German Crypto Token Classification Tool

Token Classification Assistant

Select your token type to determine the applicable German regulations and required BaFin license.

Regulatory Requirements

Select your token type and click "Check Requirements" to view applicable regulations.

Quick Takeaways

- All crypto‑exchange activities in Germany need a BaFin licence or a recognised exemption.

- MiCAR, FinmadiG and KMAG are the three pillars of the 2025 regulatory framework.

- Token classification (financial instrument, security‑like, capital‑investment) drives the specific licence you must obtain.

- AML/KYC follows the KryptoWTransferV "travel rule" and FATF standards.

- Existing licences are grandfathered until 31 Dec 2025, after which full MiCAR compliance is required.

When talking about German crypto exchange regulation is the set of laws and supervisory requirements that crypto exchanges must meet to operate legally in Germany, the key regulator is BaFin (the Federal Financial Supervisory Authority). Since the EU‑wide Markets in Crypto‑Assets Regulation (MiCAR) became effective on 30 Dec 2024, Germany has woven MiCAR into its national statutes, creating a layered compliance landscape that every exchange must navigate.

1. The 2025 Regulatory Stack

Three legislative acts form the backbone:

- FinmadiG - the Act on the Digitalisation of the Financial Market, introduced on 18 Feb 2025.

- KMAG - the Act on the Supervision of Markets for Crypto‑Assets, also from 18 Feb 2025.

- MiCAR - EU‑wide regulation that standardises crypto‑service rules across member states.

FinmadiG modernises electronic trading infrastructure, while KMAG defines the supervisory powers of BaFin over crypto‑markets. Together they give Germany one of the most mature crypto‑friendly regimes in Europe.

2. Licensing Geography: What BaFin Looks For

Any entity that offers custody, trading or exchange services must apply for a BaFin licence. The application package includes:

- Corporate charter and proof of capital (minimum €100,000 for pure crypto‑exchange models).

- IT‑security audit confirming compliance with BSI (Federal Office for Information Security) standards.

- Risk‑management framework covering market, operational and cyber risks.

- Detailed white‑paper for any new crypto‑asset intended for public sale, as required by MiCAR.

- KYC/AML policies that satisfy KryptoWTransferV and FATF travel‑rule obligations.

BaFin evaluates each component against the German Securities Trading Act (for financial instrument tokens) and the German Securities Prospectus Act (for security‑like tokens). Failure to align with the correct legal basis results in licence refusal or, as seen with Ethena GmbH in June 2025, a forced winding‑up.

