MAX Exchange Fee Calculator

Calculate Your Trading Fees

See how much you'll pay in fees based on your trade size and MAX Token holdings.

Example: 100,000 TWD

Your Fee Estimate

How MAX Token Helps

Hold MAX Token to reduce your trading fees from 0.20% (taker) or 0.10% (maker) to as low as 0.10% (taker) or 0.05% (maker).

Buy MAX Token directly on MAX Exchange to unlock these discounts.

Looking for a crypto platform that truly understands Taiwan’s banking system? MAX Exchange review breaks down what makes this locally‑focused exchange tick, where it shines, and where it falls short - so you can decide if it fits your trading style.

What Is MAX Exchange?

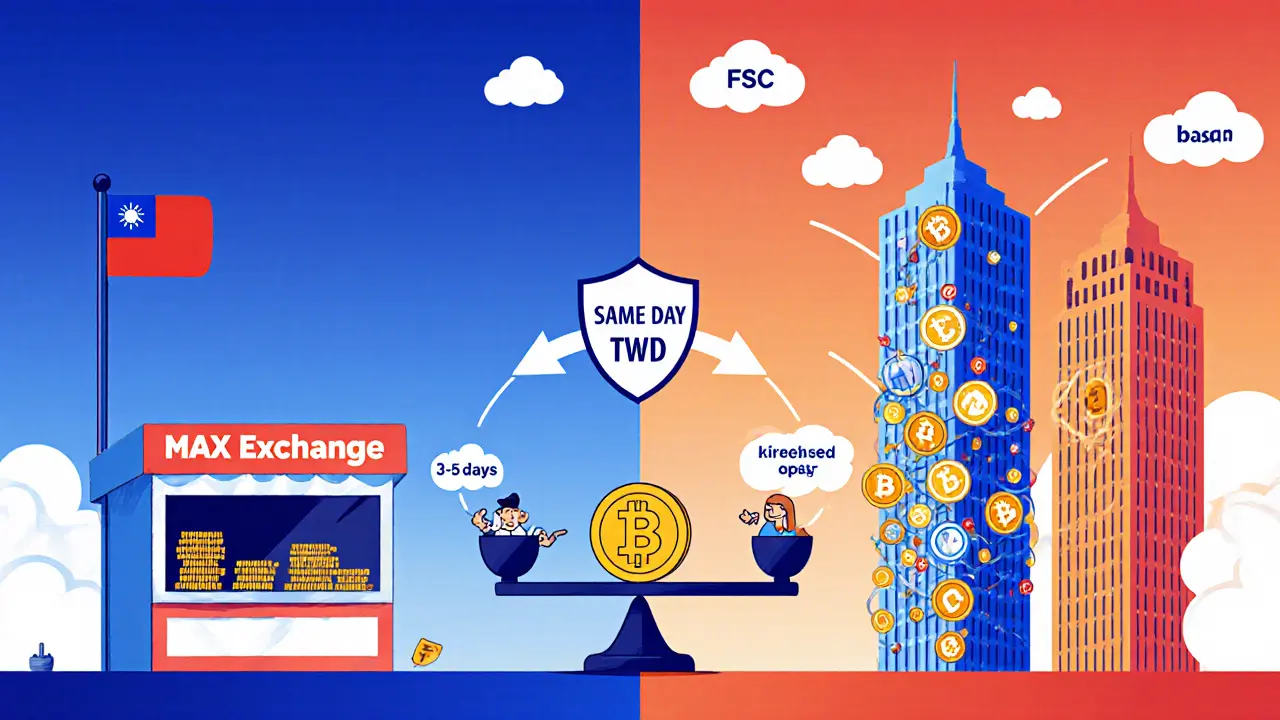

MAX Exchange is a centralized cryptocurrency exchange operating under the MaiCoin Group, designed primarily for Taiwanese users who want seamless New Taiwan Dollar (TWD) on‑ramps and off‑ramps. Launched by the MaiCoin Group after receiving approval from Taiwan’s Financial Supervisory Commission (FSC), the platform targets traders who need same‑day TWD deposits and withdrawals without the multi‑day delays common on global venues.

