Philippines Crypto Exchange Penalty Calculator

Understand Your Risk

The Philippines' SEC can levy fines from 50,000 PHP to 10 million PHP per violation, plus a daily penalty of 10,000 PHP until compliance is achieved.

Estimated Penalty

Base Fine:

Daily Penalty: 10,000 PHP × days =

Total Penalty:

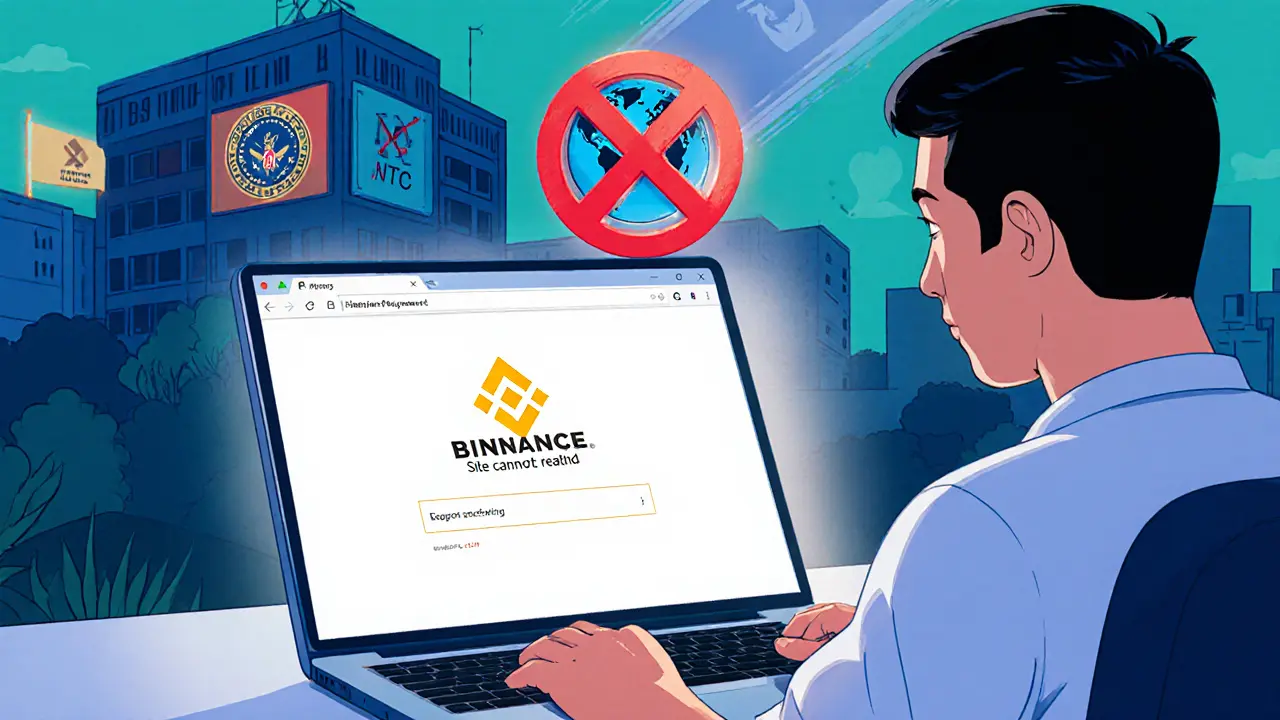

The Philippines has turned into one of Southeast Asia’s toughest arenas for crypto exchanges. Since early 2024, the government has blocked Binance outright, and the new Crypto Asset Service Provider (CASP) framework introduced in May 2025 casts a wide net that could swallow Bitget as well. If you’re a Filipino trader, you need to know exactly what’s happening, why it matters, and what you can safely do now.

