Cryptocurrency Legality: Where It's Allowed, Banned, and Everything In Between

When you buy or trade cryptocurrency, a digital asset that runs on decentralized networks like Bitcoin or Ethereum. Also known as digital currency, it doesn't need banks to move money—but it does need to follow the law in your country. That’s the catch. While crypto works the same everywhere, the rules don’t. One day you’re staking Ethereum and earning rewards; the next, you’re breaking local rules just by holding it.

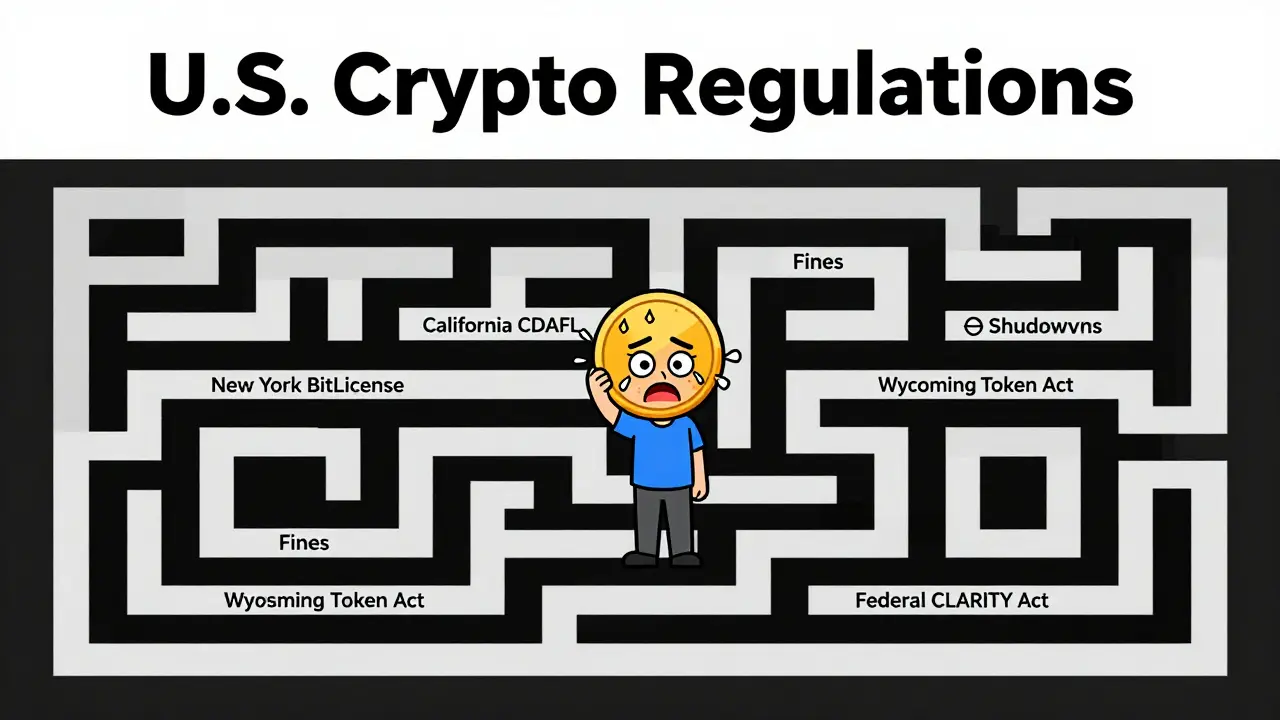

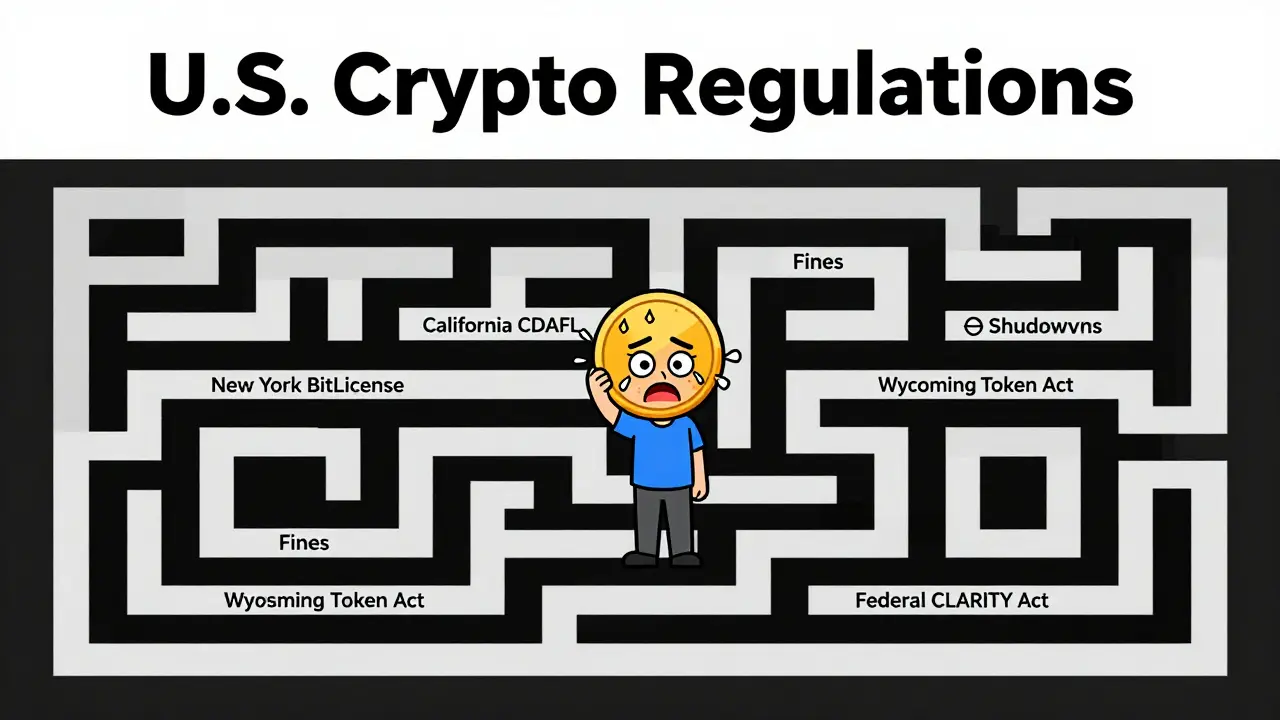

Take China, a country that officially banned crypto trading and mining in 2021. Also known as the People's Republic of China, it still sees an estimated $86.4 billion in underground crypto trades every year, according to real transaction data. People use VPNs, peer-to-peer platforms, and offshore exchanges to keep going—but they do it at risk. Fines, account freezes, even jail time are possible if caught. Meanwhile, in the European Union, a unified crypto rulebook called MiCA came into force in 2024. Also known as Markets in Crypto-Assets Regulation, it forces exchanges, wallet providers, and stablecoin issuers to get licensed, prove they hold reserves, and protect users. If you’re in the EU, this means more safety—but also more paperwork. The U.S.? It’s a mess. Some states let you mine freely; others treat crypto like a security. The SEC sues companies daily, but no clear federal law exists yet.

It’s not just about where you live. It’s about what you do. Buying Bitcoin on Coinbase? Probably fine in most places. Running a crypto exchange without a license? That’s a felony in dozens of countries. Airdropping tokens? Legal in some, banned in others. Even staking Ethereum can trigger securities laws in certain jurisdictions. The truth is, cryptocurrency legality isn’t black and white—it’s a patchwork of local laws, enforcement habits, and political pressure.

That’s why the posts here matter. You’ll find real breakdowns of shady platforms like Piyasa and Coinopts that pretend to be legal—but aren’t. You’ll see how MiCA is forcing European exchanges to change their rules overnight. You’ll learn why underground crypto markets in China keep growing despite the ban. And you’ll spot the warning signs before you get caught in a scam that looks like a loophole.

3

Dec

As of 2025, U.S. crypto regulations vary wildly by state. New York demands strict licenses, California balances innovation with oversight, and most states wait for federal clarity. Know where you stand before trading or building a crypto business.

Read More