Who Runs MAX Exchange?

The exchange is backed by MaiCoin Group, a veteran fintech company in Taiwan that also operates a popular e‑wallet and a range of blockchain services. This corporate backing gives MAX Exchange a solid compliance foundation and access to a physical service center in Taipei for in‑person assistance.

Regulatory Compliance and Security

Regulation is the biggest selling point. MAX Exchange is certified as a virtual asset service provider by the Taiwan Financial Supervisory Commission, meaning it must meet strict anti‑money‑laundering (AML) and know‑your‑customer (KYC) standards. The platform also holds an ISO 27001 certification, confirming that its information‑security management system follows internationally recognised best practices.

Fiat Integration: TWD Deposits and Withdrawals

For Taiwanese traders, the biggest pain point on foreign exchanges is fiat conversion. MAX Exchange solves this with native TWD support:

- Bank transfers settle **same‑day** for both deposits and withdrawals.

- No need for third‑party payment processors that add hidden fees.

- All transactions are backed by a TWD trust protection scheme that segregates user funds from operational accounts.

These features give it a clear edge over platforms like Binance or Coinbase, which still rely on slower, indirect pathways for TWD.

Trading Features & Asset Selection

MAX Exchange focuses on spot trading and currently lists over 30 cryptocurrencies, including the household names:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Solana (SOL), Dogecoin (DOGE), and a handful of other Mid‑cap tokens.

While the selection is modest compared to global exchanges that host thousands of tokens, every listed coin undergoes a security review to block fraudulent projects.

Fees & MAX Token Discount

Standard taker fees sit around 0.20% and maker fees near 0.10%, though exact rates vary by volume tier. Users can slash fees by up to 50% when they pay with the native MAX Token. This incentive encourages holding the token but also adds a layer of complexity for newcomers who must first acquire MAX.

User Experience: Mobile App and Support

The Android app has amassed over 100,000 downloads with a 3.7‑star rating from more than 2,000 reviewers (as of October2025). Users praise the app’s clean UI and the speed of TWD transactions. Common complaints focus on:

- Limited crypto lineup - traders looking for the latest DeFi tokens must maintain a secondary account on a global exchange.

- English support is sparse; most help articles and in‑app prompts are in Traditional Chinese.

Support channels include email, in‑app chat, and a physical service desk at MaiCoin HQ in Taipei, which is a rare feature among digital‑only platforms.

How MAX Exchange Stacks Up Against Global Players

| Feature | MAX Exchange | Binance | Coinbase |

|---|---|---|---|

| Native fiat support (TWD) | Same‑day deposits/withdrawals | Indirect via third‑party partners (3‑5days) | Indirect via PayPal/credit cards (2‑3days) |

| Regulatory compliance (FSC) | Licensed VASP, ISO27001 | Global licenses, no Taiwan‑specific VASP | US‑focused licenses, limited Taiwan coverage |

| Number of listed assets | ~30 | ~5,000 | ~600 |

| Average daily volume (USD) | ≈ $80M | ≈ $12B | ≈ $4B |

| Fee discount with native token | Up to 50% with MAX Token | 25% with BNB | None |

The table shows why MAX Exchange is a solid choice for Taiwan‑centric traders but not a one‑stop shop for global asset hunting.

Pros & Cons Checklist

- Pros

- Direct TWD integration - same‑day settlement.

- Full FSC licensing gives legal peace of mind.

- ISO 27001 security certification.

- Physical service center for face‑to‑face help.

- Fee discount when paying with MAX Token.

- Cons

- Only ~30 cryptocurrencies - missing many new DeFi tokens.

- Liquidity lower than major global exchanges.

- English support limited; most resources are in Traditional Chinese.