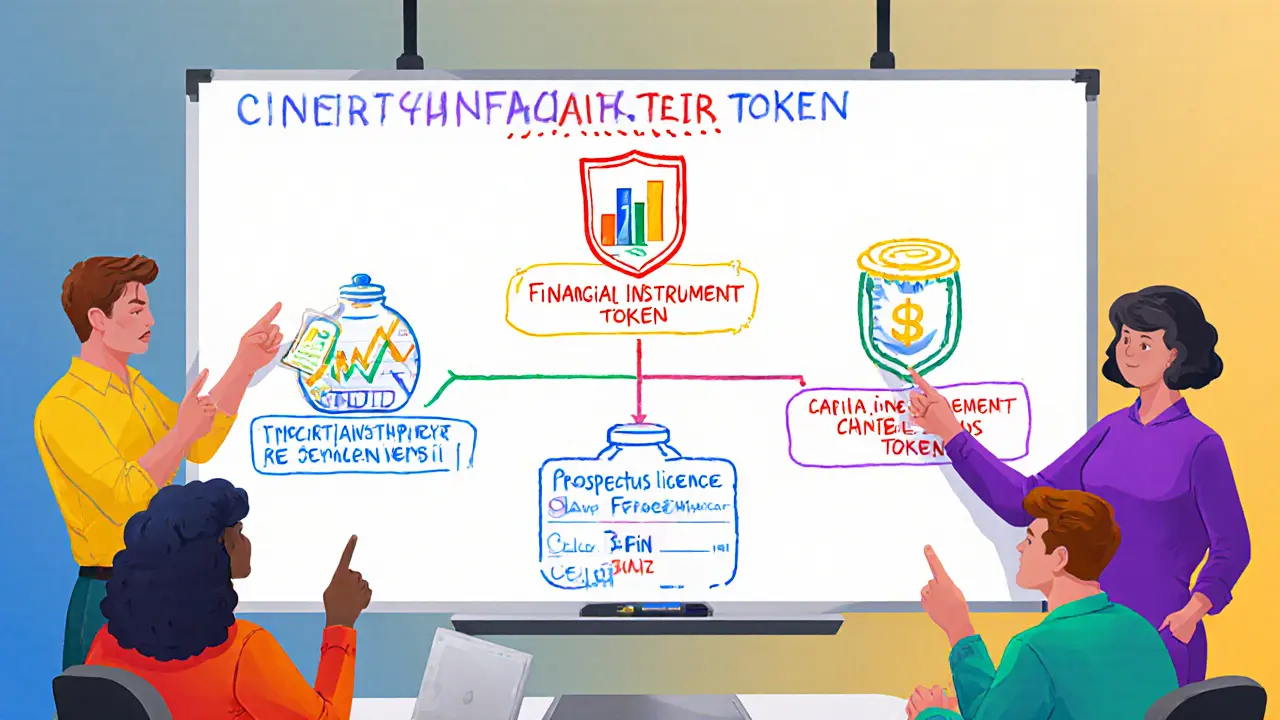

3. Token Classification - The Licensing Decision Tree

German law splits crypto‑assets into three buckets. The bucket determines which regulatory pathway applies, which in turn dictates the licence type.

| Token Type | Applicable German Law | BaFin Licence Needed | Key Compliance Points |

|---|---|---|---|

| Financial instrument token | German Securities Trading Act & MiFID II | Investment‑service licence (MiFID II) | Prospectus, market‑making rules, investor‑risk disclosure |

| Security‑like token | German Securities Prospectus Act | Prospectus licence or exemption under § 2‑24 WpPG | Full prospectus, ongoing reporting, public offering white‑paper |

| Capital‑investment token | German Capital Investment Act | Collective‑investment‑scheme licence | Fund‑management rules, asset‑valuation transparency |

When an exchange plans to list multiple token types, it must either obtain several licences or structure the platform to segregate activities under the appropriate regulatory umbrella.

4. AML & KYC - The KryptoWTransferV Framework

The German Crypto Asset Transfer Regulation (KryptoWTransferV) operationalises the FATF “travel rule”. Every crypto‑transfer over €1,000 triggers a mandatory collection of originator and beneficiary details, which the exchange must forward to the German Financial Intelligence Unit (FIU).

Key steps for compliance:

- Integrate a real‑time transaction monitoring engine that flags transfers crossing the €1,000 threshold.

- Capture full name, address, date of birth, and government‑issued ID for both parties.

- Store the data for at least five years in a tamper‑proof ledger.

- Provide FIU access on demand via an encrypted API.

Non‑compliance can lead to fines up to €5 million per breach and possible revocation of the BaFin licence.

5. Tax Reporting - What the March 2025 Circular Demands

The Federal Ministry of Finance’s March 2025 circular clarified two major points:

- Active versus passive staking income must be reported separately; active staking counts as business income, while passive staking is treated as capital gains.

- DeFi protocol interactions now require a “transaction overview” that details entry‑point contracts, token flows, and realized gains.

Exchanges must generate daily‑rate‑based valuation reports for each crypto‑asset, retain them for ten years, and submit an annual summary to the tax office.

6. Grandfathering & Transition Rules

Existing crypto‑service providers that held a German licence before 29 Dec 2024 were granted a grace period until 31 Dec 2025 to migrate to a MiCAR‑compatible licence. During this window they could continue operations without filing a new white‑paper, but they had to notify BaFin of any new token offerings.

Providers that operated without a licence before MiCAR’s rollout were required to submit an informal activity notice by 30 Jun 2025. Failure to do so resulted in an automatic cease‑and‑desist order.

7. Practical Checklist for Launching a German Crypto Exchange

Use this list to verify that you’re ready for BaFin’s authorisation process:

- Choose the correct token classification for every asset you intend to list.

- Prepare a MiCAR‑compliant white‑paper (if you’ll issue new tokens).

- Secure €100k minimum capital and open a German‑law‑compliant escrow account.

