If you're looking for a decentralized exchange to trade crypto without a middleman, you might have heard of Turtle Network DEX. But here’s the truth: there’s very little real information out there about it. Unlike Uniswap or PancakeSwap - platforms with millions of users and public audits - Turtle Network DEX feels like a ghost in the crypto world. It’s listed on CoinMarketCap with a 24-hour volume of $161.5 billion, but that number doesn’t match up with anything else you’ll find. No reputable analyst, no crypto news site, no Reddit thread, no YouTube tutorial mentions it in any meaningful way. So what’s really going on?

What Is Turtle Network DEX?

Turtle Network DEX is a decentralized exchange built on the Turtle Network blockchain, which originally forked from the Waves protocol back in 2018. It’s supposed to let users swap tokens directly from their wallets without relying on a central company. That’s the standard promise of any DEX. But unlike Uniswap, which runs on Ethereum and supports thousands of tokens, or PancakeSwap on BNB Chain with active liquidity pools, Turtle Network DEX doesn’t show up in any top DEX rankings for 2025. Not on Koinly. Not on CryptoPotato. Not even in DeFi Rate’s deep dives.

The platform claims to be based in Belgium, but there’s no official website with clear documentation, no team page, no LinkedIn profiles for developers, and no GitHub repository showing active code commits. If a DEX doesn’t have a public codebase, you can’t verify what’s actually running behind the scenes. That’s not just unusual - it’s a red flag in crypto, where transparency is the only real security.

Why No One Talks About It

Let’s be honest: if a crypto project is any good, people talk about it. You’ll find Reddit threads with 500+ comments, Discord servers with 10,000 members, Twitter threads breaking down new features, and YouTube creators doing walkthroughs. Turtle Network DEX has none of that. Search for it on Reddit. Try Twitter. Look up “Turtle Network DEX review” on YouTube. You’ll get maybe two or three vague forum posts from 2020, and that’s it.

Compare that to Curve Finance, which has a dedicated community of traders who monitor its 0.04% stablecoin swap fees, or 1inch, which is constantly updated with new aggregation algorithms. Those platforms publish weekly dev updates. Turtle Network DEX? Nothing. No blog. No changelog. No roadmap. Even the CoinMarketCap volume figure - $161.5 billion - is wildly out of sync with reality. For context, the entire DeFi sector combined doesn’t hit that number daily. That figure is either a data error, a bot-driven fake, or a mislabeled asset. Either way, it’s not trustworthy.

Security? No Audits, No Transparency

Security is the #1 concern when using a DEX. You’re handing over your private keys to a smart contract. If that contract has a bug, your funds are gone forever. That’s why top DEXs like Uniswap, SushiSwap, and Curve have all been audited multiple times by firms like ChainSecurity, Trail of Bits, and QuantStamp. Those audit reports are public. You can read them. You can check the findings.

For Turtle Network DEX? Zero public audits. No bug bounty program. No security team listed. No known vulnerabilities disclosed. That’s not just a lack of information - it’s a lack of basic responsibility. If you’re going to handle other people’s crypto, you don’t hide behind silence. You publish your code, you invite scrutiny, and you fix what’s broken. Turtle Network DEX does none of that.

What Can You Actually Do on It?

Based on its architecture, Turtle Network DEX likely offers basic token swapping using an automated market maker (AMM) model - similar to how Uniswap works. You connect your wallet, pick two tokens, and swap. That’s it. There’s no evidence of advanced features like limit orders, leveraged trading, yield farming, or liquidity mining. No staking. No governance tokens. No NFT integration. Nothing that makes a DEX stand out in 2026.

And here’s the kicker: we don’t even know which wallets it supports. Does it work with MetaMask? Trust Wallet? Ledger? WalletConnect? There’s no documentation. No help articles. No error messages you can Google. If you try to connect and it fails, you’re on your own. No customer support. No email. No Telegram. No Twitter DMs that get answered. You’re literally trading blind.

How It Compares to Real DEXs in 2026

| Feature | Turtle Network DEX | Uniswap (Ethereum) | PancakeSwap (BNB Chain) | Curve (Stablecoins) |

|---|---|---|---|---|

| 24-Hour Volume | $161.5B (unverified) | $4.2B | $2.1B | $3.8B |

| Security Audits | None | Multiple (OpenZeppelin, CertiK) | Multiple | Multiple (ChainSecurity, Trail of Bits) |

| Supported Wallets | Unknown | MetaMask, Trust Wallet, Ledger, WalletConnect | Same as above | Same as above |

| Trading Pairs | Unknown | Over 10,000 | Over 8,000 | 150+ stablecoin pairs |

| Developer Activity | No public GitHub or updates | Active GitHub, weekly releases | Active GitHub, community proposals | Active GitHub, core team updates |

| Community Size | No visible community | 500K+ Discord members | 300K+ Discord members | 200K+ Telegram members |

| Unique Features | None documented | Flash swaps, governance (UNI) | Yield farming, CAKE staking | Low-fee stablecoin swaps, CRV token |

Look at that table. Every single metric where Turtle Network DEX is supposed to compete, it’s either missing, unverified, or invisible. Meanwhile, the top DEXs are constantly adding new tools - like multi-chain bridging, cross-chain swaps, and on-chain options trading. Turtle Network DEX hasn’t moved in years. Not because it’s perfect. Because it’s stalled.