- iOS app not officially listed (as of Oct2025).

Who Should Use MAX Exchange?

If you are a Taiwanese resident who values regulatory certainty, wants to move TWD in and out of crypto quickly, and primarily trades BTC, ETH, and a handful of major altcoins, MAX Exchange is a natural fit. Traders who chase the newest meme tokens, need deep liquidity for large orders, or operate outside Taiwan will likely keep a secondary account on a global platform.

Getting Started: Step‑by‑Step

- Download the Android app from Google Play (search “MAX Exchange - Buy Bitcoin”).

- Open the app and tap “Create Account”. Enter your Taiwanese mobile number and email.

- Complete KYC by uploading a Taiwan ID, proof of address, and a selfie.

- Link a local bank account (options include CTBC, Bank of Taiwan, etc.).

- Deposit TWD - funds should appear in your wallet within a few hours, often same‑day.

- Navigate to the “Spot Trading” tab, select the pair you want (e.g., BTC/TWD), and place a market or limit order.

- If you hold MAX Token, enable the fee‑discount toggle in the settings to enjoy up to 50% off trading fees.

Because the platform’s UI is built for beginners, you’ll find tutorial pop‑ups the first time you open each screen. For deeper features like API trading, refer to the “Developer” section in the app’s settings.

Future Outlook

MAX Exchange’s growth hinges on Taiwan’s regulatory climate. As long as the FSC continues to support licensed VASPs, the exchange can maintain its niche advantage. Analysts predict regional exchanges that combine compliance with user‑friendly fiat links will keep a steady user base, even if they never rival Binance’s volume. Potential upgrades could include:

- Launching an iOS app to capture the mobile‑only segment.

- Adding a few selective new altcoins after rigorous security vetting.

- Introducing staking services for supported assets.

If MAX Exchange rolls out these features, it could narrow the gap with larger players while preserving its compliance edge.

Key Takeaways

- MAX Exchange offers the fastest TWD‑to‑crypto bridge in Taiwan, with same‑day settlement.

- Strong regulatory backing (FSC license, ISO27001) makes it one of the safest local options.

- Asset variety is limited to ~30 major coins; liquidity is lower than global exchanges.

- Fee discounts are available through the native MAX Token, but English support remains sparse.

- Best suited for Taiwanese residents focused on Bitcoin, Ethereum, and stablecoins.

Frequently Asked Questions

Is MAX Exchange available to users outside Taiwan?

Currently the platform requires a Taiwanese bank account and ID, so non‑Taiwan residents cannot fully register. Some users workaround by using a local partner’s bank details, but this violates the terms of service.

What security measures protect my funds?

MAX Exchange holds an ISO27001 certification, stores the majority of user assets in cold wallets, and locks user funds in a TWD trust protection scheme that separates them from operational balances. Additionally, two‑factor authentication (2FA) is mandatory for withdrawals.

How do I get the fee discount with MAX Token?

Purchase MAX Token on the exchange, then go to Settings → Fee Discount and toggle the option. Fees drop from the standard 0.20%/0.10% to as low as 0.10%/0.05% depending on the token amount you hold.

What are the withdrawal limits?

Verified users can withdraw up to NT$500,000 (≈ $16,000) per day. Higher limits require a corporate account or a manual review by the compliance team.

Is there an iOS app?

As of October2025, MAX Exchange only offers an Android app. The company has hinted at an iOS release for 2026, but no official launch date has been announced.

Sara Stewart

July 15, 2025 AT 12:30Totally agree that the FSC licensing gives MAX a serious compliance edge-it’s not just a buzzword, it actually backs up the KYC/AML processes you need to trust your funds. The ISO‑27001 cert adds another layer of reassurance, especially when you consider how many exchanges still rely on legacy security models. Pairing that with same‑day TWD settlement means you can arbitrage on market swings without the usual 2‑3 day lag. The fee‑discount mechanic via the MAX token is a clever way to seed liquidity for their native token while rewarding high‑frequency traders. Just remember the discount tiers: you need to hold a decent amount of MAX to slice the taker fee from 0.20 % down to 0.10 %. All in all, if you’re a Taiwanese trader who values regulatory certainty, this platform checks most of the boxes.