- Conduct a BSI‑certified IT‑security audit (penetration test, code review, data‑encryption).

- Implement KryptoWTransferV‑ready AML/KYC tooling (real‑time monitoring, secure data storage).

- Set up tax‑reporting pipelines that generate daily market‑price valuations.

- Draft internal compliance manuals covering MiFID II, Prospectus Act, and Capital Investment Act obligations.

- Submit the full BaFin application package via the online portal; expect a 6‑month review period.

8. Common Pitfalls & Pro Tips

Pitfall 1: Assuming a single licence covers all token types. Pro tip: Map each token to its legal bucket early; file parallel licences if needed.

Pitfall 2: Overlooking the travel‑rule threshold for low‑value transfers. Pro tip: Configure your AML engine to aggregate daily totals per user.

Pitfall 3: Ignoring the new DeFi tax rules. Pro tip: Partner with a tax‑tech provider that can generate the required transaction overview automatically.

Do I need a BaFin licence if I only provide a custodial wallet?

Yes. Custody is classified as a crypto‑asset service under the German Crypto Asset Transfer Regulation, and BaFin requires explicit authorisation for any entity holding customers’ crypto assets.

Can an existing German investment bank offer crypto trading without a new licence?

If the bank already holds a MiFID II investment‑service licence, it may offer crypto‑trading for tokens that fall under the financial‑instrument definition, but it must still notify BaFin and publish a MiCAR‑compliant white‑paper for any new token offerings.

What happens if I miss the €1,000 travel‑rule threshold?

BaFin may issue a monetary penalty and, in severe cases, suspend or revoke your licence. It’s safer to implement an automated threshold check that captures every qualifying transfer.

Is the 2025 grandfathering period applicable to foreign‑based exchanges?

Only if the foreign exchange already holds a German licence. Otherwise, it must apply for a fresh BaFin licence and comply with MiCAR from day one.

How do I prepare the white‑paper required by MiCAR?

Include token economics, rights attached to the token, risk factors, governance model, and a clear description of the issuance process. Have the document reviewed by a legal firm familiar with both MiCAR and German securities law before submission to BaFin.

By following the steps above, you can turn the dense German regulatory landscape into a clear roadmap for launching or scaling a crypto exchange in 2025 and beyond.

Rebecca Kurz

October 19, 2025 AT 08:22They’re hiding the real rules behind BaFin’s paperwork, and it’s all a massive control scheme!!!

Nikhil Chakravarthi Darapu

October 25, 2025 AT 14:22The German framework is impressive, but India’s own fintech push shows we can craft regulations that protect investors without stifling innovation. BaFin’s licensing thresholds are high, yet they ensure market integrity. Our regulators should adopt similar standards, not copy‑paste foreign rules. A strong national stance will keep the ecosystem sovereign.

Tiffany Amspacher

October 31, 2025 AT 19:22Whoa, reading this feels like diving into a philosophical labyrinth-are we mere mortals navigating bureaucratic mazes, or are we the architects of our own digital destiny? The token classification feels like a modern echo of Plato’s forms, each asset striving for its perfect legal shadow. Yet the paperwork drags on like an endless soliloquy, and my brain is doing cartwheels.

Lindsey Bird

November 7, 2025 AT 01:22Seriously, this whole licensing thing is drama central! I’m just here for the coffee and the crypto hype.

john price

November 13, 2025 AT 07:22Look, the whole token bucket system is a riddle wrapped in a conundrum, and if you ask me the law‑books are like a maze with typos at every corner-such as misstatements about the €100k capital requirement! Still, one must grapple with the fact that BaFin’s oversight isn’t just a bureaucratic hurdle; it’s a gatekeeper to legitimatty. You can’t just toss a white‑paper and hope for the best-there’s a whole compliance engine humming behind the scenes. So, if you’re serious, buckle up and read the fine print.

Ryan Steck

November 19, 2025 AT 13:22Yo, the whole BaFin thing is a sneaky ploy, man-like they’re watching every transfer and feeding data to hidden cabals. If you miss that €1,000 travel rule they’ll slap you with fines and shut you down, no joke.

