When you hear "LIBRA" in crypto, you might think of Facebook’s failed stablecoin project. But as of 2026, the name is mostly tied to a wild, chaotic memecoin that exploded in Argentina - and then crashed harder than most people expected. This isn’t about blockchain innovation. It’s about politics, memes, and how fast money can vanish when hype outpaces reality.

The Argentina LIBRA memecoin: born in hype, died in confusion

On February 14, 2025, a new cryptocurrency called LIBRA (LIBRA) appeared on the Solana blockchain. Its launch was announced with a tweet from an account pretending to be Argentine President Javier Milei. The message? "LIBRA is here to fund small businesses and fix Argentina’s economy." Within hours, the token’s market cap hit $4.5 billion. People were buying it like it was gold.

But here’s the truth: the Argentine government never endorsed it. By February 20, 2025, officials issued a public denial. Still, the damage was done. Traders had already poured in, chasing the rumor. The token climbed to #12 on CoinGecko’s rankings by March 3, 2025. It wasn’t just popular - it was everywhere.

Behind the scenes, things were messy. Blockchain analysts from TRM Labs found that 63% of the initial token supply went to wallets created at the exact same time as the coin’s launch. That’s not random. That’s a red flag for a pre-mine - where insiders dump tokens before the public even knows they exist. By August 2025, LIBRA had lost 78% of its value. By December, it was down 89% from its peak.

How did people get burned?

Most buyers didn’t understand what they were buying. LIBRA had no utility. No team. No roadmap. Just a name and a political rumor. People saw "Milei" and thought "government-backed." They weren’t wrong to feel that way - the marketing made it seem real.

Scams followed fast. Fake airdrop links flooded Reddit and Telegram. Users were told to connect their Phantom wallet to claim free LIBRA tokens. Instead, they lost everything. Trustpilot data shows 68% of complaints about Phantom wallet in early 2025 were tied to LIBRA scams. One user on r/Argentina lost 300,000 ARS (about $350 at the time) after clicking a link that drained their wallet. Another Reddit user, "ArgentoHodler," made $2,000 by buying low and selling early. He called it "the best trade of my life." But he was the exception.

The token’s contract had zero protections. No liquidity lock. No anti-whale rules. Early buyers - likely the same people who created the pre-mine wallets - dumped their tokens in massive waves. Prices crashed. Retail investors were left holding bags.