Laura Hoch

July 29, 2025 AT 04:42From a broader perspective, the exchange’s focus on a narrow asset universe reflects a deliberate risk‑mitigation philosophy rather than mere oversight. By vetting each listed coin, they reduce exposure to rug‑pull schemes that plague the wider DeFi ecosystem. The trade‑off is reduced access to emerging tokens, but for investors who prioritize capital preservation over hype, that’s a rational compromise. Moreover, the presence of a physical service desk in Taipei bridges the digital‑to‑real gap, fostering a sense of accountability that most offshore platforms lack. In a market where trust is often purchased cheap, MAX’s structured approach offers a refreshing counter‑narrative.

Devi Jaga

August 11, 2025 AT 20:54Oh sure, because having only thirty coins is the pinnacle of innovation-nothing screams “cutting‑edge” like a menu that looks like a 2015 exchange. I guess they think we all have the patience to juggle a second account elsewhere just to chase the next meme token. And let’s not forget the liquidity swamp; trying to fill a huge buy order there feels like shouting into a void. If you’re happy with a boutique shop that only sells the basics, great, but calling it a “full‑featured” platform is a stretch.

Hailey M.

August 25, 2025 AT 13:06Wow, MAX really knows how to keep the wallet happy-same‑day TWD deposits are like a warm hug for any trader! 😅 The Android app’s sleek UI makes placing a market order feel almost effortless, and the 3.7‑star rating isn’t just a random number; it reflects real user satisfaction. 🙌 Sure, the token lineup is modest, but the security vetting is worth the trade‑off. 🎉 If you’re looking for a hassle‑free bridge between your bank and Bitcoin, this is the spot.

Schuyler Whetstone

September 8, 2025 AT 05:18Man this is typical, people think just because it’s local its automatically safe lol. They forget even licensed places can get hacked if they’re sloppy. You gotta keep an eye on your own security, not just trust the badge.

David Moss

September 21, 2025 AT 21:30Honestly, the whole “regulated” narrative is a smokescreen-what they don’t tell you is that every major exchange is in cahoots with the global financial elite, funneling data straight to the shadow banks. If you hand over your KYC, you’re basically signing up for a surveillance program; the “ISO‑27001” badge is just paper. Remember, the only truly private way to trade is off‑grid, not through a platform that reports every transaction to the FSC.

Pierce O'Donnell

October 5, 2025 AT 13:42Limited token list, limited upside.

Vinoth Raja

October 19, 2025 AT 05:54Look, if you’re fine with sticking to the big‑cap crowd, MAX gives you the fastest fiat on‑ramp in Taiwan, and that speed can be a game‑changer for day‑traders. The trade‑off is you miss out on the low‑cap DeFi craze, but that’s a conscious risk you’ll have to weigh. In an ecosystem where speed beats everything, they’ve nailed that part.