Quick Timeline: From Binance Warning to Full Block

In November 2023 the Securities and Exchange Commission (SEC) warned Binance is the world’s largest cryptocurrency exchange by trading volume that it was operating without a proper Philippine licence. The regulator gave the platform 90 days to exit the market. By March 2024 the SEC, with help from the National Telecommunication Commission (NTC), ordered internet service providers to block Binance’s website and API endpoints. Users suddenly saw a blank screen when trying to log in.

Why the Crackdown? The New CASP Framework

May 2025 brought SEC Memorandum Circular No. 4 and No. 5, creating the first comprehensive Crypto Asset Service Provider (CASP) framework. Effective July 5, 2025, the rules require any crypto‑related business serving Filipinos to:

- Register as a domestic corporation with at least 100 million PHP (≈ US$1.8 million) paid‑in capital.

- Maintain a physical office in the Philippines.

- Separate customer funds from company assets.

- Submit detailed monthly financial and AML reports.

Violations trigger fines from 50,000 to 10 million PHP per breach, plus a daily penalty of 10,000 PHP until compliance is achieved.

Bitget’s Position Under the New Rules

The SEC’s August 1, 2025 advisory listed ten exchanges that were operating without a CASP licence - OKX, Bybit, KuCoin, Kraken, and others. Bitget was not named explicitly, but the advisory makes clear that the rules apply to *all* foreign platforms serving Philippine users. That means:

- Bitget must register as a Philippine corporation or cease serving local users.

- Failure to do so could result in the same blocking actions taken against Binance.

- Promoters, influencers, or “agents” who push Bitget to Filipinos could face criminal liability.

At the time of writing, Bitget’s website is still reachable, but regulators have issued warnings that enforcement will follow the same pattern as Binance.

How the Authorities Enforce the Ban

The SEC works with the NTC to order internet service providers (ISPs) to block DNS resolution and IP traffic to unlicensed exchanges. In practice, users see a “site cannot be reached” error. The regulator also publishes public advisories urging users to withdraw assets within a 90‑day window.

Beyond ISP blocks, the SEC has begun issuing cease‑and‑desist letters to local promoters. Anyone caught advertising Binance or Bitget as a “safe” way to invest can be fined and even face criminal charges under the Anti‑Money‑Laundering Act.

VPNs: A Legal Gray Area

Many Filipinos turn to Virtual Private Networks (VPNs) to mask their IP address and reach blocked exchanges. VPN providers market “access to Binance in the Philippines” as a premium feature. While using a VPN is not illegal per se, accessing a service that the SEC has explicitly barred can be construed as willful violation. If you trade via a VPN and the SEC traces the activity, you could be liable for the same fines imposed on promoters.

Regional Context: Southeast Asia Tightens the Screws

Thailand’s SEC blocked five exchanges in May 2025, and Indonesia raised crypto tax rates dramatically. The coordinated push suggests a regional trend: governments want to force foreign platforms to either localise or disappear. For Filipino traders, this means fewer “off‑shore” options and a stronger incentive to move assets to domestic, licensed exchanges such as Coins.ph or PDAX.

What Filipino Investors Should Do Right Now

Here’s a practical checklist to protect yourself:

- Check your exchange’s licensing status. Look for a SEC‑issued CASP licence on the platform’s website or in official announcements.

- If you’re on Binance, withdraw all assets before the next deadline (the SEC typically gives 30‑day notice after a block).

- Consider moving funds to a locally licensed exchange that complies with the 100‑million‑PHP capital rule.

- Avoid promoting or endorsing unlicensed platforms on social media - you could be charged as an “enabler”.

- If you must use a VPN, be aware that you are operating in a legal gray area and could face penalties if discovered.