Is It Even Still Active?

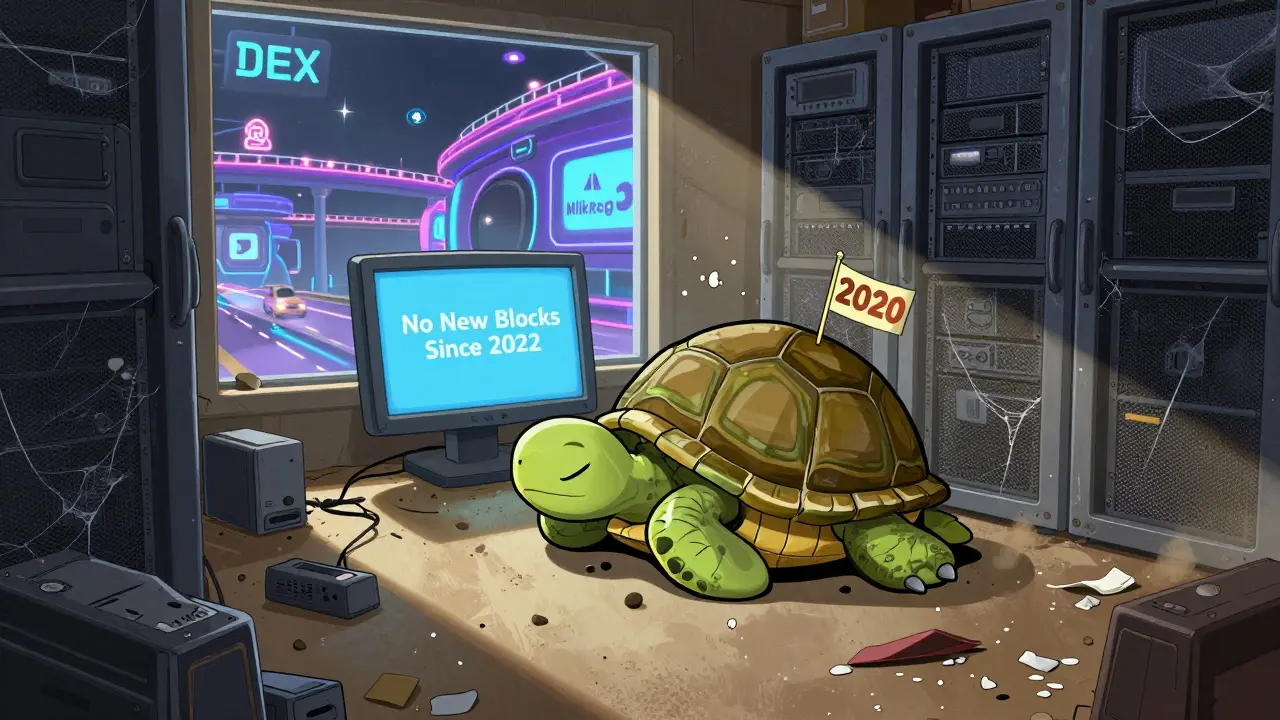

The last confirmed update on Turtle Network’s main blockchain was in late 2022. No new blocks have been added to the chain since then, according to public blockchain explorers. That’s not normal for a live platform. Even low-traffic blockchains still produce blocks every few seconds to maintain consensus. If the chain isn’t moving, the DEX isn’t working. It’s just a static webpage with a fake volume number.

Some might argue it’s a “sleeping project” - waiting for a revival. But in crypto, sleeping projects die. The market moves too fast. New platforms like MilkRoad Swap (launched March 2025) are already offering native Solana-Ethereum bridging. Turtle Network DEX doesn’t even have a website that loads properly on mobile. That’s not innovation. That’s abandonment.

Should You Use It?

No. Not unless you’re willing to risk your entire crypto portfolio on a black box with zero transparency.

There’s no evidence it’s secure. No proof it’s active. No way to contact support if something goes wrong. And that $161.5 billion volume? It’s either a glitch, a scam, or a mislabeled metric from another project. Either way, it’s not real data you can trust.

If you want a decentralized exchange that works - one with real users, real audits, real updates - stick with the ones that have stood the test of time. Uniswap, PancakeSwap, Curve, and 1inch are all proven. They’ve survived bear markets, hacks, and regulatory pressure. They’re still here. Turtle Network DEX? It’s a ghost.

Don’t be fooled by a high number on CoinMarketCap. Numbers mean nothing without context. And context? There’s none for Turtle Network DEX.

What to Do Instead

If you’re looking to trade crypto without a centralized exchange, here’s what actually works in 2026:

- Use Uniswap if you’re trading Ethereum-based tokens. It’s the most reliable DEX on the planet.

- Use PancakeSwap for BNB Chain tokens. Lower fees, faster trades.

- Use Curve if you’re swapping stablecoins like USDT, USDC, or DAI. Fees are near zero.

- Use 1inch to get the best price across multiple DEXs at once.

- Always use a hardware wallet like Ledger or Trezor. Never keep large amounts in a software wallet.

There’s no shortcut. No hidden gem. No secret DEX that outperforms the leaders. The market has already chosen. And Turtle Network DEX isn’t on the list.