Mixer Transaction Simulator

Simulate North Korean Laundering Process

Input the stolen crypto amount to see how mixers break the traceable link and reduce transparency.

Key Process Breakdown

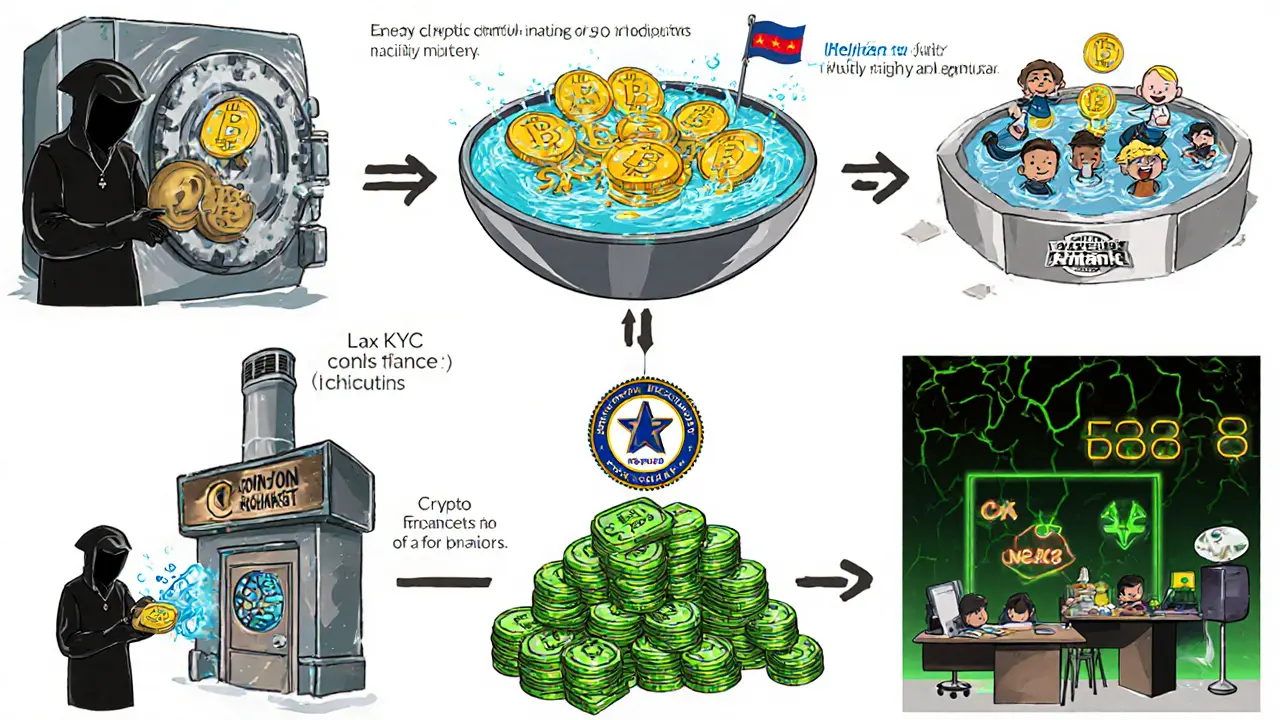

This shows how the same funds move through different mixer types:

Visual Transaction Flow

Final Result

After all fees and layers of obfuscation

Cryptocurrency mixing services are platforms that scramble the trail of digital coins, making it hard to link a payment to its original owner. By the time a user receives "clean" coins, the link to the source address has been broken, much like tossing several identical bills into a tip jar and later pulling out a different one. This anonymity is a double‑edged sword: privacy‑focused users appreciate it, while criminals, including state‑backed actors, see a shortcut around sanctions and anti‑money‑laundering (AML) rules.

Why Mixers Exist: The Technical Playbook

Mixers work in three basic steps. First, users send their crypto to a pooling address. Second, the service shuffles the pooled coins using either a centralized server or a trust‑less smart‑contract protocol. Finally, the service sends out the same amount of crypto-minus a fee-to the destination addresses specified by the user. Fees usually range from 1 % to 3 % of the transaction value. The longer the shuffle (often called "multiple hops"), the harder it becomes for blockchain analysts to trace the funds.

Centralized Mixers: Easy to Use, Easy to Target

Most early mixers were run by a single operator who temporarily held users' coins. The operator could offer a simple web interface, set fixed fees, and guarantee fast payouts. However, this model creates a single point of failure. If the operator disappears, users lose their money; if the operator is compromised, all transaction logs could be exposed. Law‑enforcement agencies in the U.S., Europe, and Asia have repeatedly cracked down on centralized mixers, treating them as unregistered money‑service businesses.