Kaitlyn Zimmerman

November 1, 2025 AT 21:07Let me break down why MAX can be a solid entry point for newcomers and seasoned locals alike. First, the same‑day TWD settlement removes the typical latency that forces traders to hedge on other platforms, effectively reducing exposure to price volatility during the deposit window. Second, the FSC licensing isn’t just a bureaucratic stamp; it enforces strict AML/KYC practices that protect both the exchange and its users from illicit activity. Third, the ISO‑27001 certification means the exchange follows internationally recognized information‑security standards, which translates to better safeguards for your private keys and personal data. Fourth, the fee‑discount structure via the MAX token provides tangible savings-holding enough MAX can halve your taker fees, which adds up significantly for high‑frequency traders. Fifth, the availability of a physical service desk in Taipei offers a rare human touch, allowing you to resolve issues face‑to‑face rather than waiting on endless chat bots. Sixth, the Android app’s UI is intuitive; even if you’re new to crypto, the tutorial pop‑ups guide you through buying, selling, and navigating the spot market. Seventh, the platform’s limited asset list is a double‑edged sword: while you won’t find obscure DeFi tokens, you also avoid the risk of low‑liquidity, high‑volatility coins that can be a nightmare to liquidate. Eighth, the trust protection scheme segregates user funds from operational accounts, a practice that mitigates the risk of internal misappropriation. Ninth, the platform’s compliance with local banking regulations ensures that your fiat transactions are covered by local consumer protection laws, something many offshore exchanges can’t promise. Tenth, the community support in Taiwanese forums is active and helpful, providing peer‑to‑peer advice on best practices. Eleventh, the roadmap hints at future features like staking and an iOS app, signaling that the team is investing in growth. Twelfth, the overall user experience balances simplicity with enough depth for advanced traders, making it a versatile tool in a trader’s arsenal. Thirteenth, the exchange’s focus on security and compliance helps build institutional trust, potentially opening doors for future fiat‑on‑ramp partnerships. Fourteenth, the transparent fee schedule avoids hidden costs that often surprise users on larger platforms. Finally, the native MAX token itself may appreciate as the platform gains market share, offering an additional asset class for investors. All these points together make a compelling case for trying MAX if you’re based in Taiwan and value speed, security, and regulatory clarity.

DeAnna Brown

November 15, 2025 AT 13:19Honestly, anyone who says “just use Binance” is ignoring the real pain of waiting days for TWD withdrawals-it’s like being stuck in the Stone Age! 🚀 MAX’s same‑day settlement is the future, and the fact that they’re backed by MaiCoin gives them the infrastructure that global giants can only dream of replicating in Taiwan. If you think limited listings are a deal‑breaker, remember that fewer coins mean fewer vectors for hacks. The platform’s commitment to security is downright heroic in a world where exchanges are constantly under fire. Don't be fooled by hype; real value is built on compliance and speed.

Chris Morano

November 29, 2025 AT 05:31It's great to see a platform that actually puts users first with transparent fees and a clear regulatory framework. The trust protection scheme really gives peace of mind, especially for newcomers who might be wary of keeping large balances online. Having a physical service desk is a big plus; it bridges the gap between digital finance and real‑world support. I think the community will keep growing as more traders discover the benefits of fast TWD settlements.

Ikenna Okonkwo

December 12, 2025 AT 21:43When we examine the landscape of crypto exchanges through a philosophical lens, several themes emerge that illuminate why a niche player like MAX can thrive. First, the principle of locality asserts that financial services anchored in a specific jurisdiction enjoy a legitimacy that transcends pure technology. By aligning with the FSC, MAX embraces the social contract that builds trust between the state and the individual. Second, the concept of epistemic humility reminds us that a narrower asset list is not inherently a flaw; it reflects a curated knowledge base that avoids the chaos of unvetted tokens. Third, network effects, while powerful, can be mitigated by offering superior latency in fiat on‑ramps-speed becomes a substitutable advantage. Fourth, the security posture, signified by ISO‑27001, embodies the idea that systemic risk can be reduced through standardized processes rather than ad‑hoc solutions. Fifth, the tokenomics of the native MAX token illustrate a feedback loop where usage begets utility, reinforcing the platform’s value proposition. Sixth, the human element-embodied by the physical service desk-provides a tangible anchor that digital‑only platforms lack. Seventh, the prospective roadmap, hinting at staking and iOS expansion, signals an evolutionary path that balances innovation with regulatory compliance. In sum, MAX exemplifies a model where regional focus, security rigor, and thoughtful token incentives converge to create a resilient exchange ecosystem that, while not a global juggernaut, offers a compelling alternative for those who prioritize certainty over sheer volume.