Crypto Regulations: What You Need to Know in 2025

When it comes to crypto regulations, official rules that govern how cryptocurrencies are issued, traded, and taxed by governments and financial authorities. Also known as digital asset laws, they now shape everything from which exchanges you can use to whether you can even stake your coins legally. In 2025, this isn’t optional background info — it’s the line between keeping your funds safe and losing them to a shutdown, fine, or scam.

One of the biggest shifts happened with the MiCA regulation, the European Union’s comprehensive framework that now legally binds all crypto businesses serving EU customers. If you trade on any platform that targets Europe, it must be licensed, disclose its reserves, and follow strict rules for stablecoins. That’s why you’re seeing platforms like Bxlend and Kraken clearly state their compliance — and why shady exchanges like Coinopts and Piyasa have vanished from EU markets. MiCA didn’t just add paperwork; it forced the whole industry to grow up.

But it’s not just Europe. Countries like the U.S., Japan, and Singapore are all tightening their own rules, and China’s underground crypto market — despite a full ban — still moves billions because people find ways around it. These rules aren’t just about stopping fraud. They’re about protecting you. A regulated exchange has to prove it holds your coins. It can’t just disappear overnight. And if a project like DeHero or SpaceY 2025 offers an airdrop, regulators now demand transparency — no more fake claims, no more hidden fees disguised as "participation costs."

Meanwhile, crypto compliance, the process of following legal requirements for reporting, KYC, and anti-money laundering checks has become a core part of how platforms operate. If you’re using a DeFi tool like RAI Finance or DODO, you’re still subject to rules — even if the platform claims it’s "decentralized." Courts are starting to hold developers accountable. And if you’re staking ETH or earning rewards from a token like IMT or ATOZ, you need to know your country taxes those earnings as income or capital gains.

What does this mean for you? Simple: you can’t ignore the rules anymore. The days of "just hop on any exchange and hope for the best" are over. The best platforms now advertise their licenses. The safest airdrops tell you exactly how to qualify without paying anything upfront. And the scams? They’re getting caught faster — because regulators are watching.

Below, you’ll find real reviews, breakdowns, and warnings based on actual events — not guesses. From how MiCA affects your wallet to why underground trading in China still thrives, this collection gives you the facts you need to move forward without getting blindsided.