Decentralized Mixers: Trustless Privacy

Decentralized solutions such as CoinJoin, JoinMarket, and newer zero‑knowledge‑proof mixers eliminate the need for a custodian. Users collectively fund a smart contract that automatically splits and recombines inputs, producing outputs that cannot be linked back to any single input. Because there is no central operator, there are no logs to seize and no single entity to sanction. Privacy improves as more participants join the pool, creating a larger anonymity set.

Regulatory Landscape and Law‑Enforcement Action

Regulators view mixers as high‑risk AML gateways. In the United States, the Department of Justice has indicted operators of Blender.io and Sinbad.io, alleging they facilitated illicit transfers. While the cases have faced criticism for lacking solid proof of intent, they signal a clear intent to treat mixers as potential money‑laundering conduits. Financial‑crime watchdogs such as FinCEN have issued advisories urging banks to flag transactions that interact with known mixer addresses.

North Korea’s Financial Arsenal: Sanctions, Crypto, and Mixers

North Korea has been under international sanctions for decades, limiting its access to traditional banking. The regime’s cyber‑crime unit, often called the Lazarus Group, has turned to cryptocurrency to fund weapons programs and evade sanctions. Reports from 2023 estimate that North Korean actors laundered between $1 billion and $2 billion in crypto, largely by moving stolen coins through mixers before cashing out on peer‑to‑peer platforms.

Step‑by‑Step: How Mixers Enable North Korean Laundering

- Hack or theft: North Korean operators compromise exchanges or wallets, stealing Bitcoin, Ethereum, or privacy‑coin variants.

- Initial hop: The stolen coins are sent to a centralized mixer like Blender.io, which takes a 2 % fee and returns “clean” coins to new addresses.

- Layering: To further obfuscate, the clean coins are fed into a decentralized CoinJoin transaction, mixing them with unrelated users.

- Integration: The mixed coins are transferred to a cryptocurrency exchange that has weak KYC controls, often in jurisdictions with lax AML enforcement.

- Cash‑out: The exchange converts the crypto to fiat, which then funnels into shell companies, front‑friend banks, or illegal goods markets.

Each hop adds a layer of anonymity, making it almost impossible for investigators to reconstruct the original source‑to‑destination chain.

Detection Challenges and Emerging Counter‑Measures

Blockchain analytics firms now use clustering algorithms, AI‑driven pattern recognition, and address‑reputation scoring to flag mixer‑related activity. However, the effectiveness of these tools drops dramatically when decentralized mixers dominate the pool, because the anonymity set expands and transaction graphs become highly interwoven. Some governments are considering mandatory KYC for any service that receives coins from known mixer addresses, but enforcement remains uneven.

Policy Recommendations for Combating Mixer Abuse

- Require exchanges to implement real‑time checks against a shared database of flagged mixer addresses.

- Encourage international coordination to sanction both centralized operators and developers of decentralized protocols that are knowingly used for illicit purposes.

- Promote the adoption of chain‑analysis standards that can identify multi‑hop mixing patterns without infringing on legitimate privacy use cases.

- Increase penalties for financial institutions that willfully ignore suspicious mixer transactions.

- Support research into privacy‑preserving AML techniques, such as zero‑knowledge proof‑based compliance.

Quick Checklist for Compliance Teams

- Monitor inbound transfers from addresses linked to known mixers (e.g., Blender.io, ChipMixer, Wasabi Wallet).

- Flag rapid, high‑volume transfers that involve multiple hops within a short time frame.

- Cross‑reference counterparties against sanction lists that include North Korean entities.

- Escalate any transaction that shows a pattern of moving funds from a mixer to a low‑KYC exchange.

- Document all alerts and investigations to satisfy regulatory audits.

Centralized vs Decentralized Mixers: A Comparison

| Aspect | Centralized Mixers | Decentralized Mixers |

|---|---|---|

| Control of Funds | Operator holds coins temporarily | No single party holds funds; smart contracts execute automatically |

| Privacy Level | Moderate - depends on operator’s logs | High - anonymity set grows with participants |

| Typical Fees | 1-3 % per transaction | Usually lower (0.1-0.5 %) but may include gas costs |

| Regulatory Risk | Often targeted as unregistered money‑service businesses | Harder to regulate; focus on endpoints (exchanges) instead |

| Security Concerns | Custodial risk, hacking, operator exit scams | Smart‑contract bugs, reliance on network stability |

Looking Ahead: The Future of Crypto Mixing and Sanctions Evasion

As blockchain adoption grows, so does the sophistication of privacy technologies. New protocols that combine confidential transactions with layered mixing could make tracing virtually impossible without a breakthrough in quantum computing or a radical policy shift. At the same time, governments are tightening sanctions, pushing rogue states like North Korea to continuously evolve their laundering playbook. The cat‑and‑mouse game will likely intensify, making proactive compliance and international cooperation more critical than ever.

