using USDT or USDC on offshore wallets to move value without triggering exchange alerts.

These work‑arounds are not risk‑free. Using a VPN can attract a fine for “illegal fundraising,” while OTC trades often lack consumer protection and can be scams.

Impact on the global market

When news of tighter Chinese restrictions spikes, you can feel it in the price charts. In May 2025, rumors that China would make crypto trading “completely illegal” sent Bitcoin from $111,000 down to $104,000 within hours and pulled Ethereum about 7%. The reason is simple: China represents roughly 400 million potential users, and removing their demand shrinks daily trading volume. On the flip side, the crash also creates buying opportunities that savvy investors label as “smart‑money entering on the dip.”

China’s own digital currency - the e‑CNY

While foreign exchanges are locked out, the state is pushing its own digital yuan, the e‑CNY. It works like a regular yuan but lives on a government‑run blockchain. The goal is to give citizens a digital way to pay while keeping full control over monetary policy. Some analysts think the e‑CNY will eventually replace the need for private crypto in everyday transactions, especially as the government explores a yuan‑backed stablecoin.

Future outlook - will the ban ever lift?

Experts are split. A few senior officials hinted in July 2025 that a “more targeted approach” might appear, possibly allowing licensed exchanges with stricter KYC. Yet no concrete timeline exists, and the state’s focus on the e‑CNY suggests the blanket ban will stay at least through 2026. For traders, the practical advice is to keep an eye on policy signals, use safe work‑arounds sparingly, and consider diversifying into DEXs or stablecoins that sit outside the traditional banking system.

Quick checklist for anyone in China

- Know which exchanges are officially blocked (see table above).

- If you must trade, use a reputable VPN and an offshore wallet.

- Consider OTC or DEX routes for smaller amounts.

- Stay aware of legal risks - fines can reach thousands of yuan.

- Watch for official statements about the e‑CNY, as it may become the only legal crypto‑like tool.

Which major crypto exchanges are banned in China?

All large centralized platforms - Binance, Coinbase, Kraken, Huobi, OKX, KuCoin, Gate.io, and Bitfinex - are blocked. The ban started in 2017 and each exchange was added to the restriction list between 2017 and 2022.

Can I use a VPN to access a banned exchange?

Technically yes, many traders still use VPNs, but the government regularly cracks down on VPN services. Using one risks a fine for illegal fundraising if you’re caught.

What is the e‑CNY and how does it affect crypto traders?

The e‑CNY is China’s state‑backed digital yuan. It gives citizens a digital payment option that the government controls, reducing the appeal of private cryptocurrencies and providing a legal alternative for digital transactions.

Are decentralized exchanges (DEXs) legal in China?

DEXs operate on smart‑contract code and are not hosted on a single server, making them harder to block. However, accessing them still often requires a VPN, and the legal gray area means users could still face penalties if caught.

What are the penalties for violating the exchange ban?

Violators can be charged under illegal fundraising statutes, face fines ranging from a few thousand to tens of thousands of yuan, and in serious cases may encounter criminal prosecution and travel restrictions.

Sarah Hannay

October 25, 2025 AT 08:33In evaluating the recent exposition on the prohibition of cryptocurrency exchanges within the People's Republic of China, one must first acknowledge the historical trajectory that commenced in 2017 with the People's Bank of China's inaugural edict. The subsequent escalation to a comprehensive ban by 2021 reflects a deliberate strategy to curtail capital outflows and consolidate monetary sovereignty. The enumerated list of platforms-namely Binance, Coinbase, Kraken, Huobi, OKX, KuCoin, Gate.io, and Bitfinex-serves as a compelling illustration of the breadth of enforcement. Each entity's inclusion in the restriction roster underscores the state's resolve to preempt foreign digital asset access. Moreover, the technical mechanisms employed, such as DNS filtration and IP packet suppression, exemplify the sophisticated architecture of the Great Firewall. The article accurately delineates the reliance on ISP compliance and the occasional dismantling of VPN services. It is noteworthy that, despite these constraints, a segment of the Chinese trading populace persists through alternative avenues, including decentralized exchanges and over‑the‑counter arrangements. While these work‑arounds convey a modicum of operational continuity, they inevitably introduce heightened counterparty risk and regulatory exposure. The narrative further elaborates on the macro‑economic repercussions observable in price volatility when Chinese policy signals intensify. The cited market reaction in May 2025, wherein Bitcoin experienced a precipitous decline, validates the substantial influence of Chinese demand on global trading volumes. Concurrently, the exposition on the state‑issued digital yuan, or e‑CNY, elucidates the government's parallel ambition to furnish a sovereign digital payment medium. This development may gradually erode the appeal of private cryptocurrencies among domestic users. Finally, the article's prognostication regarding the potential for a more nuanced regulatory framework remains speculative, pending concrete policy articulation. In sum, the piece furnishes a thorough, data‑driven overview of the regulatory landscape, its enforcement nuances, and the resultant market dynamics.