What about Facebook’s Libra? Don’t mix them up

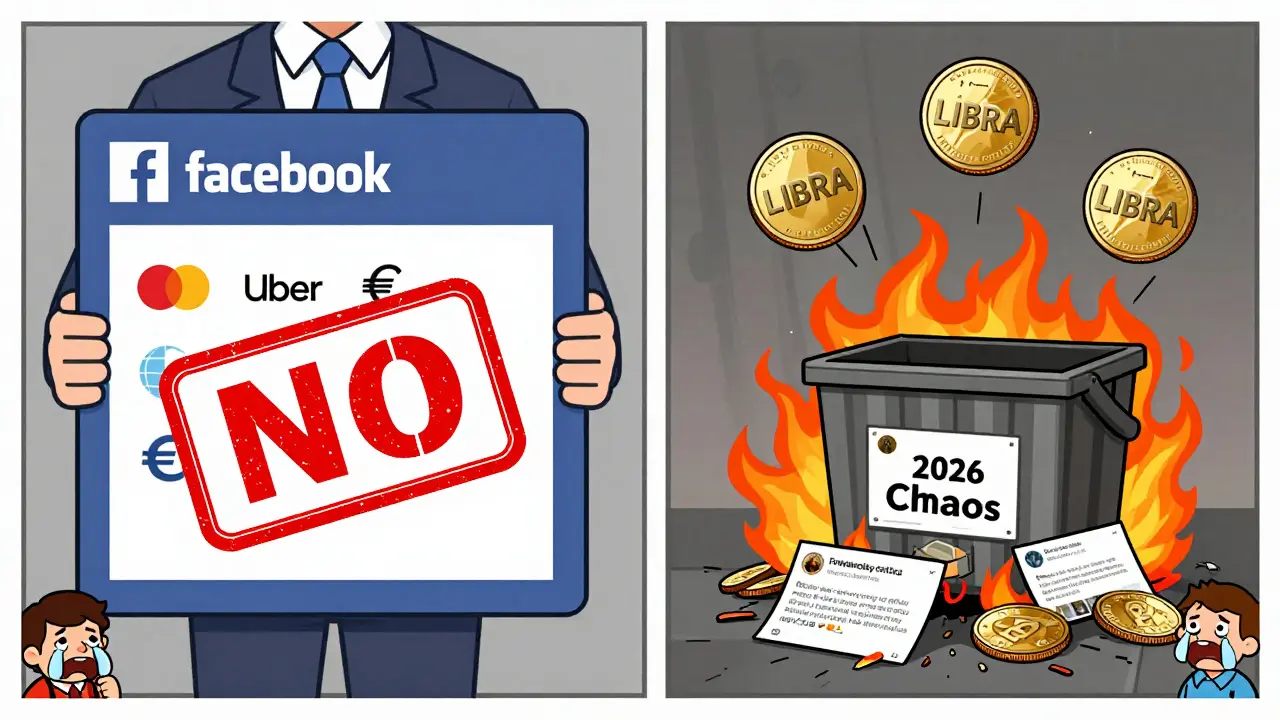

Many people still confuse this memecoin with Facebook’s old project, also called Libra. That one was serious. Announced in June 2019, it was meant to be a global stablecoin backed by a basket of real assets like the US dollar and euro. Facebook partnered with big names: Mastercard, Uber, Spotify, and more. They called it "faster, cheaper, and more reliable" than traditional banking.

But regulators shut it down. The Federal Reserve, the European Central Bank, and others said it threatened financial stability. In December 2020, Facebook renamed it Diem. It never launched. In January 2022, the Diem Association sold its tech to Silvergate Bank for $200 million. The blockchain code, written in a language called Move, still exists - but it’s dead. Silvergate filed a patent for its reserve management system in January 2026, but it has nothing to do with the Argentina memecoin.

They’re completely different. One was a corporate project killed by regulators. The other is a meme that rode a political rumor to a brief, explosive life - then collapsed.

Then there’s Libra Protocol (LBR)

And if you’re still confused, here’s a third LIBRA: Libra Protocol (LBR). It’s a separate crypto project listed on CoinMarketCap since 2023. It offers cloud mining and staking, paying out tiny rewards every 15 minutes - 0.27% of your staked amount. Sounds boring? That’s because it is. It has around 12,450 active users as of late 2025. Its price hovers between $0.00085 and $0.0012. No political drama. No viral tweets. Just another low-volume token trying to survive in a crowded market.

Why did LIBRA (the memecoin) even work at all?

It worked because of timing and psychology. Early 2025 was a memecoin boom. Solana-based tokens like WIF and BONK were surging. People were hungry for quick wins. Then LIBRA dropped with a name that sounded official and a story that felt like hope - especially in Argentina, where inflation hit 200% in 2024.

Dr. Elena Rodriguez, an economist at Buenos Aires University, called it "a dangerous confluence of cryptocurrency speculation and political theater." Her team found that 92% of LIBRA’s initial liquidity was held in just 17 wallets. That’s not decentralization. That’s control.

Mark Cuban, on the other hand, called it "a fascinating case study in meme-driven adoption." He pointed out that LIBRA hit 1.2 million unique wallets in 72 hours - faster than Dogecoin’s first week. He’s right. The speed was real. But speed doesn’t mean sustainability.

What’s left of LIBRA in 2026?

As of January 2026, there are three versions of LIBRA circulating on Solana:

- The original contract (So1Libra...)

- A "verified" version promoted by Milei supporters (MileiLIBRA...)

- A community-forked "legit" version (TrueLIBRA...)

Only 28% of current trading happens on the original contract. The rest is split between the imitators. This isn’t innovation. It’s chaos. Retail investors are confused. Exchanges don’t list any of them officially. Wallets like Phantom warn users about "unauthorized transactions" tied to LIBRA.

Regulators in Argentina issued Warning Notice 2025-017: any crypto claiming government support without formal registration is securities fraud. That’s the law. And LIBRA broke it - even if no one ever asked for permission.

Should you buy LIBRA now?

No.

Not the original. Not the fake versions. Not even if someone tells you "Milei is coming back to support it." The project is dead. The hype is gone. The only people still trading it are speculators hoping for a pump - and scammers hoping you’ll fall for another fake airdrop.

If you’re curious about crypto, look at projects with real teams, audited code, and transparent governance. LIBRA had none of that. It was a rumor wrapped in a token. And rumors don’t last.

Is LIBRA (LIBRA) coin backed by the Argentine government?

No. The Argentine government publicly denied any involvement with the LIBRA memecoin in February 2025. The token was never officially endorsed, and its association with President Javier Milei was fabricated. The government later issued a formal warning that any crypto claiming state backing without registration is illegal under Law 26,831.

