Crypto Business Compliance: What You Need to Know to Stay Legal in 2025

When you run a crypto business compliance, the set of legal and operational rules that crypto companies must follow to operate legally. Also known as crypto regulatory adherence, it's no longer about staying ahead of the curve—it's about not getting crushed by it. In 2025, if you’re offering crypto services—whether it’s trading, staking, lending, or issuing tokens—you’re legally required to follow rules that didn’t exist five years ago. And they’re not suggestions. They’re enforceable laws with real penalties: fines, asset freezes, even criminal charges.

One of the biggest shifts is the MiCA regulation, the European Union’s comprehensive framework for crypto assets and service providers. Also known as Markets in Crypto-Assets Regulation, it’s now active across all EU member states and affects any business serving EU customers—even if you’re based in Singapore or Texas. MiCA forces crypto firms to get licensed as VASPs, Virtual Asset Service Providers, which includes exchanges, wallet providers, and custodians. Also known as crypto intermediaries, these entities must prove they have proper security, KYC/AML systems, and financial resilience. You can’t just launch a website and call yourself a crypto exchange anymore. You need audited proof of reserves, documented anti-fraud procedures, and a clear path for customer complaints. Malta, Switzerland, and Singapore have their own rules too, but MiCA is becoming the global benchmark.

What does this mean for you? If you’re building a DeFi platform, running an airdrop campaign, or even operating a crypto payment processor, you need to ask: Who regulates me? Are you collecting user data? Then you need GDPR compliance. Are you issuing a stablecoin? Then you need reserve transparency and redemption guarantees. Are you letting users trade tokens? Then you need to verify each one isn’t a scam or security under securities law. The posts below cover real cases—like how Malta’s licensing process fails 70% of applicants, why Piyasa and Coinopts got shut down for skipping compliance, and how Iran’s mining laws are changing overnight. You’ll see how hacks, scams, and failed projects often trace back to one thing: ignoring the rules before they were enforced.

This isn’t about bureaucracy. It’s about survival. The crypto industry is growing up. The wild west days are over. The businesses that thrive in 2025 aren’t the ones with the flashiest marketing—they’re the ones with clean records, licensed operations, and real accountability. Below, you’ll find detailed guides on exactly what compliance looks like in practice: from licensing steps in Malta to the hidden traps in MiCA’s stablecoin rules. No fluff. Just what you need to know to keep your business alive—and legal.