Prabhleen Bhatti

November 3, 2025 AT 22:50Indeed, the taxonomy of sanctioned platforms aligns with the canonical schema of centralized exchange architectures, whereby liquidity aggregation and order‑book orchestration coalesce under a singular corporate entity; consequently, the jurisdictional reach of the PBoC's prohibitions extends to any node interfacing with such sylvan ecosystems-be it via direct API invocation or ancillary service layers. The bifurcation of circumvention strategies-VPN tunneling versus decentralized bridge protocols-necessitates a granular risk‑assessment matrix, especially when factoring in the stochastic latency introduced by encrypted relay pathways. Moreover, the confluence of KYC stipulations and cross‑border capital controls engenders a multi‑vector compliance vector, which, if transgressed, precipitates punitive statutory repercussions. Hence, operators must calibrate their operational parameters, ensuring cryptographic resilience while maintaining auditability within the bounds of Chinese regulatory doctrine.

John E Owren

November 13, 2025 AT 14:06For anyone navigating this landscape, it's essential to keep a clear head and prioritize security. Using a reputable VPN can help mask your traffic, but make sure the provider has a solid no‑logs policy. Pair that with an offshore wallet that you control the private keys for, and you reduce exposure. Always stay updated on the latest regulations to avoid unintended violations.

Joseph Eckelkamp

November 23, 2025 AT 05:22Ah, the noble art of VPN hopping-truly the pinnacle of modern finance, isn’t it? One might think that obscuring your IP magically shields you from all regulatory wrath, when in reality the state’s surveillance apparatus is anything but indifferent. Still, the spectacle of watching traders tip‑toe around an invisible firewall does have its entertainment value. Just remember, sarcasm aside, the risk remains very real.

Jennifer Rosada

December 2, 2025 AT 20:39It is morally incumbent upon individuals to respect the sovereign laws that govern their jurisdiction. Engaging in illicit financial activity not only jeopardizes personal liberty but also erodes collective trust in the economic system. Therefore, adherence to the established prohibitions is a matter of ethical responsibility.

adam pop

December 12, 2025 AT 11:55The official narrative is merely a façade for a deeper agenda orchestrated by unseen entities. Every time a VPN is blocked, it is evidence of an elaborate surveillance network designed to monitor dissent. Trust no one, especially those promising a safe passage through the digital maze.

Dimitri Breiner

December 22, 2025 AT 03:11When you consider the broader picture, diversifying your exposure beyond centralized exchanges is a wise move. Decentralized platforms, though not without their own challenges, offer a layer of resilience against state‑driven shutdowns. Pair that with a disciplined risk‑management strategy, and you’ll be better positioned for long‑term success. Stay vigilant and keep learning.

LeAnn Dolly-Powell

December 31, 2025 AT 18:28Great points! 🌟 Exploring DEXs can really open up new possibilities. Keep your spirits high and your trades smart! 🚀

Michael Hagerman

January 10, 2026 AT 09:44Whoa, did you see the drama unfold when the firewall finally knocked Binance offline? It was like watching a blockbuster thriller, except the stakes were real wallets and sleepless nights. People were scrambling, VPNs were flickering, and every forum was lit up with frantic tips. Some folks even tried the old Tor trick, only to find themselves tangled in a maze of slow connections. In the end, the market reacted like a soap opera cliffhanger-prices dipped, surged, and then steadied as everyone held their breath. Remember, when the Great Firewall flexes its muscles, the crypto community feels the tremors.

Laura Herrelop

January 20, 2026 AT 01:01The very notion of digital autonomy, when juxtaposed against an ever‑tightening state apparatus, invites contemplation on the essence of freedom itself. One could argue that the prohibition merely accelerates the migration toward decentralized constructs, wherein trust is algorithmic rather than institutional. Yet, this migration is fraught with paradoxes: anonymity breeds both liberty and lawlessness. As participants navigate these blurred boundaries, they become inadvertent philosophers of the new financial order. The tension between surveillance and secrecy shapes a dialectic that will define the next era of monetary interaction. Ultimately, the quest for unencumbered exchange persists, even as the mechanisms evolve.

olufunmi ajibade

January 29, 2026 AT 16:17Inclusivity demands that we share knowledge about safe practices while acknowledging the challenges faced by all users. Emphasizing robust security measures and community support can empower traders to navigate restrictions responsibly. Together, we build a resilient ecosystem that respects both innovation and regulation.