Is LIBRA the same as Facebook’s Diem?

No. Facebook’s Libra, later renamed Diem, was a serious stablecoin project backed by major companies like Mastercard and Uber. It was designed to be stable, regulated, and global. Diem was shut down in January 2022. The Argentina LIBRA memecoin is a completely unrelated Solana-based token that launched in 2025. They share a name, but nothing else.

Can I still trade LIBRA coin?

Technically, yes - but it’s risky. You can still trade it on decentralized exchanges like Raydium and Orca on Solana. But three different versions are circulating, and none are officially listed on major exchanges. Most trading activity is low, and scams are common. The original token’s price is less than 10% of its peak value. Trading it now is speculation, not investment.

Why did LIBRA crash so hard?

LIBRA crashed because it had no real value, no team, and no protections. Its price was driven entirely by hype and fake political claims. Once regulators stepped in and the scam was exposed, early holders dumped their tokens. With no liquidity lock or anti-whale rules, the price collapsed. Over 78% of its value vanished in six months.

What blockchain is LIBRA on?

The Argentina LIBRA memecoin runs on the Solana blockchain. It uses the same technical structure as other Solana memecoins like WIF and BONK. Transactions are fast (under 0.5 seconds) and cheap (about $0.0015 per trade). But unlike other tokens, it has no smart contract security features - making it vulnerable to manipulation.

Are there any legitimate LIBRA crypto projects left?

The original LIBRA memecoin is dead. The Diem project is gone. Libra Protocol (LBR) still exists, but it’s a small, low-traffic token with no major adoption or utility. As of 2026, there are no legitimate, active LIBRA projects with real teams or long-term value. Any new "LIBRA" you see is likely a scam or a copycat.

steven sun

January 19, 2026 AT 21:33lol i just bought libra bc i thought it was milei’s new crypto and now my wallet’s empty 😭

Shamari Harrison

January 21, 2026 AT 18:51For real though - this is a textbook case of how memecoins exploit political desperation. Argentina’s inflation hit 200% in 2024, so people latched onto anything that sounded like a lifeline. The fact that 63% of tokens were pre-mined? That’s not a bug, it’s the whole design. No one’s getting rich here except the devs who dumped before the tweet even trended.

And the worst part? The scam links still pop up on Telegram. People are still losing money because they don’t realize the ‘verified’ versions are all fake. Phantom wallet warnings are there for a reason - listen to them.

Jen Allanson

January 22, 2026 AT 01:21It is both morally reprehensible and economically irresponsible to allow such a fraudulent scheme to gain any traction under the guise of political endorsement. The exploitation of vulnerable populations through the deliberate conflation of a state-sanctioned narrative with a completely unregulated digital asset constitutes a gross violation of fiduciary ethics - and yet, the public continues to enable it through blind speculation.

Mark Estareja

January 22, 2026 AT 17:46Pre-mined 63%? That’s not a rug pull - that’s a full-on heist with a blockchain veneer. The liquidity was concentrated in 17 wallets. That’s not decentralization, that’s a cartel. And the fact that people still trade the ‘MileiLIBRA’ fork? Pure cognitive dissonance. You’re not investing - you’re funding the next wave of scammers who’ll spin up ‘TrueLIBRA v3’ next month.

Also, Diem was a regulatory nightmare, but at least it had a whitepaper. This? This is a tweet with a smart contract attached.

Sara Delgado Rivero

January 23, 2026 AT 00:56People still dont get it LIBRA was never real and now its even worse because there are three versions floating around and everyone thinks theyre buying the right one but theyre not and the only thing left is scams and fake airdrops and if you think you can get rich off this youre delusional

Ryan Depew

January 24, 2026 AT 10:48Look, I’m not here to judge people for falling for this - I’ve been there. Bought WIF at the top too. But LIBRA? This one’s special because it weaponized nationalism. People weren’t just chasing gains - they were chasing hope. And hope’s the most dangerous asset class in crypto.

The real tragedy? The original devs probably made millions. The retail buyers? They’re now stuck with a token worth 1.2% of its peak. And the worst part? The community’s still arguing about which fork is ‘real.’ It’s like watching a funeral where everyone’s fighting over who gets the urn.

Kevin Pivko

January 24, 2026 AT 13:26LIBRA was never about crypto. It was about attention. The whole thing was a viral stunt designed to extract value from the intersection of political rage and financial ignorance. And now? The only thing more predictable than the crash is the next scam that’ll copy this exact playbook. Mark my words - by Q3 2026, there’ll be a ‘Milei2.0’ token with a TikTok influencer as the ‘CTO.’