What is a cryptocurrency mixer?

A cryptocurrency mixer, also called a tumbler, receives crypto from multiple users, shuffles the coins, and returns the same amount to new addresses, breaking the link between sender and receiver.

Why do criminals, especially state actors, use mixers?

Mixers hide the origin of funds, allowing sanctioned entities like North Korea to move stolen or illicit crypto into the global financial system without triggering AML alerts.

Are decentralized mixers safer than centralized ones?

Decentralized mixers remove a single point of custody, reducing the risk of scams or hacks, and generally provide stronger privacy because they don’t keep logs. However, they rely on smart‑contract security and still face regulatory scrutiny at the exchange endpoints.

How can financial institutions detect mixer usage?

Institutions can flag transactions that pass through known mixer addresses, look for rapid multi‑hop transfers, and use blockchain‑analytics tools that score address risk based on clustering and transaction patterns.

What steps are being taken internationally to curb North Korean crypto laundering?

Countries are tightening sanctions, sharing mixer address blacklists, imposing KYC requirements on exchanges, and coordinating investigations through Interpol and the Financial Action Task Force (FATF).

BRIAN NDUNG'U

April 1, 2025 AT 14:08The evolution of cryptocurrency mixers underscores the perpetual tug‑of‑war between privacy and regulation. While regulators seek transparency, innovators champion anonymity as a fundamental right. Stakeholders must therefore collaborate, establishing standards that safeguard legitimate users without abetting illicit actors. In this light, a balanced approach can turn a perceived vulnerability into a catalyst for stronger compliance frameworks.

Donnie Bolena

April 2, 2025 AT 17:55Great breakdown! This really shines a light on how both tech and policy can evolve together!!!

Elizabeth Chatwood

April 3, 2025 AT 21:41i think the article does a good job explaining the basics of mixers but i wish it mentioned more about how everyday users can protect themselves

Tom Grimes

April 5, 2025 AT 01:28I have to say, reading this feels like staring at a maze built by someone who loves complexity for its own sake.

The piece drags on about technical steps while ignoring the human cost of sanctions.

Every time I see another paragraph about ‘anonymity sets’ I wonder why no one mentions the victims behind the thefts.

North Korea’s cyber‑army is painted as a clever engineer, yet the real story is about stolen families and lost savings.

The article lists fees and protocols as if they are the only things that matter.

What about the people who bought a house with crypto that later turned out to be laundered?

What about the banks forced to scramble for compliance under impossible timelines?

The tone feels detached, as if a robot wrote it while sipping oil.

Even the table comparison seems to glorify the technology instead of warning about abuse.

I wish the author would have added a paragraph on ethical responsibility.

Instead, we get a checklist that reads like a marketing brochure.

It’s as if the writer wants to impress with jargon rather than help regulators.

The language is full of buzzwords but lacks empathy.

If you look closely, the only thing missing is a human face.

Overall, the article could have been a powerful call to action, but it settles for a dry technical summary.

Paul Barnes

April 6, 2025 AT 05:15One could argue that forced transparency erodes the very freedom crypto was meant to protect; perhaps the real danger lies not in mixers, but in the overreaching surveillance state.

John Lee

April 7, 2025 AT 09:01I love how the post explores both sides of the coin-pun intended! It’s fascinating to see tech being used for both good and bad, and it reminds us that solutions need creativity, not just strict bans.

Maybe fostering collaborative research between regulators and developers could bridge the gap.

After all, innovation thrives when we shape it responsibly.

Jireh Edemeka

April 8, 2025 AT 12:48Oh, because nothing says ‘effective regulation’ like a spreadsheet of mixer fees-truly groundbreaking insight.

del allen

April 9, 2025 AT 16:35i totally get it lol this stuff is crazy 😅 but i wish there were more simple guides for us regular folks

Jon Miller

April 10, 2025 AT 20:21Wow, this reads like a thriller where the villains are code and the heroes are… well, we’re not sure yet!

Rebecca Kurz

April 12, 2025 AT 00:08They never tell you that every mixer is a front for the hidden cabal pulling the strings!!!

Nikhil Chakravarthi Darapu

April 13, 2025 AT 03:55It's absurd that foreign actors think they can bypass our sanctions; we must tighten our borders and enforce crypto laws with zero tolerance.

Tiffany Amspacher

April 14, 2025 AT 07:41In the grand theater of finance, mixers are the smoke that clouds the stage, but remember-every illusion eventually lifts, revealing the truth behind the curtain.

Lindsey Bird

April 15, 2025 AT 11:28Honestly, this article feels like a snooze‑fest; could’ve been a blockbuster with a bit more punch.

john price

April 16, 2025 AT 15:15If we keep polishing the technical gloss without confronting the moral decay, we’re building a house of cards that will collapse when the first truth hits.