Comparison: Binance vs. Bitget Under Philippine Regulations

| Aspect | Binance | Bitget |

|---|---|---|

| Current operational status | Fully blocked by SEC/NTC (since March 2024) | Accessible but unlicensed; under potential enforcement |

| CASP licence requirement | Not met - no Philippine corporation | Not met - no registered entity |

| Potential penalties | Fine up to 10 million PHP per violation; daily 10 000 PHP for ongoing breach | Same fine structure applies once enforcement begins |

| Promoter liability | Criminal liability for any local promoter or influencer | Likely similar treatment under SEC advisory |

| VPN circumvention | Commonly used; legal risk remains high | Same risk if accessing via VPN |

Key Takeaways

While the Philippines is still a hot market for crypto, the government is making it clear that only licensed, locally incorporated services can stay afloat. Binance’s full ban showed the length authorities will go to enforce the rules, and Bitget sits on the brink of the same fate. Using VPNs might keep you online, but it doesn’t protect you from potential fines or criminal charges. The safest path forward is to migrate to a compliant local exchange and keep an eye on official SEC notices.

Frequently Asked Questions

Is Binance completely unavailable in the Philippines?

Yes. Since March 2024 the SEC, backed by the NTC, has ordered ISPs to block Binance’s domain and API endpoints. Accessing the platform now requires a VPN, which carries legal risk.

Has Bitget been officially banned?

Bitget is not listed in the SEC’s August 2025 advisory, but the new CASP framework applies to *all* foreign exchanges serving Filipino users without a licence. In practice, Bitget could face the same blocking order as Binance if it does not register locally.

What are the penalties for operating without a CASP licence?

The SEC can levy fines from 50,000 to 10 million PHP per violation, plus a daily penalty of 10,000 PHP for continued non‑compliance. Promoters can also face criminal liability.

Can I legally use a VPN to trade on Binance or Bitget?

Using a VPN is not illegal, but accessing a platform that the SEC has explicitly blocked may be considered a violation. Users could be subject to the same fines as the exchanges themselves.

Which local exchanges are currently compliant with the CASP framework?

Licensed platforms such as Coins.ph, PDAX, and BloomX have secured CASP licences and meet the capital and reporting requirements. They are the safest alternatives for Filipino traders.

Marina Campenni

October 18, 2025 AT 08:29It’s clear the SEC is drawing a hard line for foreign exchanges, and the risk of penalties extends beyond the platforms themselves. Traders should prioritize moving assets to licensed local services, and promoters need to steer clear of unregistered endorsements. Staying informed about official notices will help avoid accidental violations.

Irish Mae Lariosa

October 20, 2025 AT 16:02The Philippine regulatory approach, as outlined in the recent CASP framework, represents not just a bureaucratic hurdle but a fundamental shift in how crypto businesses must operate within the archipelago. By mandating a minimum 100 million‑PHP paid‑in capital, the SEC effectively filters out smaller players, ensuring only well‑funded entities can survive the compliance gauntlet. This capital requirement alone forces many foreign exchanges to consider establishing a domestic corporate shell, which involves significant legal and operational overhead. Moreover, the requirement for a physical office eliminates the convenience of a purely virtual presence, compelling firms to embed themselves in the local economy. The monthly AML reporting obligations, coupled with the stringent separation of customer funds, align the Philippines more closely with traditional financial regulations, reducing the anonymity that many crypto users have come to expect. Penalties ranging from 50,000 to 10 million PHP per breach, plus daily fines for ongoing non‑compliance, create a financial disincentive that can quickly cripple an exchange that fails to adapt. For Bitget, which remains technically accessible but unlicensed, the writing is on the wall: without swift registration, it will face the same blockades imposed on Binance. The SEC’s collaboration with the NTC to enforce DNS and IP-level blocks demonstrates a willingness to use technical measures, not just legal threats, to enforce compliance. Meanwhile, the gray area surrounding VPN usage adds another layer of complexity for traders seeking workarounds; while using a VPN isn’t illegal per se, accessing a prohibited service via VPN can still be interpreted as a willful violation. In the broader Southeast Asian context, the Philippines is not alone-Thailand and Indonesia are tightening their own crypto oversight, signalling a regional trend toward stricter control. Consequently, Filipino traders should view this as an impetus to shift towards locally licensed platforms like Coins.ph, PDAX, or BloomX, which already meet the new requirements. By doing so, they not only safeguard their assets but also support the development of a regulated domestic crypto ecosystem. Finally, influencers and promoters must recognize that endorsing unlicensed exchanges now carries criminal liability, a risk that far outweighs any short‑term affiliate gains.