3

Dec

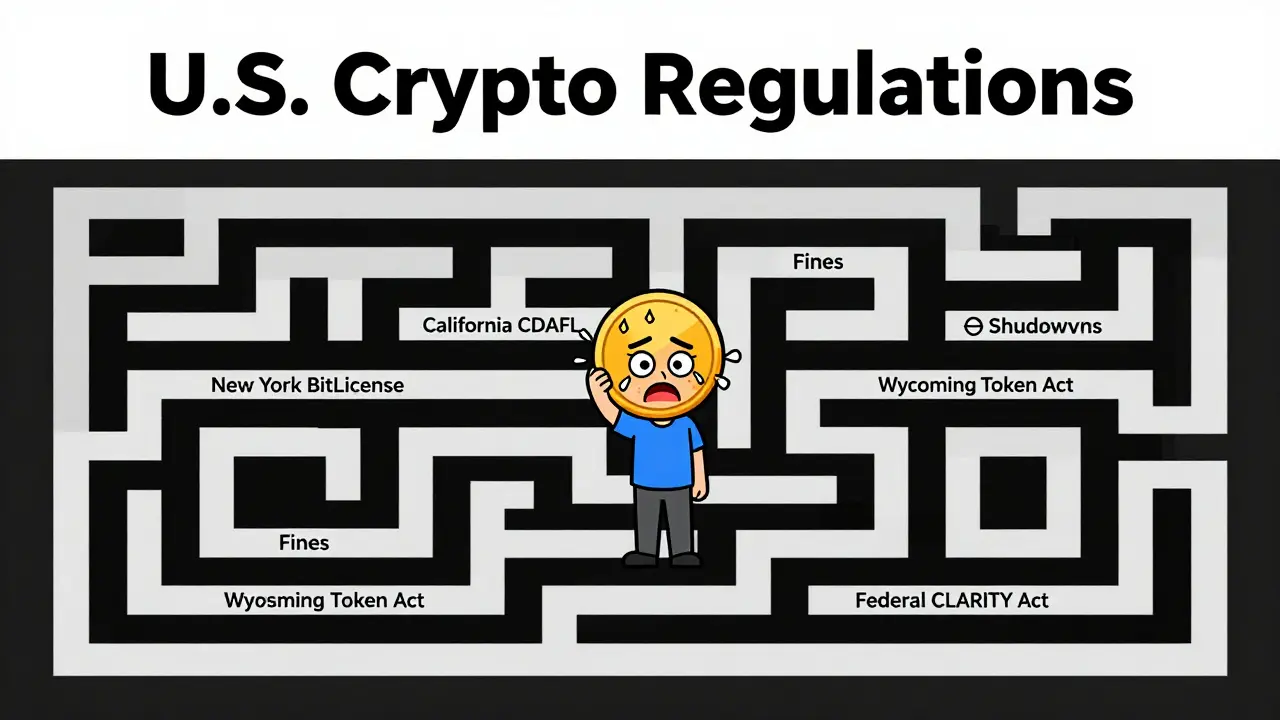

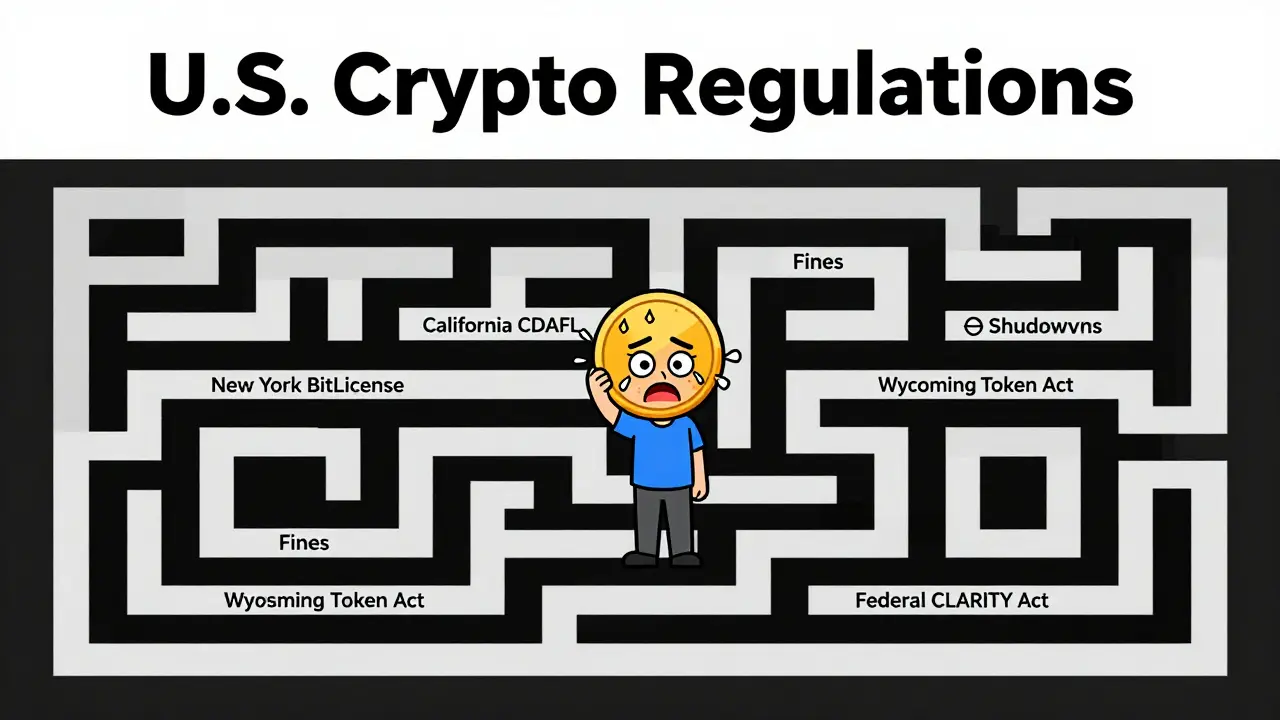

As of 2025, U.S. crypto regulations vary wildly by state. New York demands strict licenses, California balances innovation with oversight, and most states wait for federal clarity. Know where you stand before trading or building a crypto business.

Read More