Also, Diem? Don’t even bring it up. That was a corporate project with lawyers. This? This was a meme with a wallet address. Two different species.

💀

Mathew Finch

January 24, 2026 AT 16:12Argentine crypto scams? Please. This is why your country can’t even manage a currency. You let a meme become legal tender in your head. Meanwhile, the US dollar still works. The euro still works. Bitcoin still works. But no - you need a fake coin named after a politician you don’t even vote for. Pathetic.

Jessica Boling

January 24, 2026 AT 17:27So let me get this straight - a fake tweet from a president who didn’t tweet it, a token with no code audit, and now three versions of the same dumpster fire? And we’re supposed to be impressed? 🤡

At least Dogecoin had a sense of humor. This just feels like grief laundering.

Tammy Goodwin

January 24, 2026 AT 19:33I just think it’s sad how fast people forget. A year ago, LIBRA was everywhere - memes, news, Reddit threads. Now? It’s a ghost. But the people who lost money? They’re still checking the price every day. Hoping it’ll come back. Like it’s a lost pet.

It’s not. It’s just code. And code doesn’t care about your hope.

Andy Simms

January 25, 2026 AT 02:12For anyone still confused about the three LIBRAs: the original contract is dead. The Milei version is a scam. The TrueLIBRA fork is just another rug-pull waiting to happen. If you’re trading any of them, you’re not investing - you’re gambling with your life savings on a coin that has zero utility, zero backing, and zero future.

Don’t be the next person in the ‘I lost 300k ARS’ Reddit thread. Walk away.

Nadia Silva

January 25, 2026 AT 19:10It’s fascinating how the global crypto community romanticizes chaos as long as it’s not happening in their country. Americans call LIBRA a scam. Argentinians call it a revolution. Same token. Different narrative. The real villain isn’t the devs - it’s the lack of financial literacy everywhere.

Roshmi Chatterjee

January 27, 2026 AT 10:16I read this whole thing and I’m still confused - but in a good way? Like, I didn’t know there were three LIBRAs. Now I know. And I won’t touch any of them. But wow - the way politics and crypto got mixed here is like a Netflix documentary waiting to happen.

Also, Libra Protocol? That’s the boring one? Haha. I’m glad someone’s still doing the quiet grind.

Deepu Verma

January 28, 2026 AT 16:18Hey, I know it’s easy to laugh at LIBRA now - but think about how many people just needed to believe something was going to change. In a country where inflation eats your salary every month, a meme that says ‘this will fix everything’? That’s not stupid. That’s human.

Yes, it got exploited. Yes, it crashed. But don’t blame the people who believed. Blame the people who lied.

Stay safe out there. And if you’re new to crypto? Start with learning. Not with hype.

MICHELLE REICHARD

January 29, 2026 AT 09:40Let’s be real - if you didn’t know the difference between Diem and this LIBRA scam, you shouldn’t be touching crypto at all. This isn’t a ‘learning experience.’ It’s a financial trap disguised as a revolution. And the fact that people still defend it? That’s the real failure of modern education.

Also, Libra Protocol? That’s the only one with a website. And even that’s barely alive. Nothing here is worth your time.

tim ang

January 30, 2026 AT 08:44just sold my last libra tokens for 2 bucks and bought a coffee. still better than what i paid. thanks for the warning post - saved me from losing more

Andy Marsland

January 31, 2026 AT 09:32Let’s not overlook the structural failure here. The entire episode exposes the fatal flaw in the memecoin model: there is no feedback loop between value creation and price discovery. LIBRA’s price was entirely driven by narrative momentum - not utility, not adoption, not even demand. It was a pure signal-to-noise ratio failure. The market didn’t price in risk because the risk wasn’t visible - it was buried under political theater and viral branding.

Compare this to Bitcoin’s early days. Even then, people were mining because they believed in decentralization, not because some guy on Twitter said ‘buy now.’ LIBRA had no ethos. No philosophy. Just a name and a lie.

And now we have three competing forks? That’s not innovation - that’s entropy. The blockchain isn’t a playground for political fraud. It’s a ledger. And ledgers don’t lie. People do.

The real lesson? If you can’t explain the token’s economic model in one sentence - don’t buy it. LIBRA fails that test spectacularly. And so do you if you’re still holding it.

Also, Diem’s Move language? Still alive. But not in this context. That’s the irony. The only real tech here is the one nobody’s talking about.