3

Dec

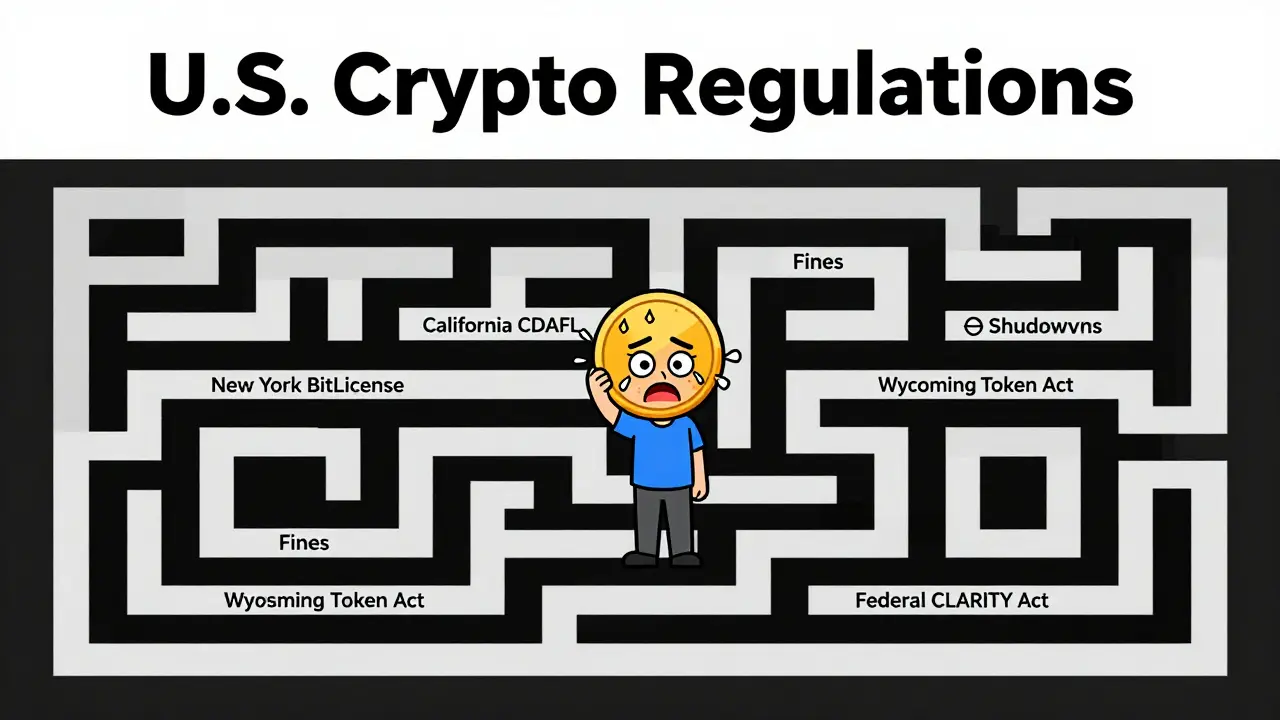

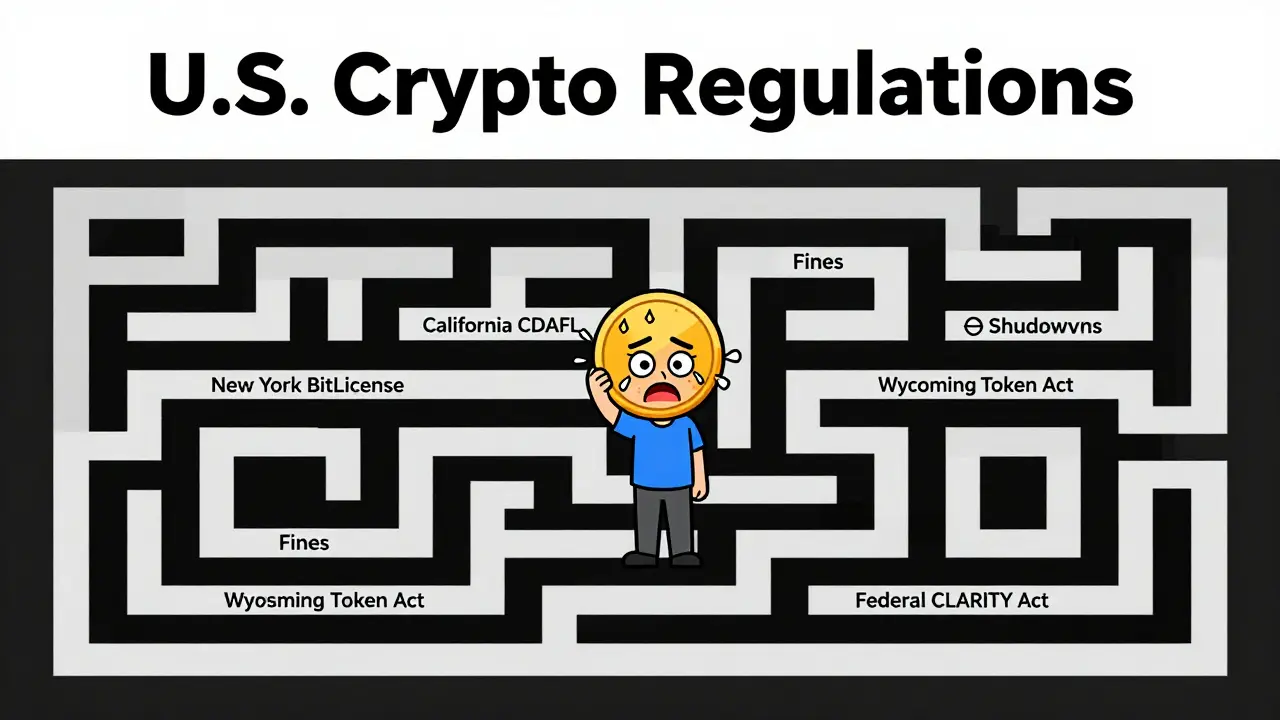

As of 2025, U.S. crypto regulations vary wildly by state. New York demands strict licenses, California balances innovation with oversight, and most states wait for federal clarity. Know where you stand before trading or building a crypto business.

Read More