James Williams, III

November 25, 2025 AT 19:22Alright, let’s break this down step by step. First, you need to map each token to its legal bucket-financial‑instrument, security‑like, or capital‑investment. That determines whether you chase an Investment‑Service licence under MiFID II, a Prospectus licence, or a Collective‑Investment‑Scheme licence. Second, assemble the capital base; the €100k minimum isn’t a suggestion, it’s a hard floor for pure‑exchange models. Third, commission a BSI‑certified IT‑security audit-penetration testing, code reviews, encryption standards-otherwise BaFin will reject the application on cyber‑risk grounds.

Fourth, draft a MiCAR‑compliant white‑paper for any new token issuance. Include tokenomics, governance, rights, and risk factors, and have it vetted by a law firm familiar with both EU and German securities law. Fifth, integrate a KryptoWTransferV‑ready AML engine that flags every transfer over €1,000, captures originator and beneficiary data, and stores it in an immutable ledger for five years.

Sixth, set up a tax‑reporting pipeline that produces daily market‑price valuations per asset and generates the DeFi transaction overview required by the March 2025 circular. Seventh, build internal compliance manuals covering MiFID II, the Prospectus Act, and the Capital Investment Act, and train staff on ongoing reporting obligations.

Eighth, submit the full BaFin dossier via the online portal and brace for a six‑month review period. During that time, be prepared for clarification requests-BaFin is notorious for deep‑dive inquiries. Ninth, monitor the grandfathering deadline; any legacy licence expires on 31 Dec 2025, after which you must be fully MiCAR‑compliant. Finally, maintain an open line with the German FIU for real‑time audit trails and be ready to adapt as EU‑wide regulations evolve. Follow this roadmap, and you’ll turn the dense German regulatory landscape into a manageable launch plan.

Patrick Day

December 2, 2025 AT 01:22So the whole system is just a big surveillance network, huh? No surprise.

Scott McCalman

December 8, 2025 AT 07:22Wow, that was a marathon of compliance steps! 😅📚 If you miss even one, BaFin will slam the door shut. Good luck!

PRIYA KUMARI

December 14, 2025 AT 13:22Honestly, most of these requirements are just bureaucratic red tape designed to choke out smaller innovators. If you’re not backed by a big bank, you’ll drown.

Jon Miller

December 20, 2025 AT 19:22Oh wow, Tiffany’s philosophical take had me feeling all the feels! This regulatory saga is like a drama series we can’t stop binge‑watching.

del allen

December 27, 2025 AT 01:22Hey, I totally get the overwhelm-just remember you’re not alone in this. 😊 If you need a hand with the white‑paper, hit me up!

Tom Grimes

January 2, 2026 AT 07:22Okay, let me try to sum this up because I feel like I’m drowning in a sea of legal jargon and I just want to let you all know how I’m feeling about it all. First, the whole BaFin thing feels like a massive wall that you have to climb, and climbing that wall is exhausting, especially when you think about the amount of paperwork involved. Second, the token classification system is confusing, and it makes my head spin because you have to figure out which bucket each token belongs to, and that’s not something you can do without a legal degree. Third, the AML and KYC requirements are intense, and it’s like they want to know everything about every user, which feels invasive, but I guess it’s meant to protect people. Fourth, the capital requirement of €100,000 is a huge barrier for small startups, and that just seems unfair, because it means only big players can really enter the market. Fifth, the need for a BSI‑certified IT security audit is another huge cost, and I’ve heard those audits can take months, which is just another delay. Sixth, the tax reporting rules are super detailed, and having to generate daily valuations for each asset sounds like a never‑ending task that will take up all my time. Seventh, the grandfathering period ending at the end of 2025 means that if you don’t get everything right by then, you’ll be kicked out, which is stressful. Eighth, the whole process of drafting a MiCAR‑compliant white‑paper is basically an academic paper, and not everyone has the resources to do that properly. Ninth, the whole licensing process can take up to six months, which feels like waiting forever for a decision that could make or break your business. Tenth, the fines for non‑compliance are massive, up to €5 million, which is terrifying for any company. Eleventh, the whole system seems designed to keep larger, established institutions in control, and that makes me feel a little hopeless about getting a fair chance. Twelfth, despite all that, there is still a path forward if you follow the checklist step by step, and that gives a small bit of hope. Finally, if you’re willing to put in the effort and money, you can navigate through it, but it’s definitely not for the faint‑hearted.