Nick O'Connor

October 22, 2025 AT 23:35Given the SEC’s recent actions, it’s prudent to treat any unregistered exchange as high‑risk; the fine structure is severe, and daily penalties can accumulate quickly, impacting both users and promoters, especially those who continue to advertise under the assumption that VPNs provide a safe harbor.

Bobby Lind

October 25, 2025 AT 07:09Crypto regulators are tightening worldwide.

Vinoth Raja

October 27, 2025 AT 13:42From a systemic‑risk perspective, the Philippines’ CASP mandate is a classic case of regulatory arbitrage mitigation; by imposing a capital floor and mandatory fund segregation, the SEC is effectively reducing the probability of a cascading failure that could emanate from an offshore exchange collapse. The jargon here-AML, DNS blocking, daily penalties-reflects a broader shift toward treating crypto assets as quasi‑securities, demanding a compliance culture akin to traditional banking. While this may appear draconian to the crypto‑savvy, it aligns with global best practices aimed at safeguarding retail investors against opaque operational models.

Kaitlyn Zimmerman

October 29, 2025 AT 21:15For anyone looking to stay on the right side of the law, the safest bet is to move assets to licensed local exchanges. These platforms already meet the capital and reporting standards, so you won’t have to worry about sudden blocks.

Cecilia Cecilia

November 1, 2025 AT 04:49The SEC’s crackdown underscores the importance of due diligence; users should verify a platform’s CASP licence before committing funds, as operating without it carries significant financial and legal repercussions.

David Moss

November 3, 2025 AT 12:22It’s alarming how quickly the authorities can shut down services; the coordination between the SEC and NTC demonstrates a powerful enforcement mechanism, and the daily fines create a relentless pressure that could bankrupt non‑compliant entities, leaving users scrambling.

Pierce O'Donnell

November 5, 2025 AT 19:55Even though the article paints a grim picture, it’s worth noting that not every exchange will disappear; some may adapt by establishing a local presence, but the hurdles are non‑trivial.

DeAnna Brown

November 8, 2025 AT 03:29The Philippines is setting a precedent that could reshape the entire Southeast Asian crypto landscape; if other nations follow suit, we might see a wave of localization that favors domestic platforms over global giants. This move isn’t just about control-it’s about fostering a homegrown ecosystem that can compete on a global stage.

Chris Morano

November 10, 2025 AT 11:02Optimism is warranted if local exchanges can leverage this regulatory push to improve security and transparency for users. Encouragingly, many have already secured the necessary licences and are ready to serve the market.

Jason Zila

November 12, 2025 AT 18:35People need to understand that compliance isn’t just a bureaucratic requirement; it’s a safeguard against fraud and money‑laundering that ultimately protects investors.

Jessica Cadis

November 15, 2025 AT 02:09From a national perspective, supporting local crypto firms aligns with economic sovereignty goals; it reduces reliance on foreign platforms and keeps capital within the country’s borders.

Katharine Sipio

November 17, 2025 AT 09:42For newcomers, the best approach is to start with a reputable local exchange that meets the new standards; this ensures a smoother experience and reduces the risk of sudden service interruptions.

Shikhar Shukla

November 19, 2025 AT 17:15It is imperative that all stakeholders, including investors, promoters, and service providers, adhere strictly to the regulatory framework to maintain market integrity and avoid punitive actions.

Hailey M.

November 22, 2025 AT 00:49Wow, the crypto scene in the Philippines is turning into a real-life “Catch‑22” – you can’t trade legally without a license, but getting that license is a massive hurdle. 🤷♀️🚀